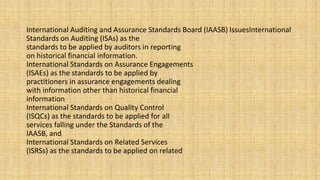

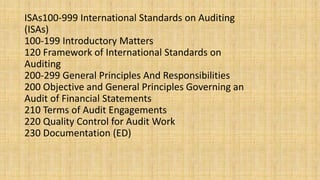

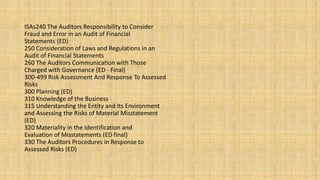

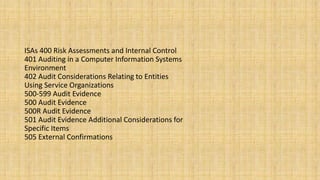

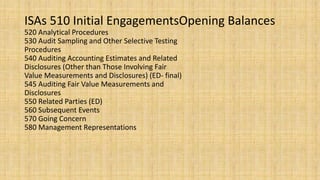

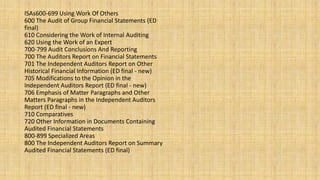

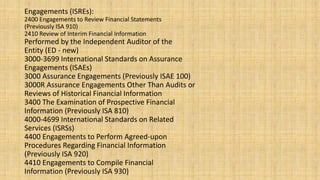

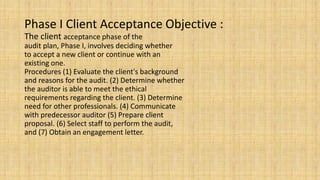

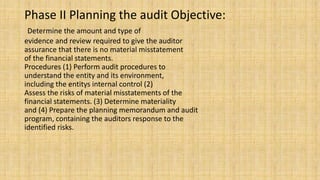

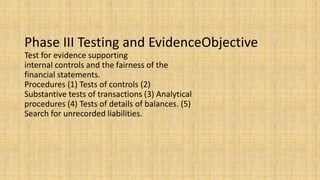

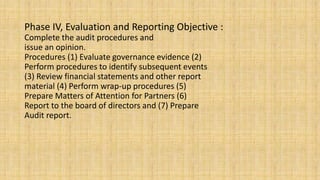

This document provides information about international auditing standards and the audit process. It discusses the historical background of auditing dating back to ancient civilizations. It also outlines the development of modern auditing with the emergence of large corporations during the Industrial Revolution. The document then explains the role of the International Auditing and Assurance Standards Board (IAASB) in establishing International Standards on Auditing (ISAs) and other standards. Finally, it describes the typical four phases of an audit process: client acceptance, planning, testing and evidence, and evaluation and reporting.