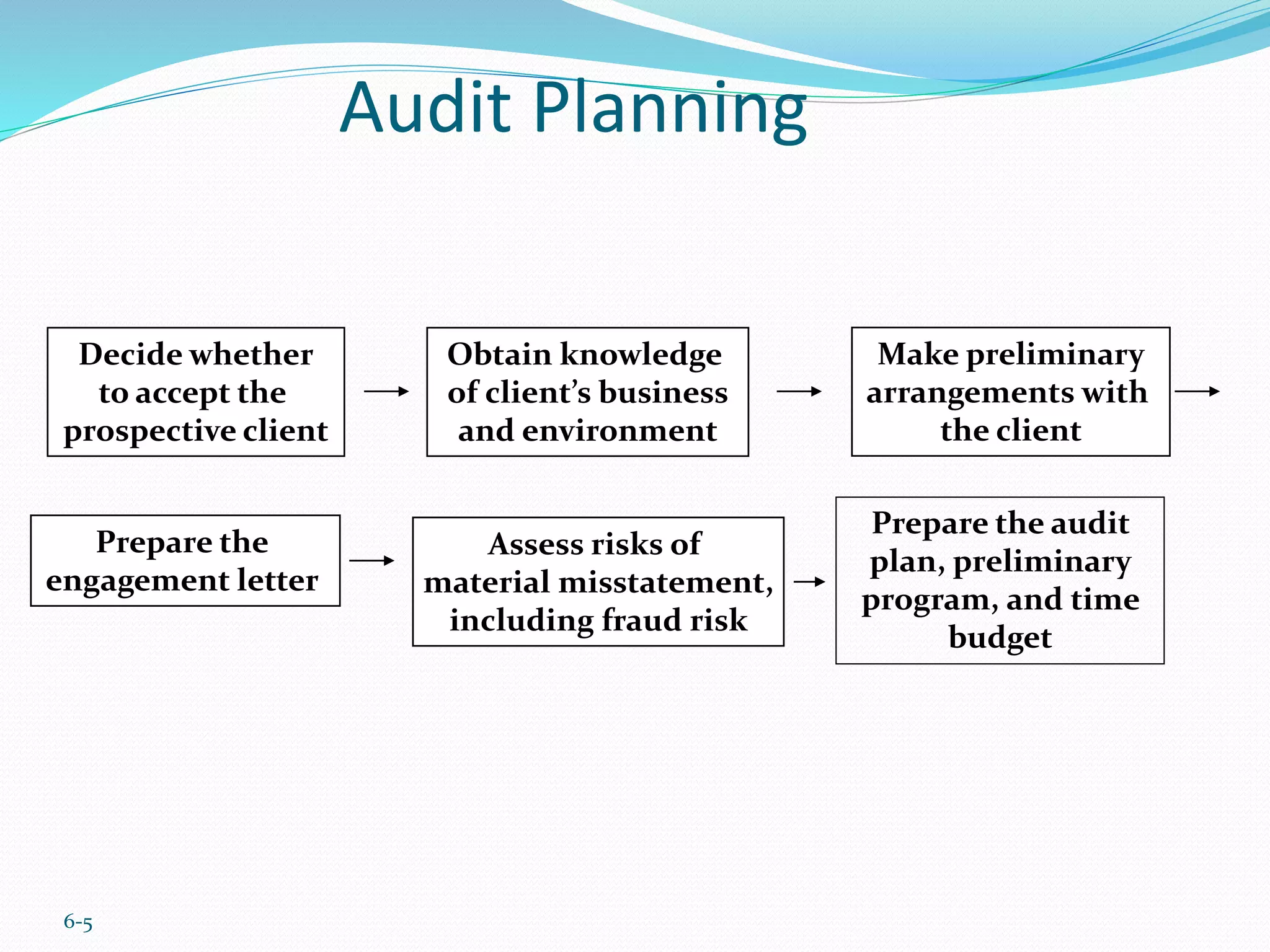

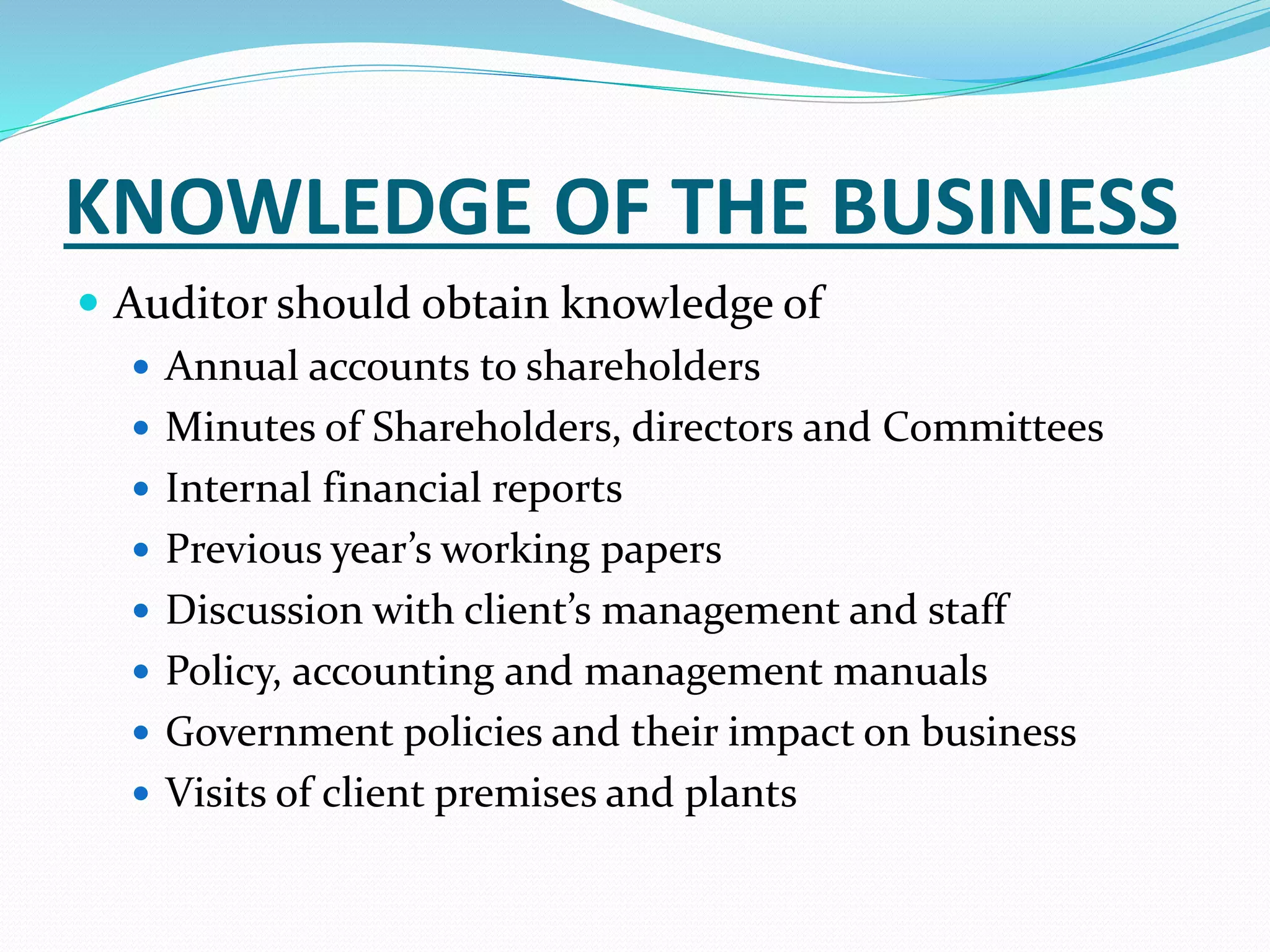

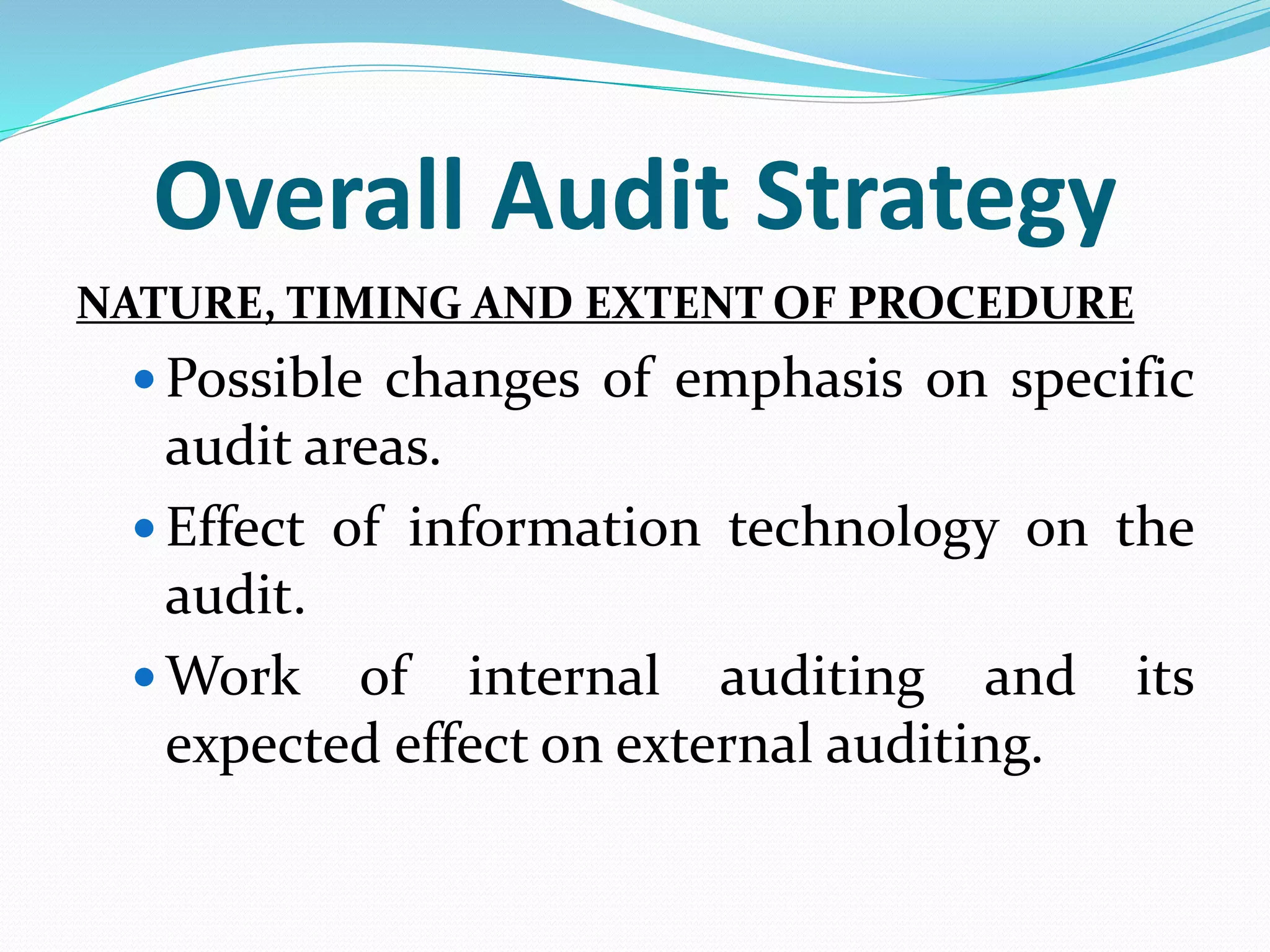

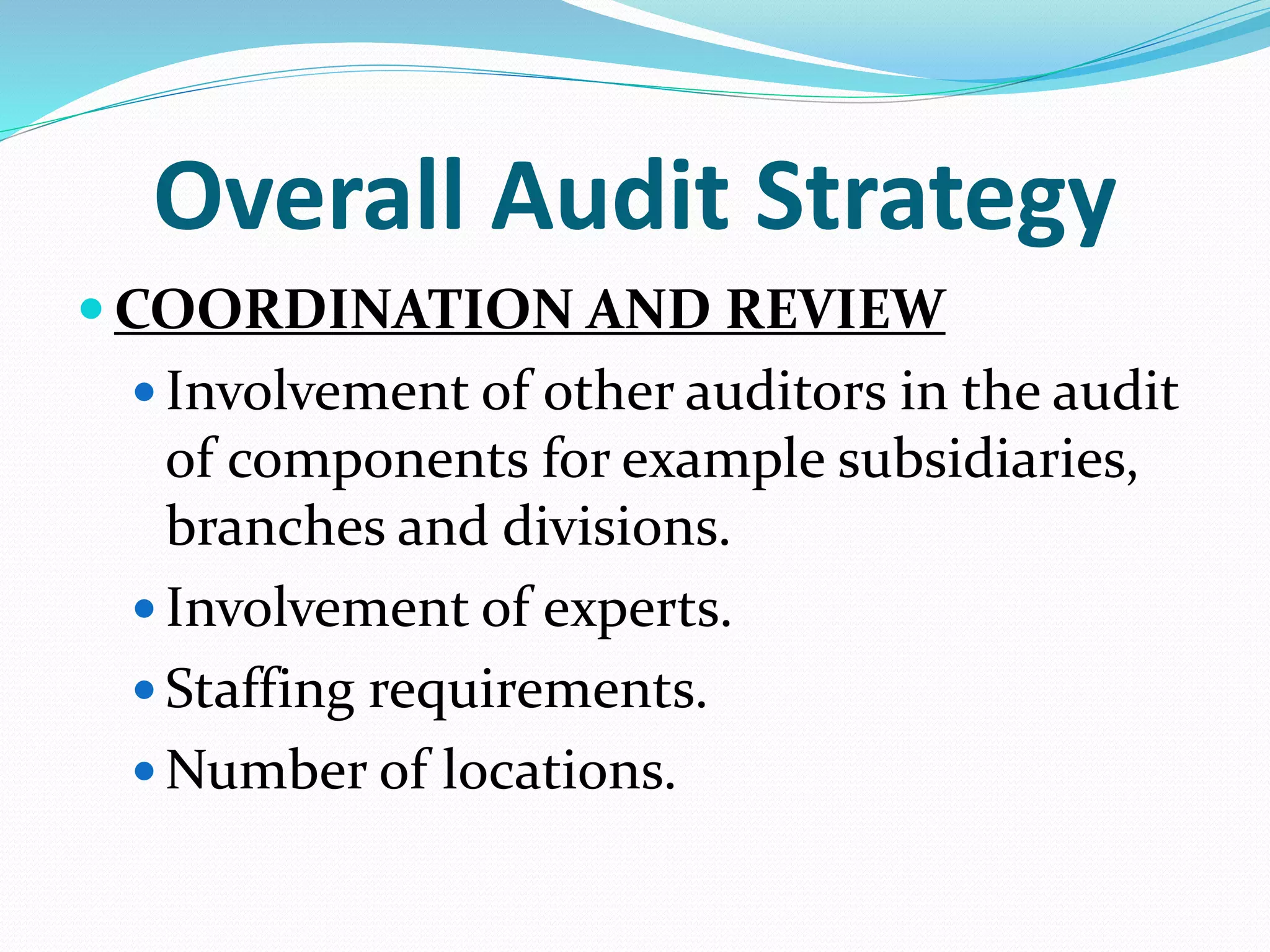

The document discusses audit planning. It states that audit planning involves developing knowledge of the client's business, assessing risks, preparing an overall audit plan and audit program, and considering factors like the client's industry and accounting systems. The planning process aims to make the audit more effective and efficient by establishing a general strategy and approach. Key aspects of planning addressed include evaluating internal controls, setting materiality, determining the nature, timing and extent of procedures, and documenting and adjusting the plan as needed.