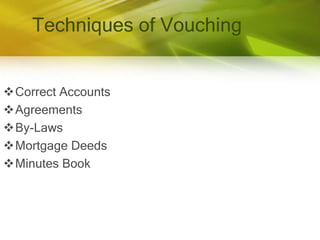

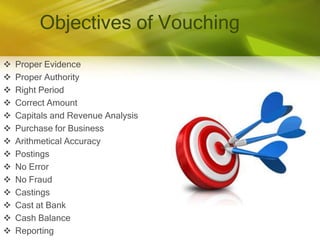

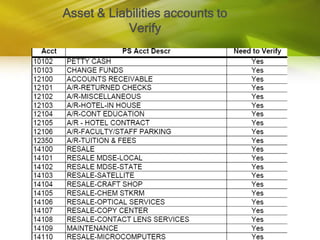

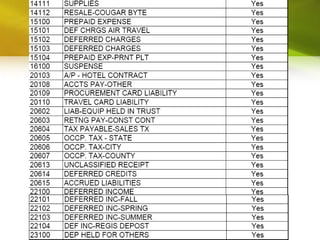

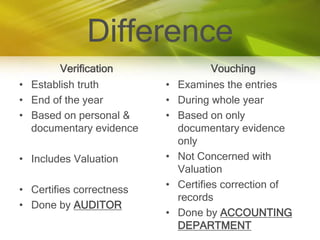

This document discusses the concepts of audit verification and vouching. It defines an audit as the evaluation of a person, organization, system, process, enterprise, project or product. Verification is the process of ensuring accuracy through inspection, observation, and analysis, particularly of assets and liabilities on a balance sheet. Vouching involves carefully examining original documents like invoices and receipts to prove the accuracy of accounting entries and identify any omitted transactions. The document outlines the objectives, principles, procedures, techniques, differences and advantages of audit verification and vouching.