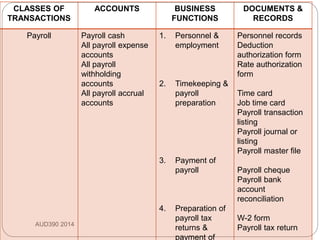

This document discusses the audit of a company's payroll cycle. It provides an overview of payroll and personnel functions, key internal controls related to payroll, and substantive audit procedures to test the payroll account. The internal controls discussed are adequate separation of duties, proper authorization of payroll activities, adequate documentation of transactions, physical control over assets and records, independent checks of payroll processing, proper preparation of tax forms, and timely payment of withheld taxes.