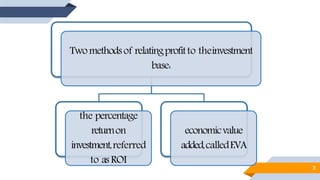

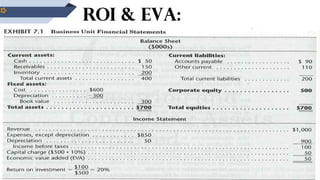

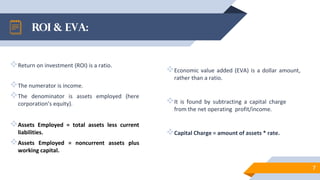

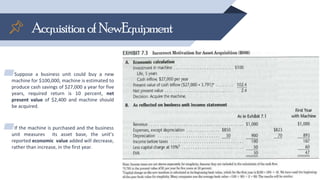

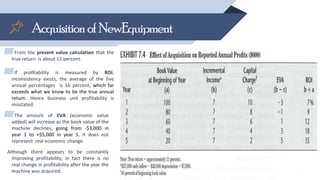

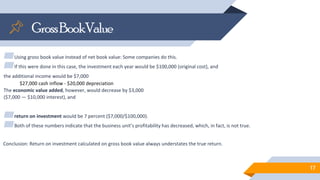

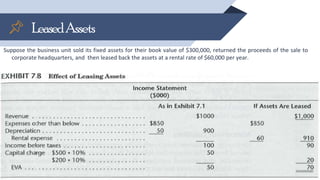

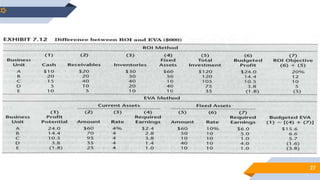

This document discusses methods for measuring and controlling assets employed in business units. It describes two main methods - return on investment (ROI) and economic value added (EVA). ROI is a ratio that compares income to assets employed, while EVA is a dollar amount that subtracts a capital charge from net operating profit. The document explores how different types of assets like cash, receivables, inventories, property/equipment should be treated in the calculation. It also addresses topics like how to treat leased assets, idle assets, intangible assets, and noncurrent liabilities. The goal of accurately measuring assets employed is to motivate managers and provide useful information for decision making.