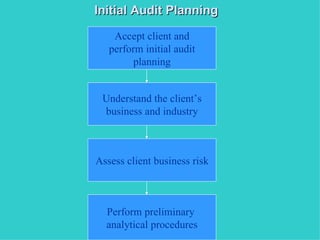

The document outlines the key steps in initial audit planning:

1. Accept the client and perform initial planning including client acceptance procedures, engagement letter, and staff selection.

2. Understand the client's business and industry by learning about operations, management, objectives, and the external environment.

3. Assess client business risk by evaluating sources of risk that could influence the client to misstate financials.

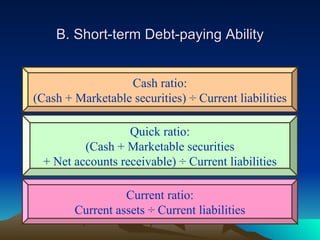

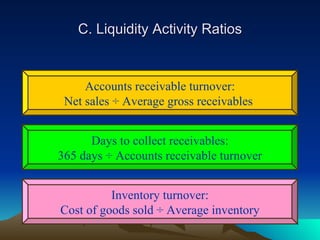

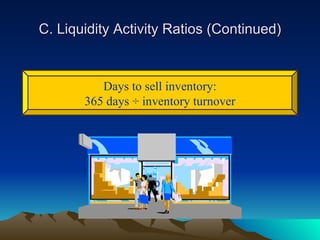

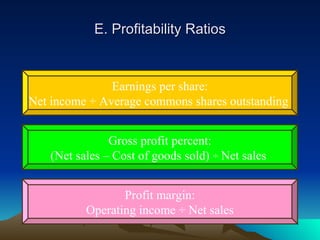

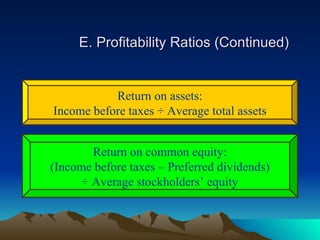

4. Perform preliminary analytical procedures to evaluate the client's financial health using ratios that assess short-term debt paying ability, liquidity, long-term debt obligations, and profitability.