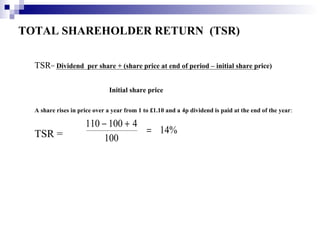

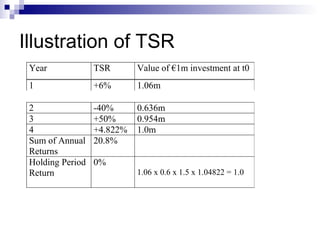

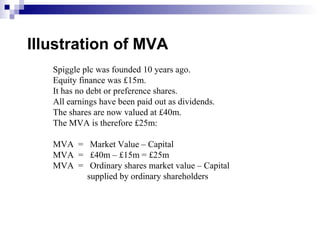

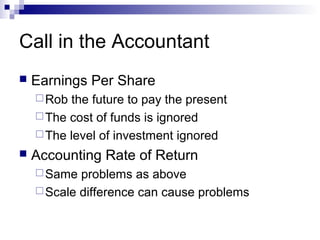

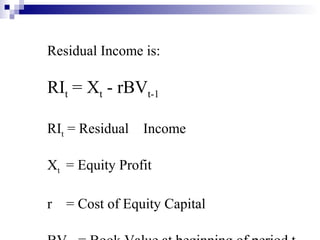

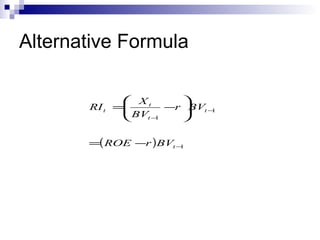

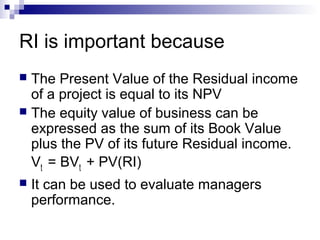

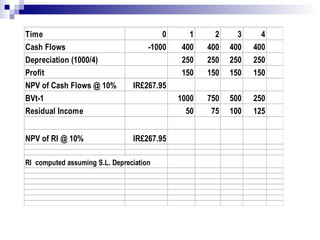

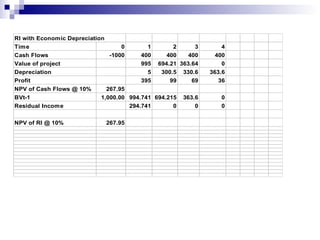

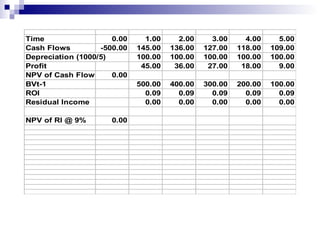

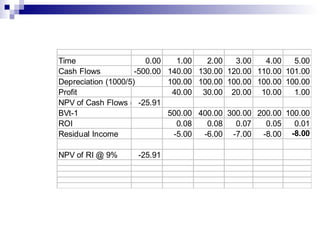

This document discusses methods for evaluating manager performance and value creation for shareholders, including total shareholder return (TSR), market value added (MVA), and residual income (RI). It defines these terms and provides examples of how to calculate them. The key points are that RI is a better measure than profit alone because it considers the cost of capital; a project can be profitable but destroy value if returns are below the cost of capital; and while the present value of RI over time equals NPV, individual period RIs can be biased estimates of value creation.