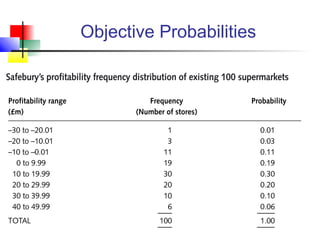

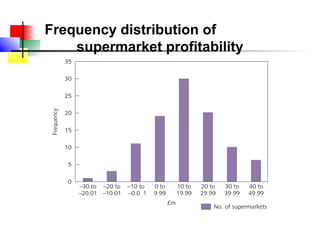

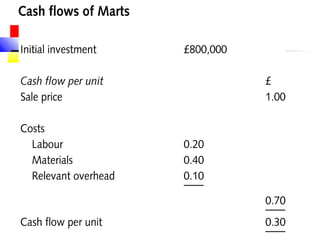

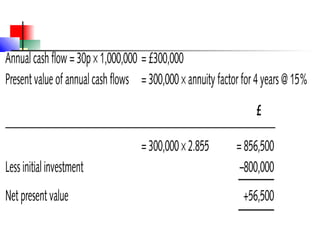

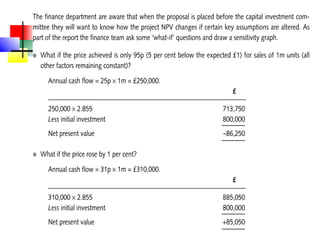

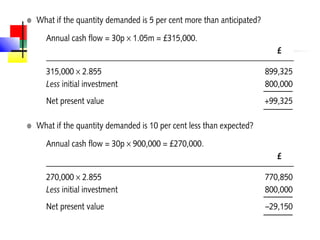

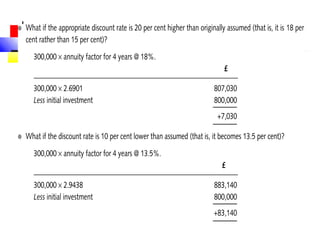

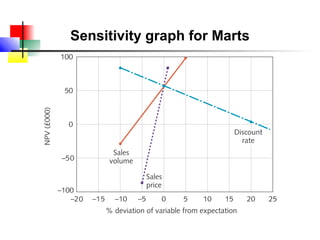

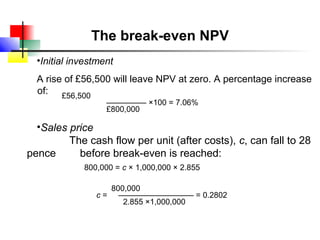

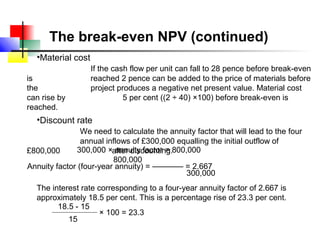

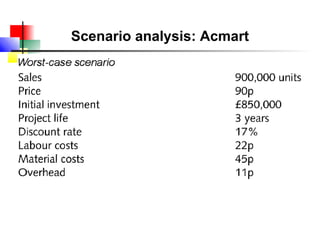

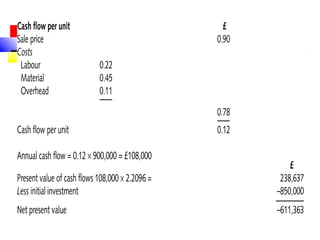

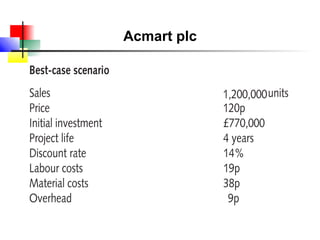

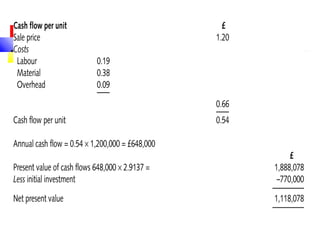

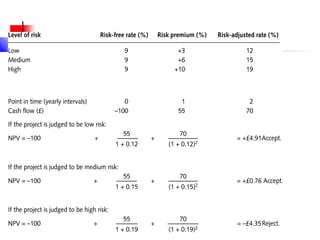

The document discusses risk in investment projects. It defines risk as the possibility of more than one outcome for an investment. It then discusses various ways to incorporate risk into a project appraisal, including sensitivity analysis, scenario analysis, and adjusting the discount rate used. Sensitivity analysis involves changing individual variables to see the impact on NPV, while scenario analysis considers the joint impact of changes to multiple variables simultaneously.