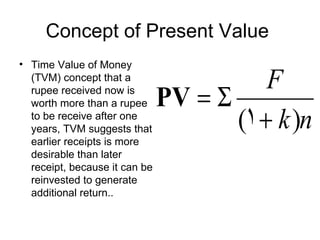

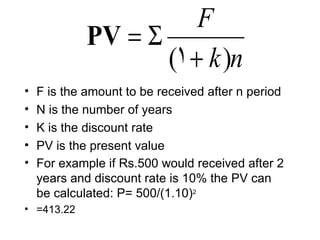

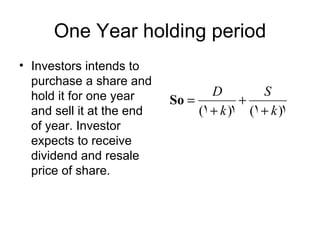

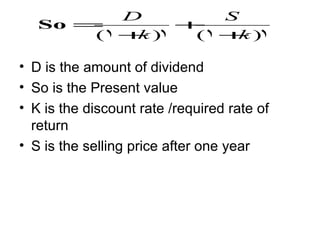

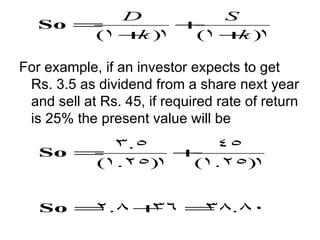

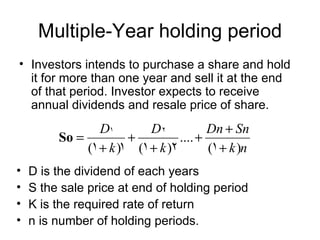

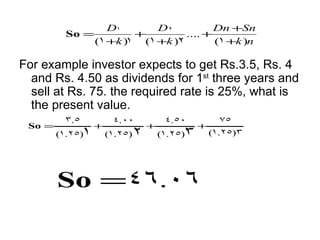

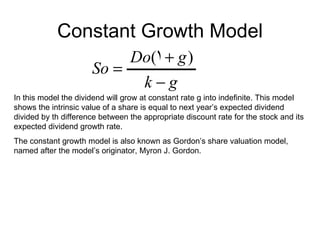

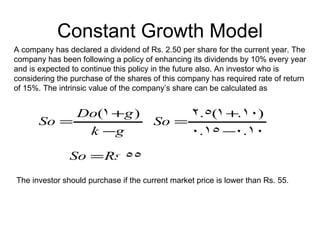

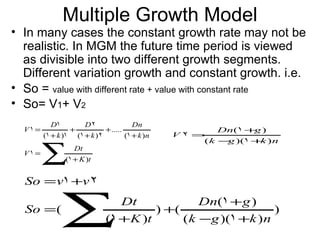

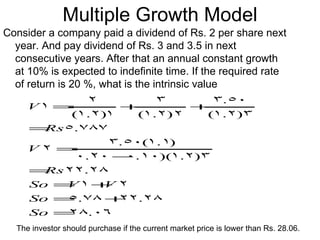

The document discusses share valuation, focusing on the comparison between intrinsic value and market price for investment decisions. It explains various concepts of value, such as book value, market value, and intrinsic value, and outlines methods for calculating the present value of expected future cash flows from dividends and resale. Additionally, it presents share valuation models, including the constant growth model and multiple growth model, to estimate intrinsic value based on expected dividends and growth rates.