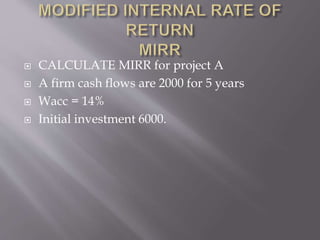

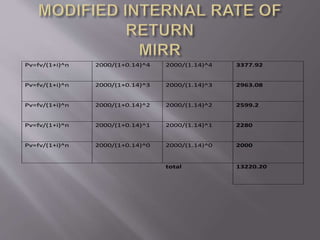

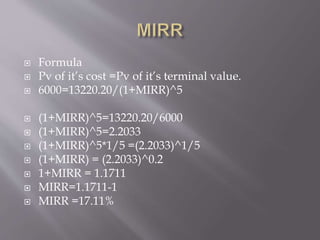

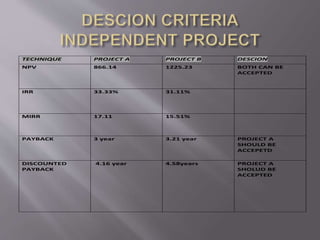

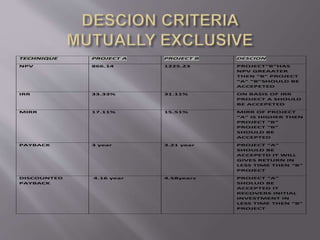

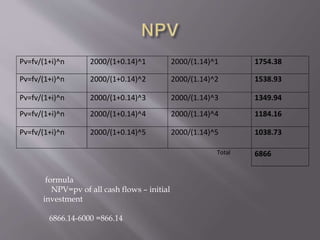

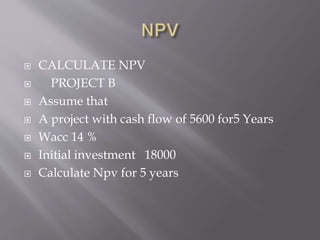

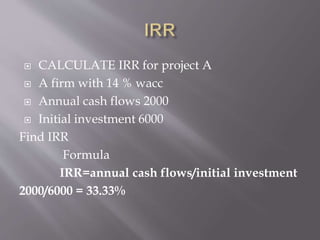

This document discusses various capital budgeting techniques including net present value (NPV), internal rate of return (IRR), modified internal rate of return (MIRR), payback period, and discounted payback period. It provides examples of calculating each of these metrics for two hypothetical projects, Project A and Project B. Based on the different criteria, it determines that Project A should be accepted over Project B in most cases due to having a higher NPV, IRR, MIRR, and shorter payback and discounted payback periods.

![ IRR=A+{C/C-D]*(B-A).

Suppose

A=low discount rate

B=high discount rate

C=npv @ low discount rate

D=npv @high discount rate.

WACC 10%

A 10%

B 20%

C 78.8

D -10.1](https://image.slidesharecdn.com/capitalbudgeting-170505194447/85/Capital-budgeting-10-320.jpg)

![ IRR = 10% +[78.8/78.8-(-10.1) * (20%-10%)

IRR = 10%+[78.8/78.8+10.1] * (20%-10%)

IRR = 10%+[78.8/88.9] * (20%-10%)

IRR =10% + 8.86

IRR = 18.86

IF IRR > MINIMUM DESIREDTHE RATE OF RETURN ACCEPTED.

IF IRR < MINIMUM DESIREDTHE RATE OF RETURN.

REJECTED.

IF IRR =MINIMUM DESIREDTHE RATE OF RETURN. ACCEPTED](https://image.slidesharecdn.com/capitalbudgeting-170505194447/85/Capital-budgeting-11-320.jpg)