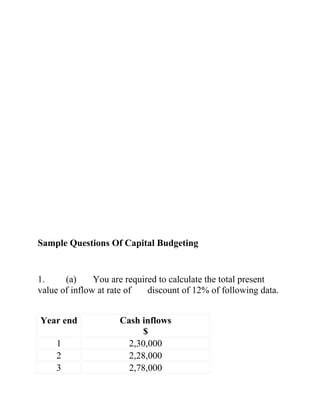

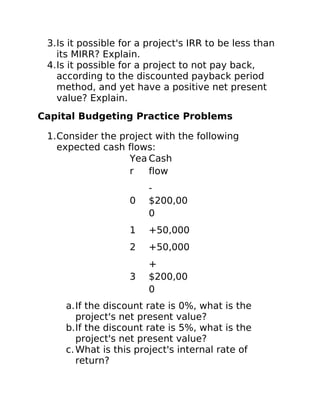

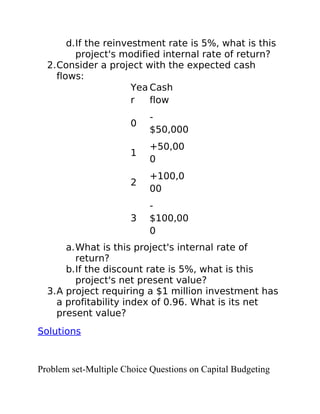

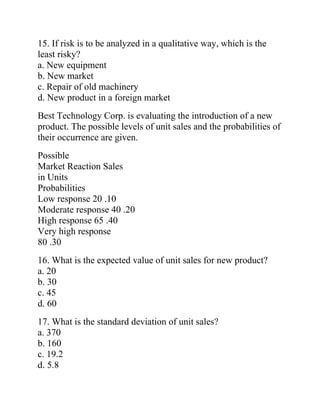

This document provides sample questions, answers, and examples related to capital budgeting techniques. It includes calculations of net present value and internal rate of return for projects with cash inflows and outflows occurring over several years. It also discusses incorporating risk into capital budgeting analysis using methods like discount rates and coefficient of variation.