This document discusses several capital budgeting techniques:

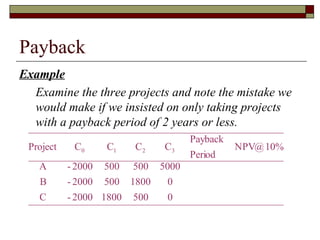

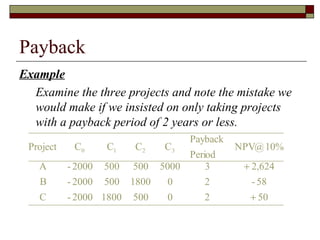

1) The payback period measures the number of years to recover the initial investment of a project. However, it ignores cash flows beyond the payback period.

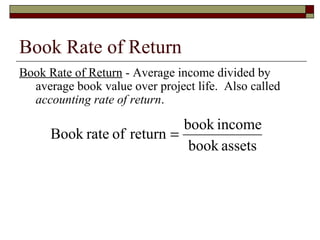

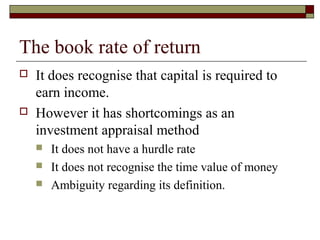

2) The book rate of return measures average income divided by average book value of assets. It does not consider the time value of money.

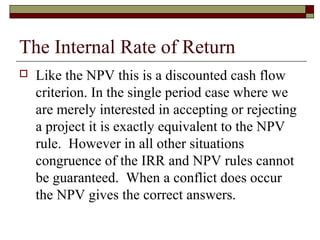

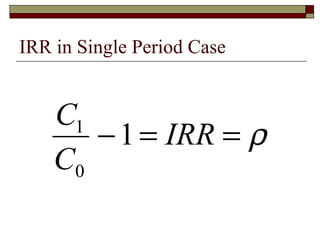

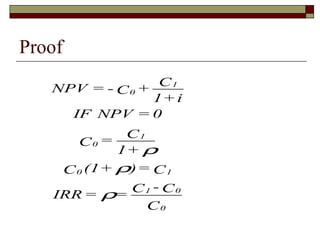

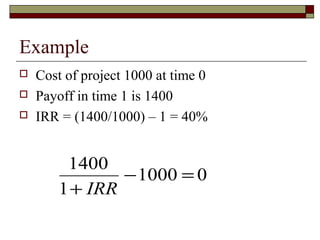

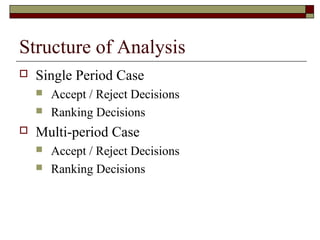

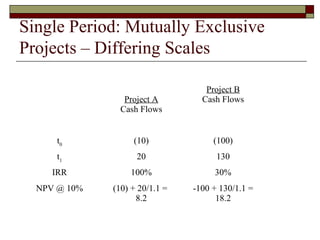

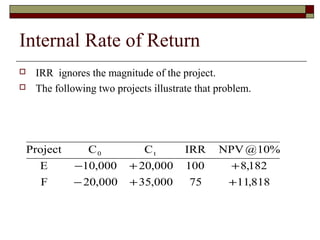

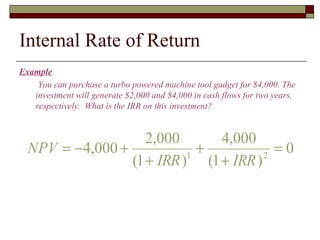

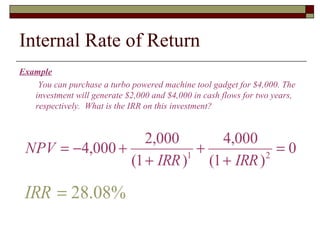

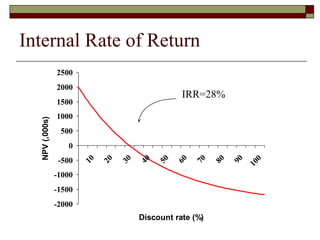

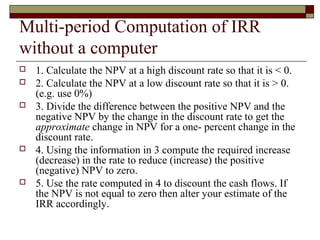

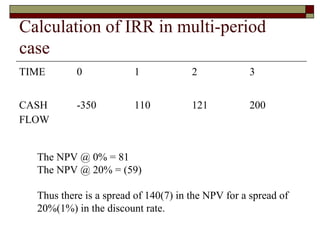

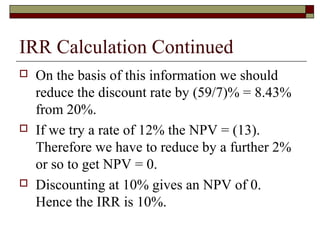

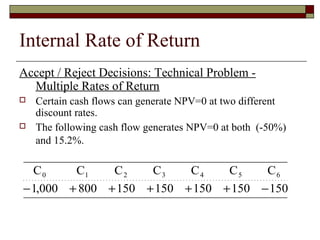

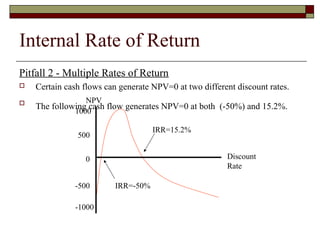

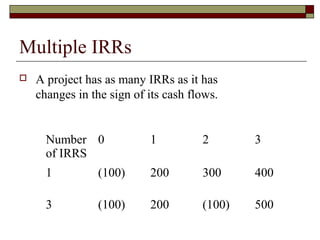

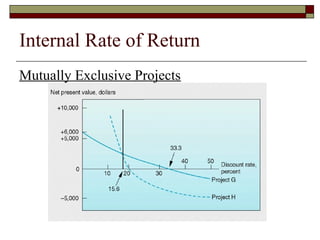

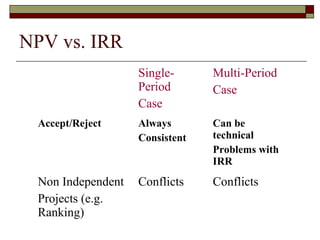

3) The internal rate of return (IRR) is the discount rate that sets the net present value (NPV) of a project to zero. It is commonly used but can be problematic for multi-period projects or when projects have different scales.

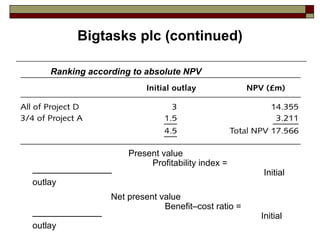

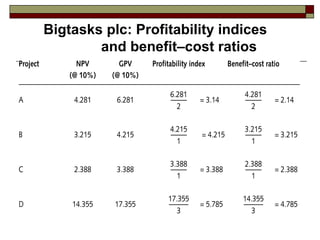

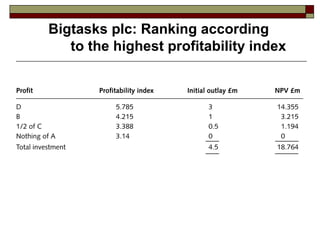

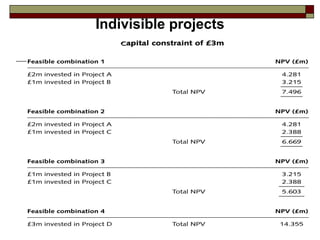

4) The profitability index is the NPV divided by initial investment. It generally agrees with NPV