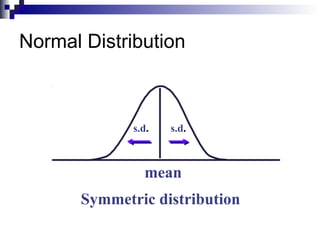

The document discusses risk and return, including expected return, variance, and standard deviation. It provides examples of how to calculate expected return by taking the returns of individual outcomes and multiplying by their probabilities. It also explains how to calculate variance and standard deviation as measures of risk and dispersion around the mean. The standard deviation is the square root of the variance and provides a measure of risk in the same units as the data. Riskier investments are expected to provide higher returns through a risk premium.