1) Derivative actions allow shareholders to sue on behalf of a corporation to enforce or defend a legal right or claim of the corporation against insiders such as directors and management.

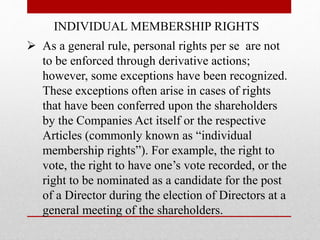

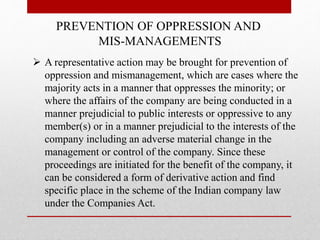

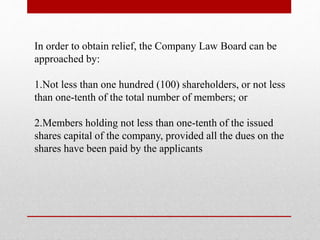

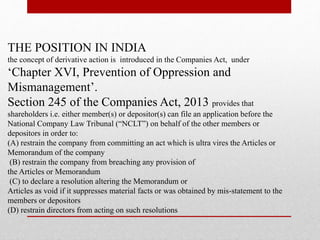

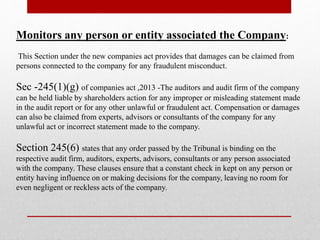

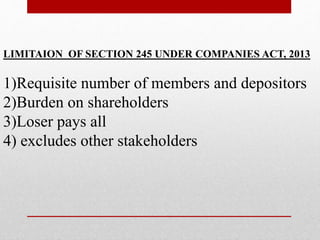

2) In India, derivative actions are introduced under the Companies Act and allow shareholders to file an application before the NCLT regarding issues like ultra vires acts, fraud on minority shareholders, or oppression of members.

3) Derivative actions promote minority rights, shareholder activism, corporate governance, and monitoring of associated persons while being cost-effective and time-efficient compared to individual lawsuits. However, derivative actions are still rarely used in India due to procedural hurdles.