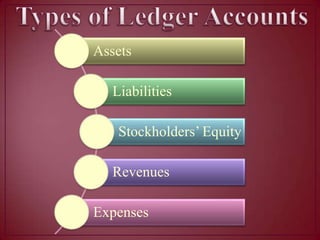

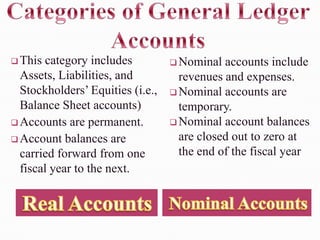

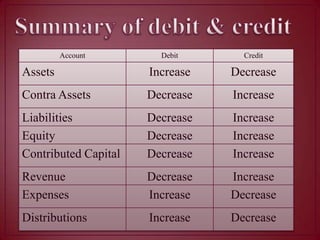

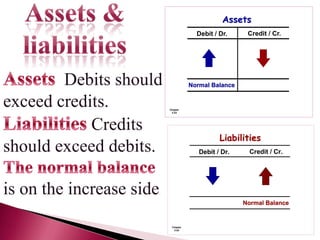

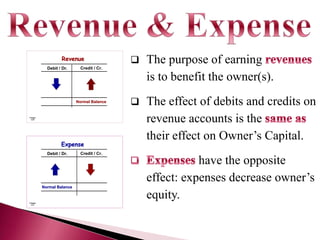

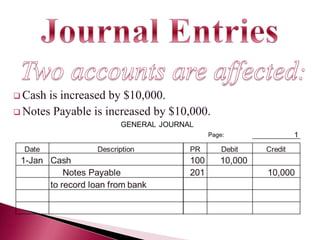

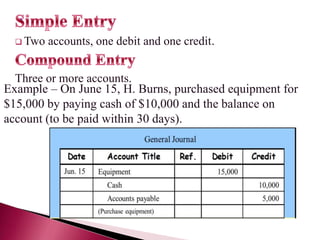

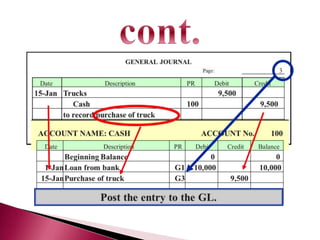

The document outlines the accounting recording process, which includes steps like collecting data from transactions, posting to journals and ledgers, and preparing trial balances and financial statements. It explains key accounting concepts like double-entry procedures, asset and liability management, and the significance of debits and credits. Additionally, it highlights the importance of accurate record-keeping and the relationship among a company's assets, liabilities, and equity.