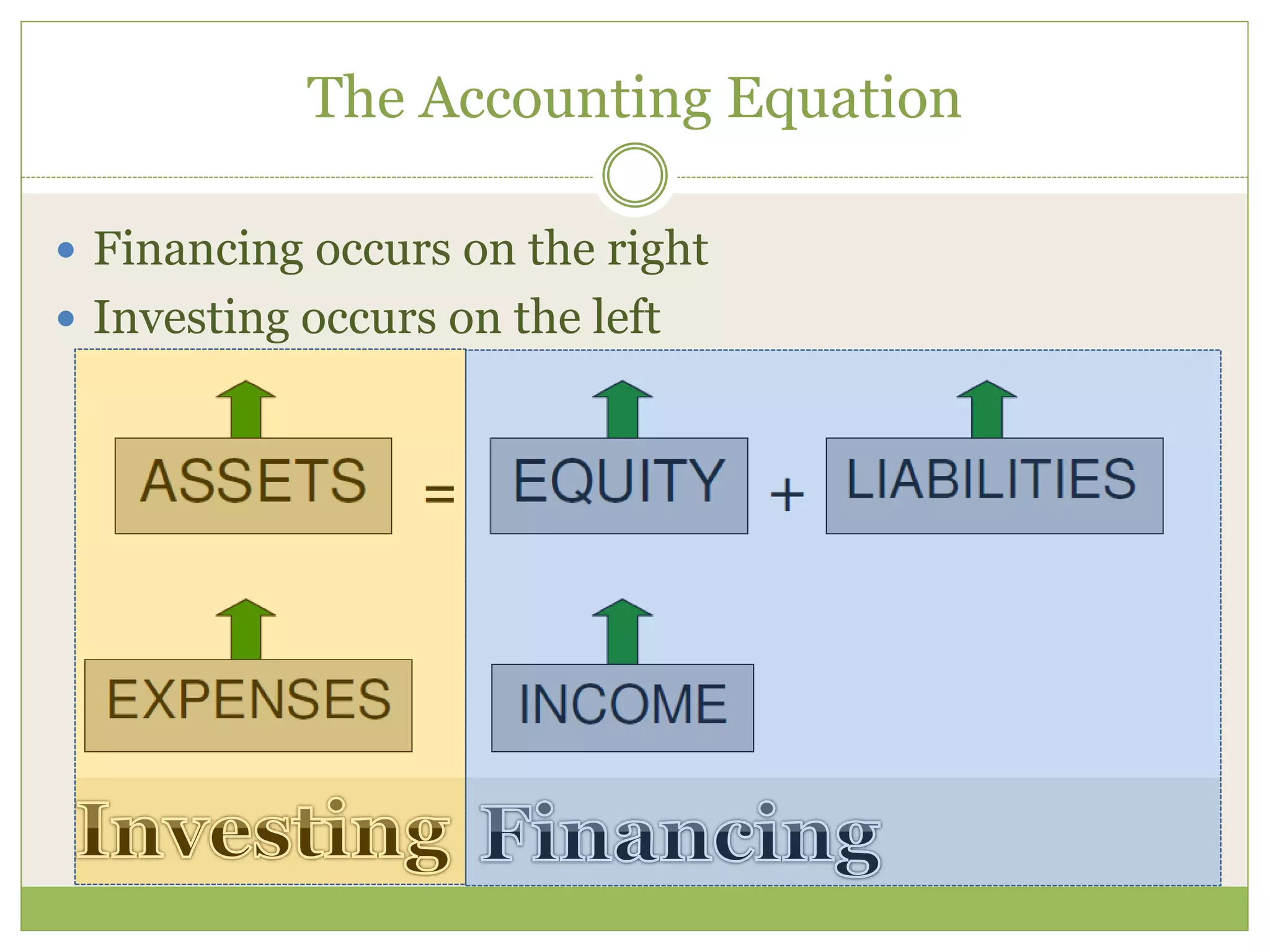

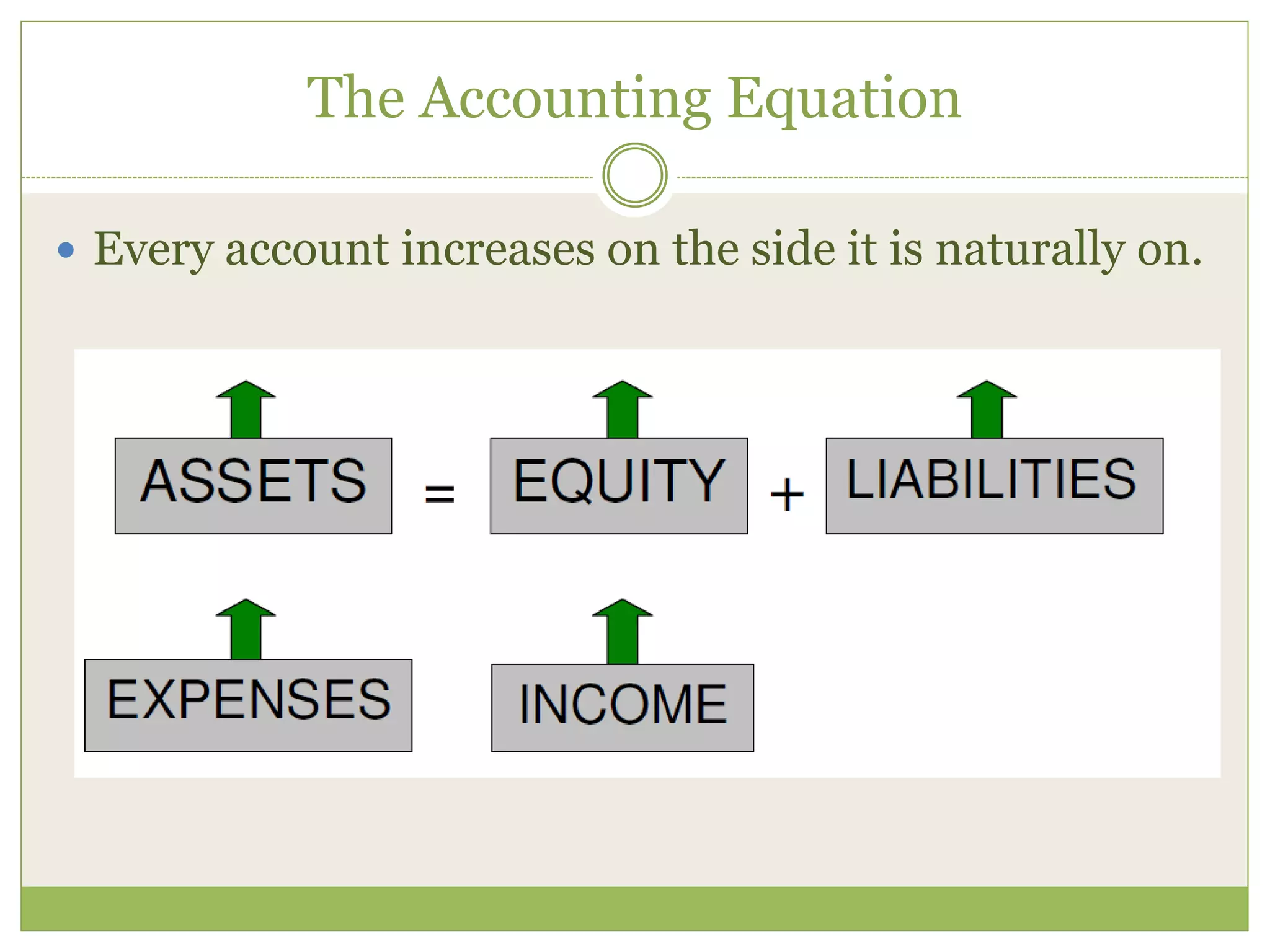

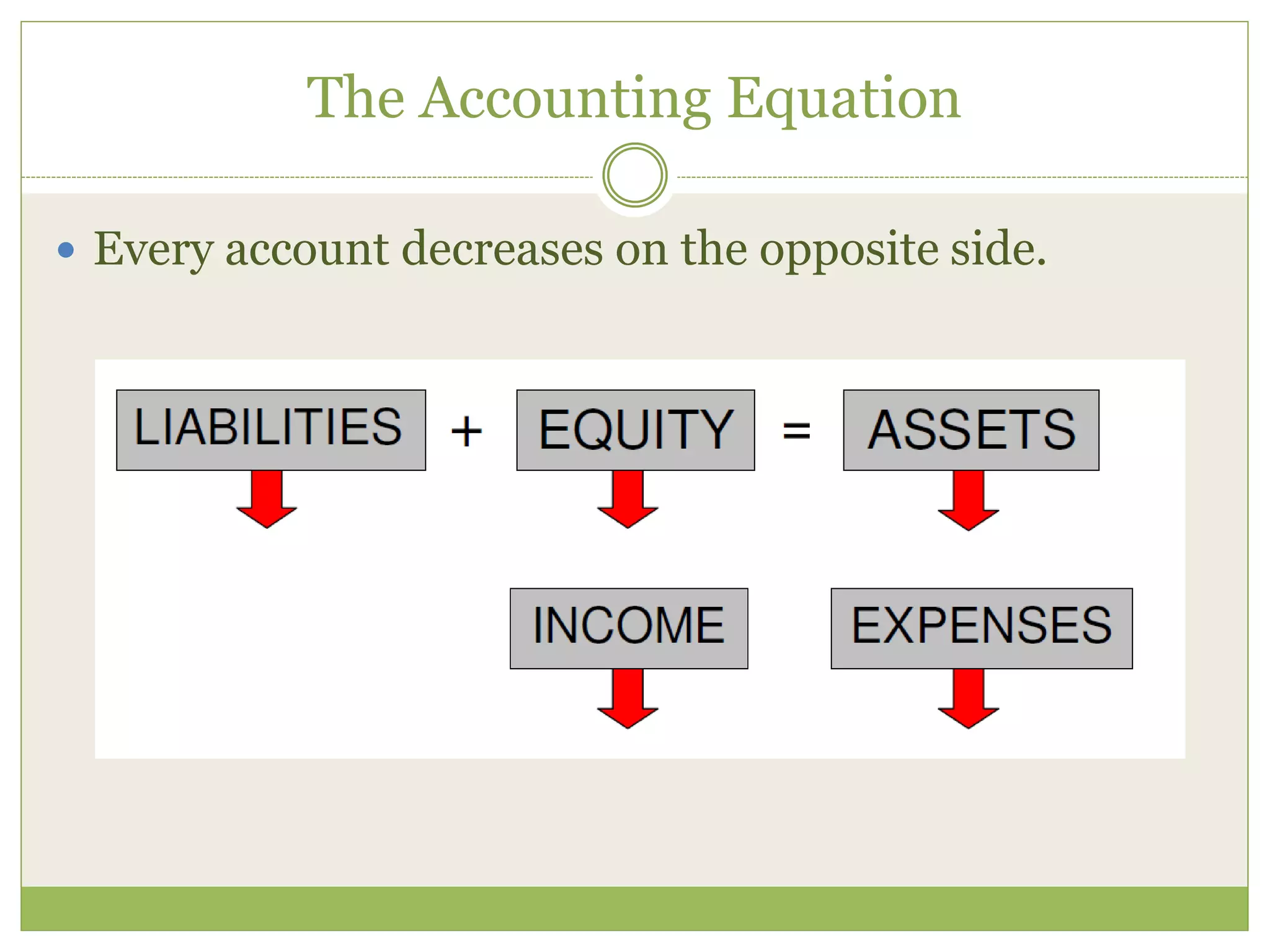

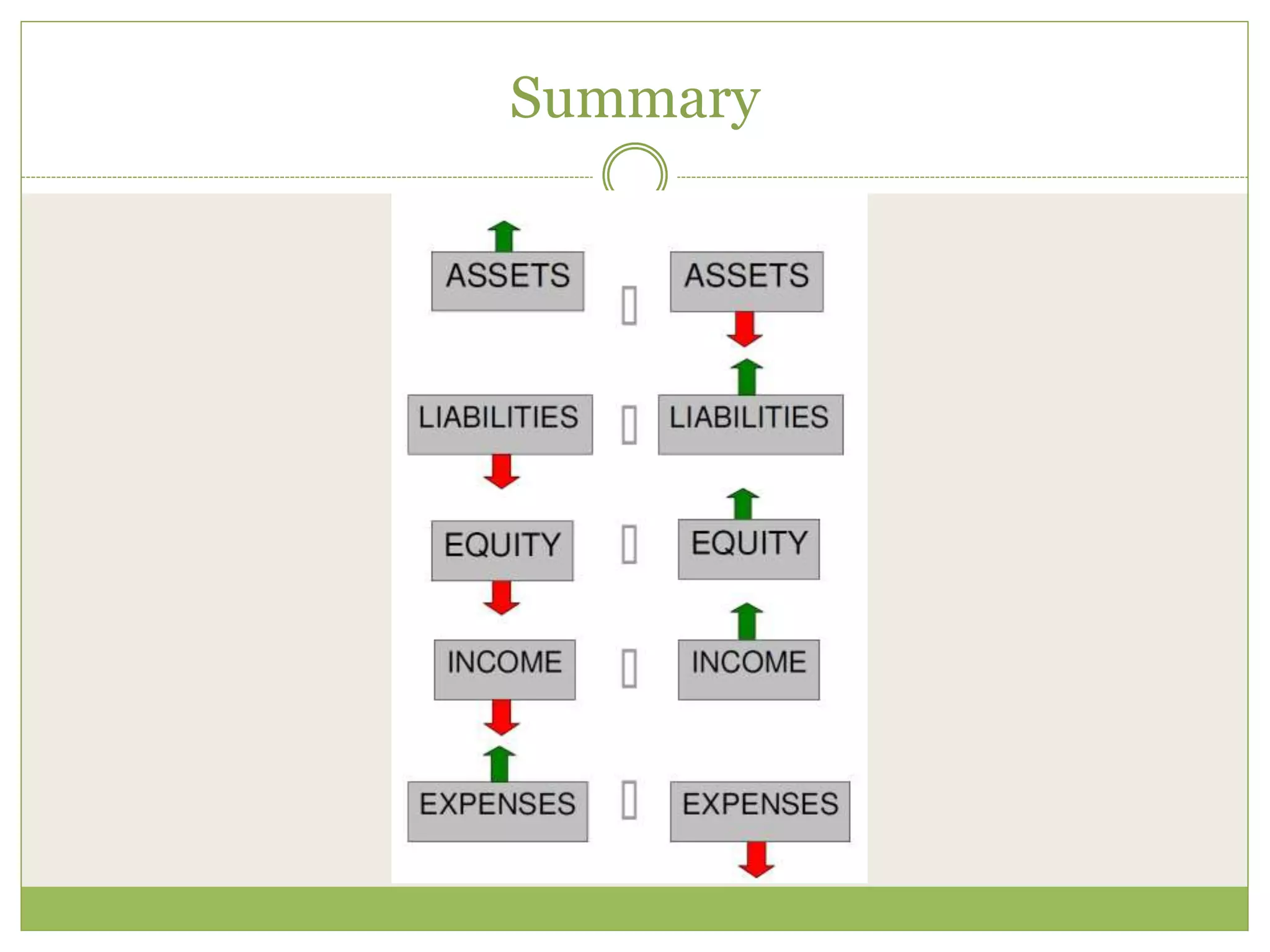

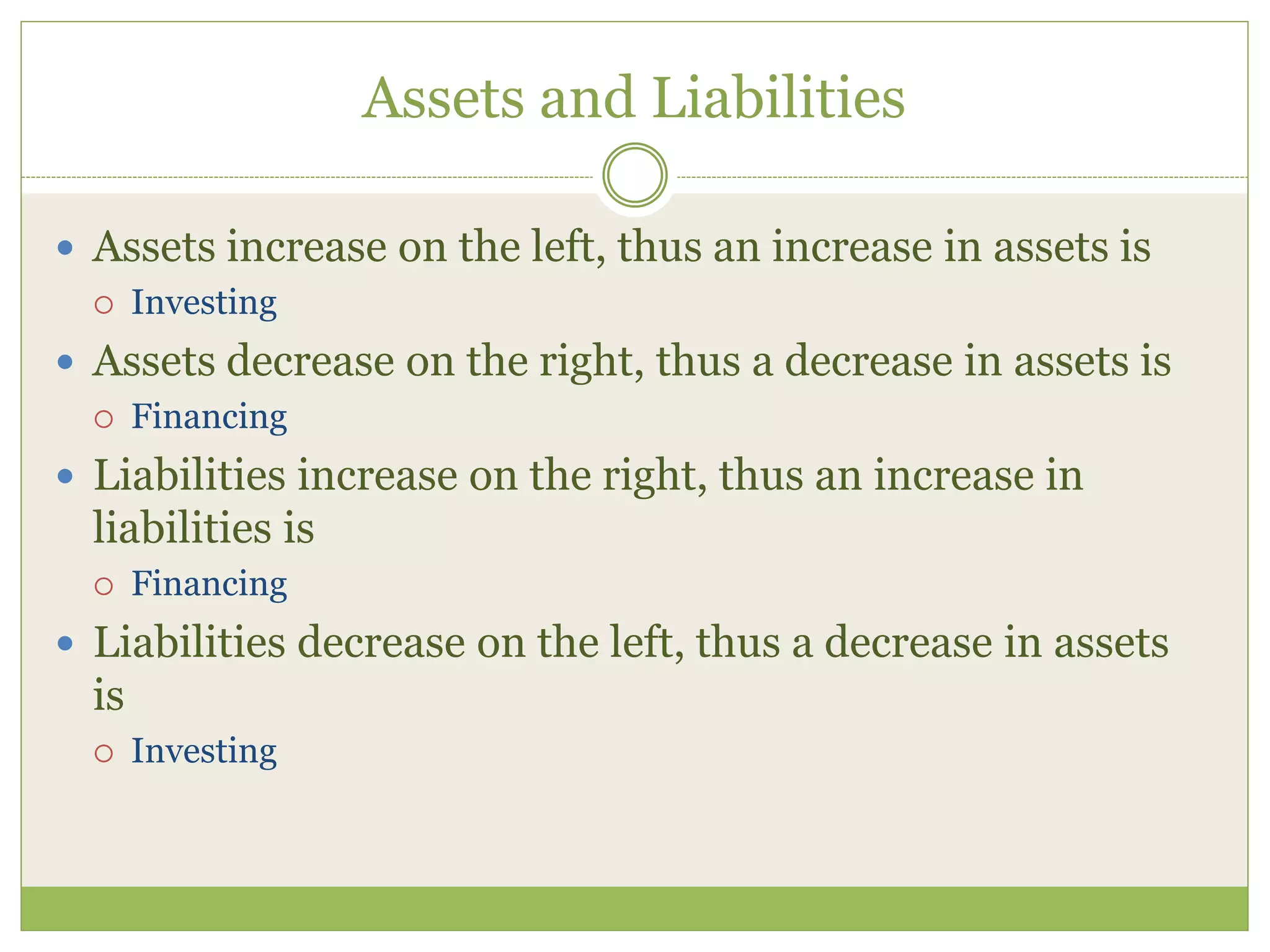

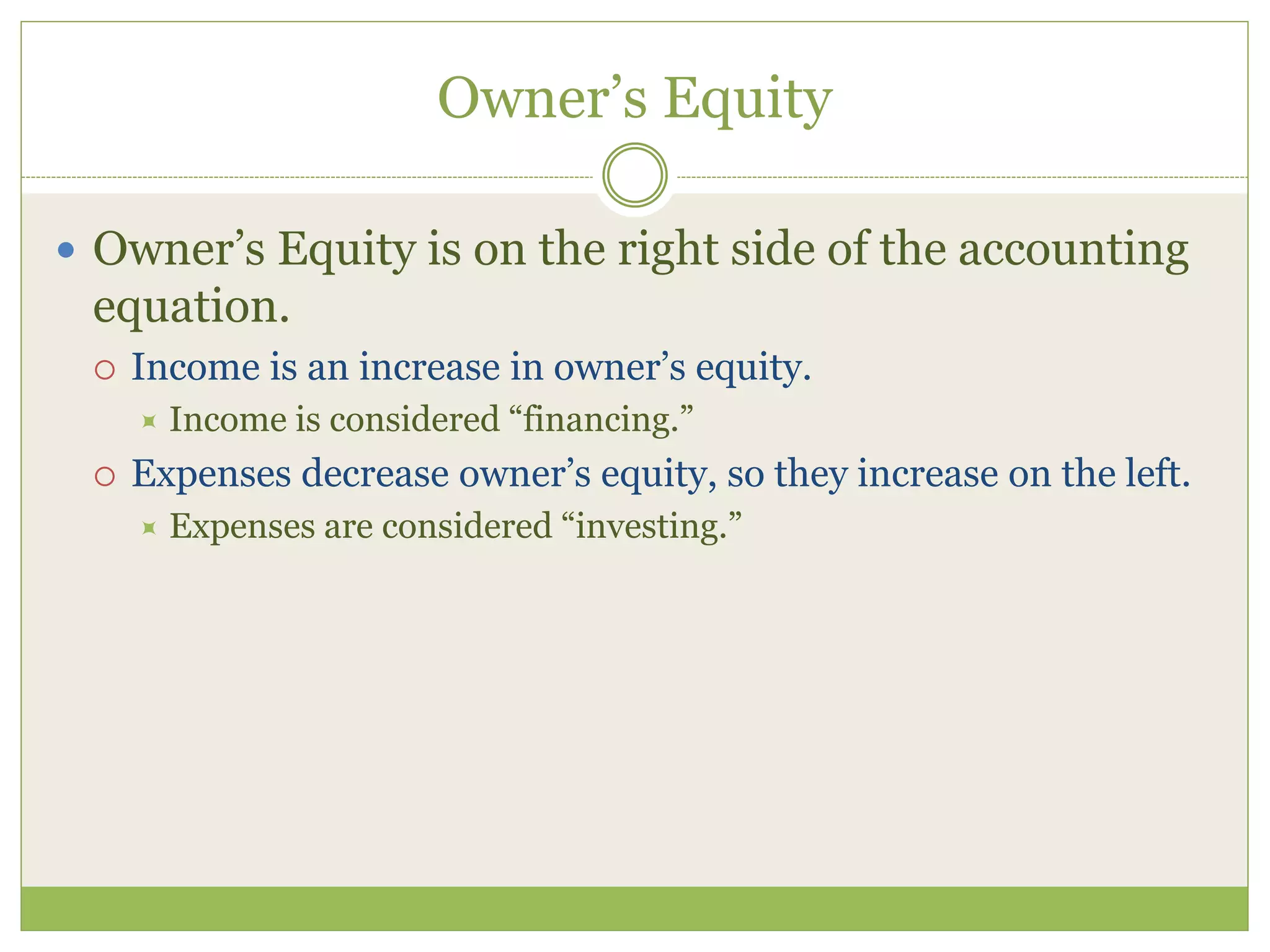

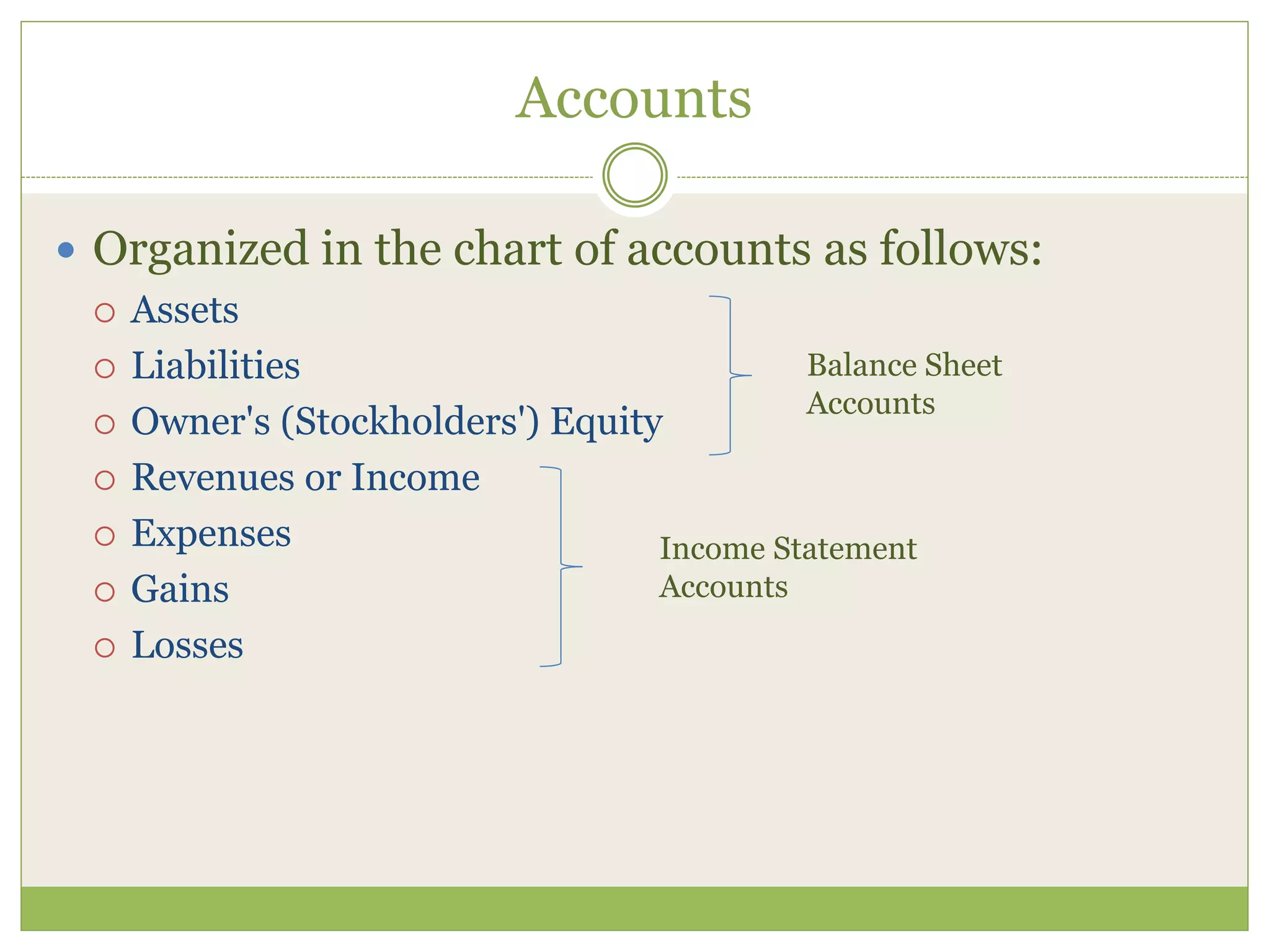

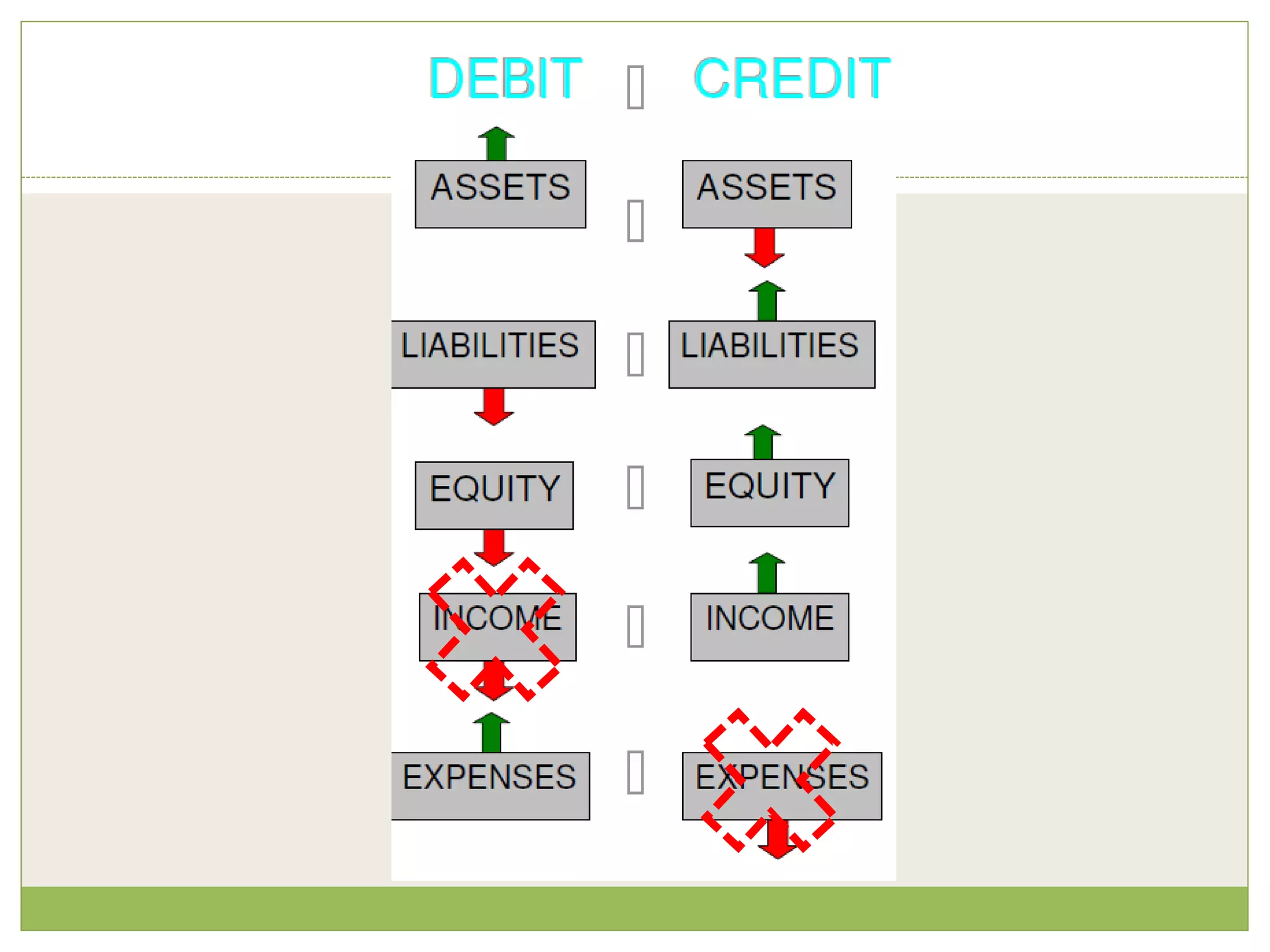

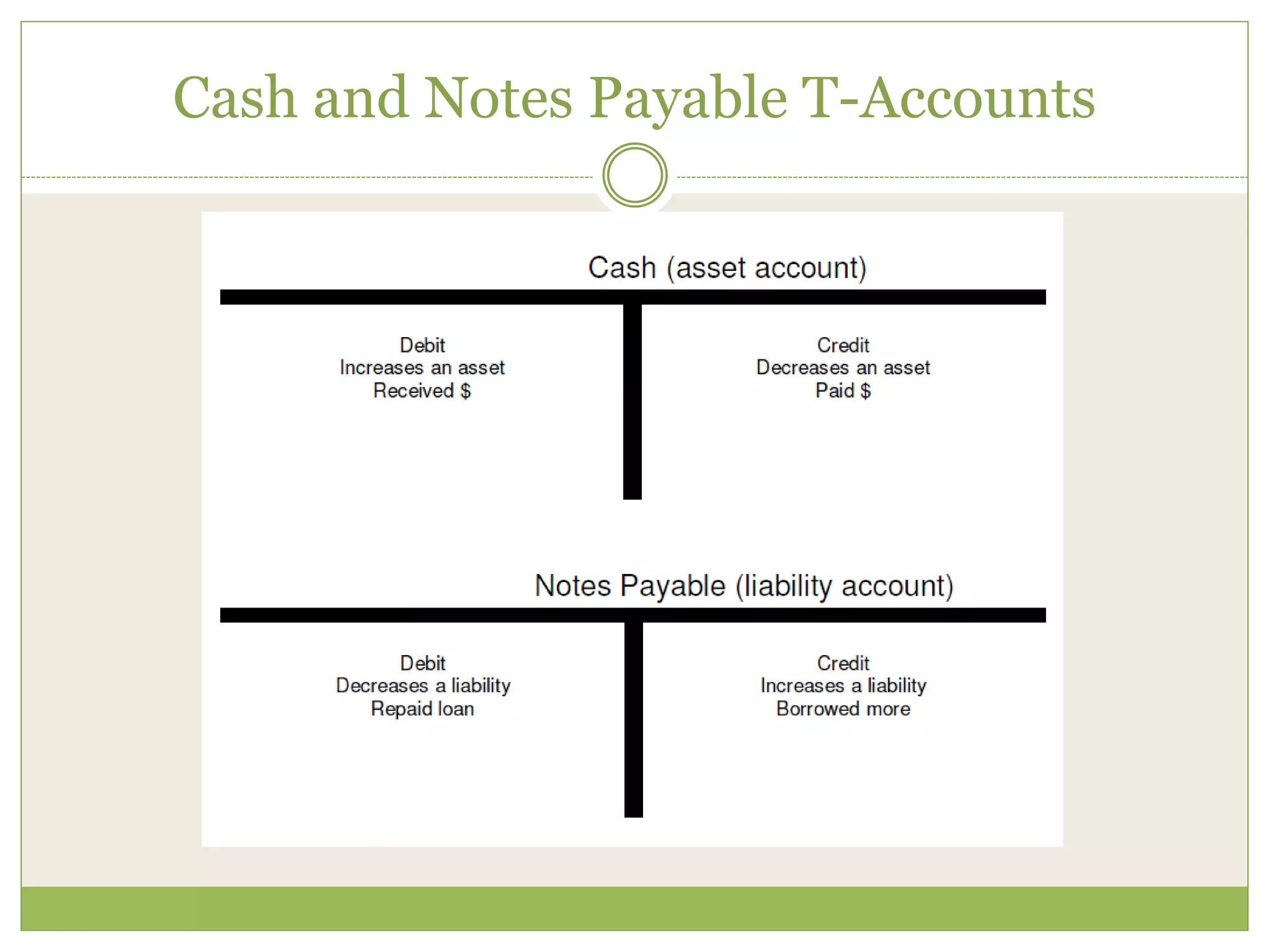

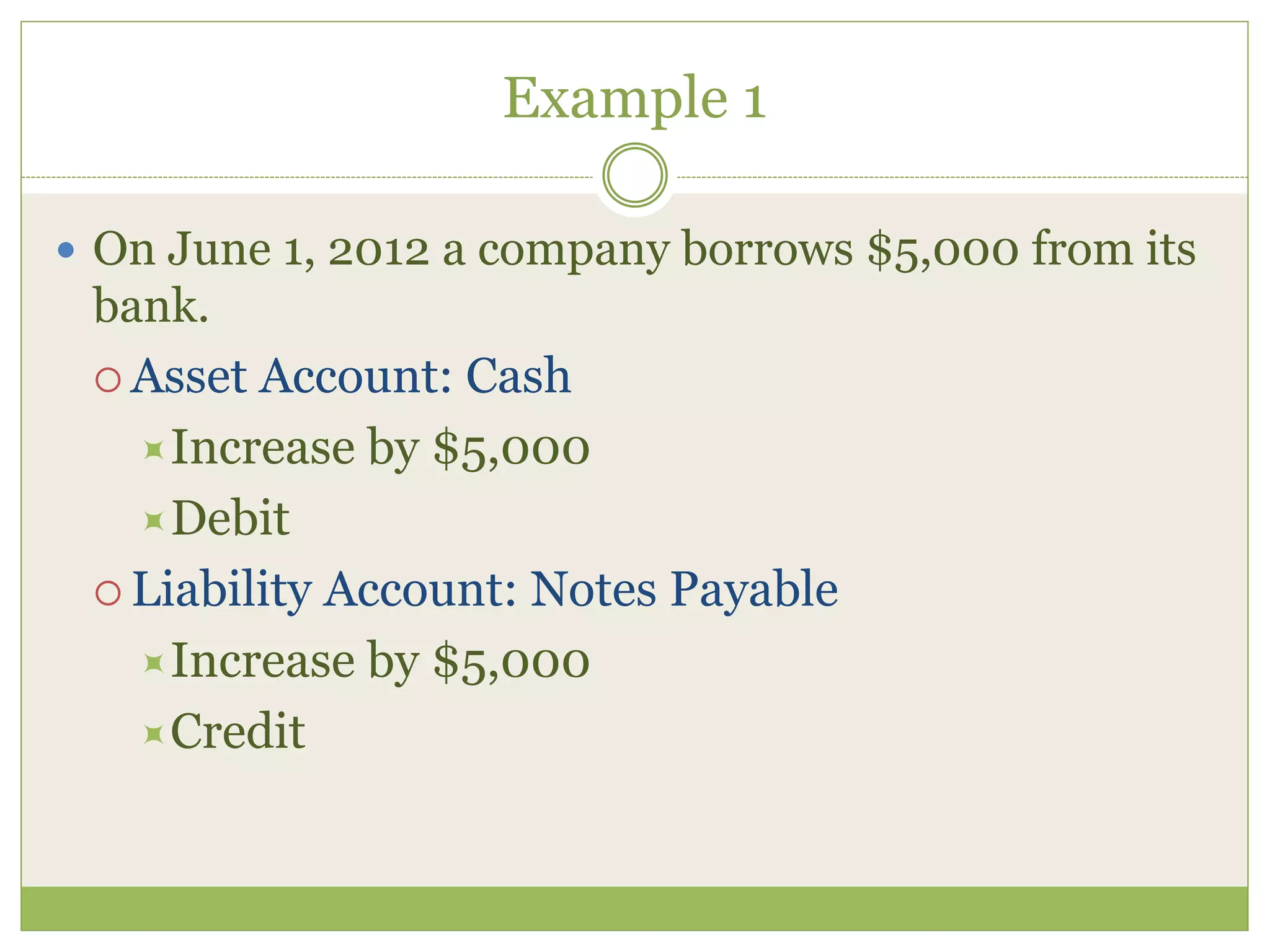

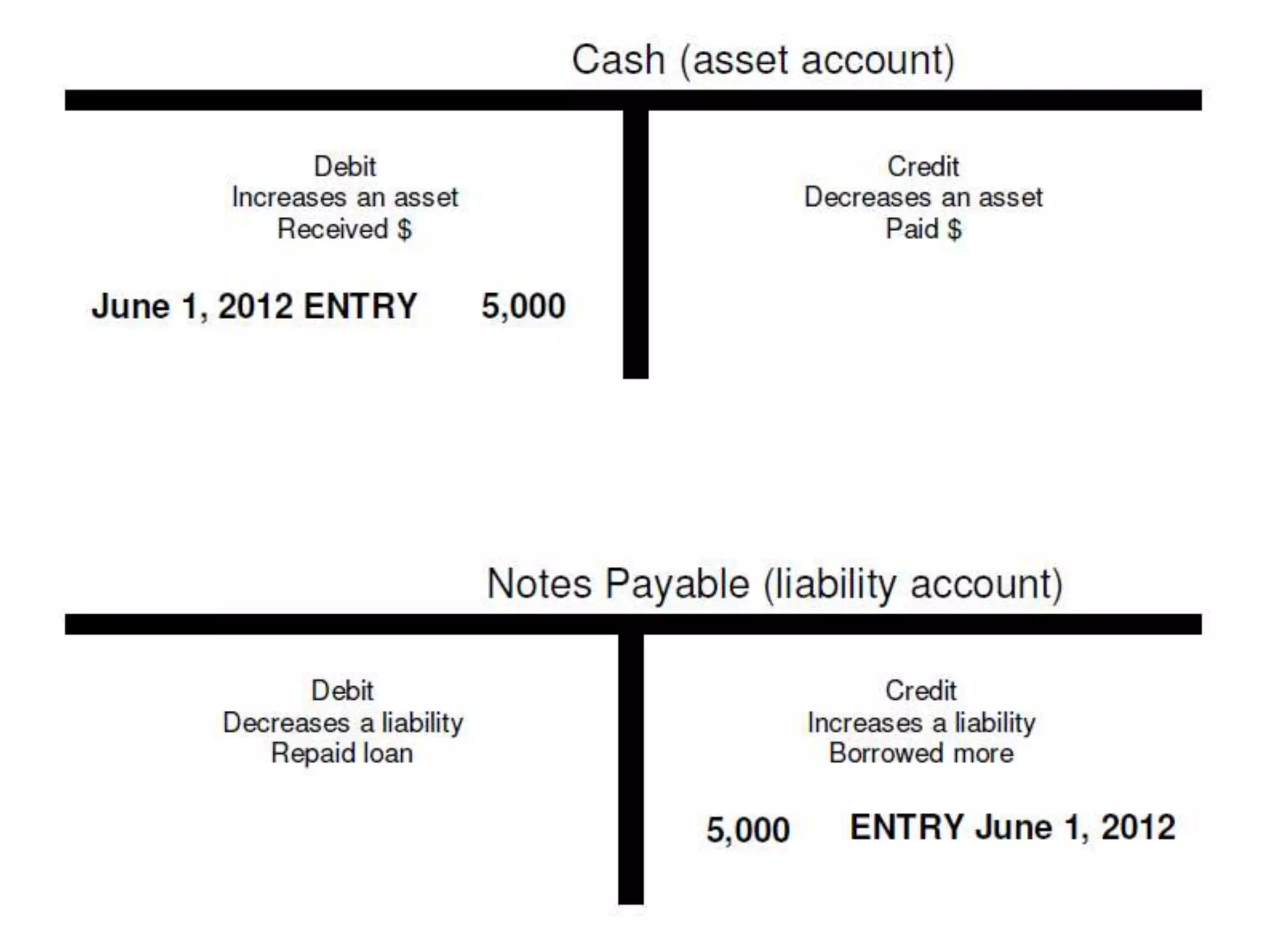

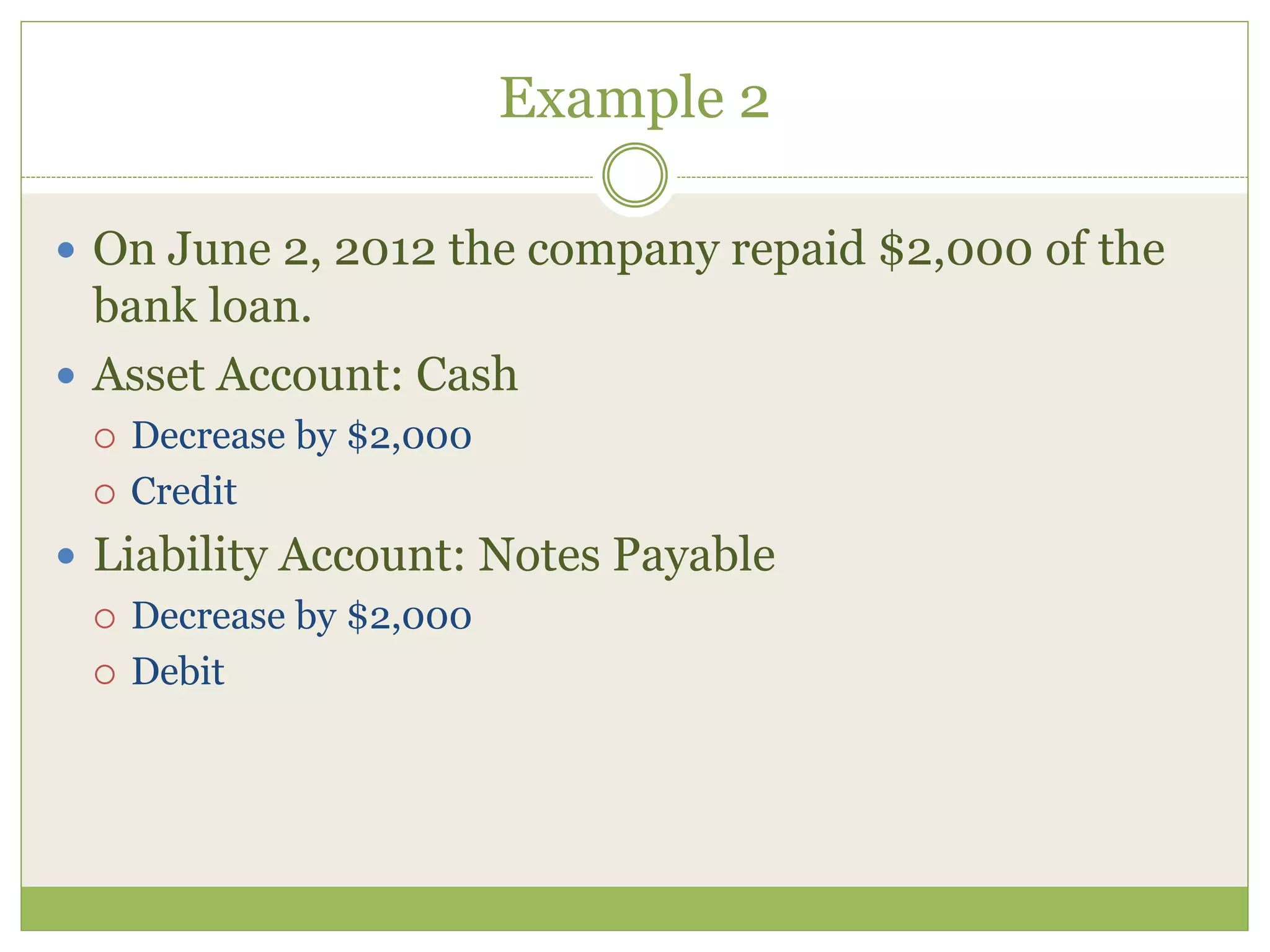

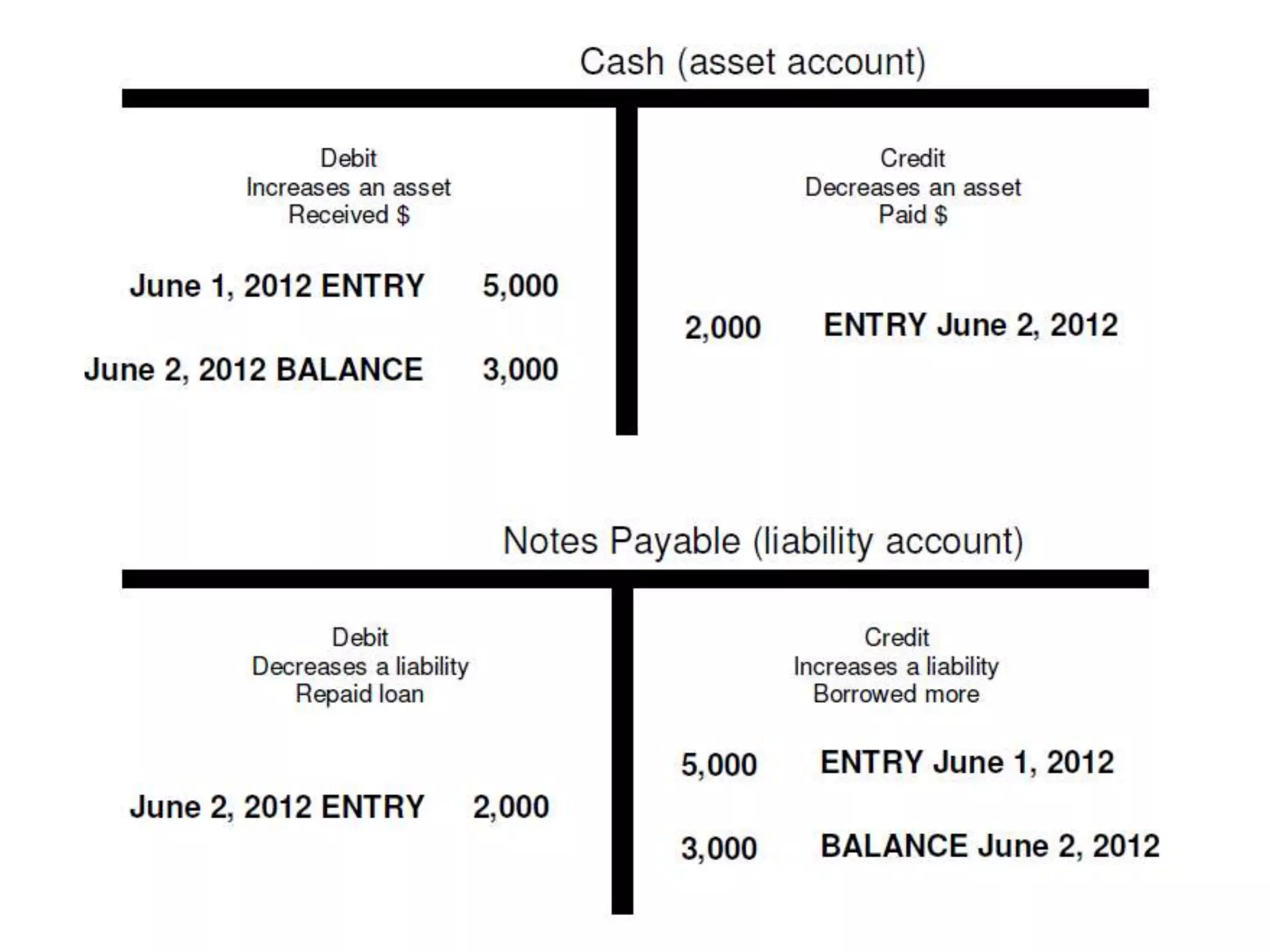

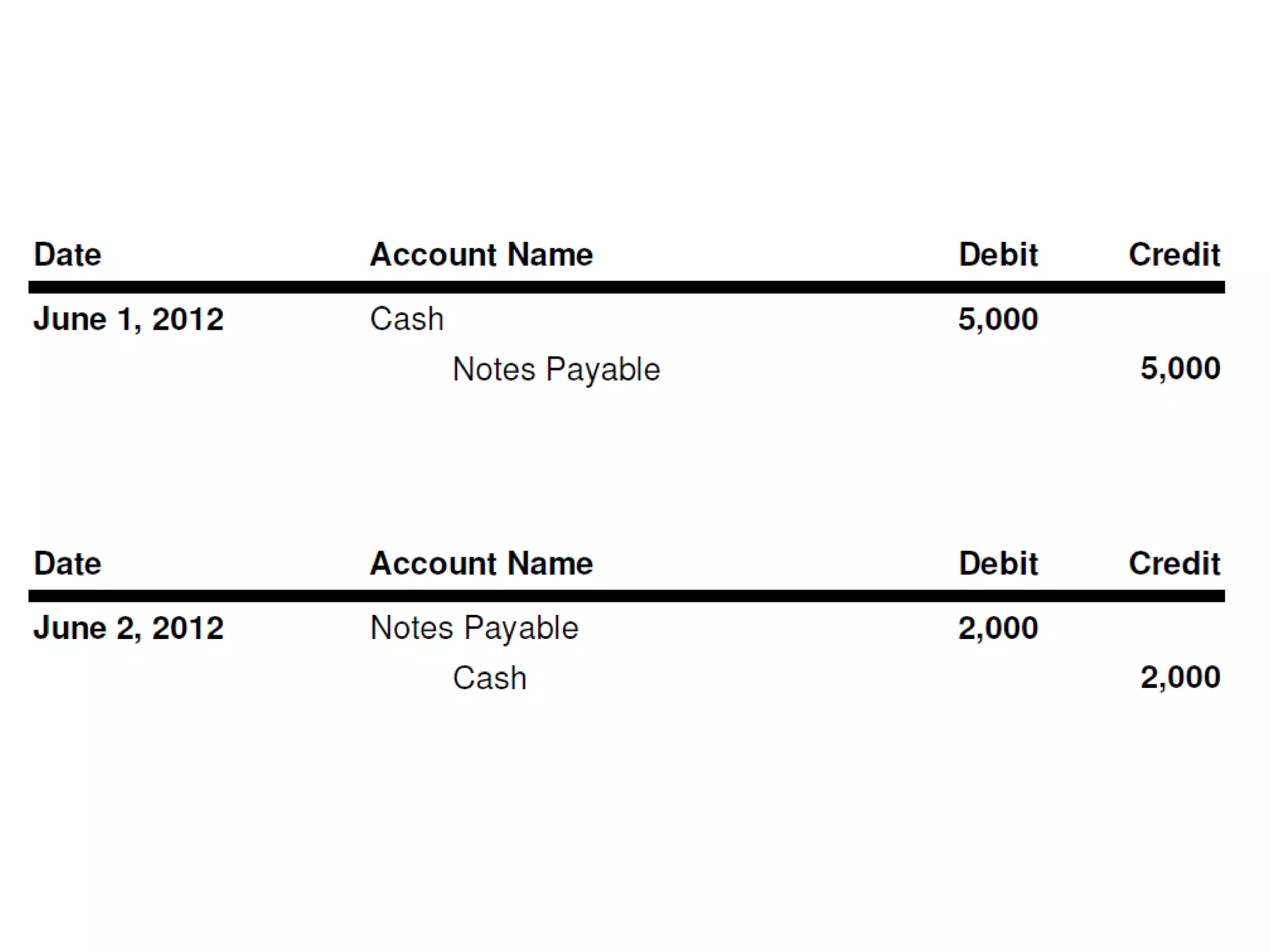

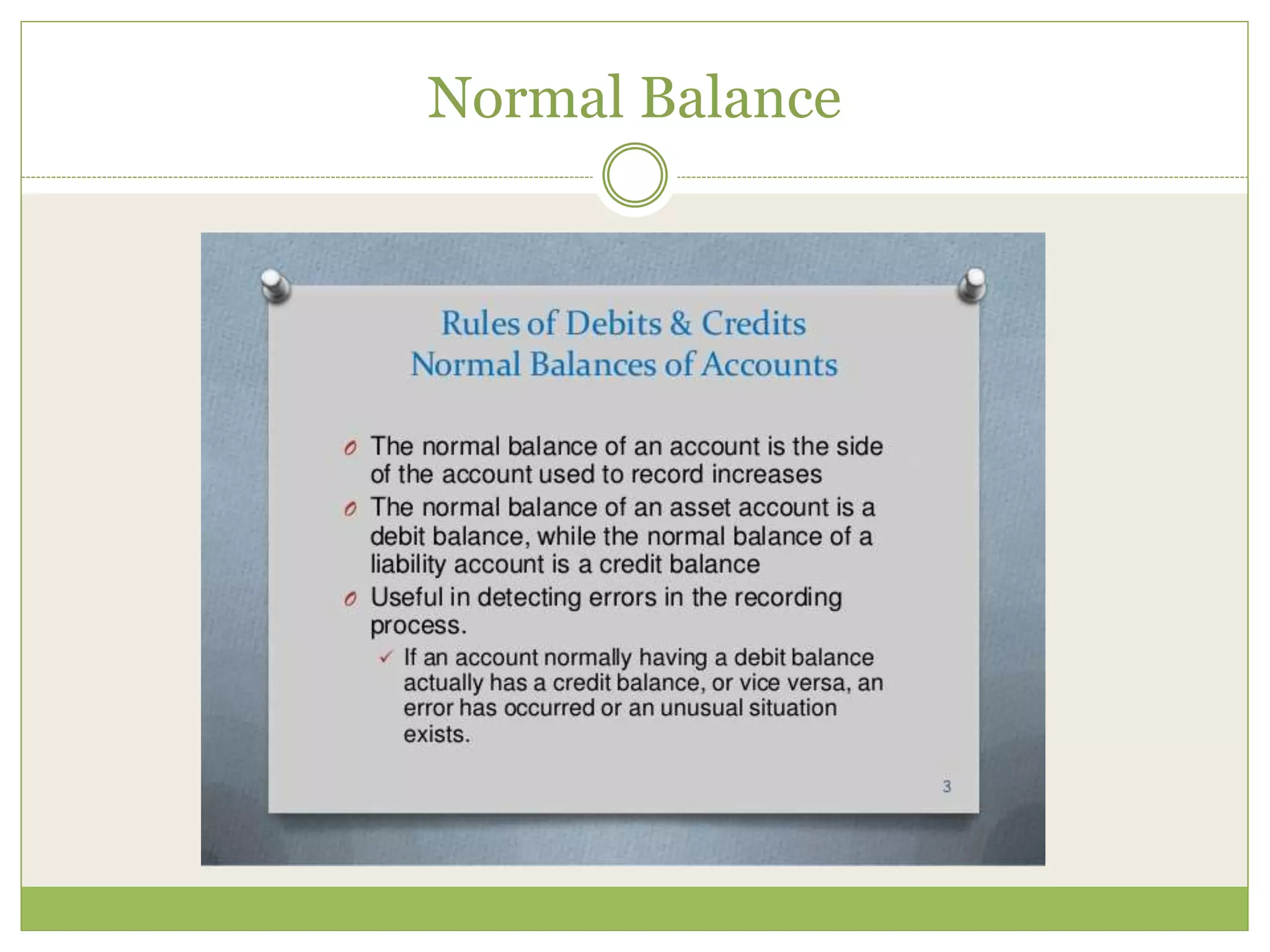

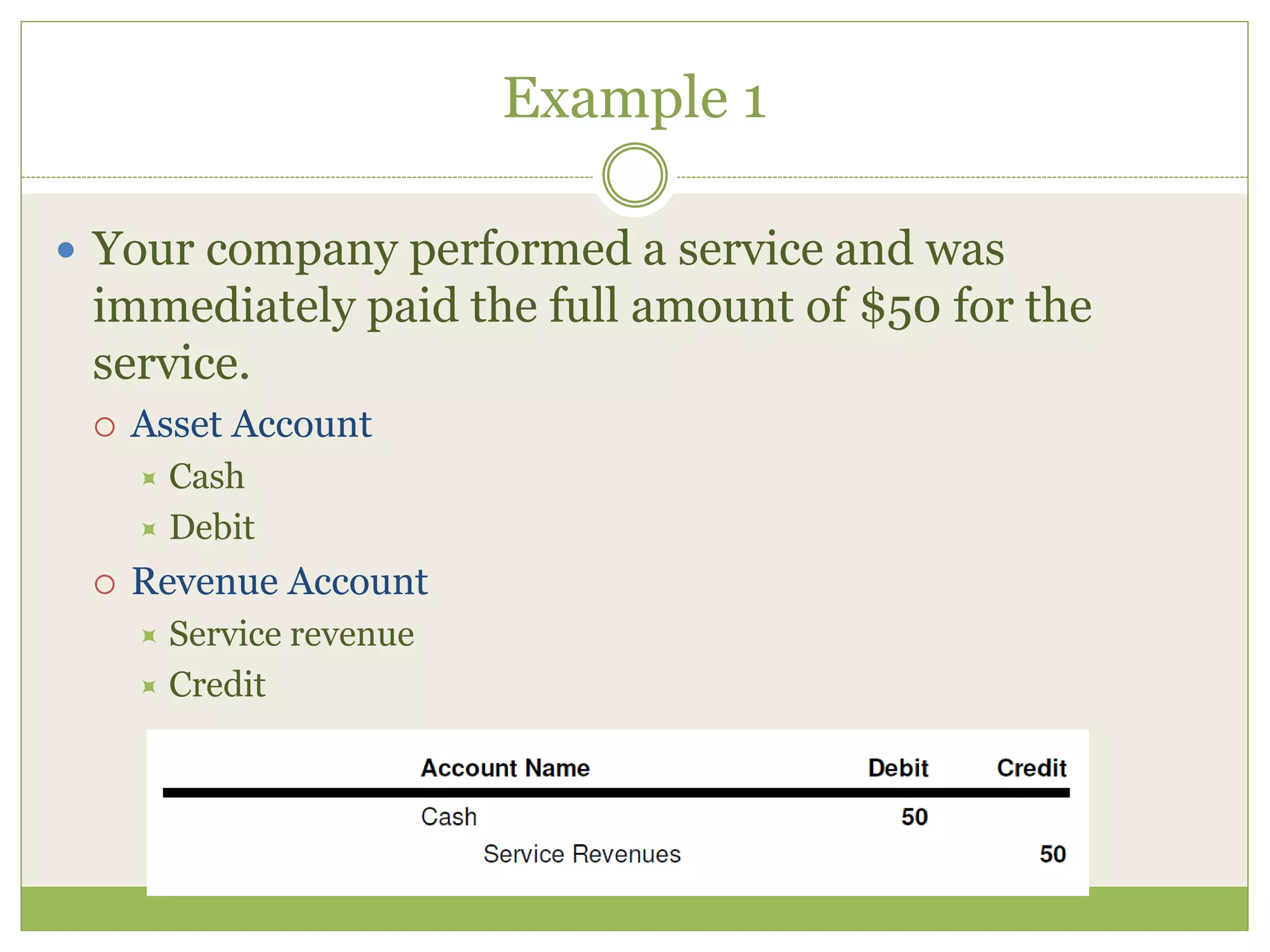

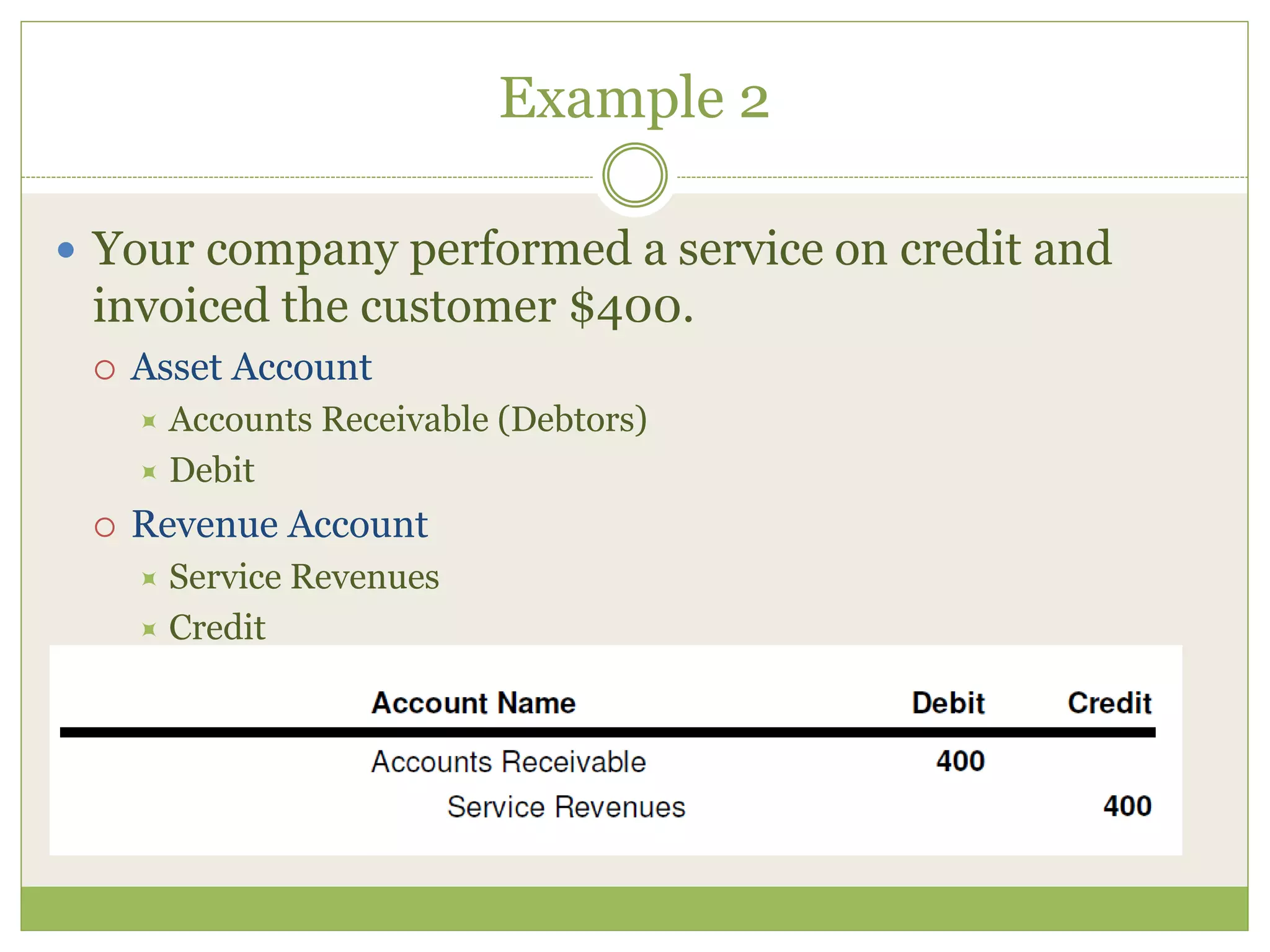

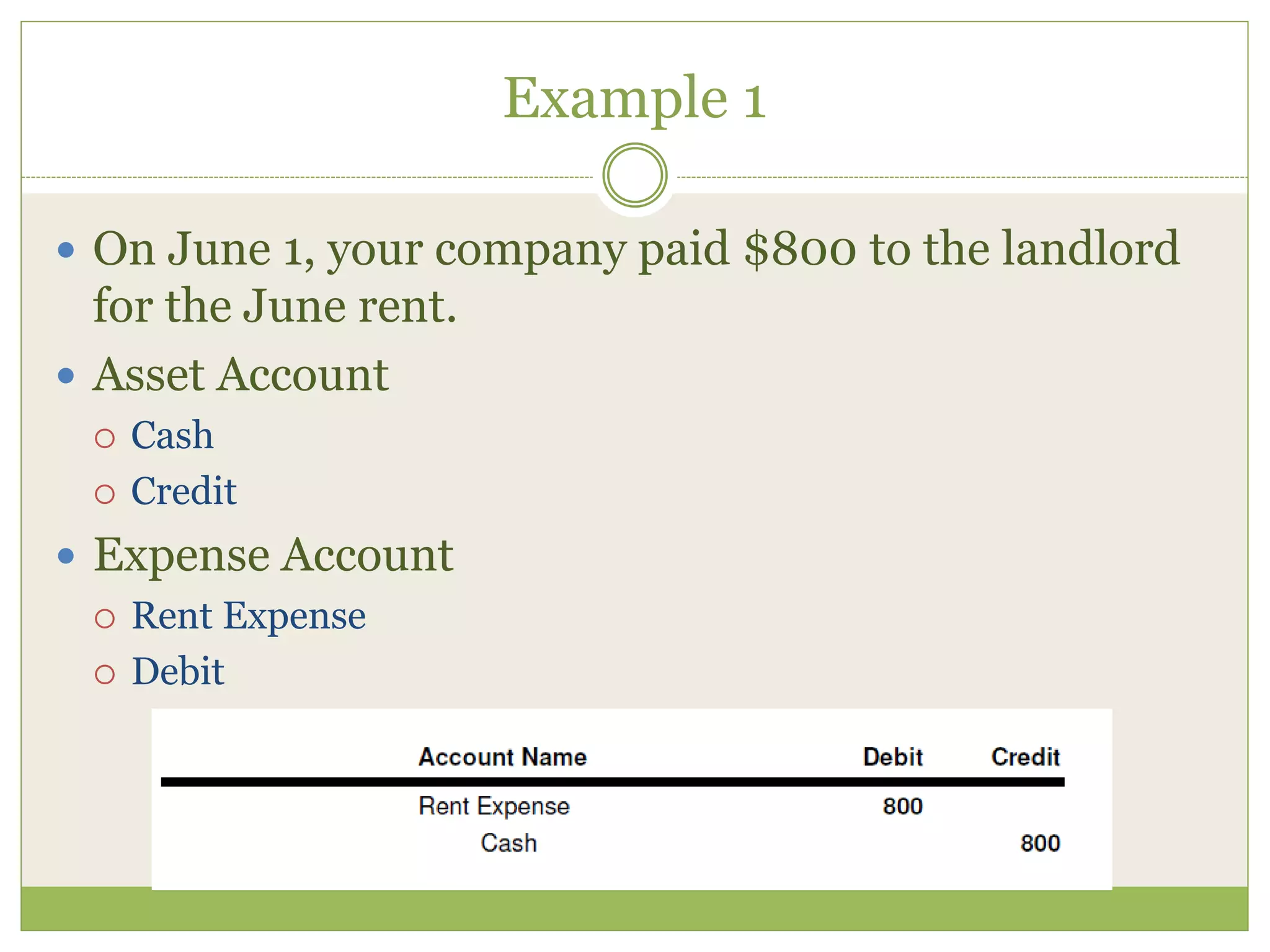

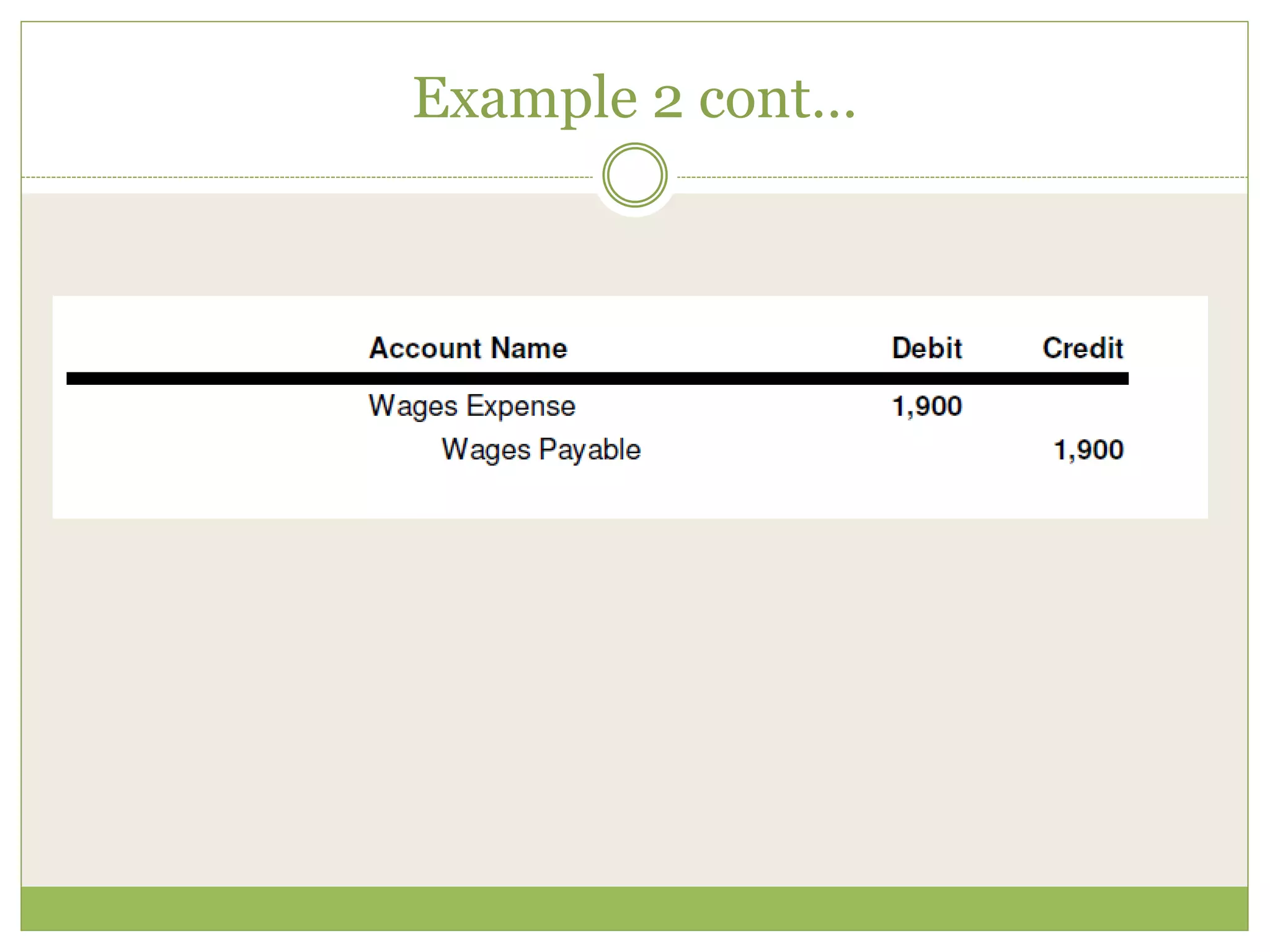

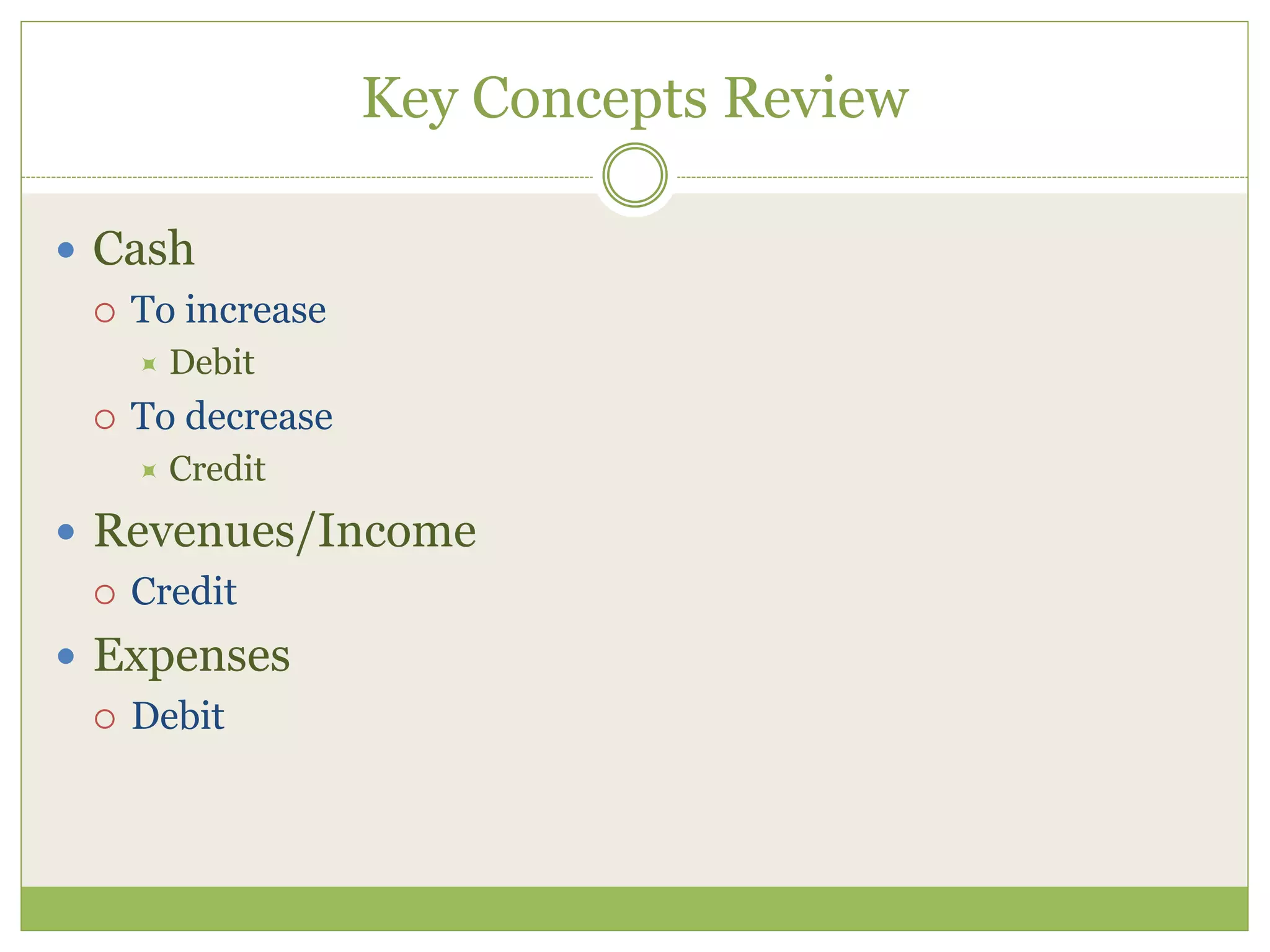

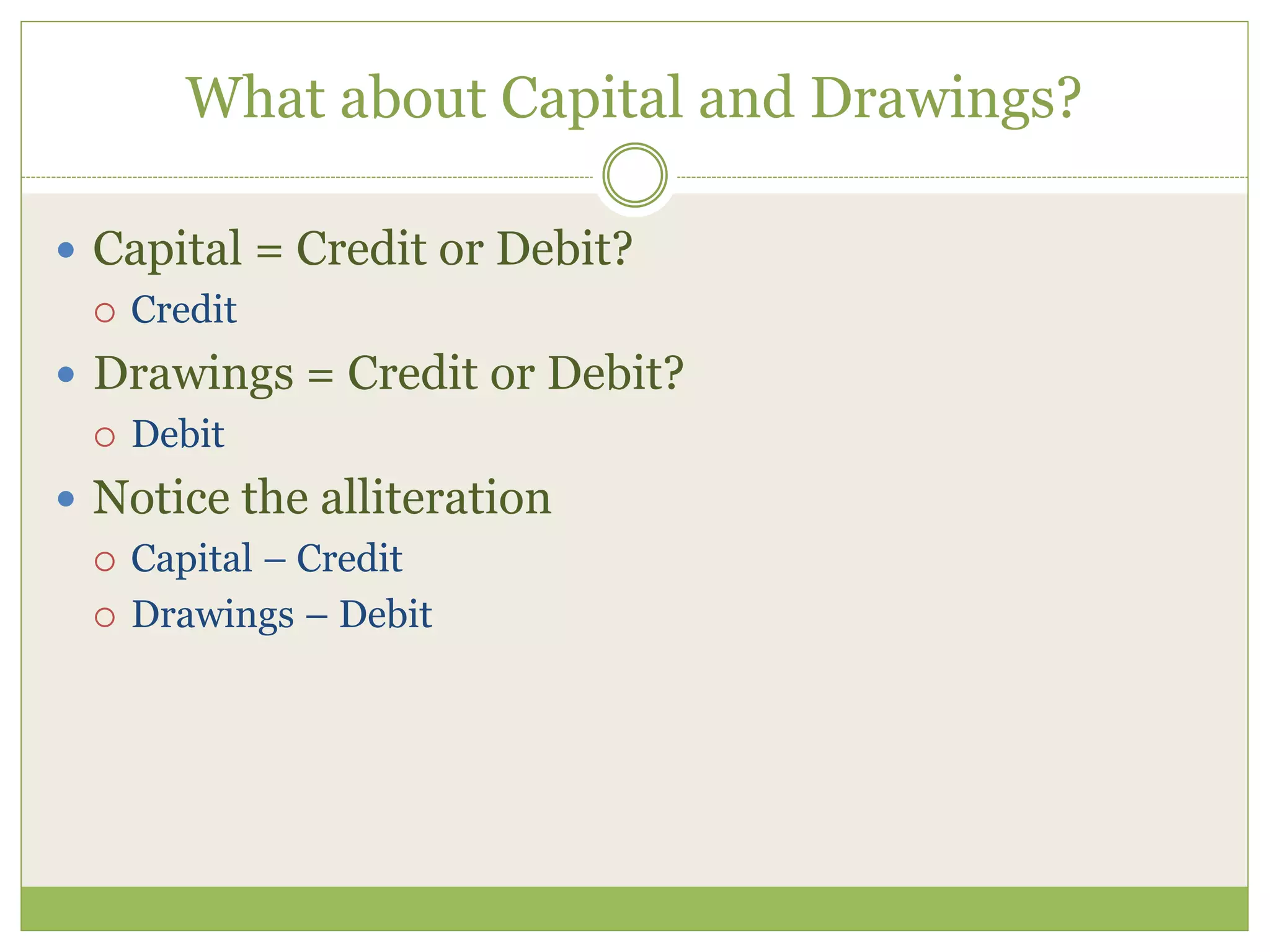

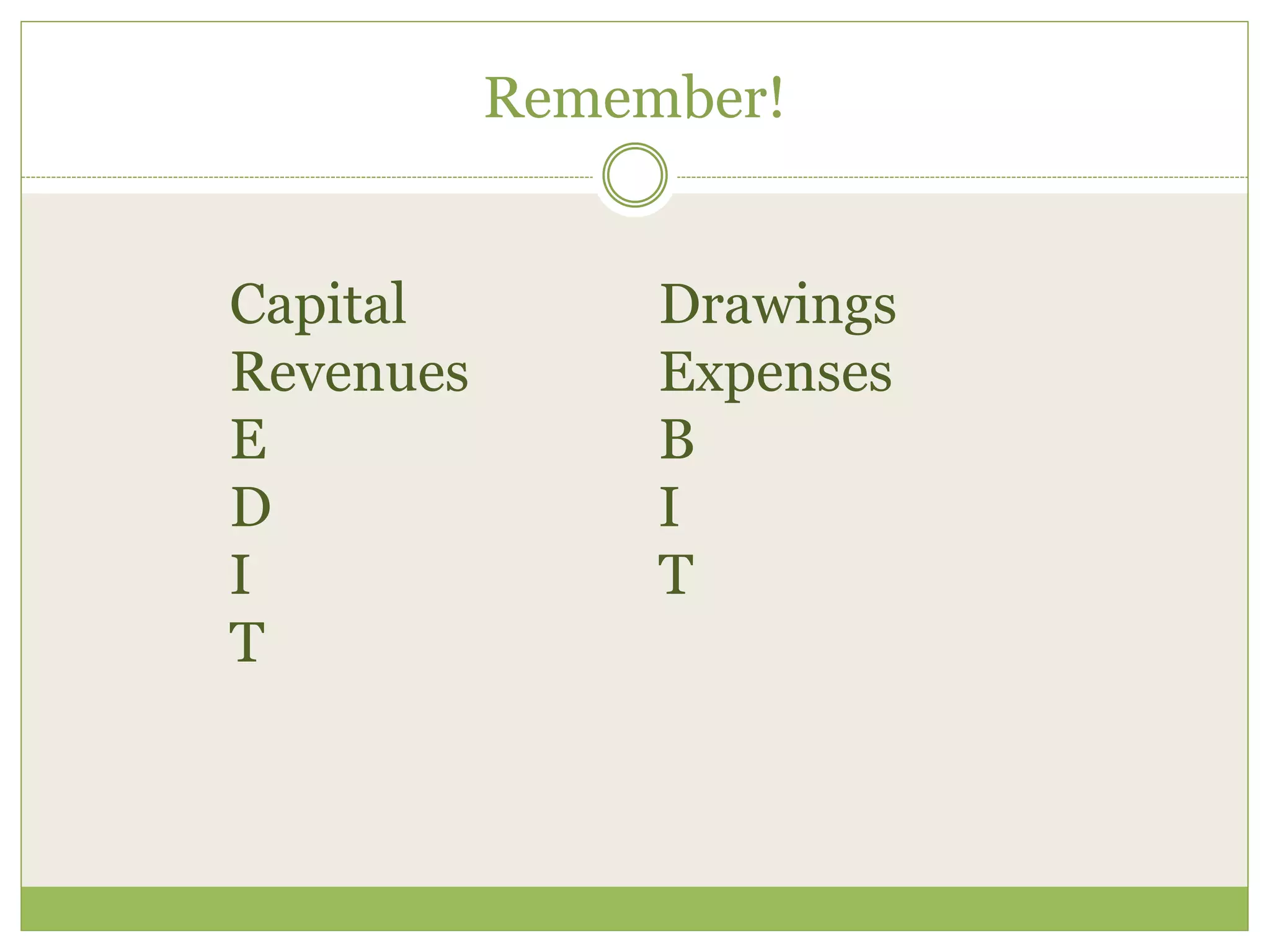

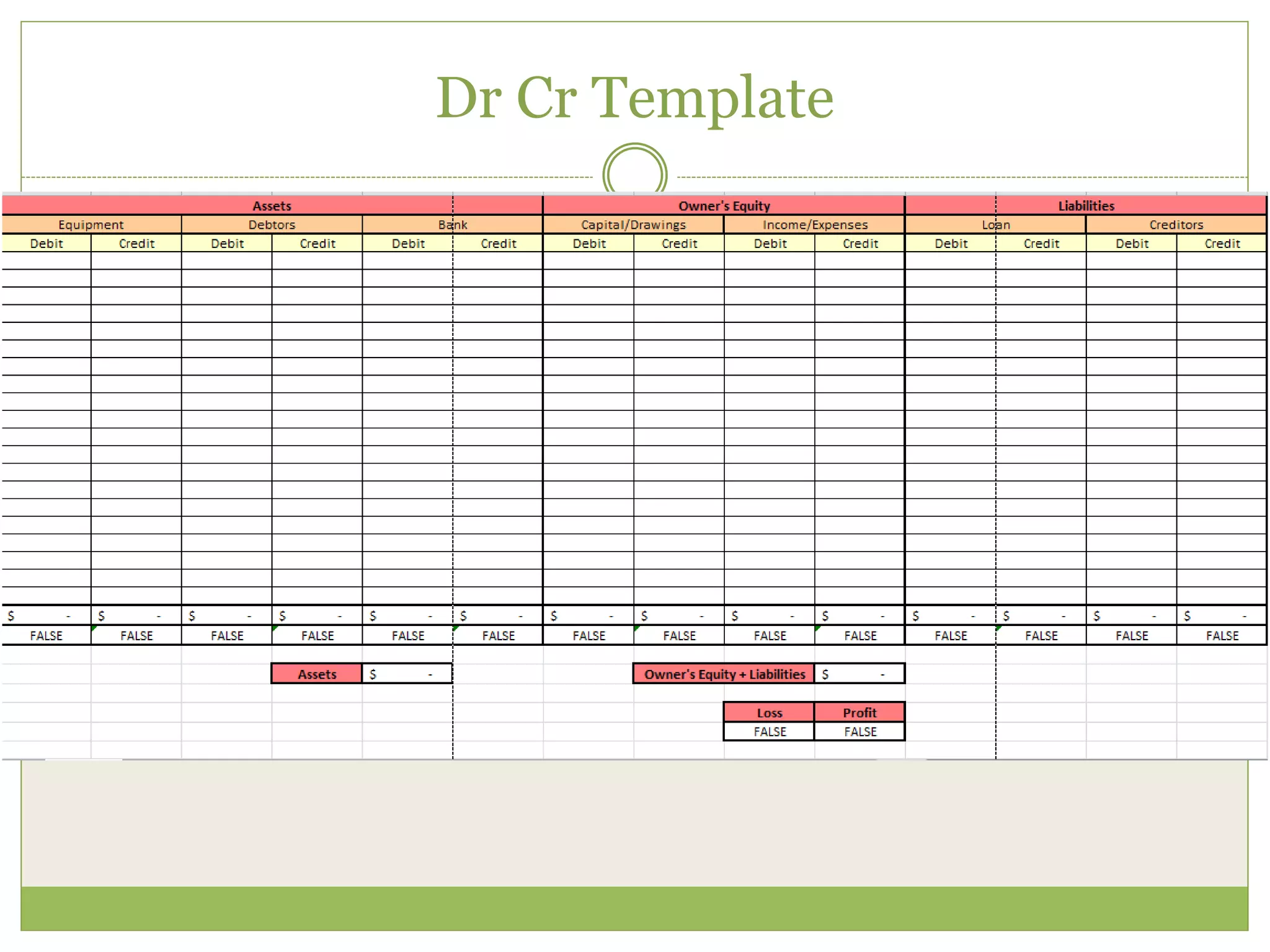

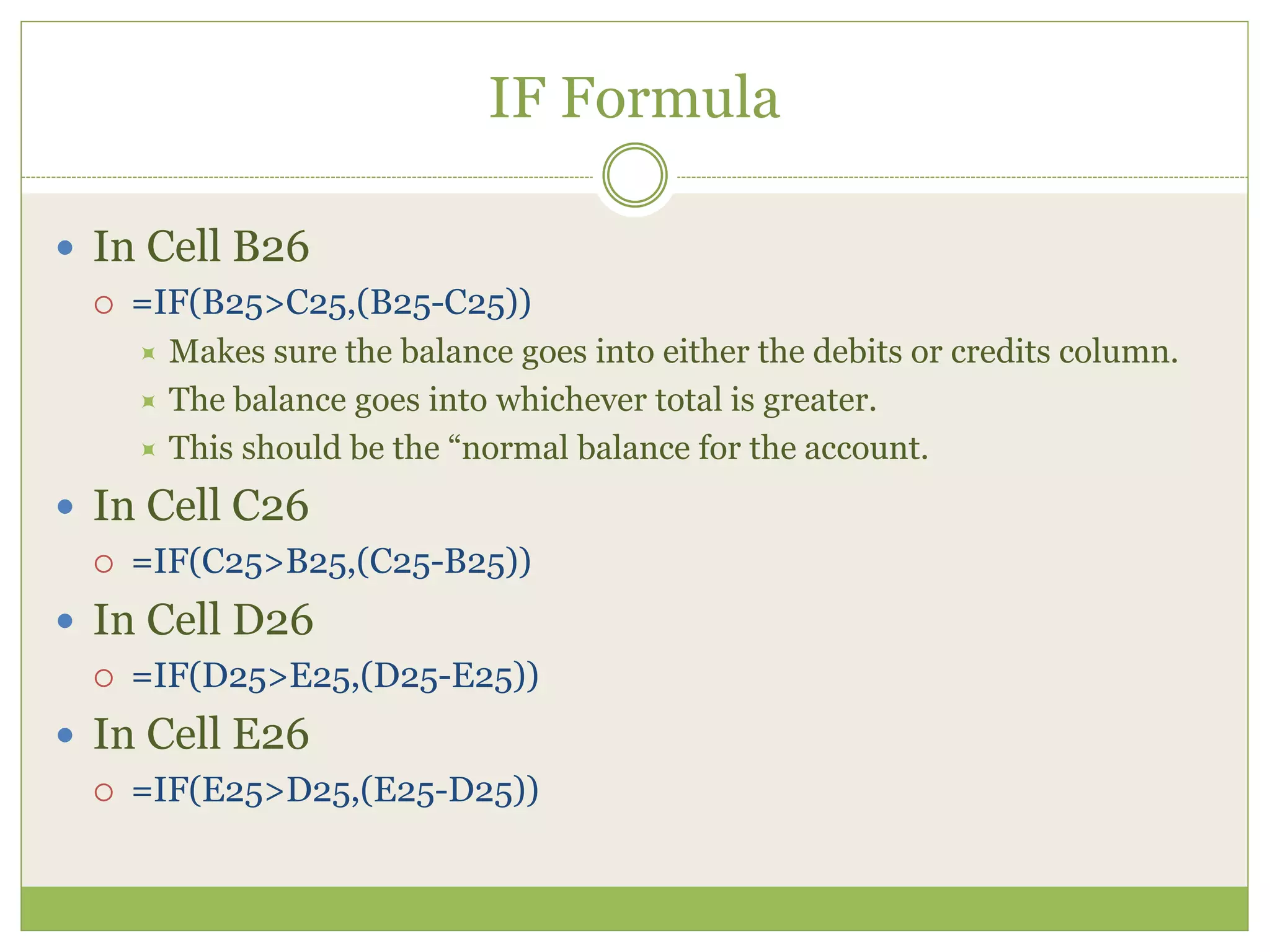

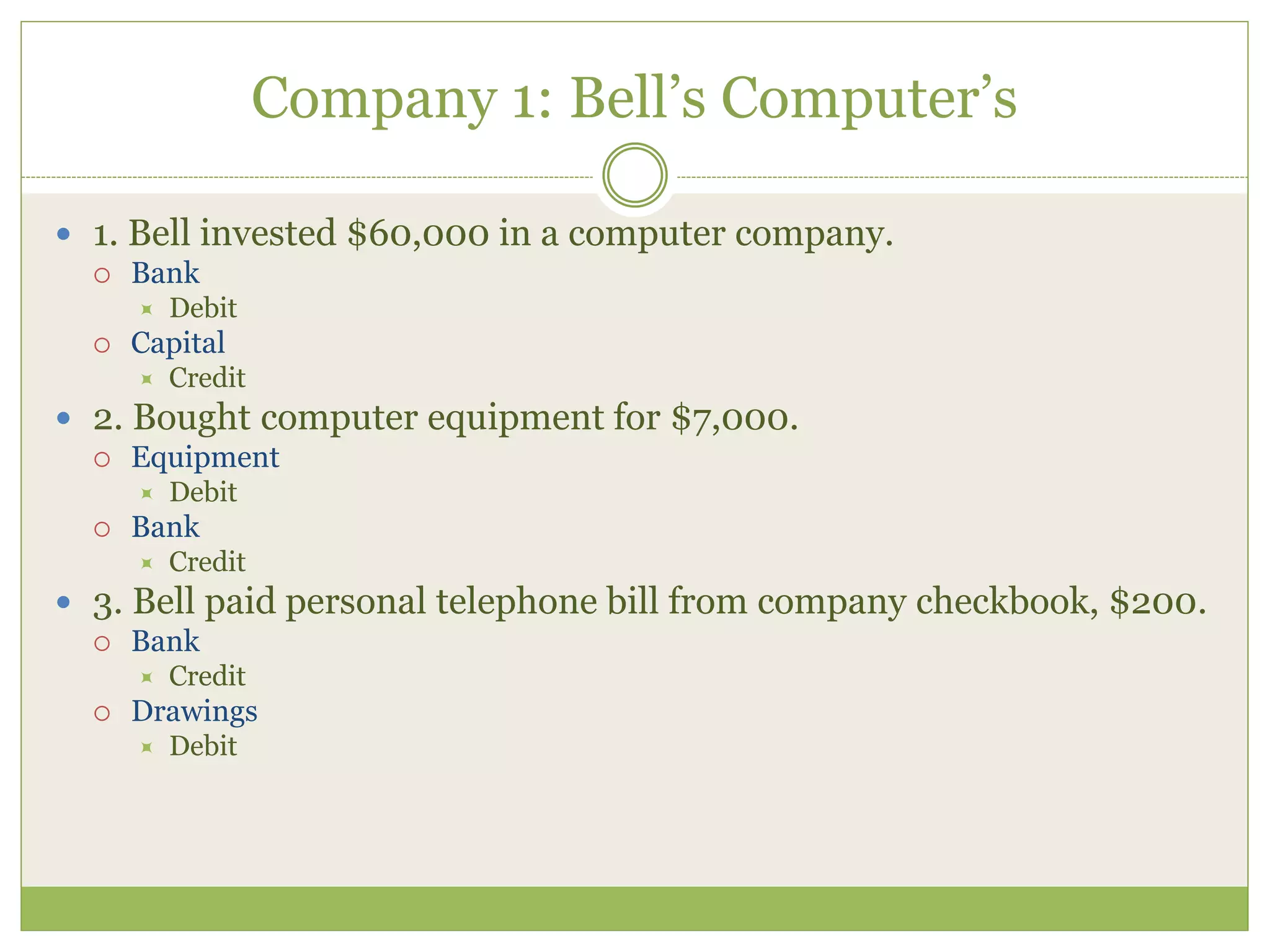

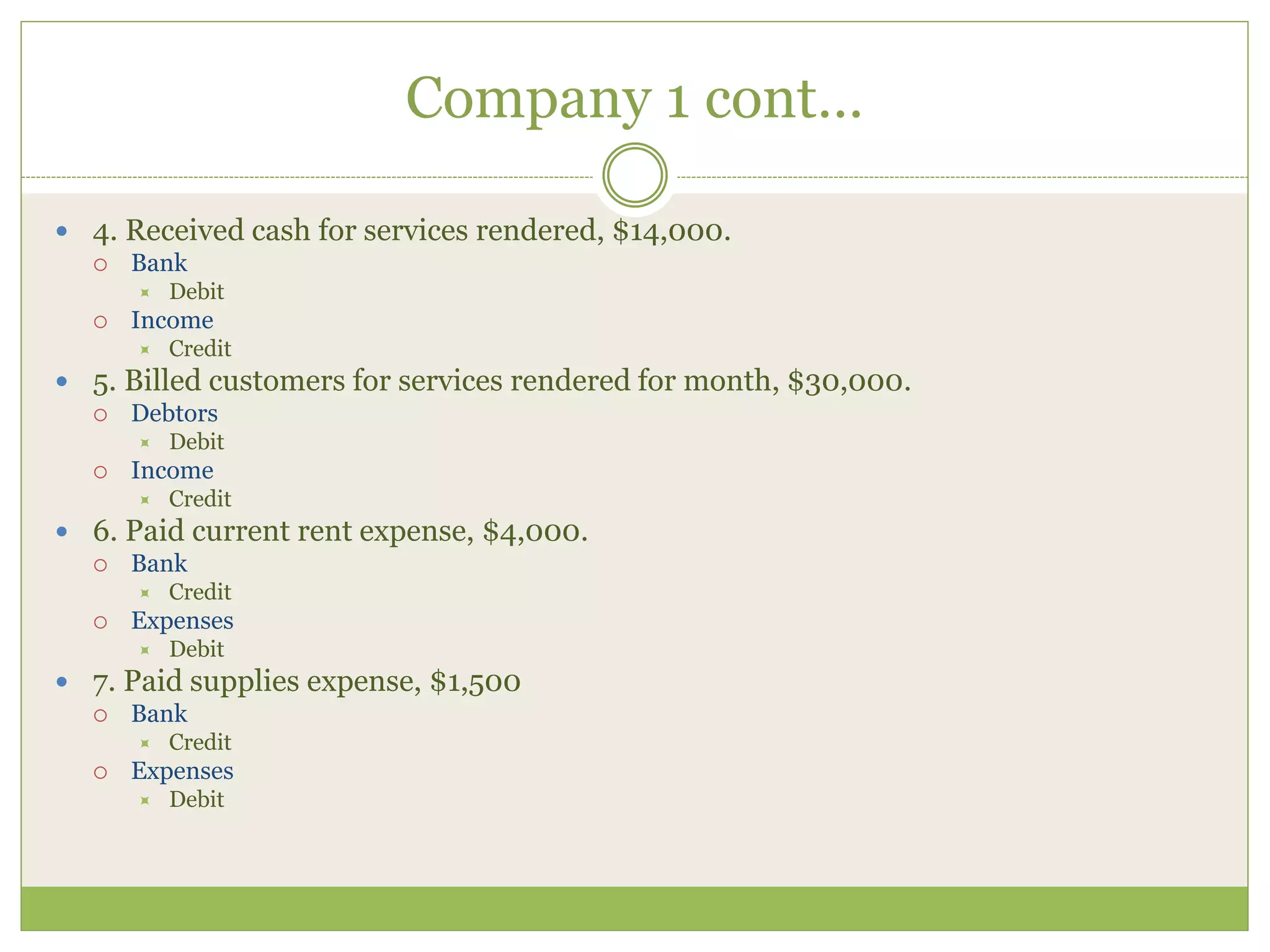

This document provides an overview of accounting concepts including financing, investing, the accounting equation, debits and credits, T-accounts, and different types of accounts. It discusses how financing occurs on the right side of the accounting equation and represents sources of money, while investing occurs on the left side and represents the use of money. The key accounting equation assets = liabilities + owner's equity is also explained. Common account types are defined including assets, liabilities, owner's equity, revenues/gains, and expenses/losses. The document also demonstrates how transactions are recorded using debits and credits in T-accounts and journals.