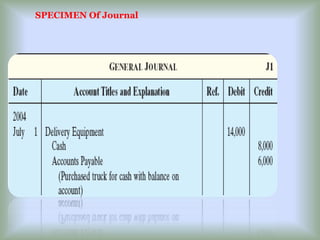

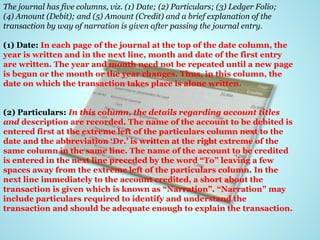

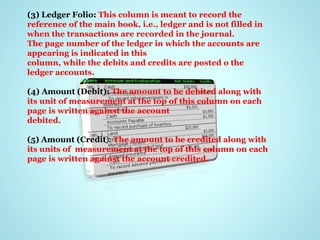

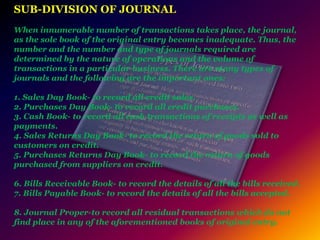

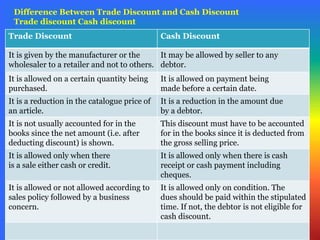

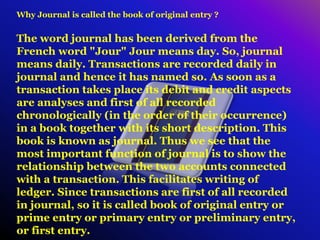

The document discusses the journal, which is the original book of entries where all business transactions are first recorded. It provides advantages of using a journal such as having all transactions recorded in one place chronologically, including narrations to explain each entry. The journal helps ensure accurate posting to ledger accounts and allows for errors to be rectified. Various types of subsidiary journals are described that can be used for specific transaction types depending on the business. Key differences between trade and cash discounts are also outlined.

![6

This presentation is owned by

ABUL KALAM AZAD PATWARY

“for class 9-10[accounting]”](https://image.slidesharecdn.com/accounting-chapter-6-150209045930-conversion-gate02/85/Accounting-chapter-6-2-320.jpg)