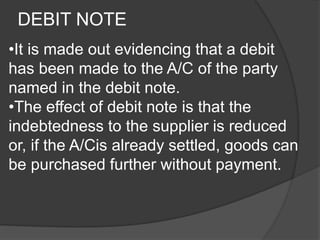

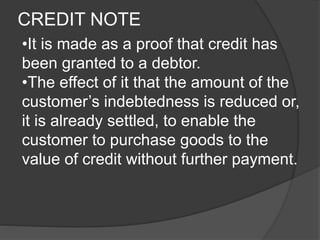

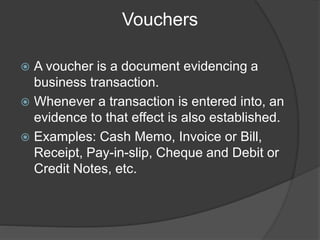

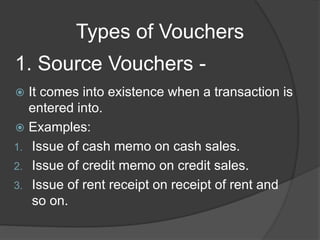

This document discusses different types of source documents and accounting vouchers used in accounting. It describes common source documents like cash memos, invoices, receipts, pay-in-slips, cheques, debit notes and credit notes. It also discusses accounting vouchers, distinguishing between source vouchers created during a transaction and accounting vouchers prepared by accountants to record transactions in accounts. Key types of accounting vouchers are cash vouchers for payments and receipts, and non-cash or transfer vouchers for credit sales, purchases and adjustments.