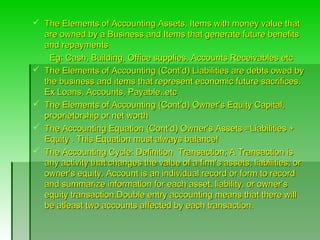

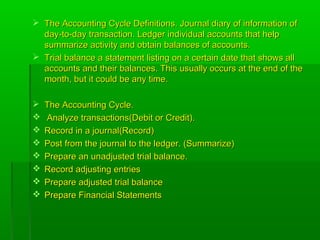

Accounting provides economic information to allow informed judgements and decisions. It has four fields: financial, management, auditing, and tax accounting. Accounting identifies, measures, and communicates transactions to understand a business's financial health, do planning and budgeting, calculate tax liability, and provide financial reports. It involves analyzing transactions, recording them in journals, posting to ledgers, preparing trial balances, recording adjustments, and generating financial statements like income statements, statements of retained earnings, and balance sheets. These statements are used by investors, employees, lenders, suppliers, customers, and governments to understand the business.