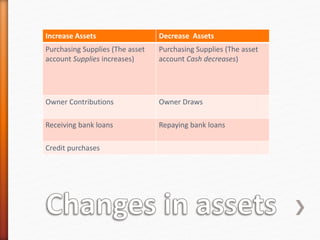

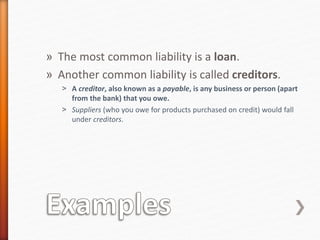

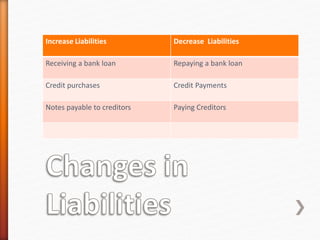

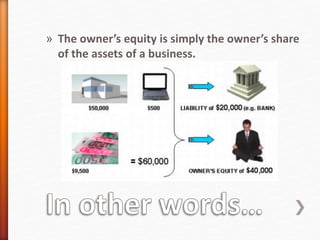

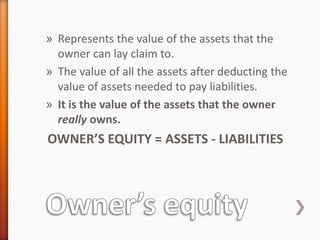

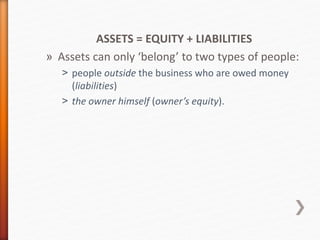

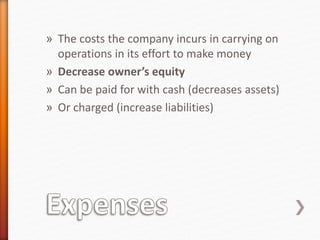

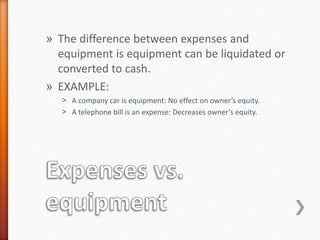

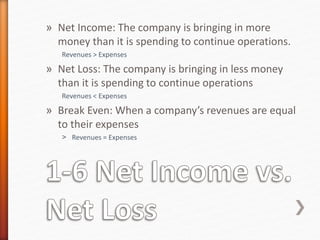

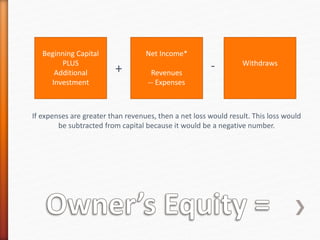

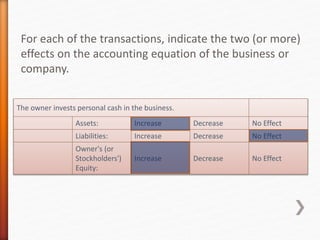

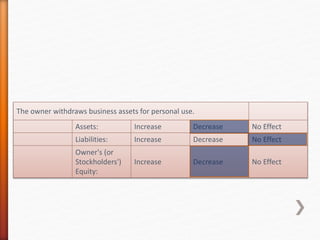

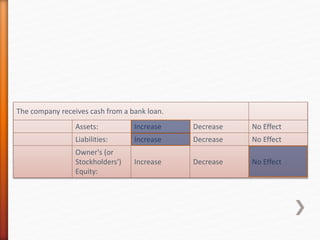

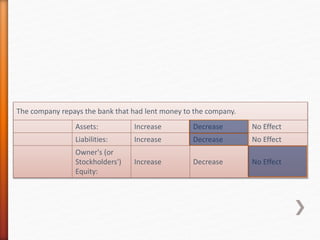

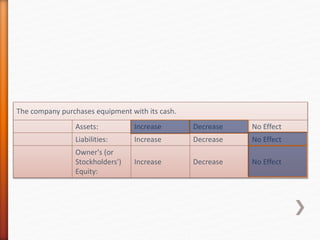

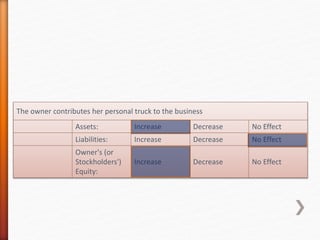

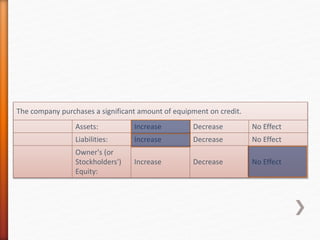

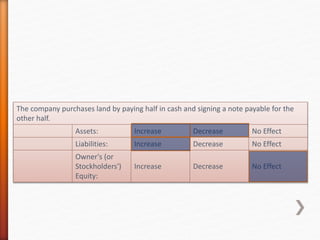

The document discusses key accounting concepts including the accounting equation, assets, liabilities, and owner's equity. It explains that the accounting equation - assets = liabilities + owner's equity - must always balance due to the double-entry bookkeeping method where every transaction affects a minimum of two accounts. Examples are provided to illustrate how various business transactions impact the components of the accounting equation by increasing or decreasing accounts.