- Any investment requires committing funds for a period of time in order to receive future payments that compensate for the time value of money, expected inflation, and investment risk.

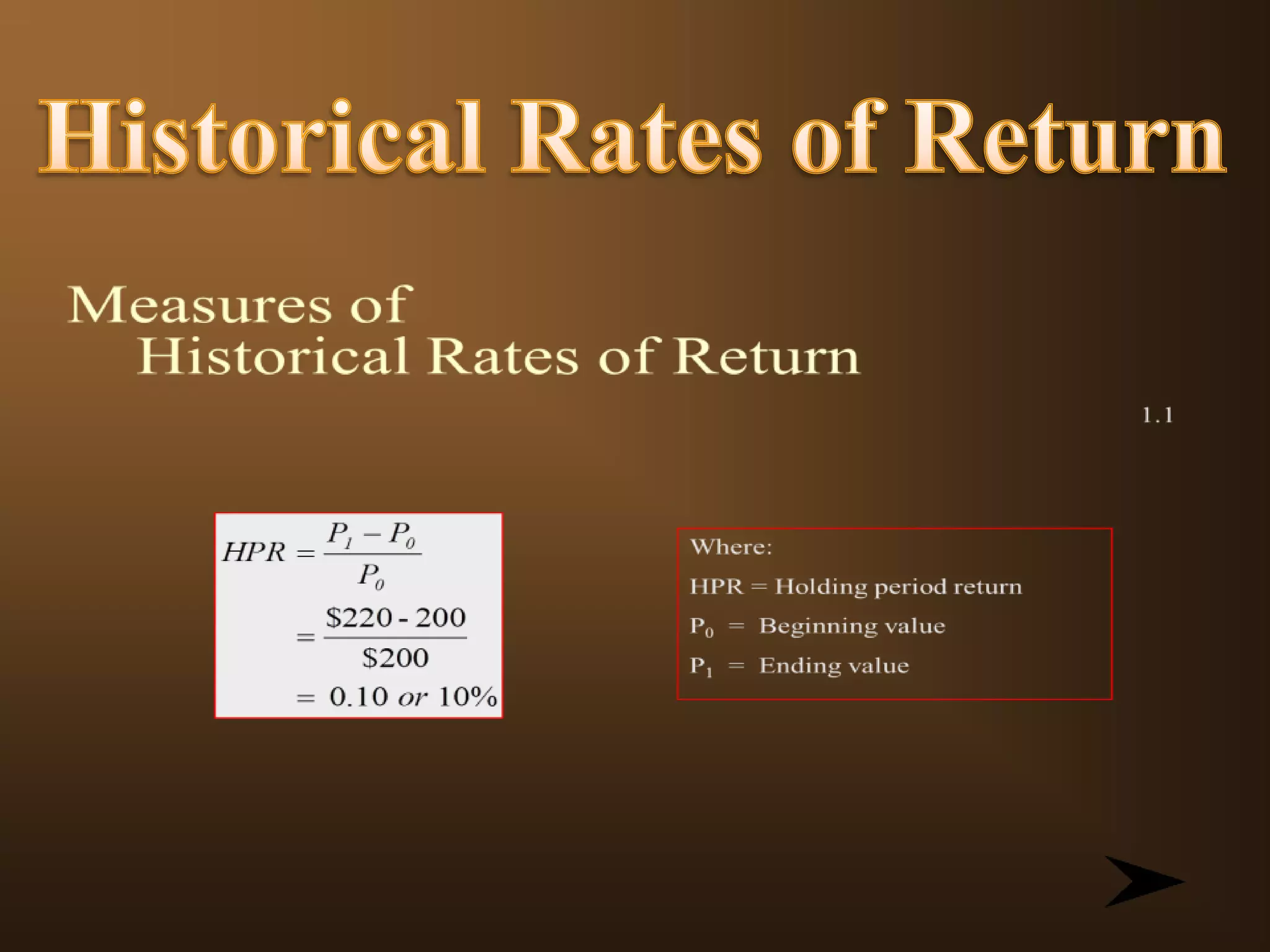

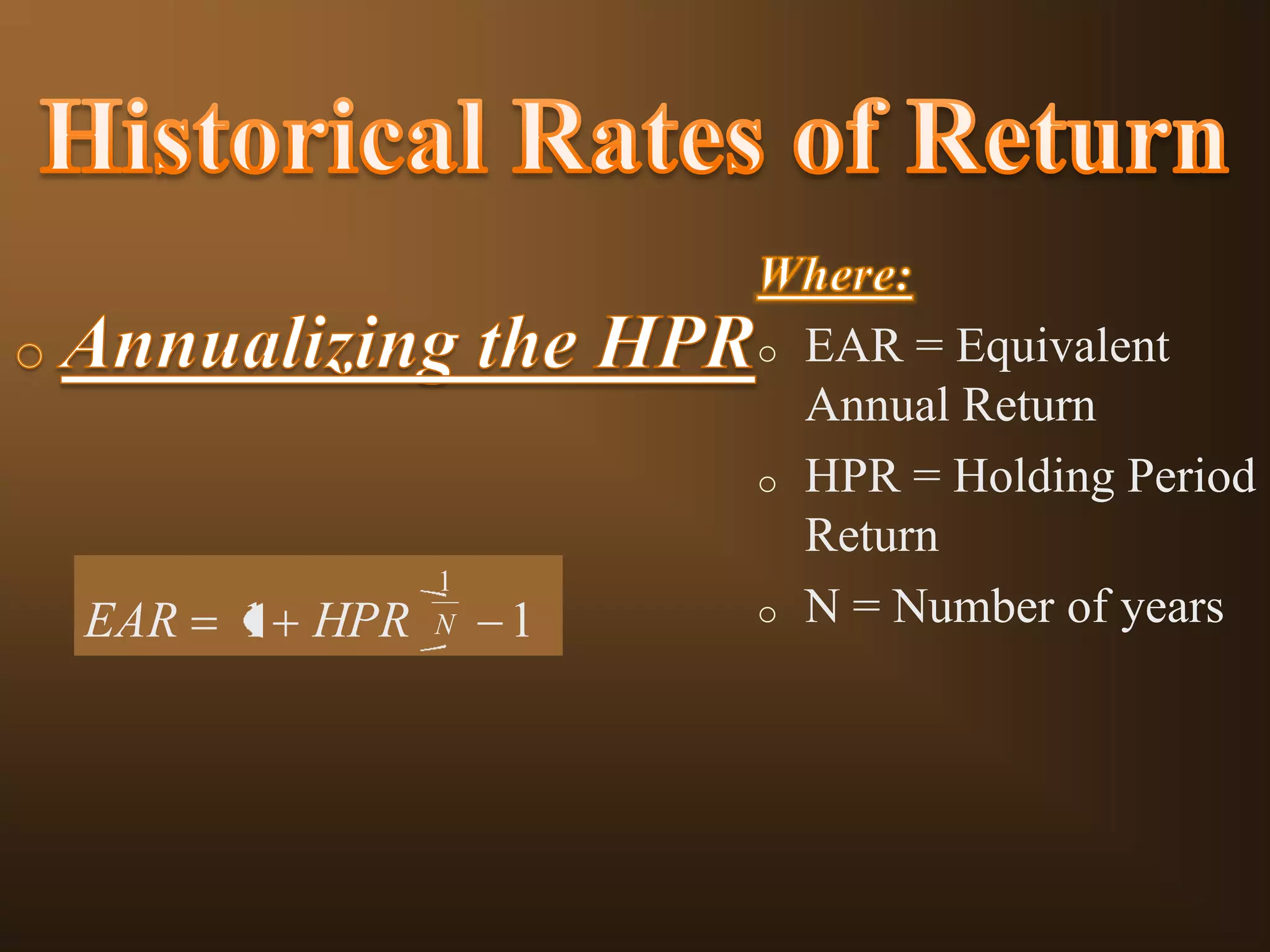

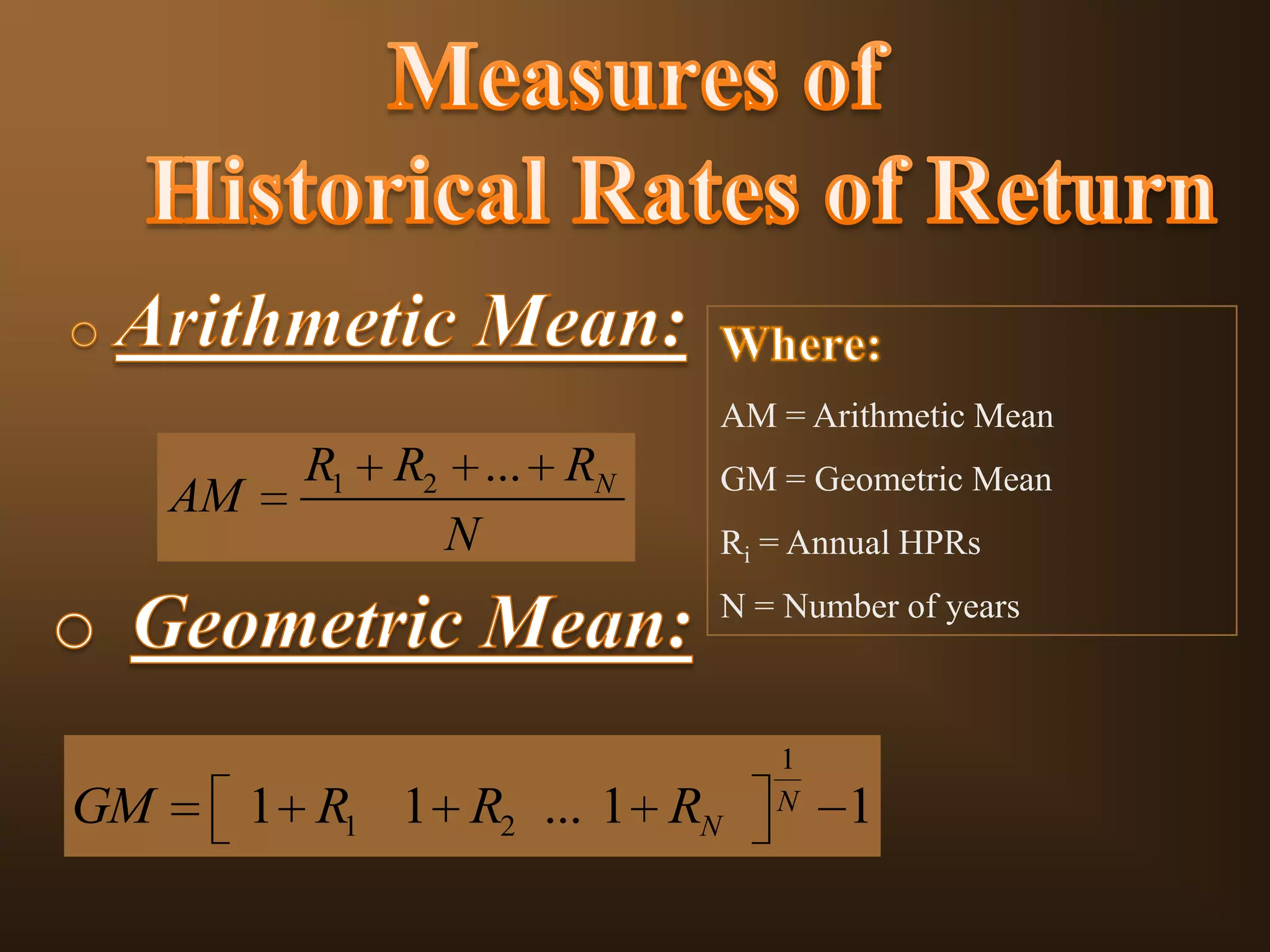

- There are different ways to calculate rates of return over multiple periods, including equivalent annual return, arithmetic mean, and geometric mean.

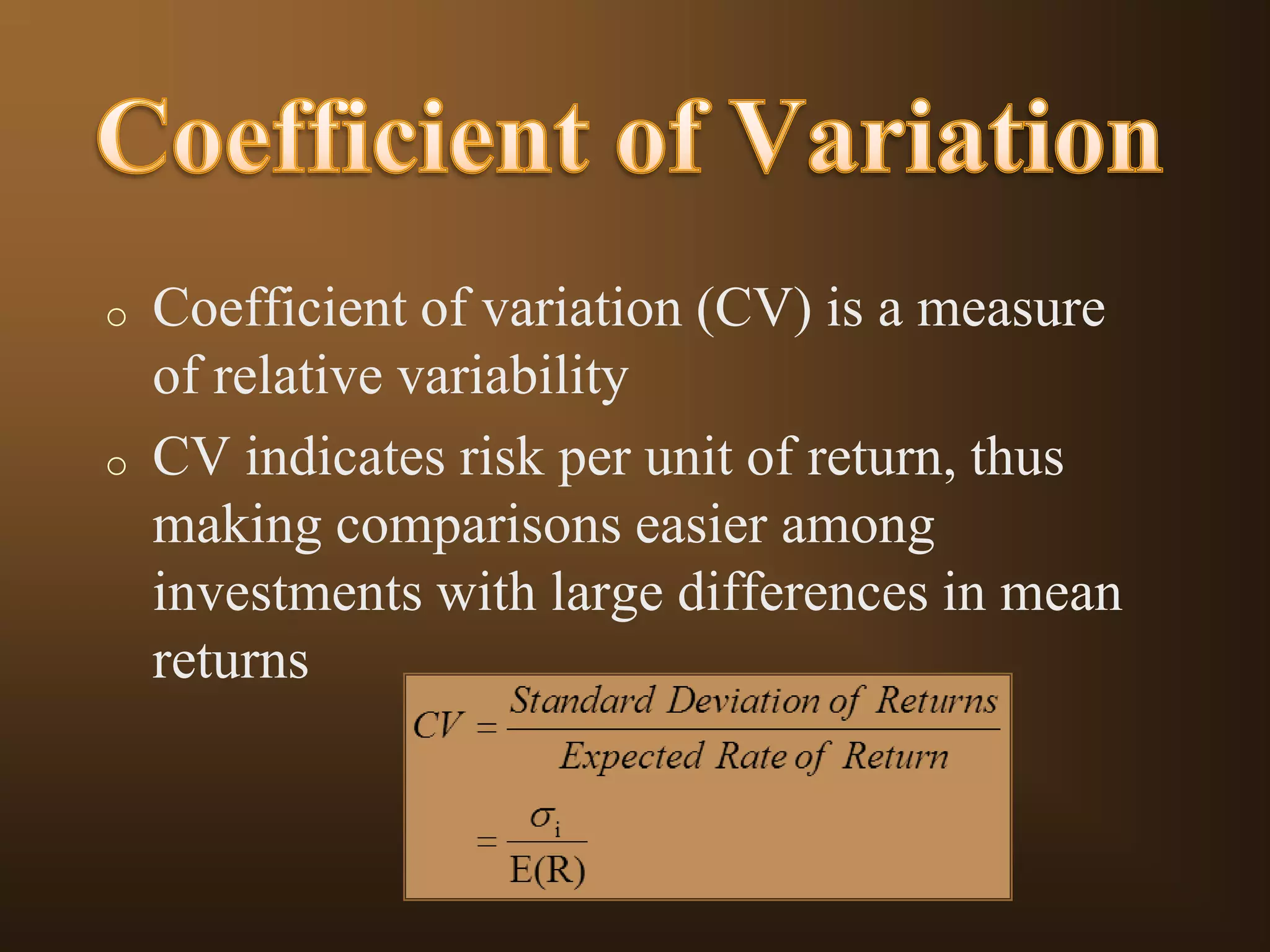

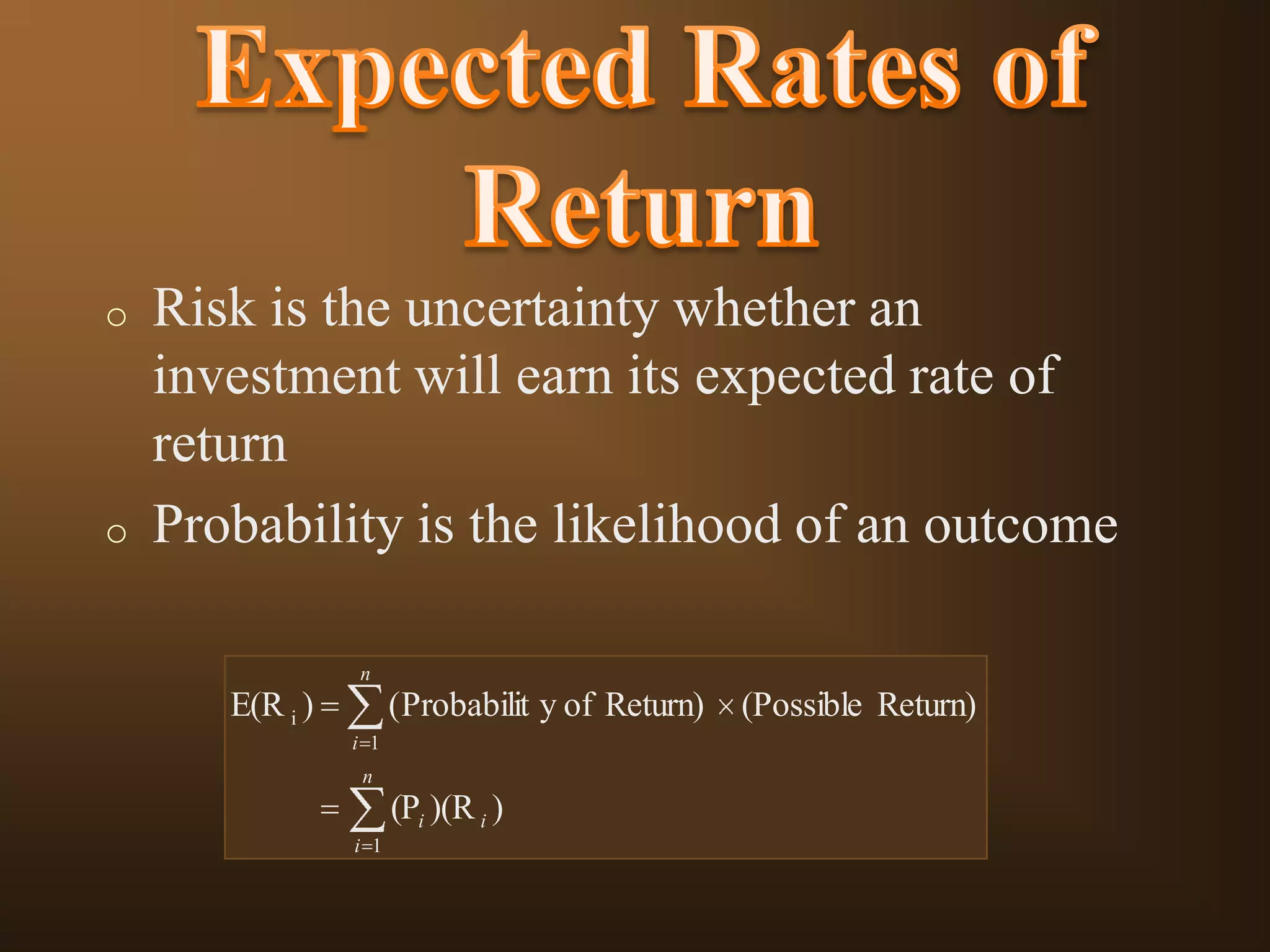

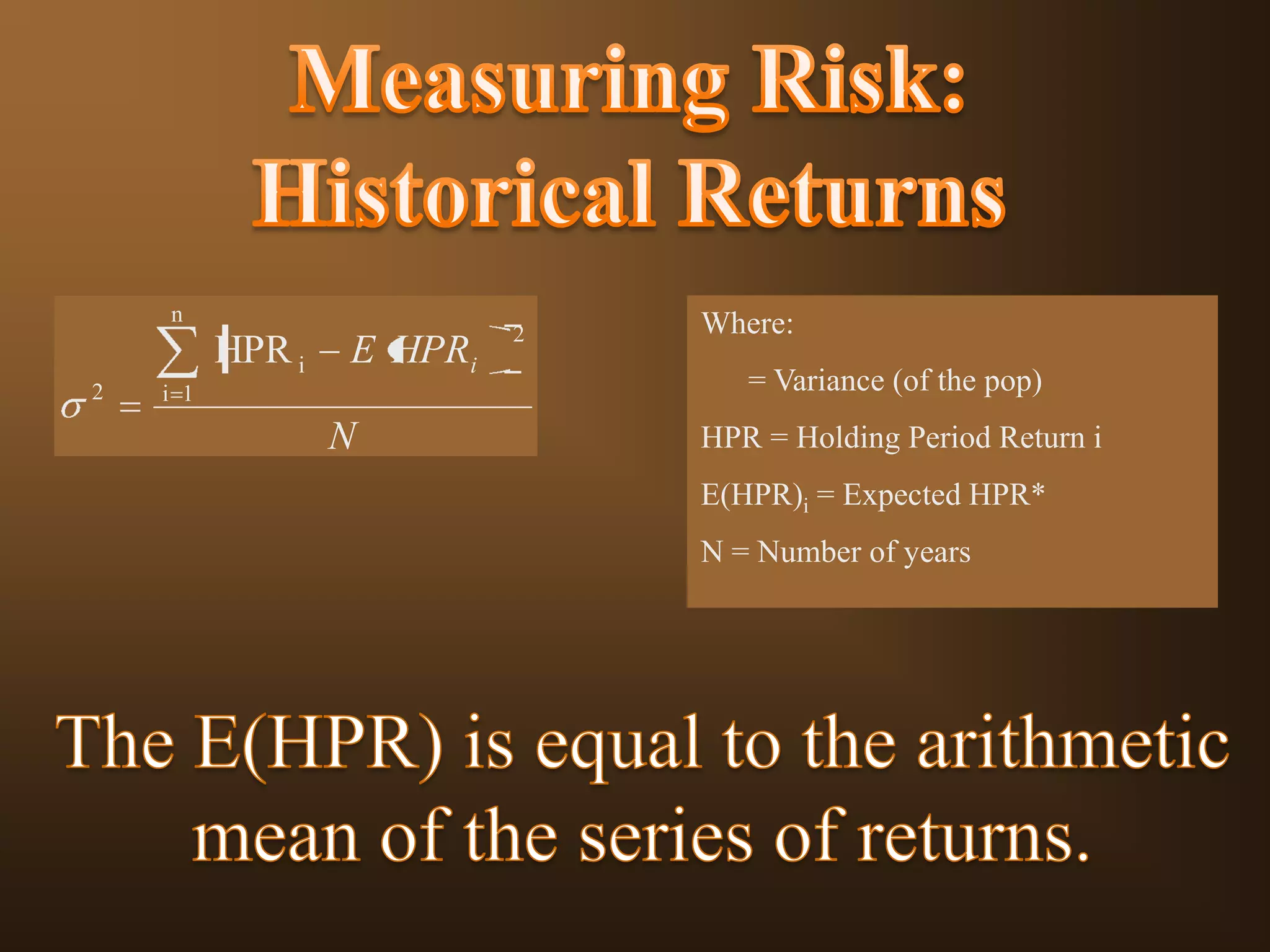

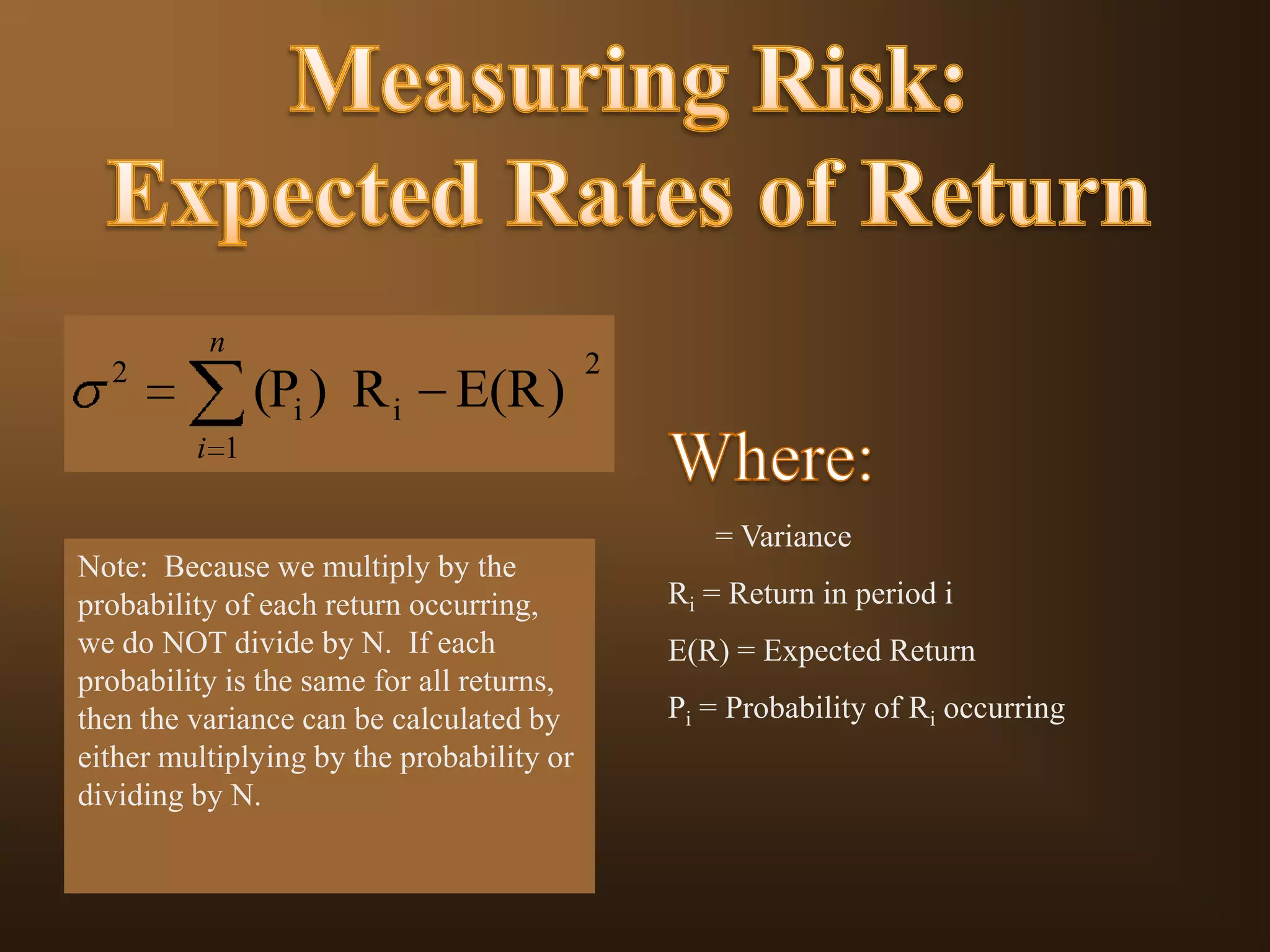

- Risk is the uncertainty of an investment's expected return, which is influenced by factors like business risk, financial risk, liquidity risk, exchange rate risk, and country risk. Investors require higher returns to compensate for higher risk.

![n

Pi [R i -E(R i )]2

i 1

n

Pi [R i -E(R i )]2

i 1

1

2

Standard Deviation is a measure of

dispersion around the mean. The higher

the standard deviation, the greater the

dispersion of returns around the mean and

the greater the risk.](https://image.slidesharecdn.com/inveatmentanalysisandportfoliomanagement-140120001144-phpapp01/75/Inveatment-analysis-and-portfolio-management-13-2048.jpg)