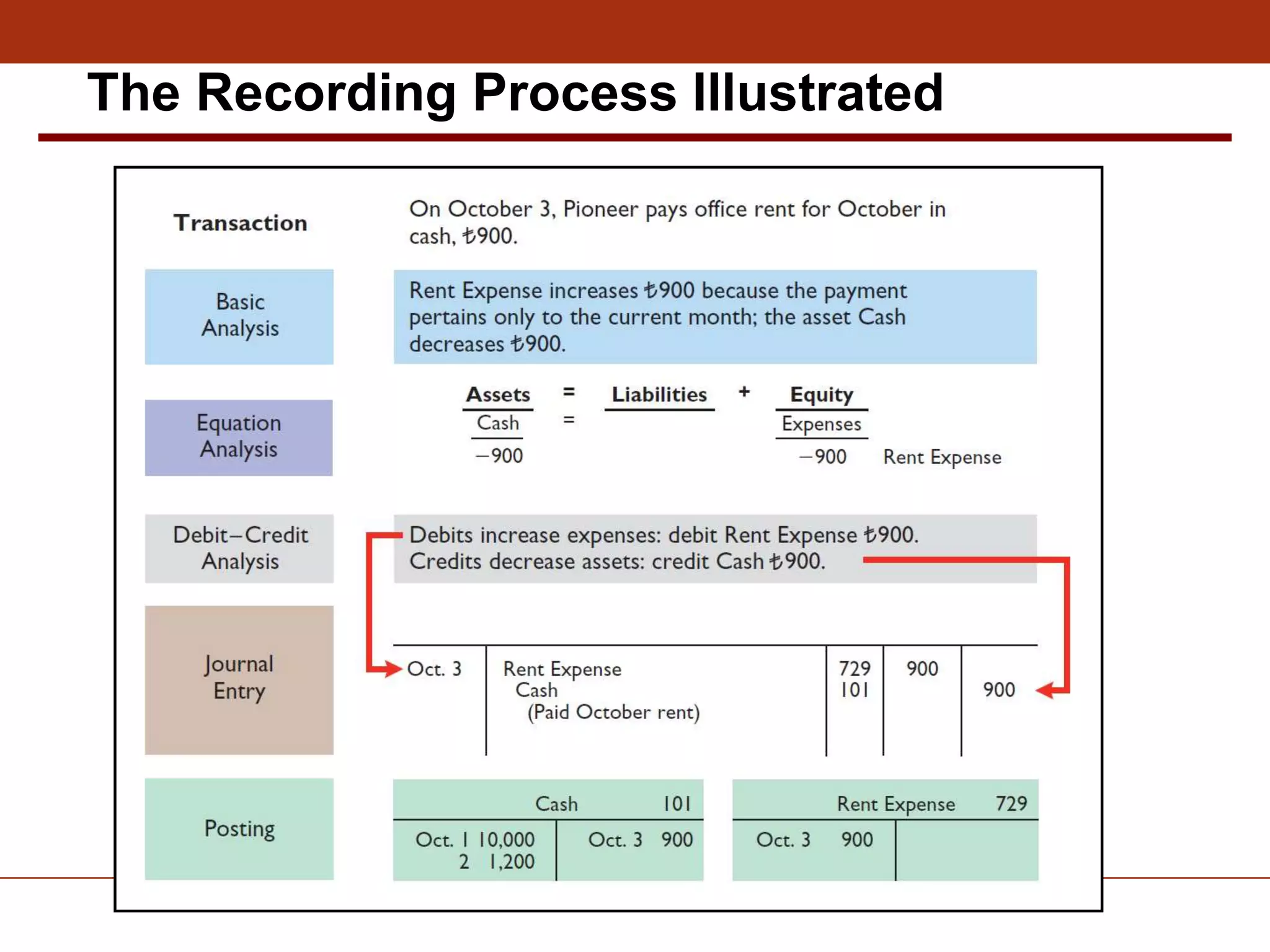

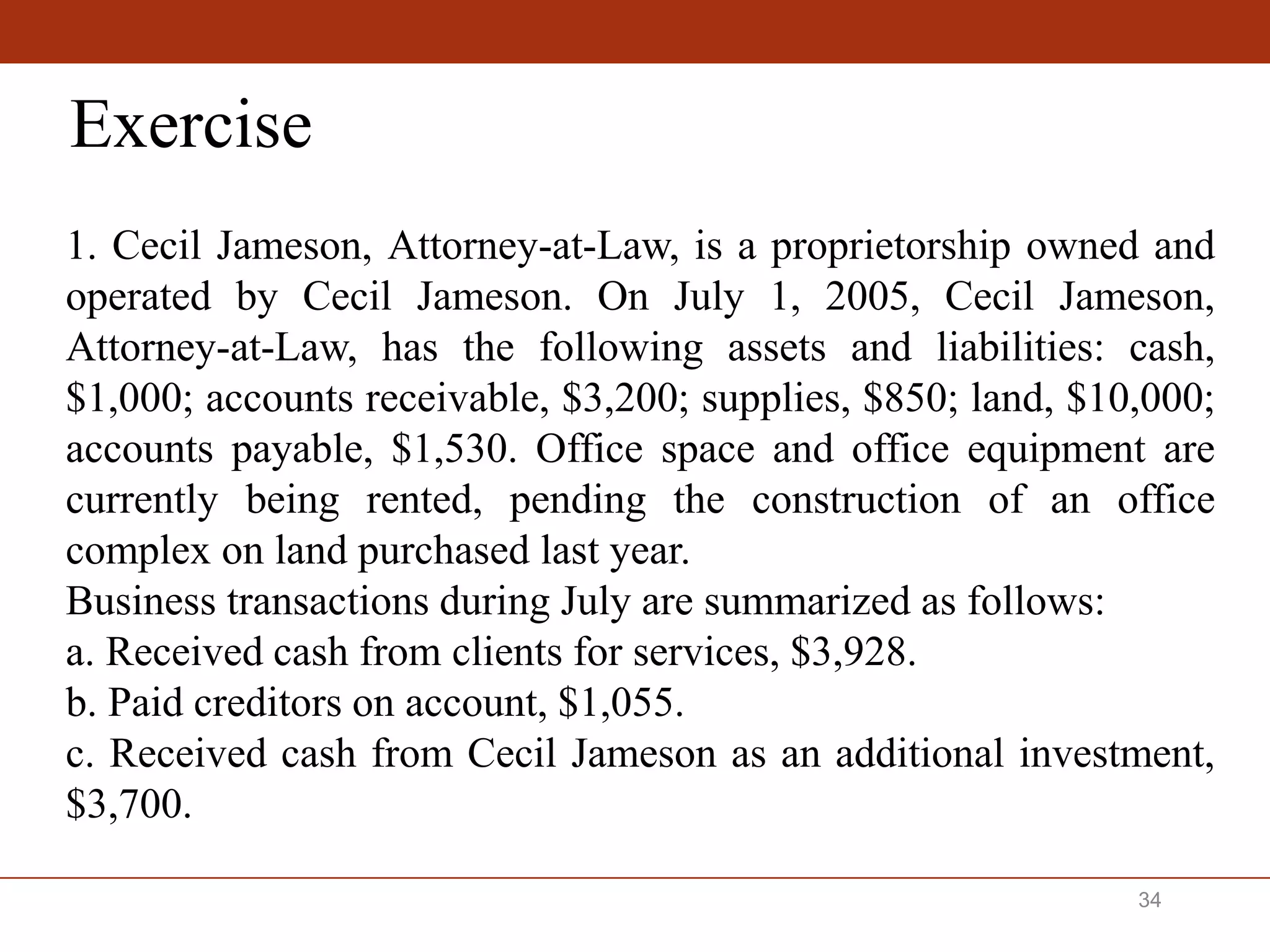

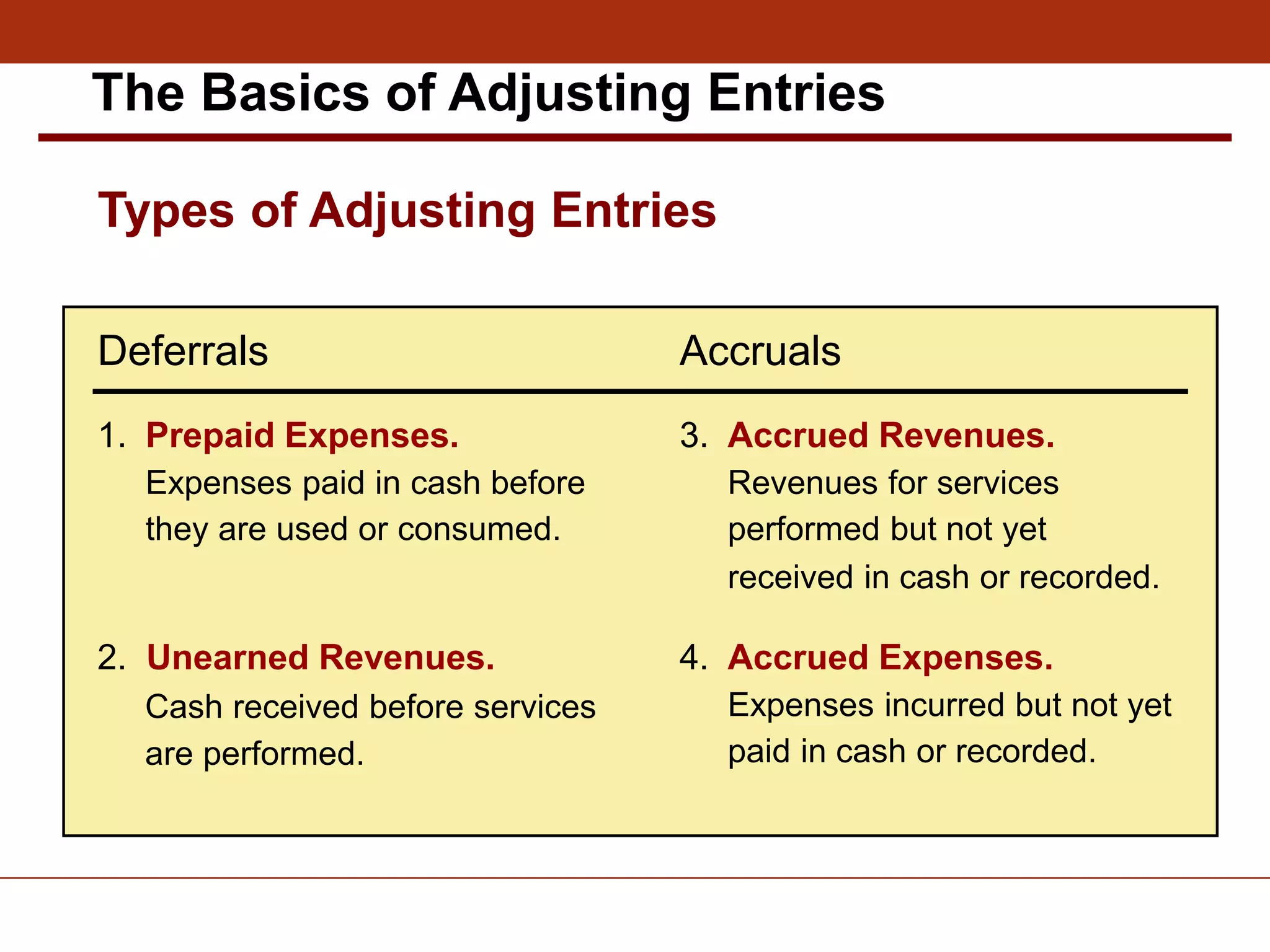

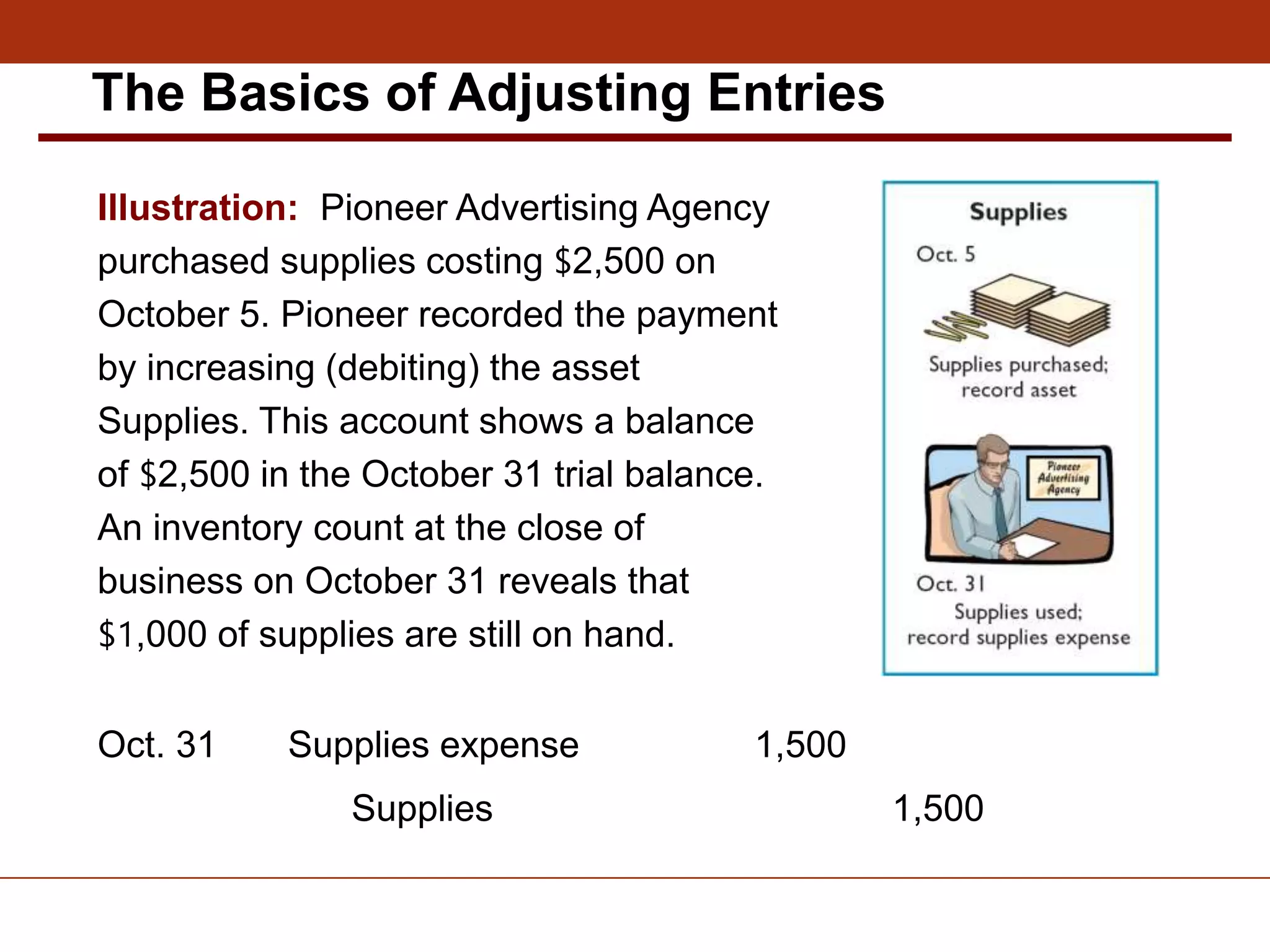

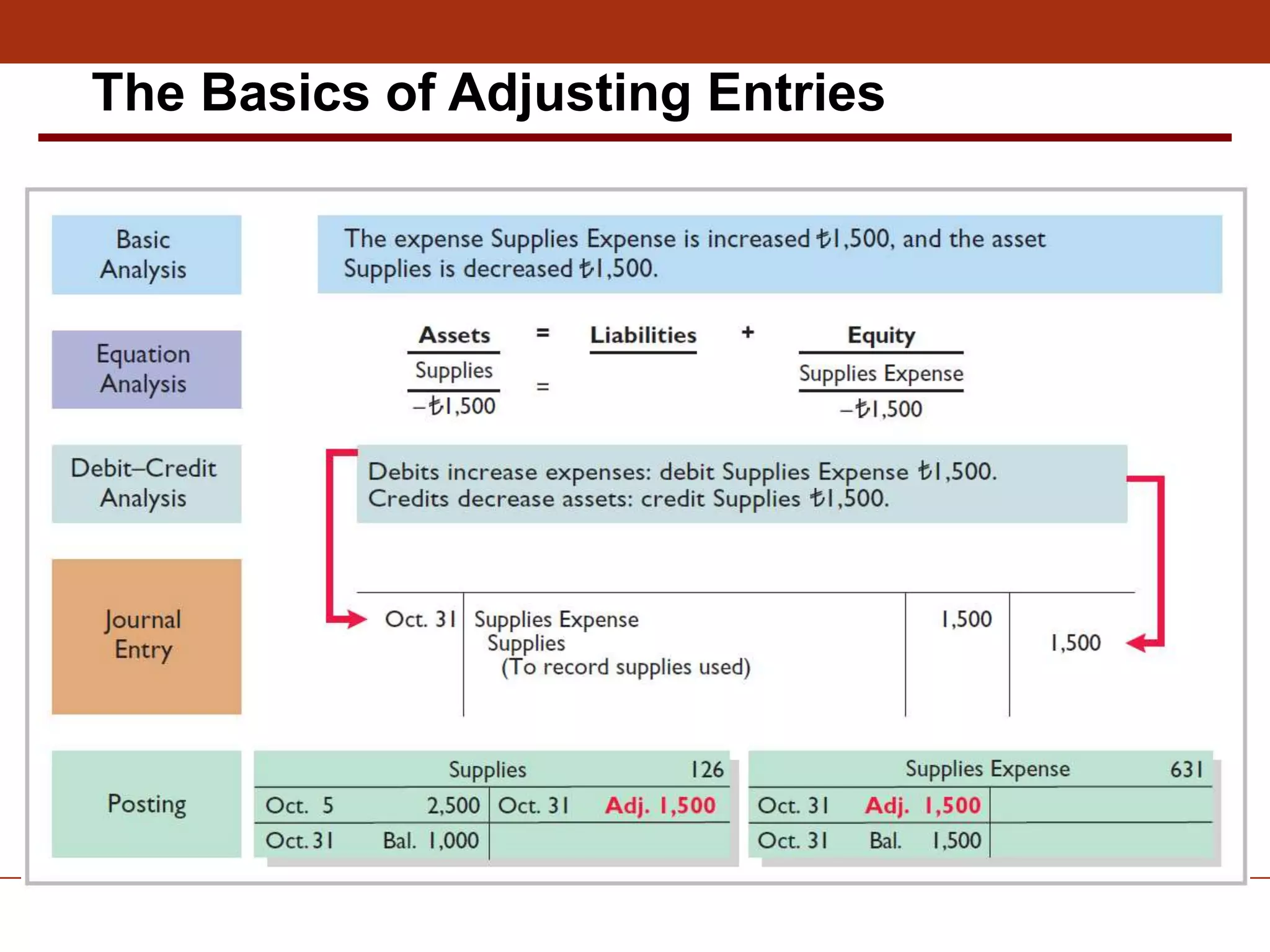

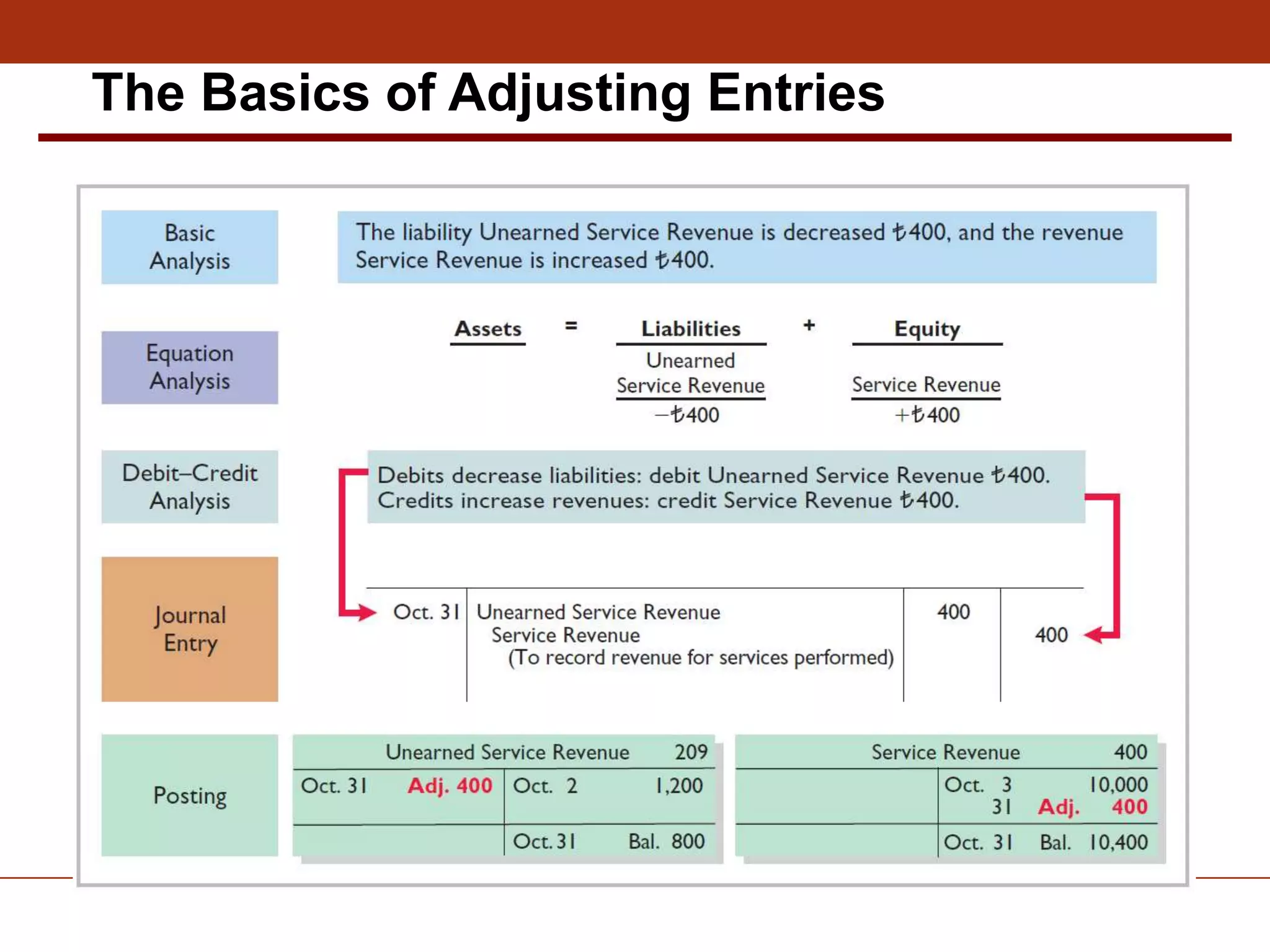

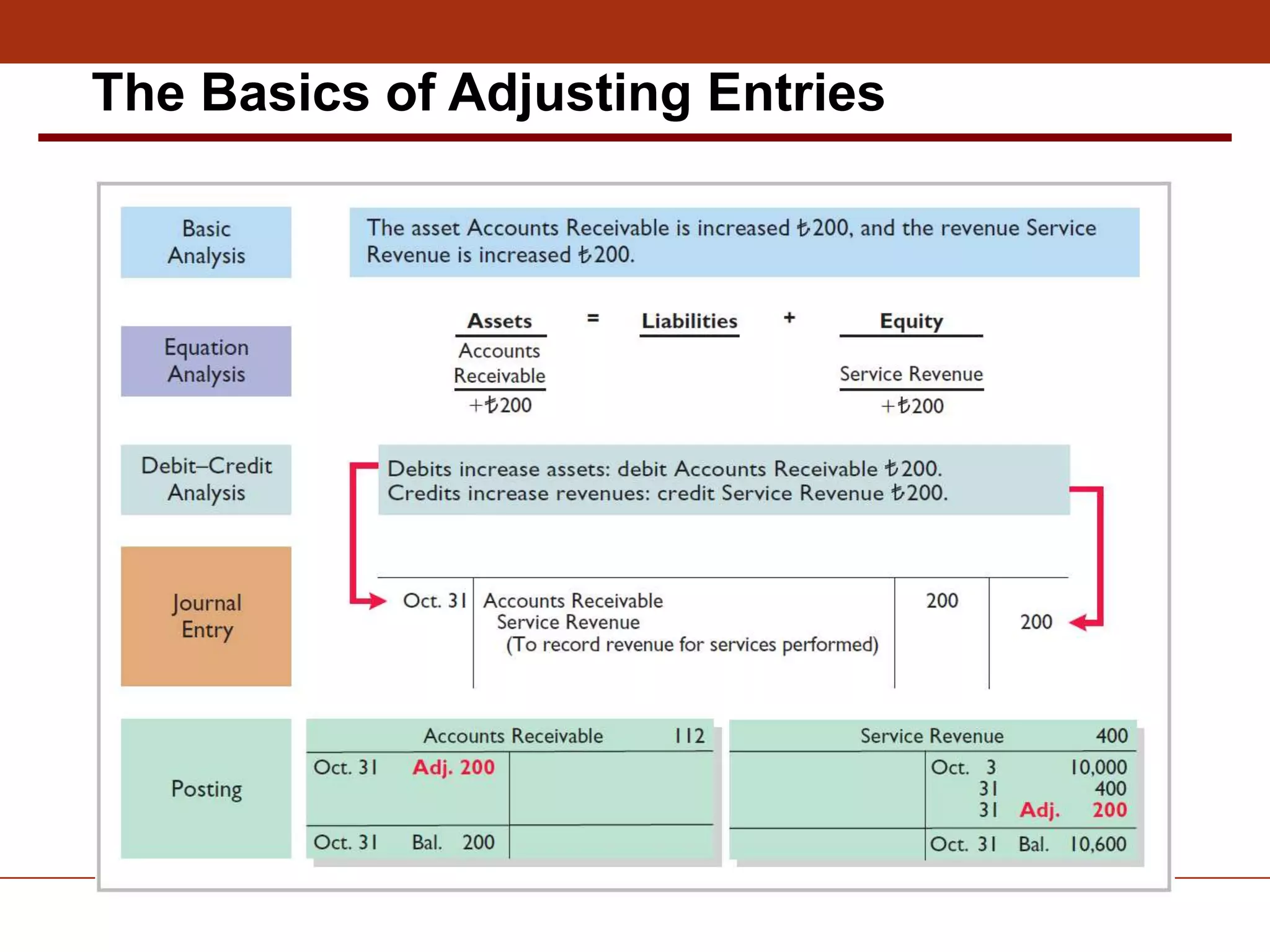

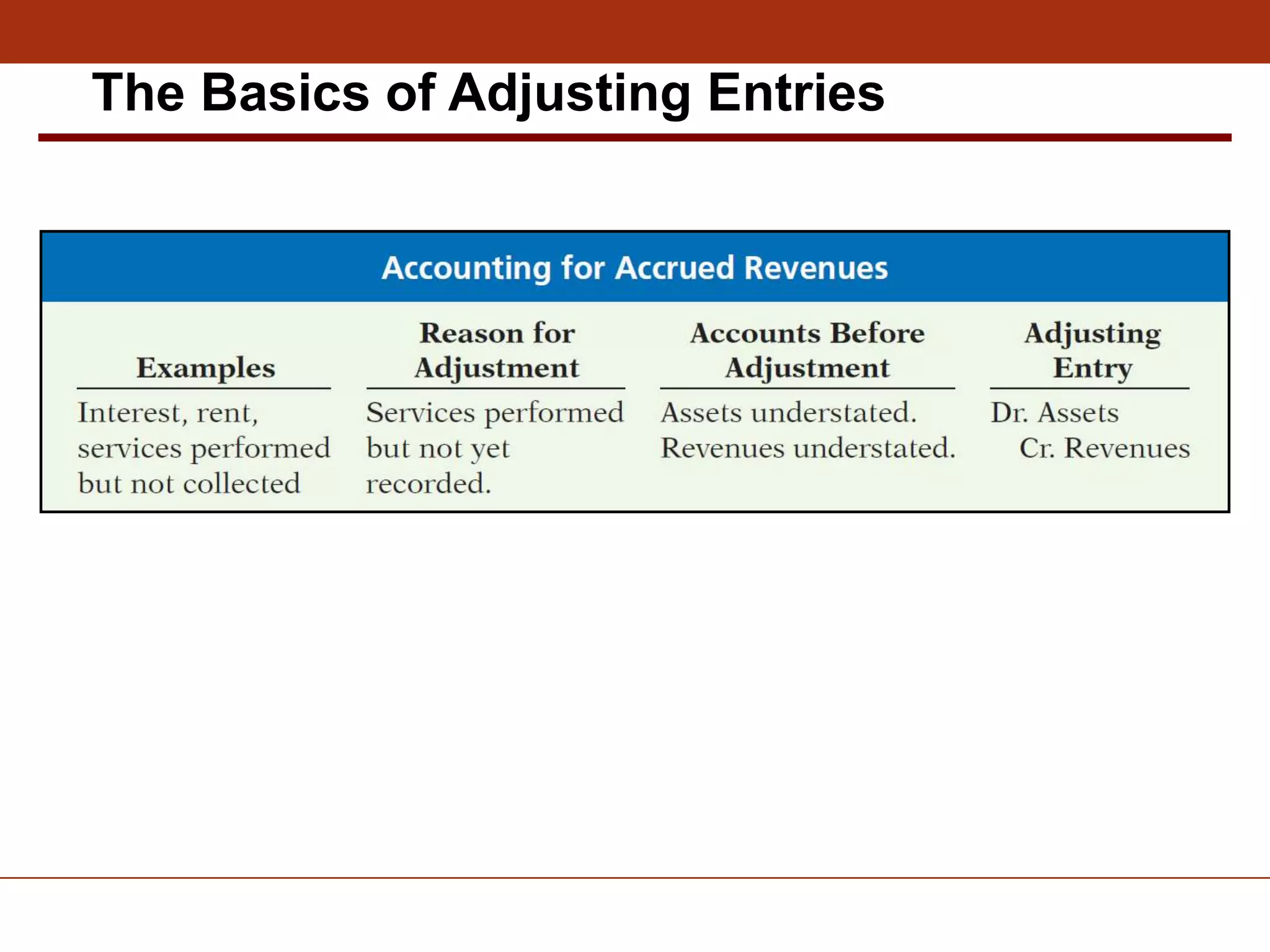

The document provides an overview of the accounting cycle and key concepts in financial accounting. It discusses [1] what accounts are and how they are used to record business transactions, [2] the basic steps in the recording process including journalizing, posting to ledgers, and preparing a trial balance, and [3] key adjusting entries related to deferrals like prepaid expenses and unearned revenues, and accruals like accrued revenues and accrued expenses. The purpose is to explain the fundamentals of recording and reporting financial information according to generally accepted accounting principles.

![Learning Objectives

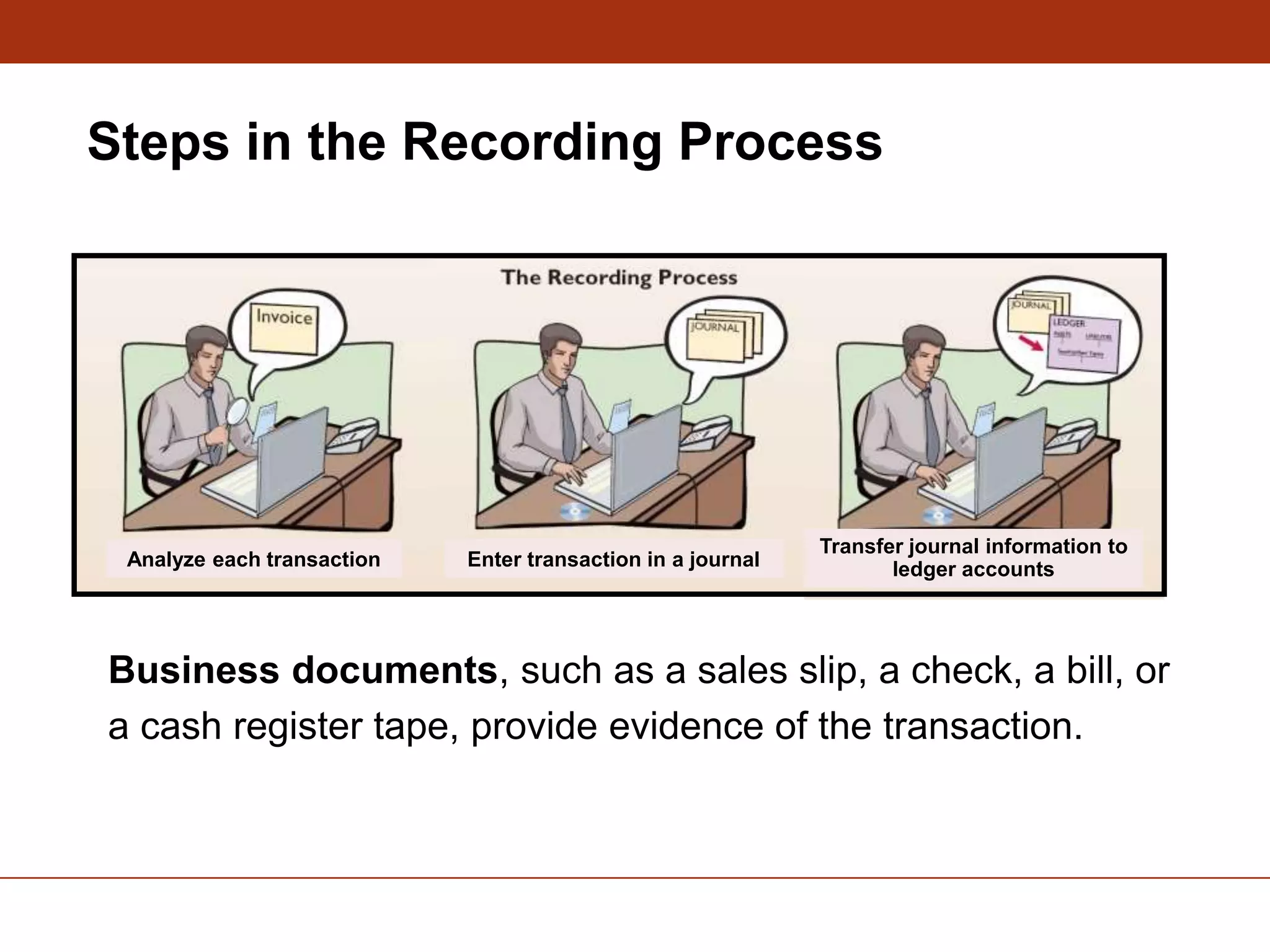

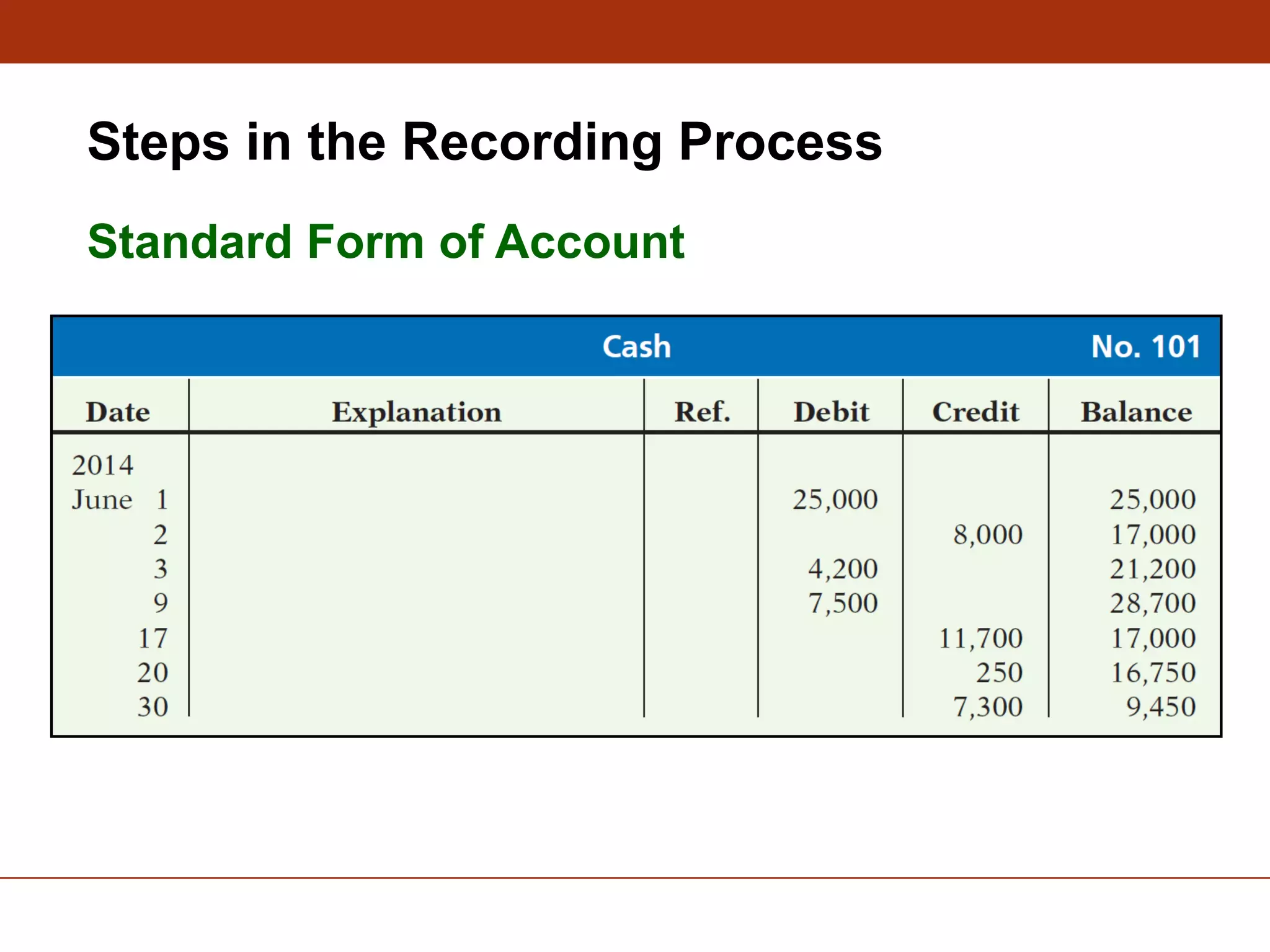

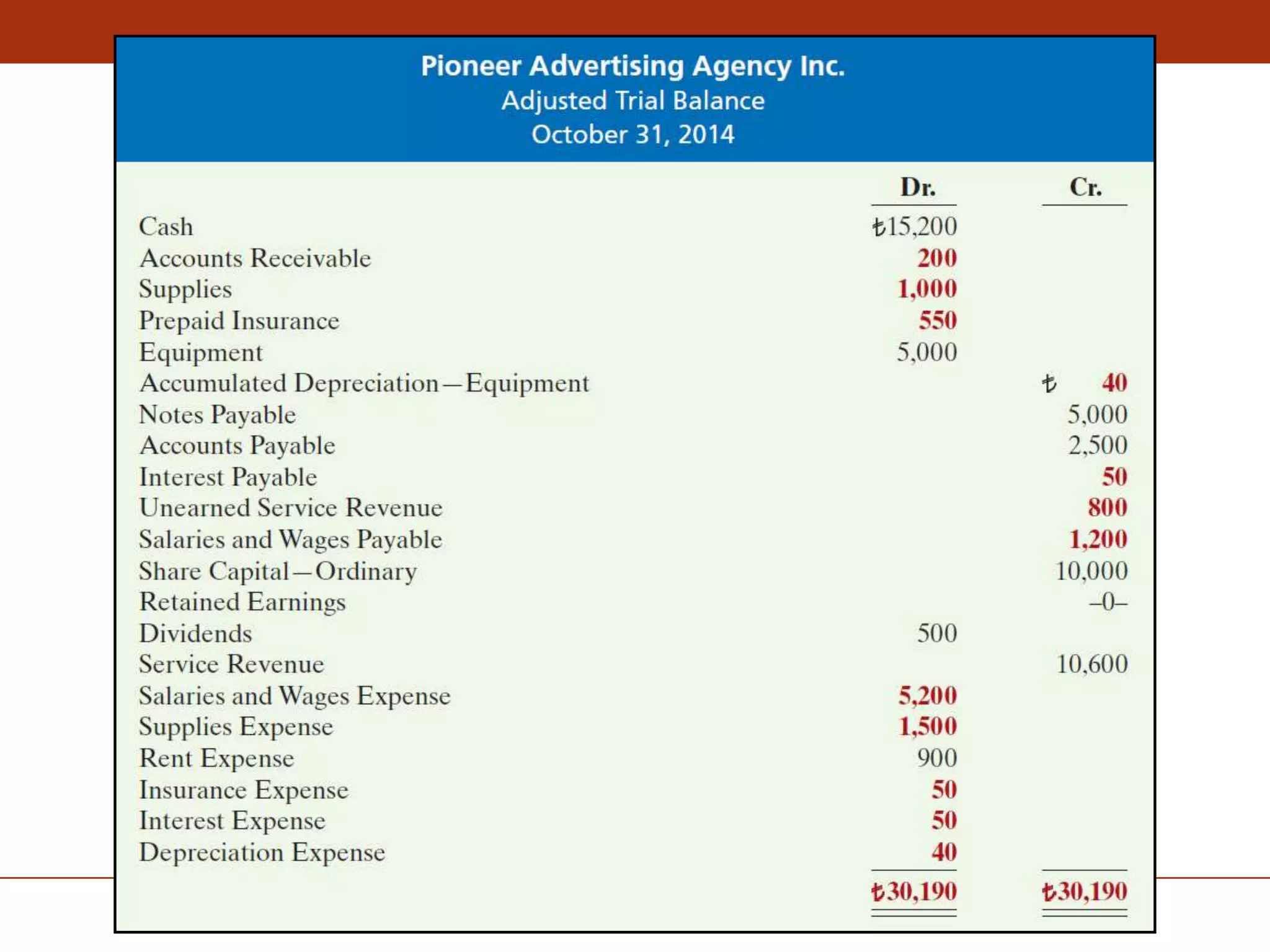

After studying this chapter, you should be able to:

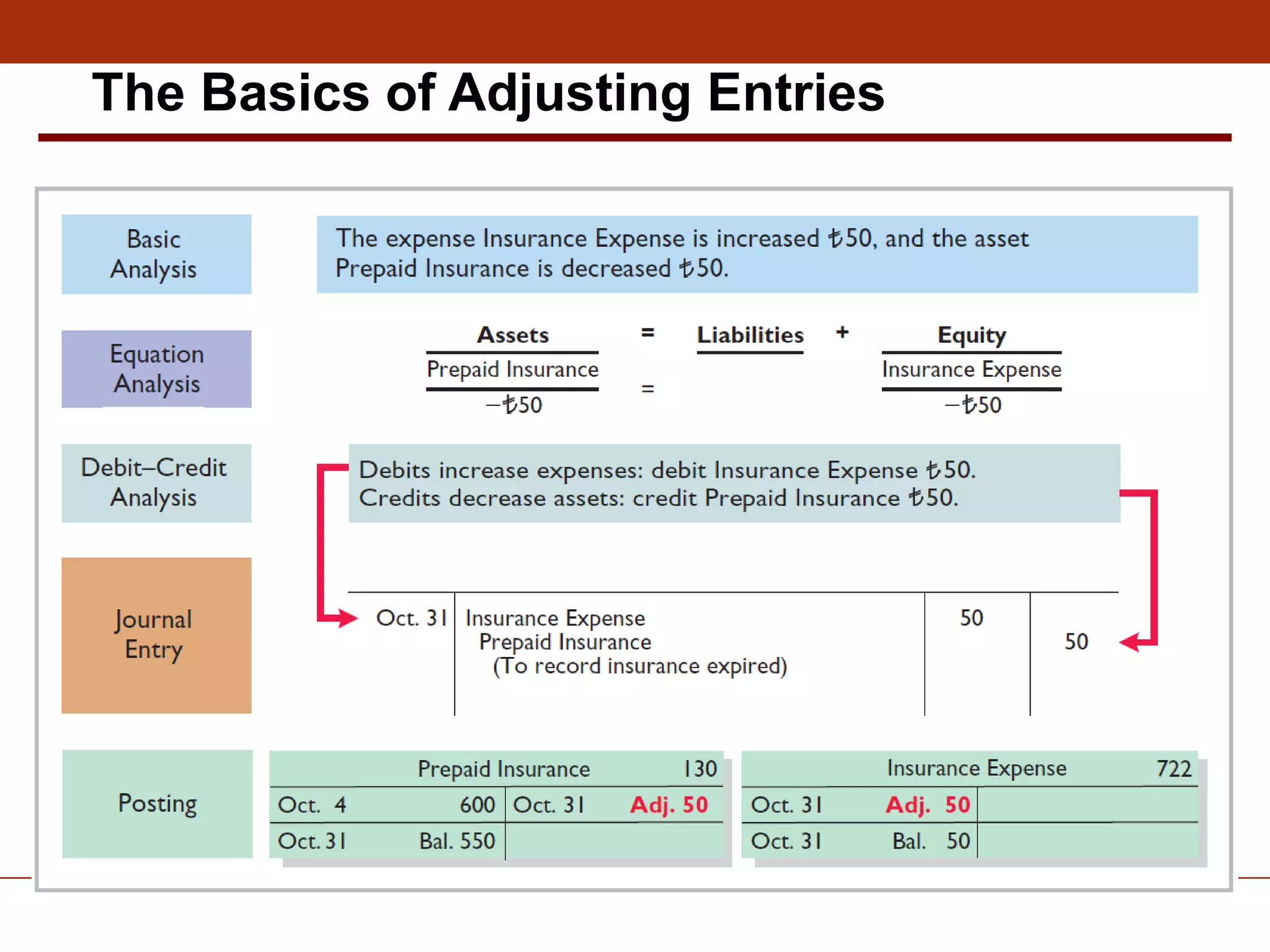

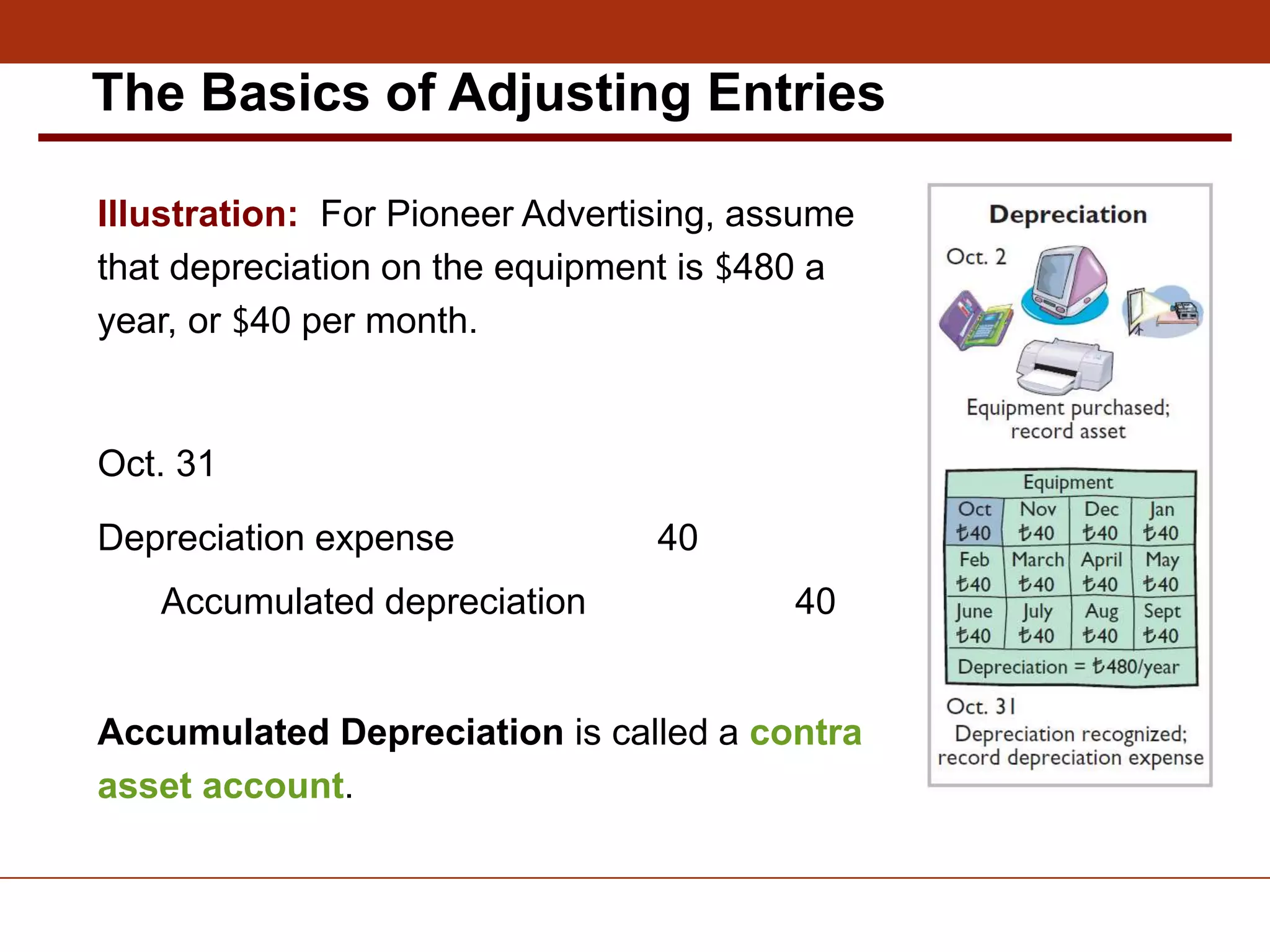

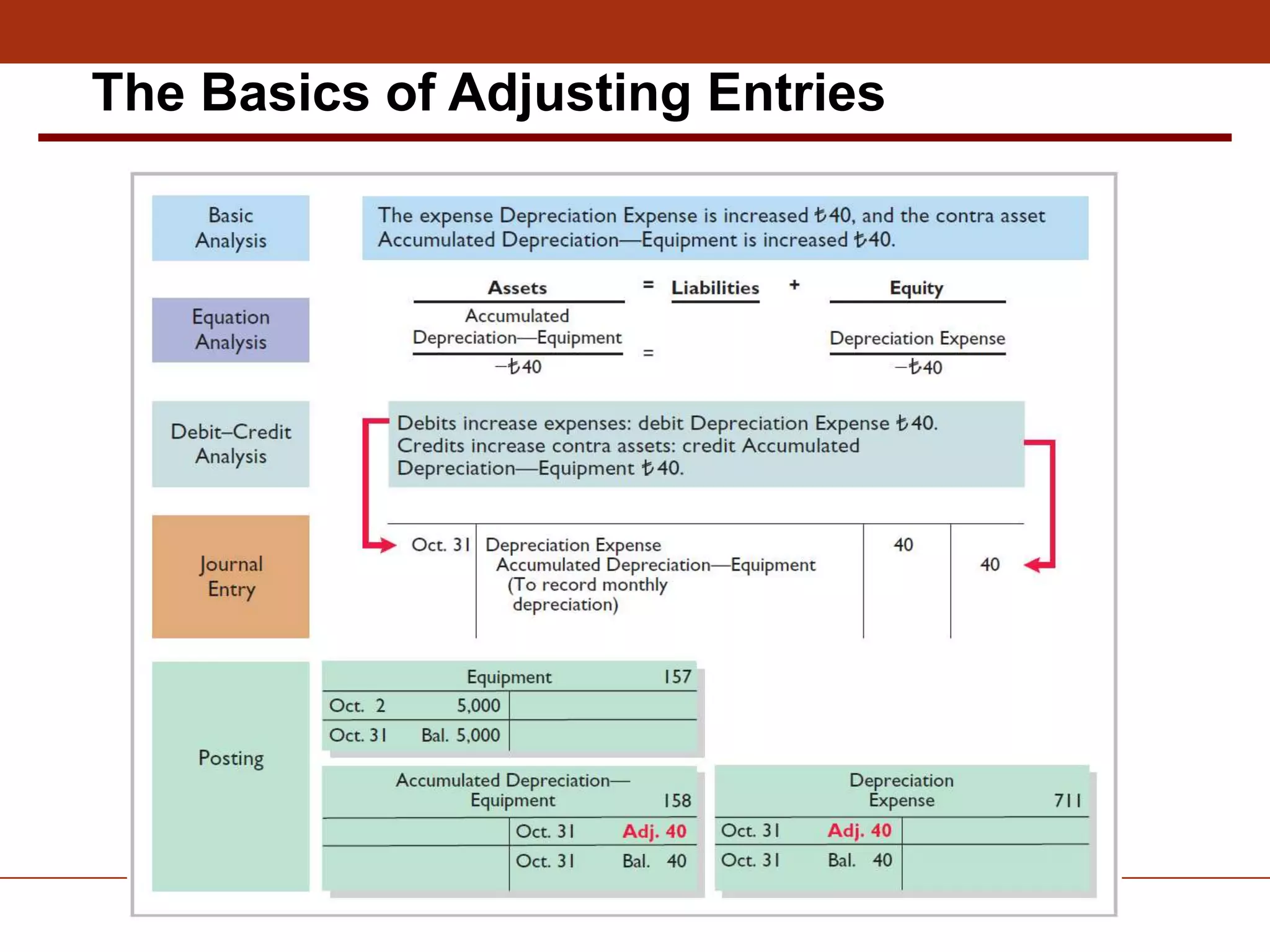

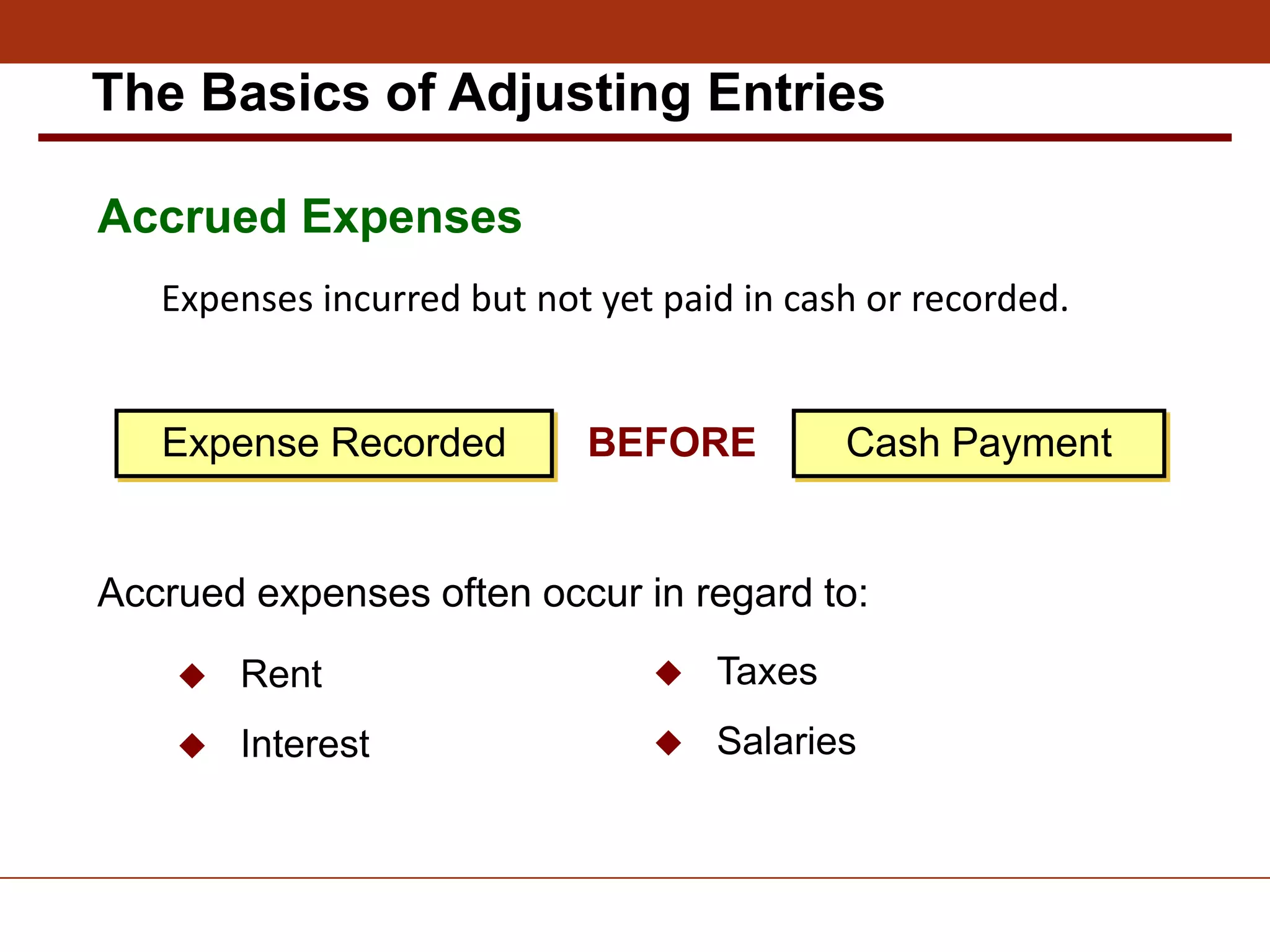

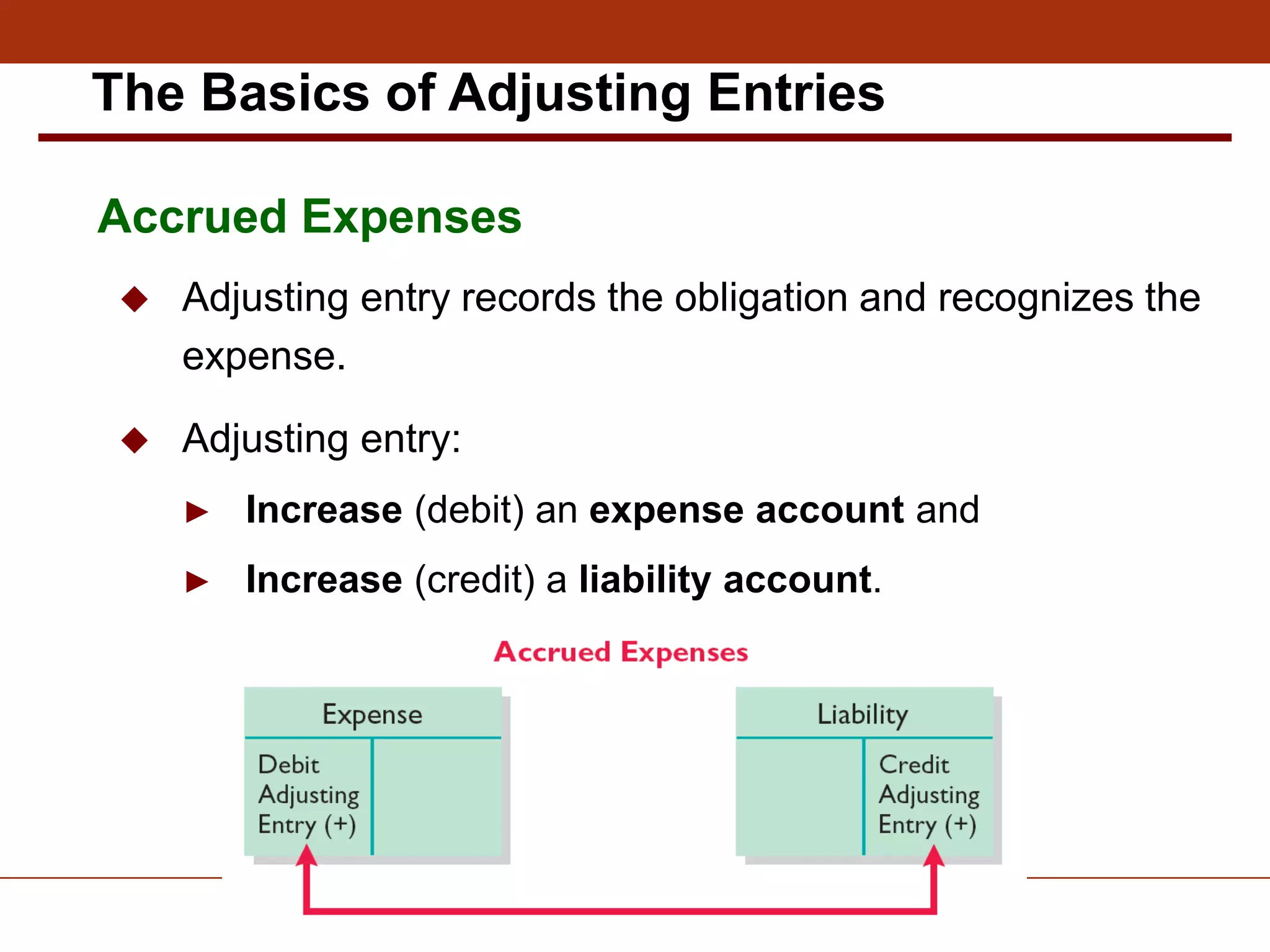

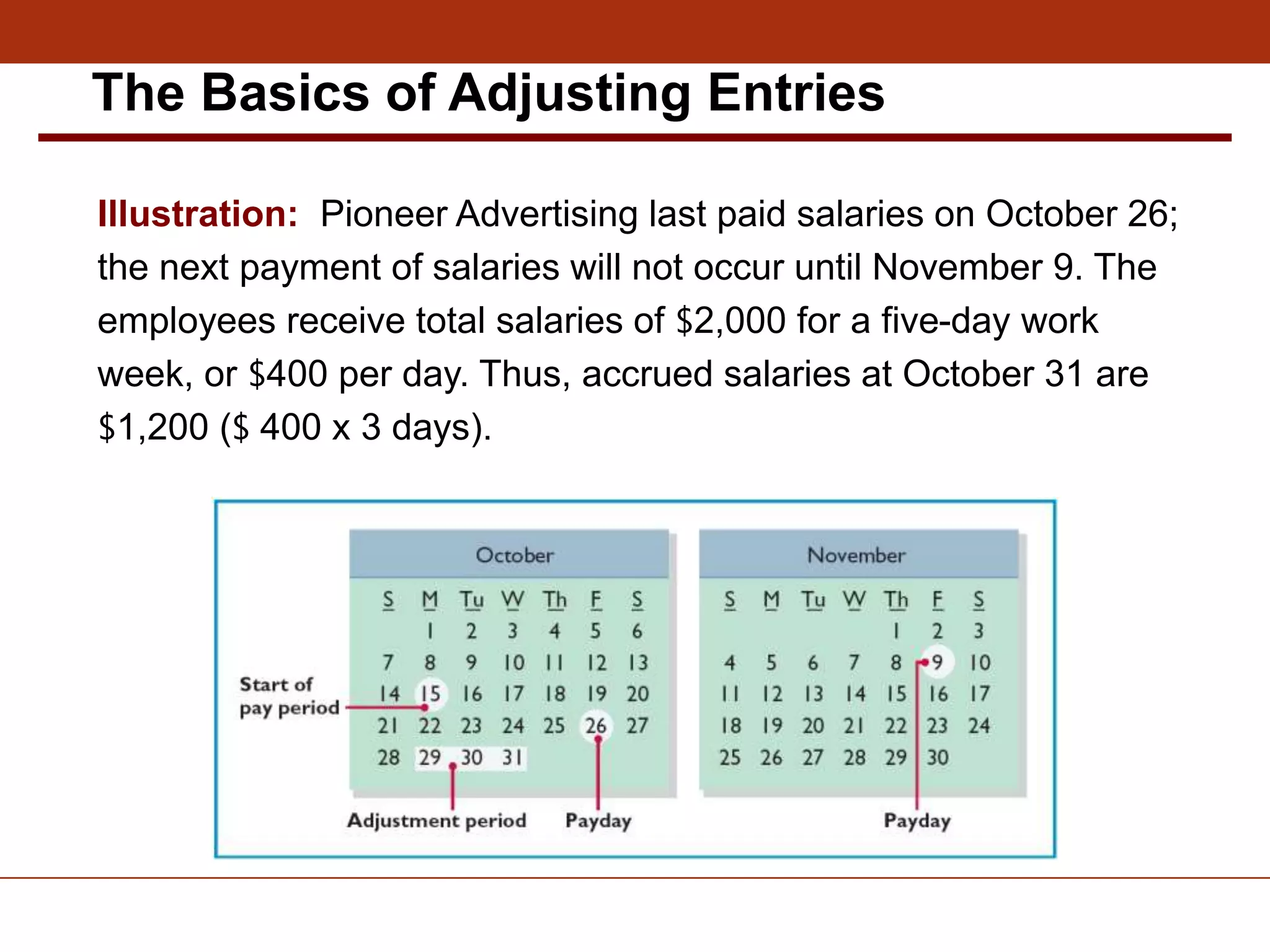

[1] Explain what an account is and how it helps in the recording process.

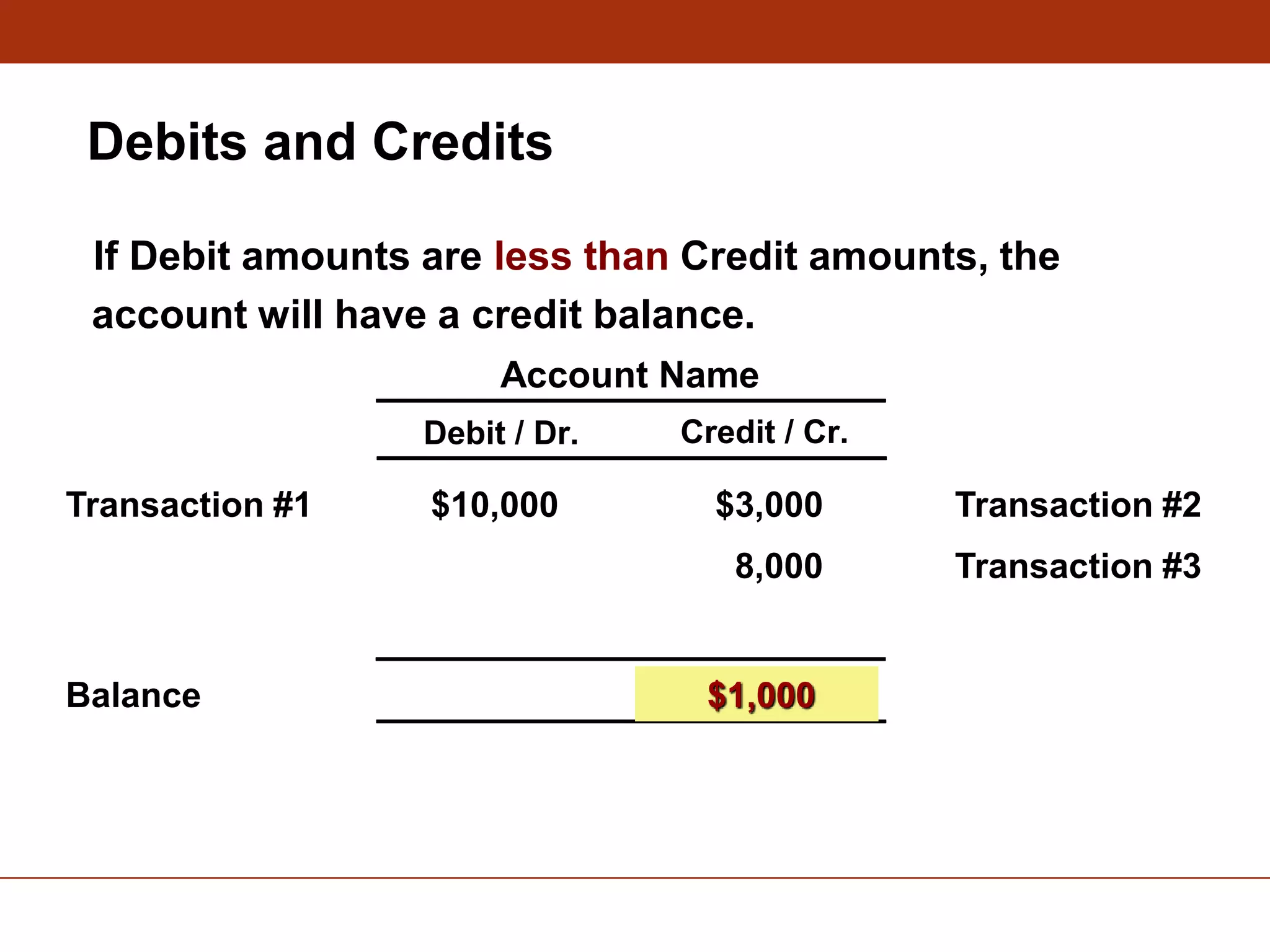

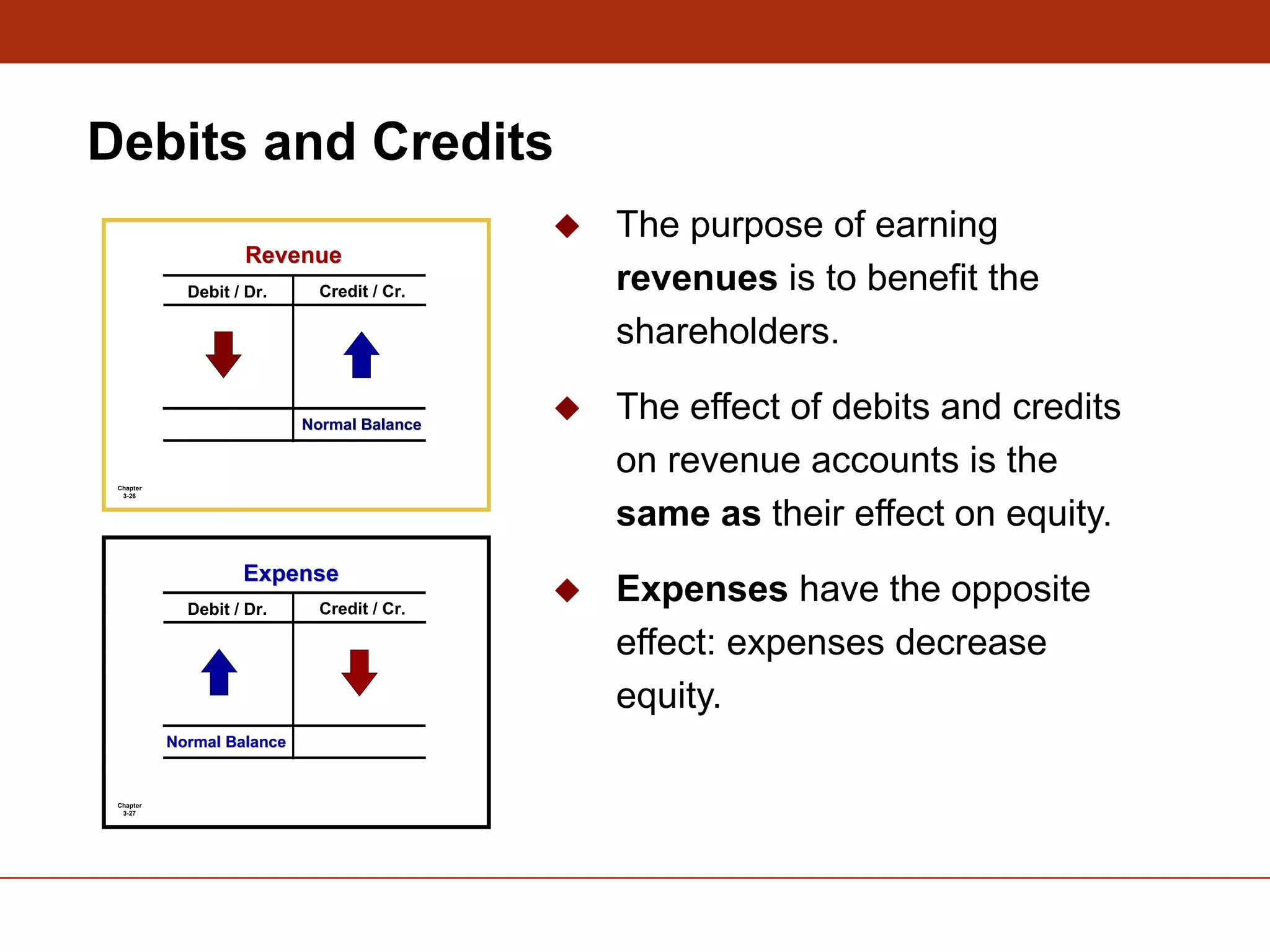

[2] Define debits and credits and explain their use in recording business

transactions.

[3] Identify the basic steps in the recording process.

[4] Explain what a journal is and how it helps in the recording process.

[5] Explain what a ledger is and how it helps in the recording process.

[6] Explain what posting is and how it helps in the recording process.

[7] Prepare a trial balance and explain its purposes.

[8] Prepare adjusting entry, worksheet and financial statements.

[9] Prepare closing entry and post closing trial balance](https://image.slidesharecdn.com/chaptertwolic-230704091000-fc5a91d2/75/Chapter-Two-LIC-ppt-2-2048.jpg)