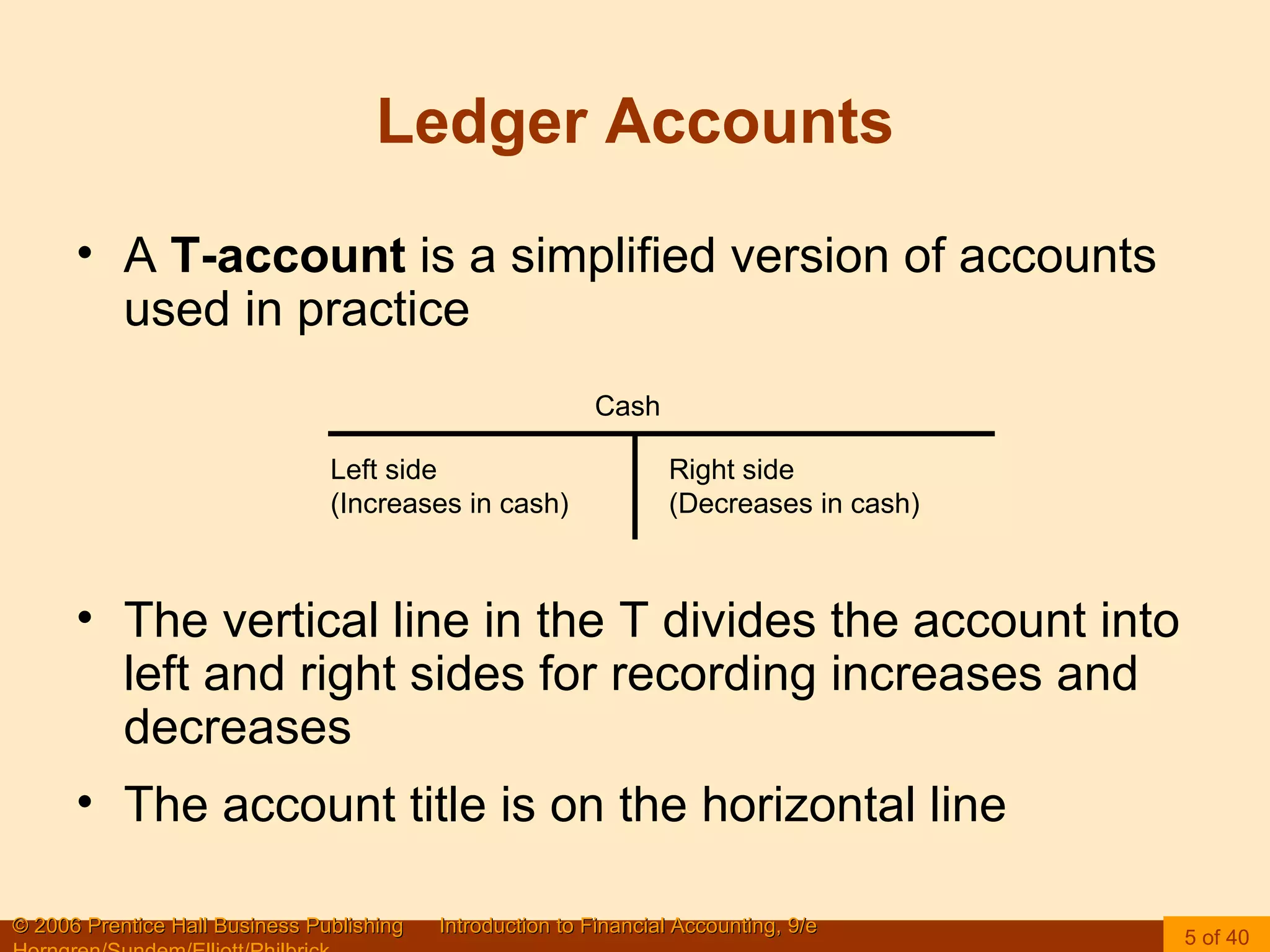

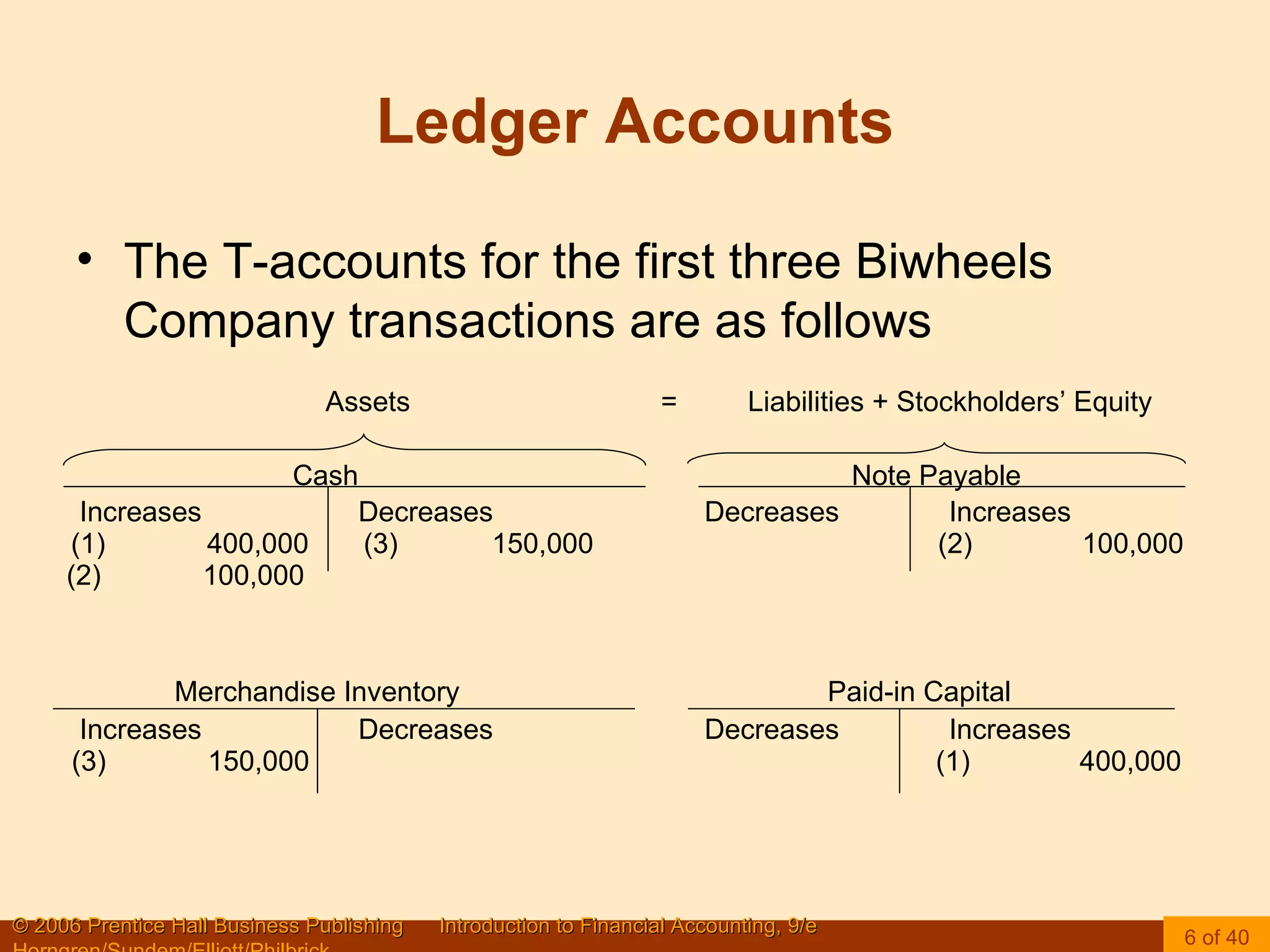

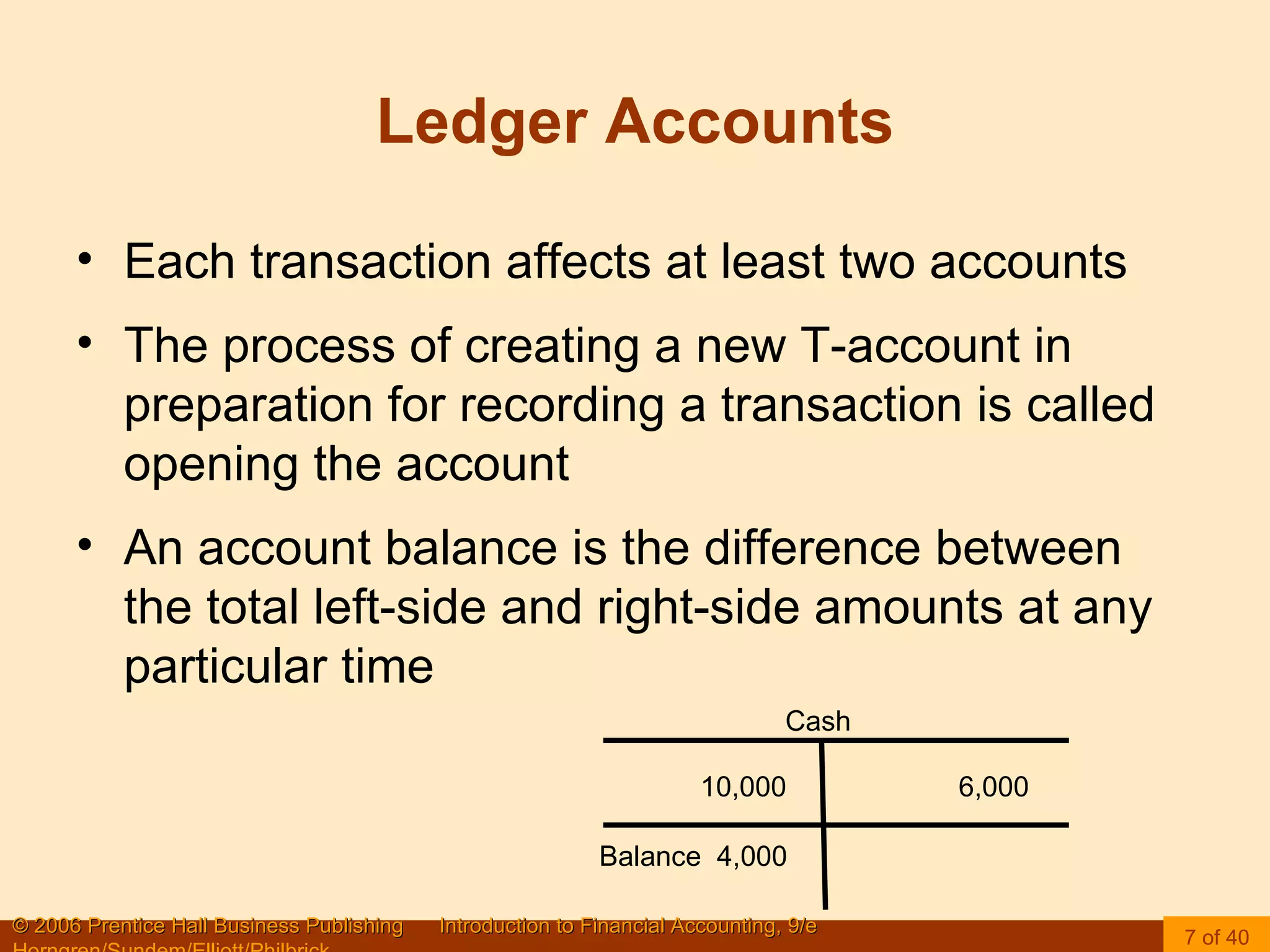

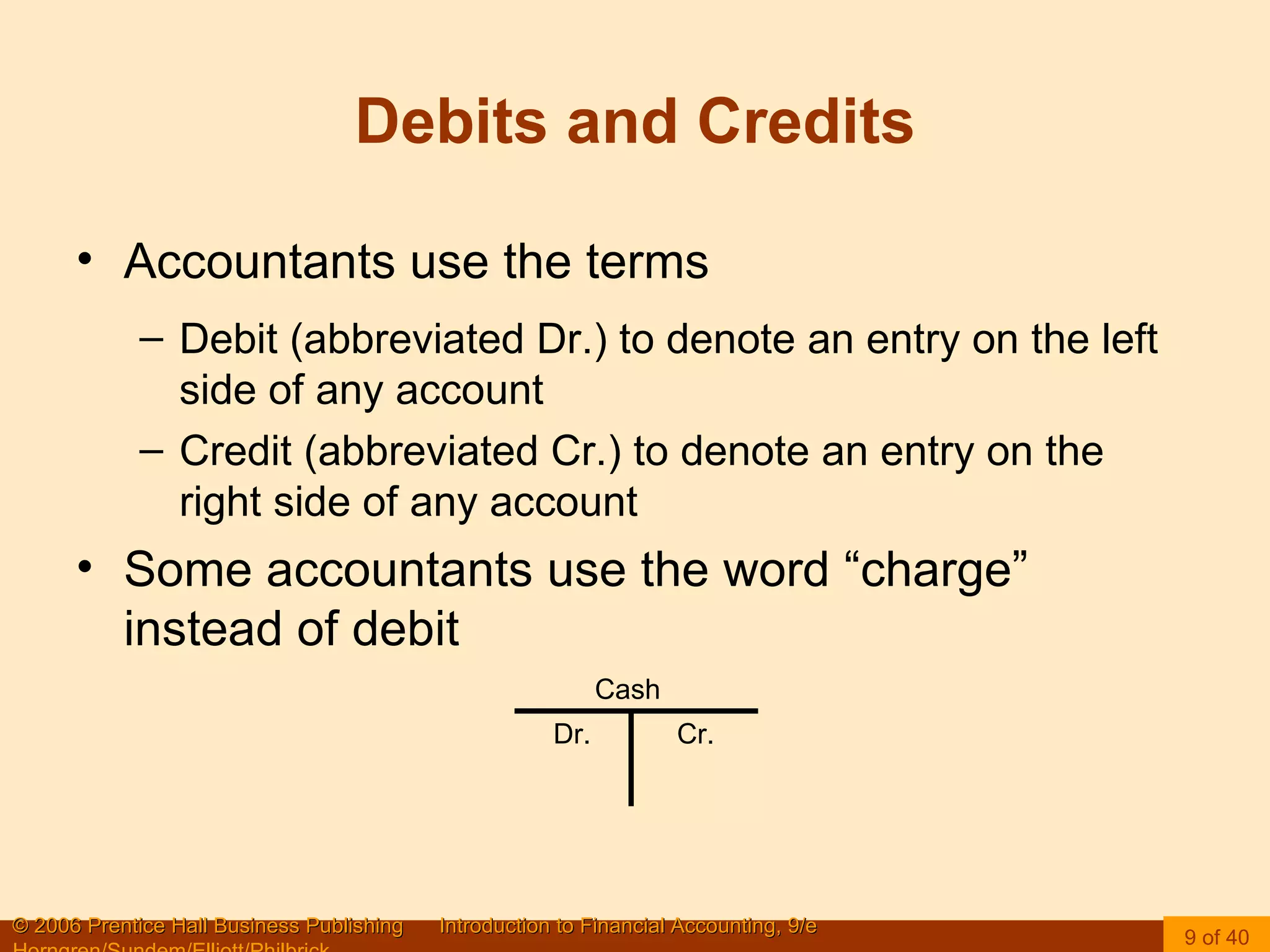

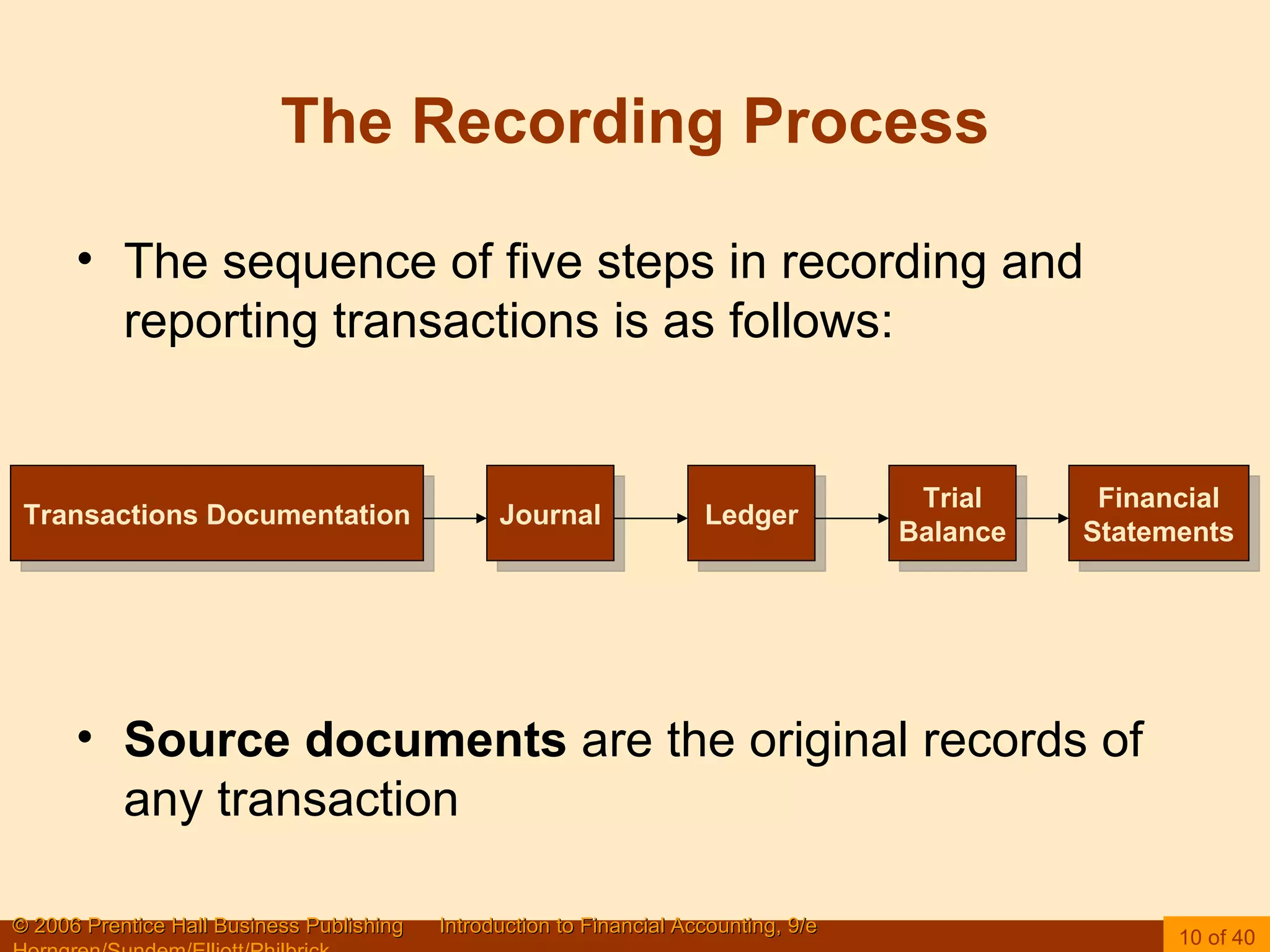

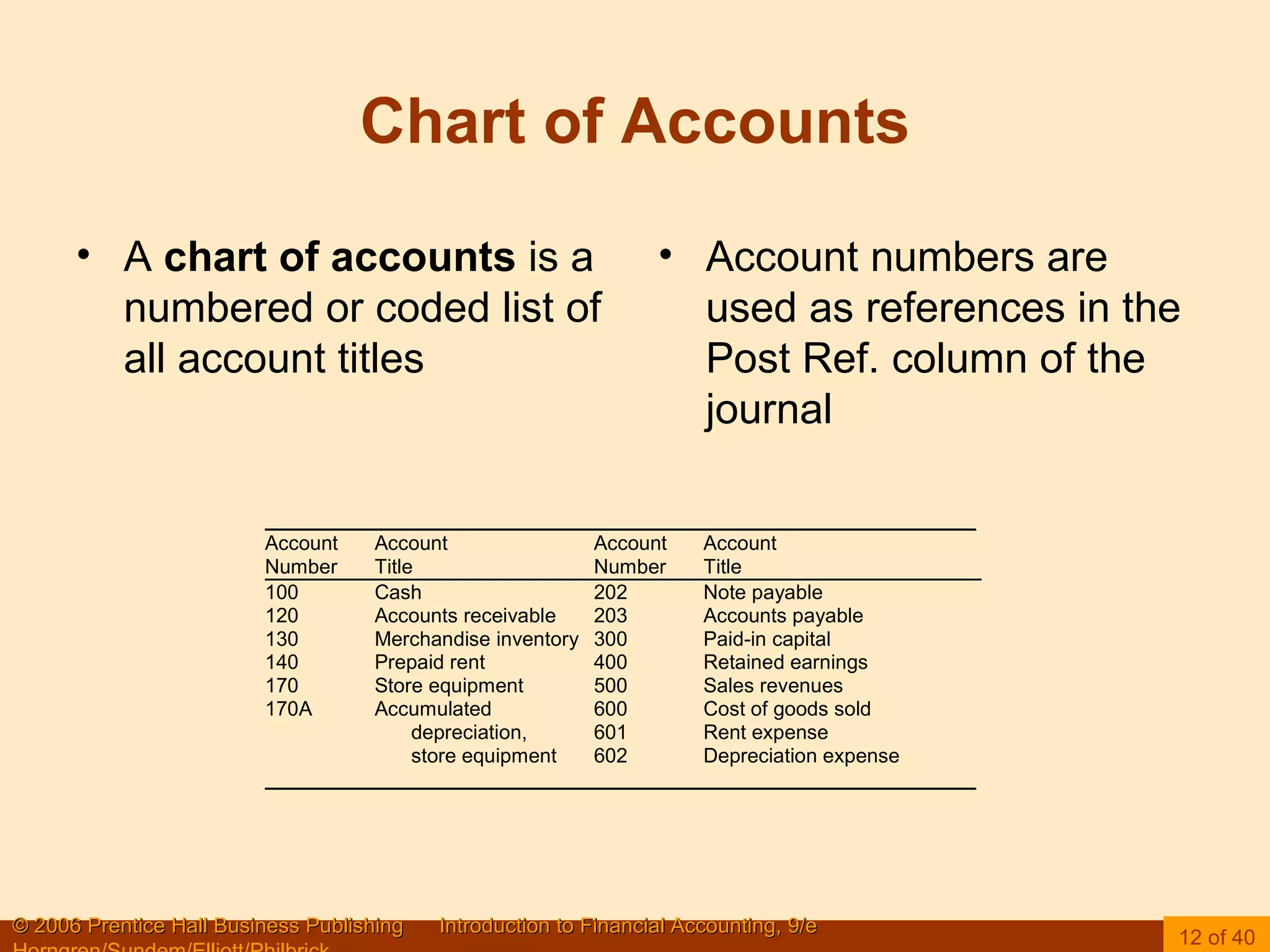

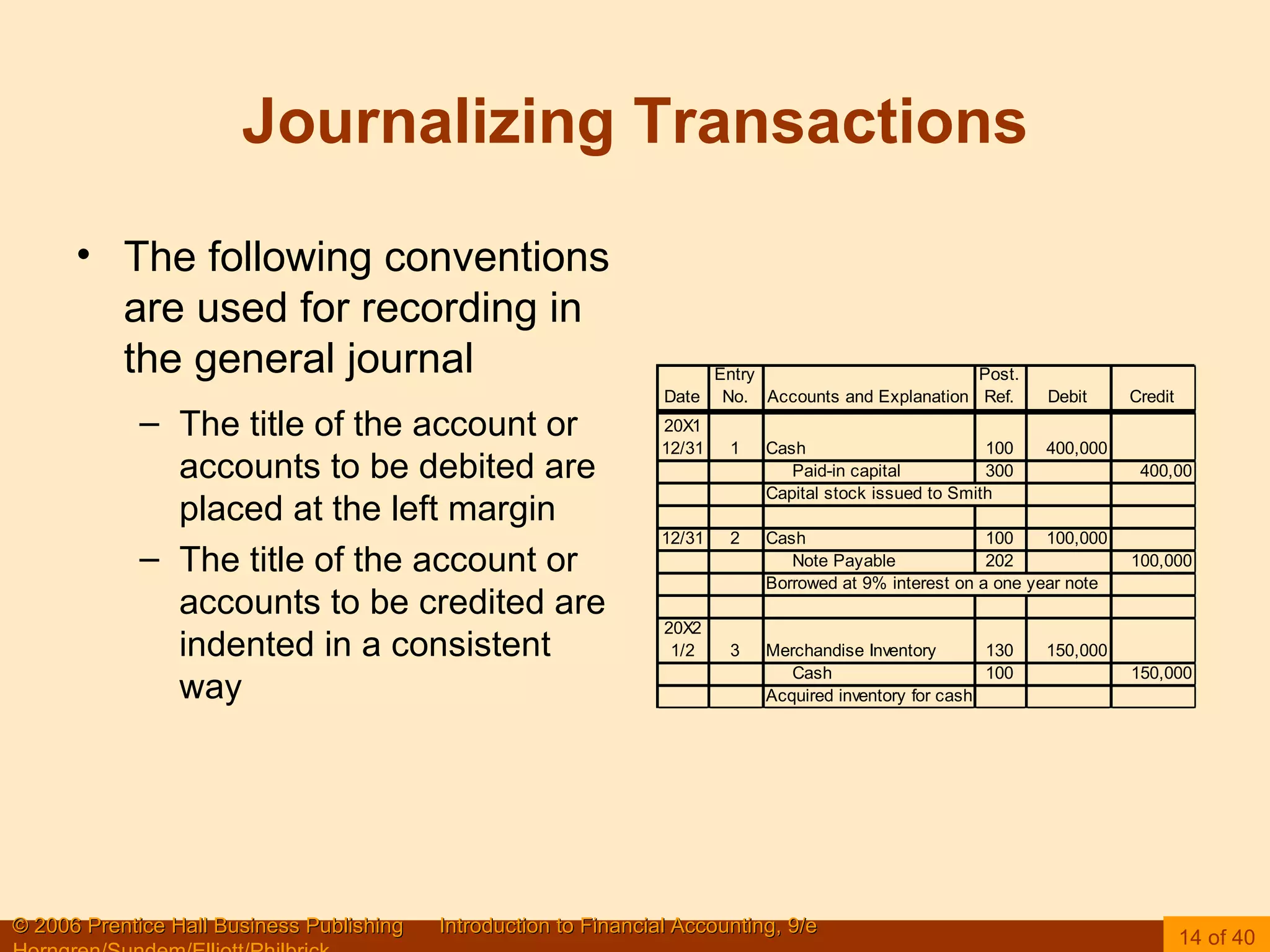

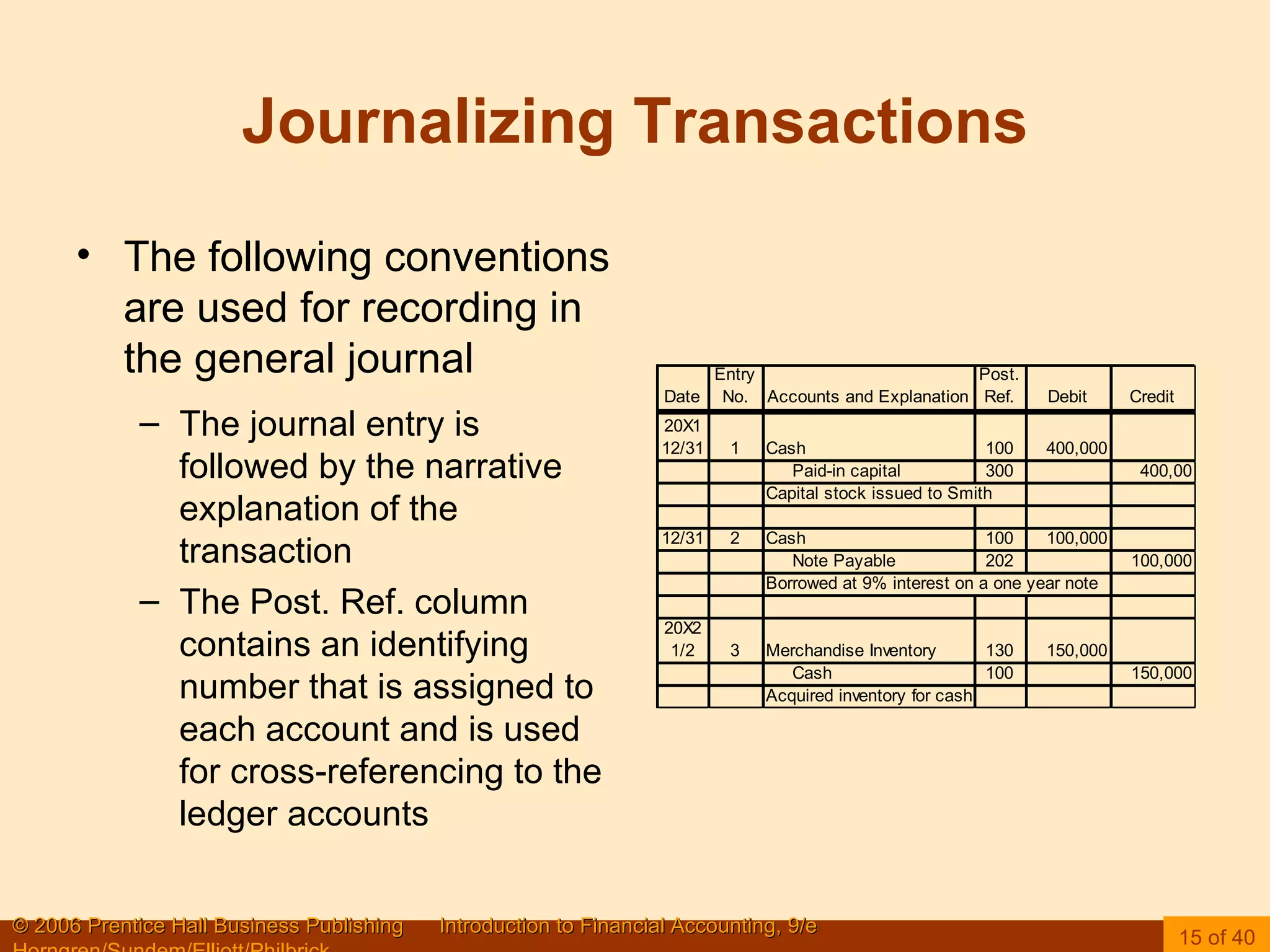

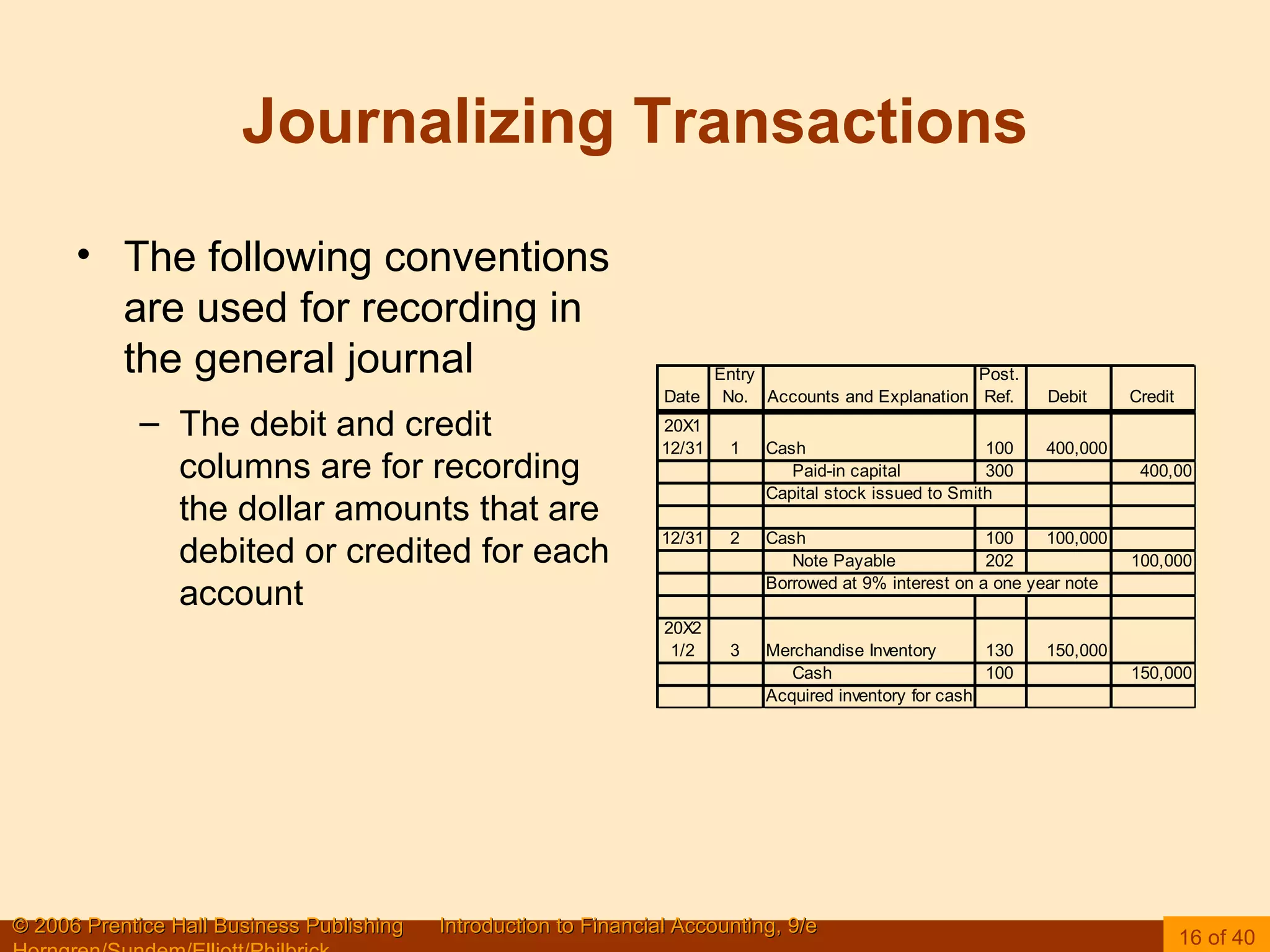

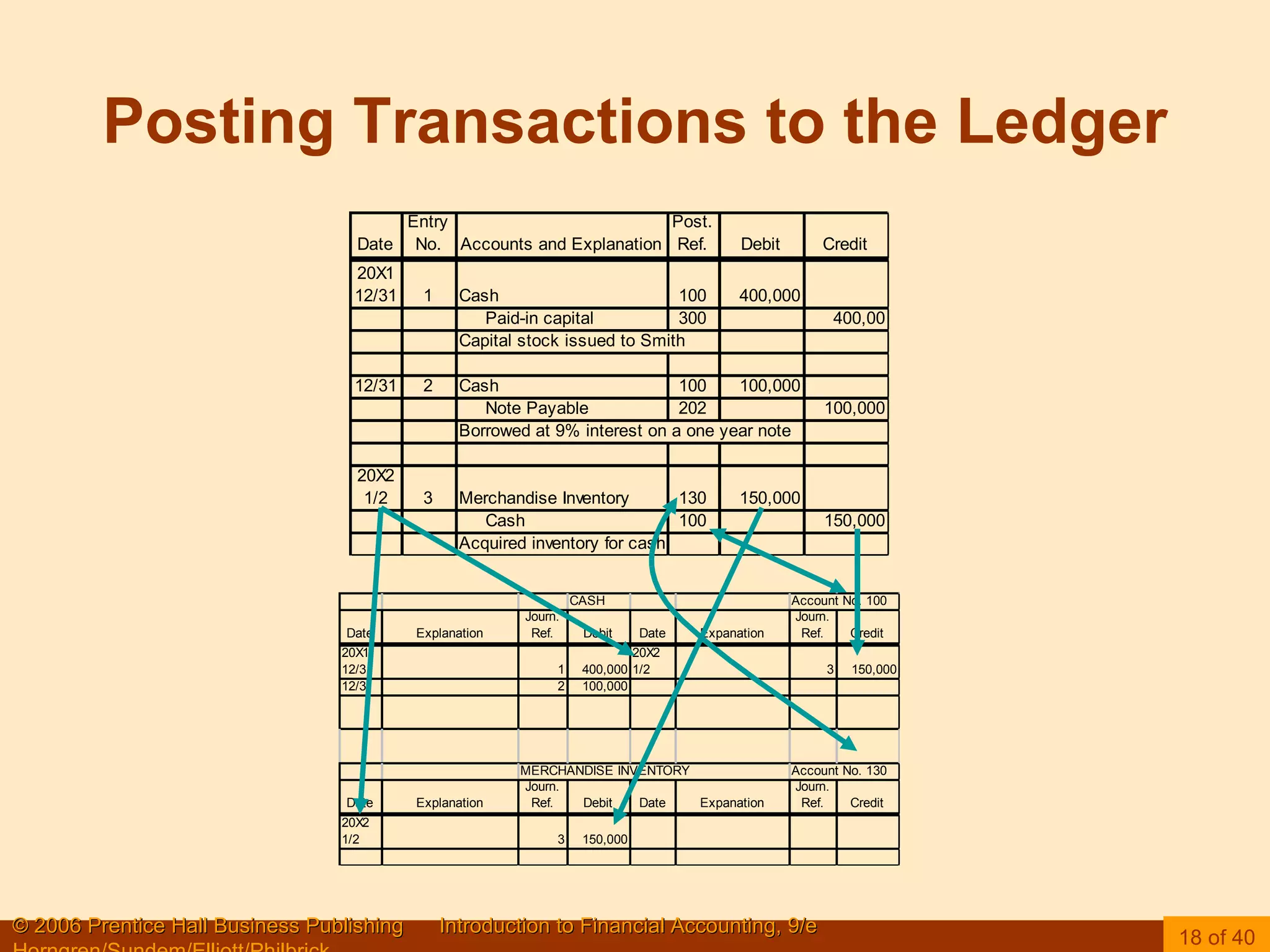

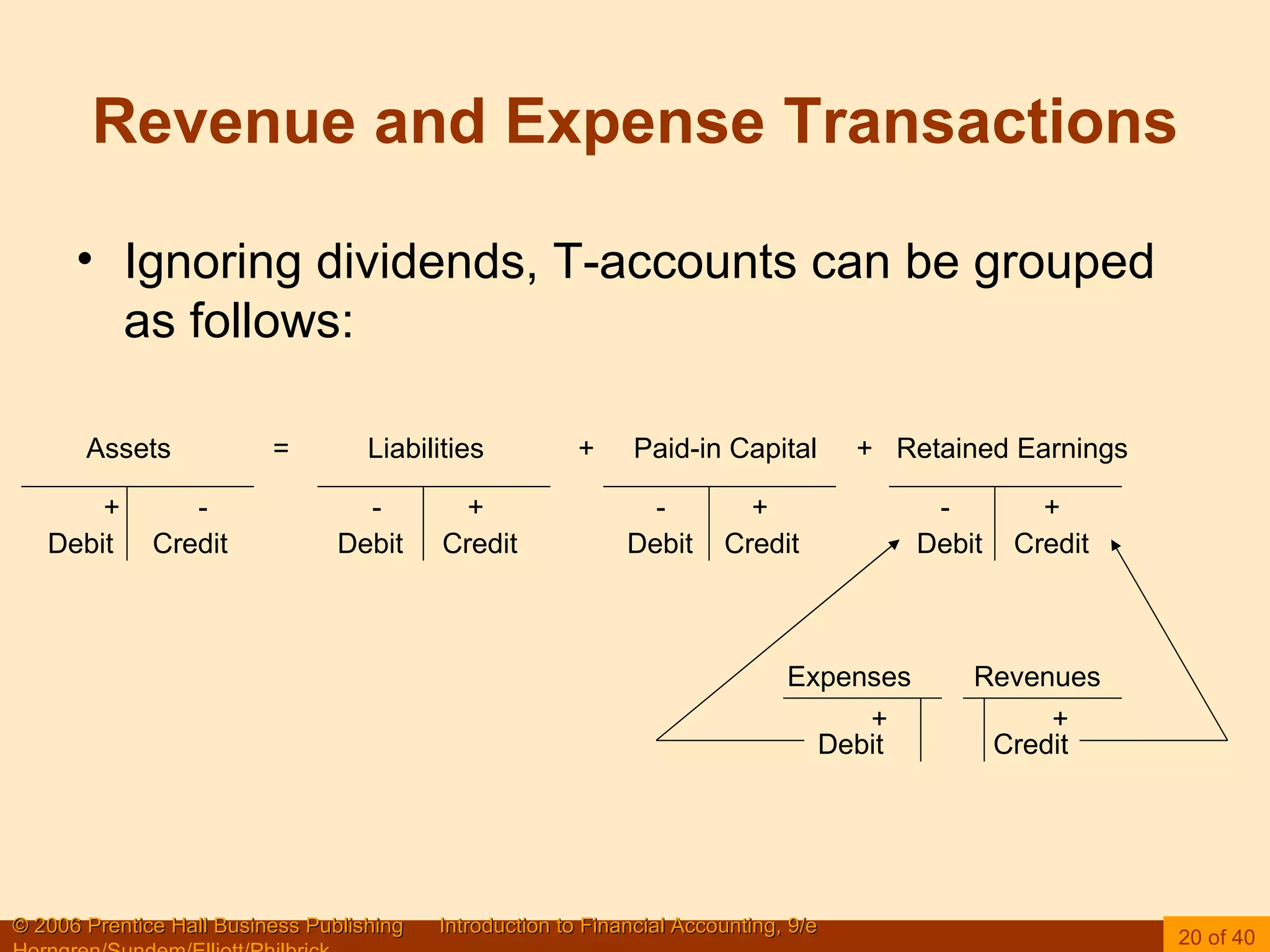

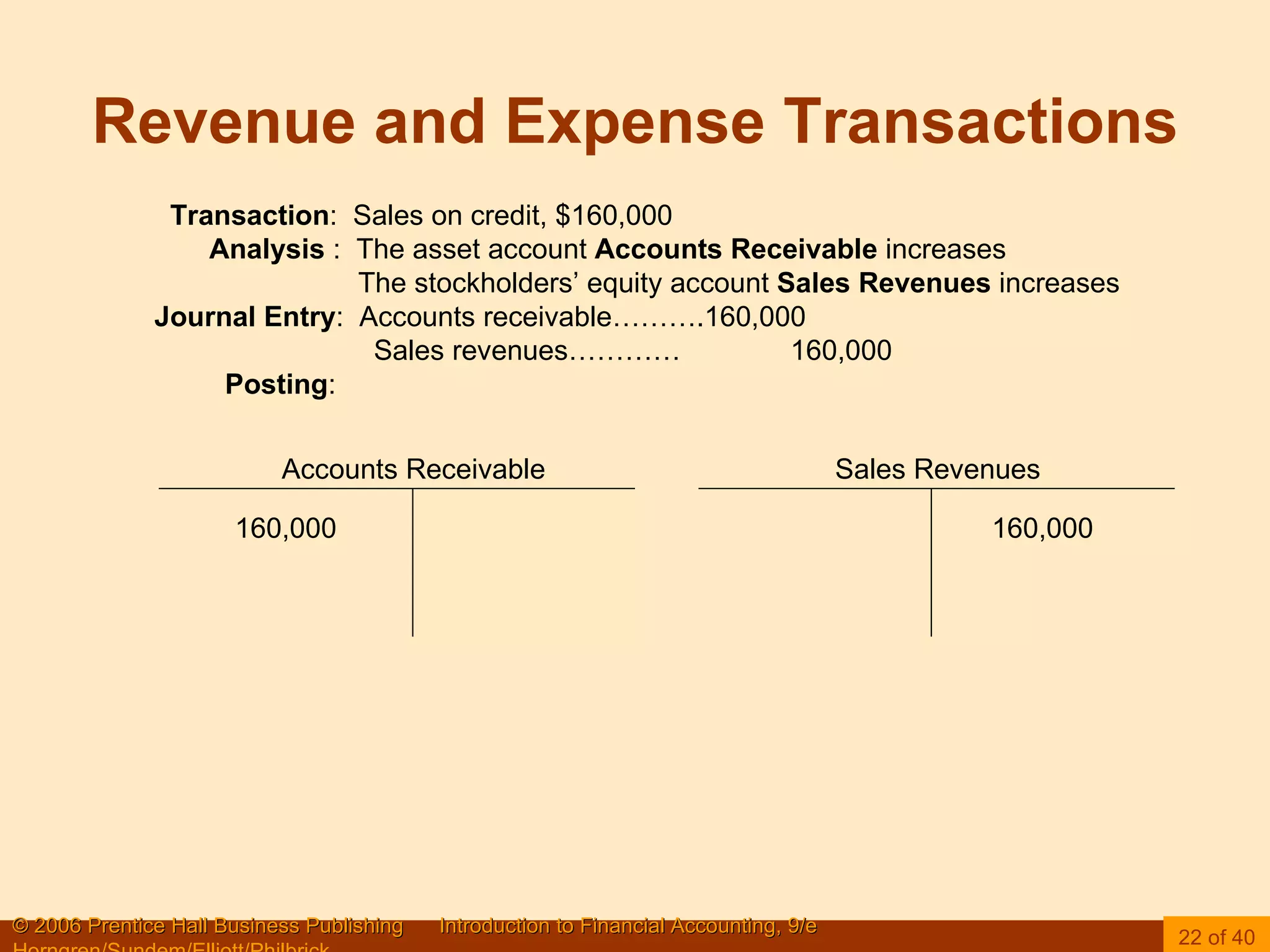

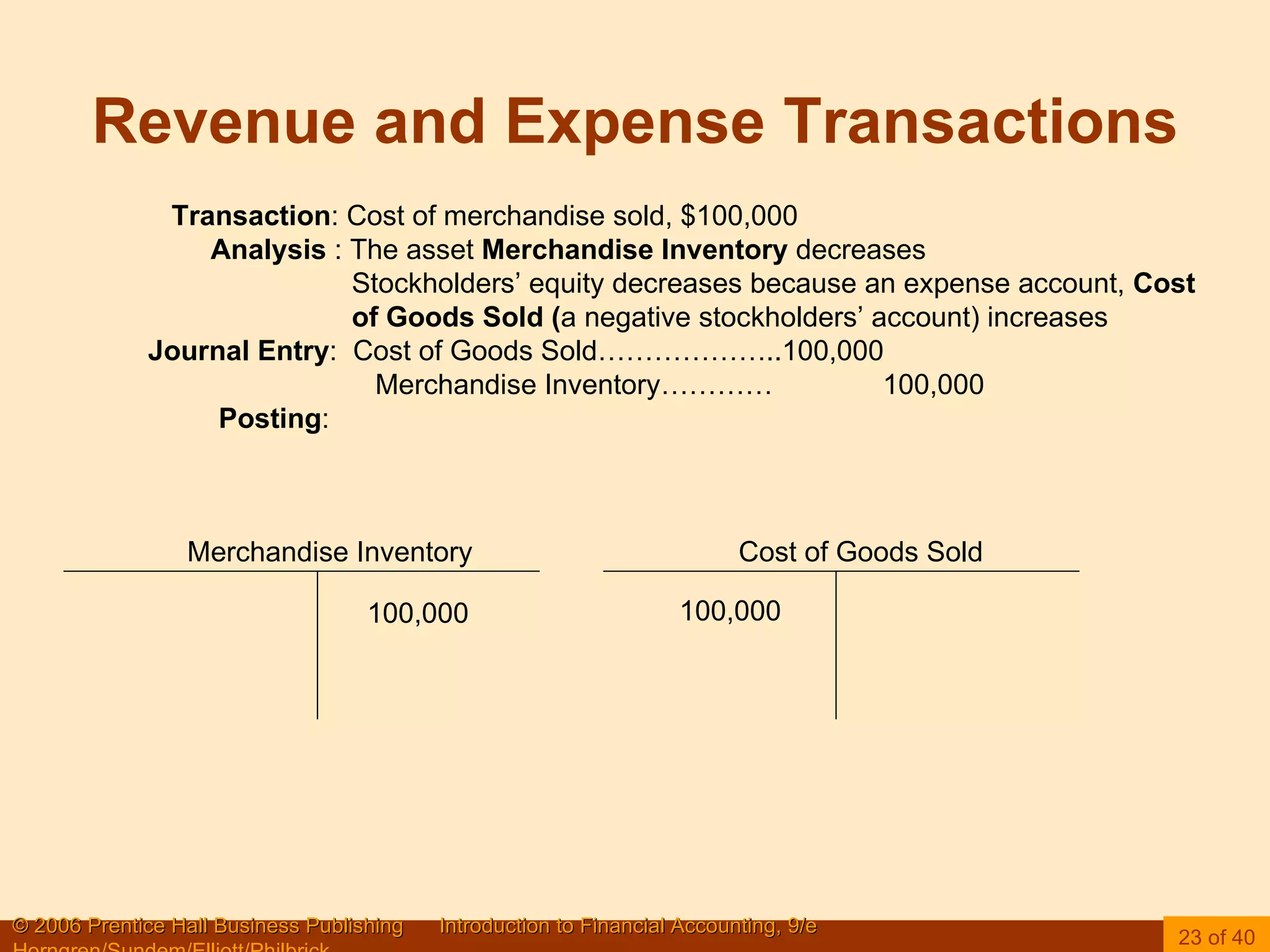

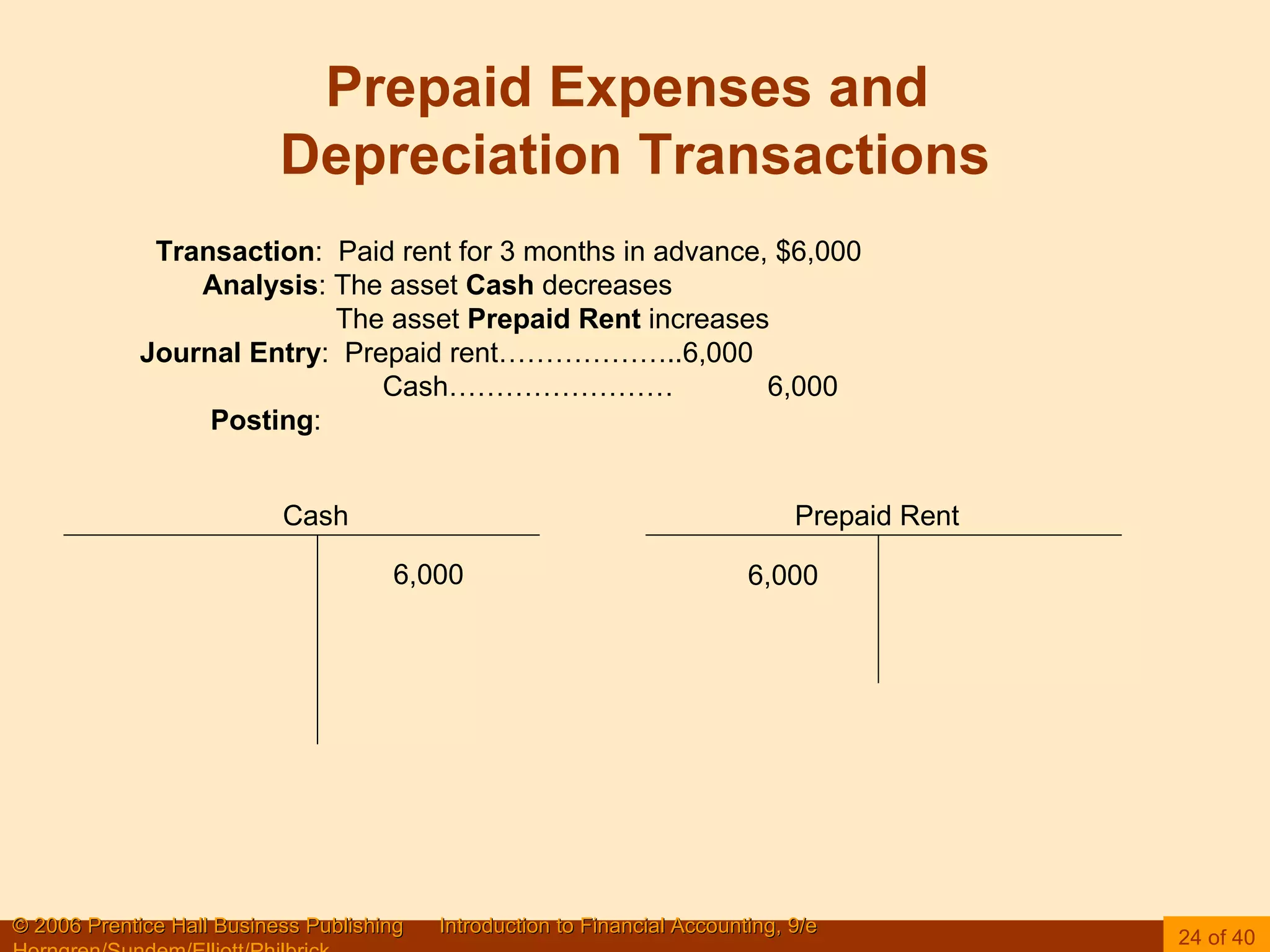

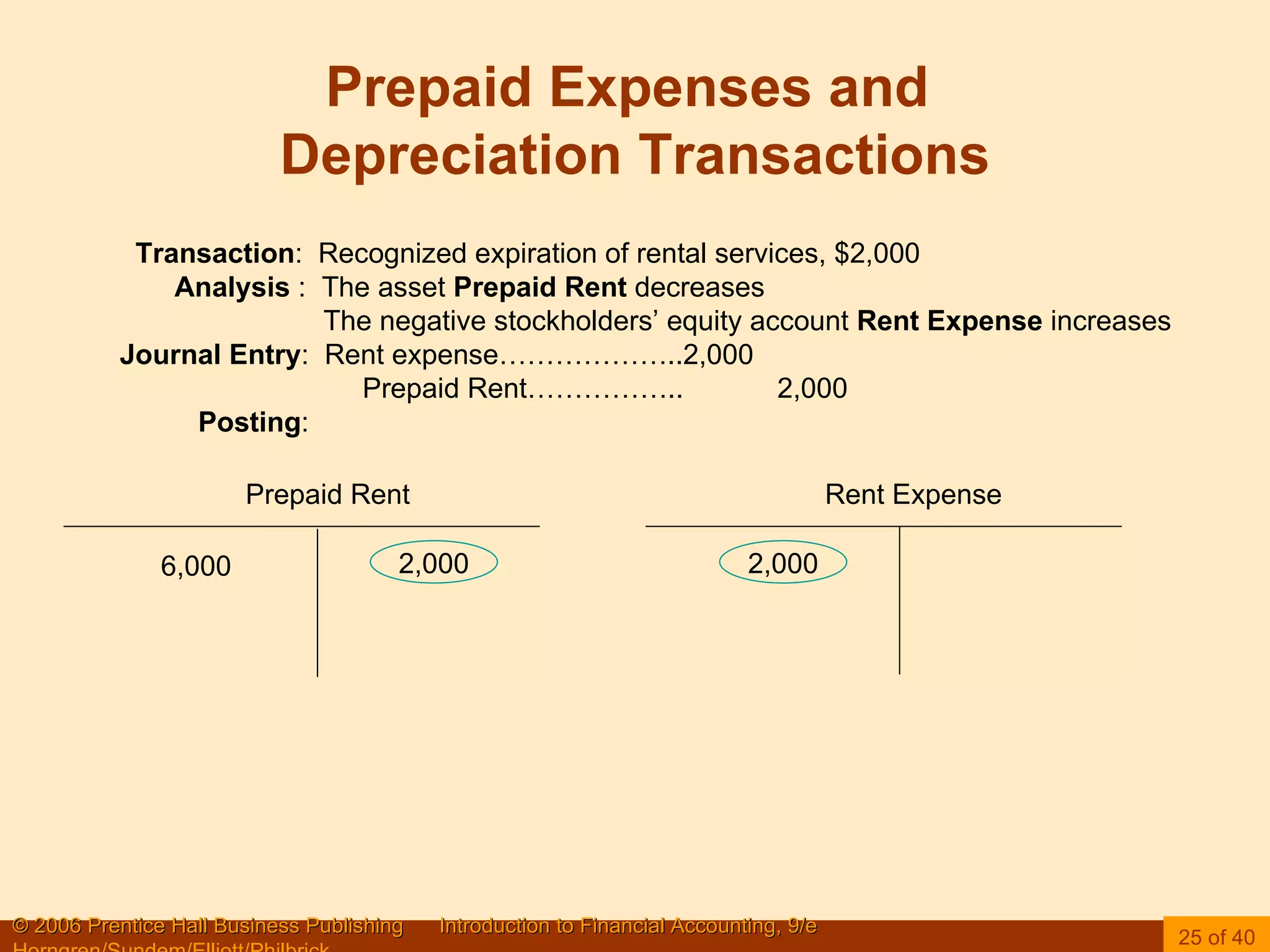

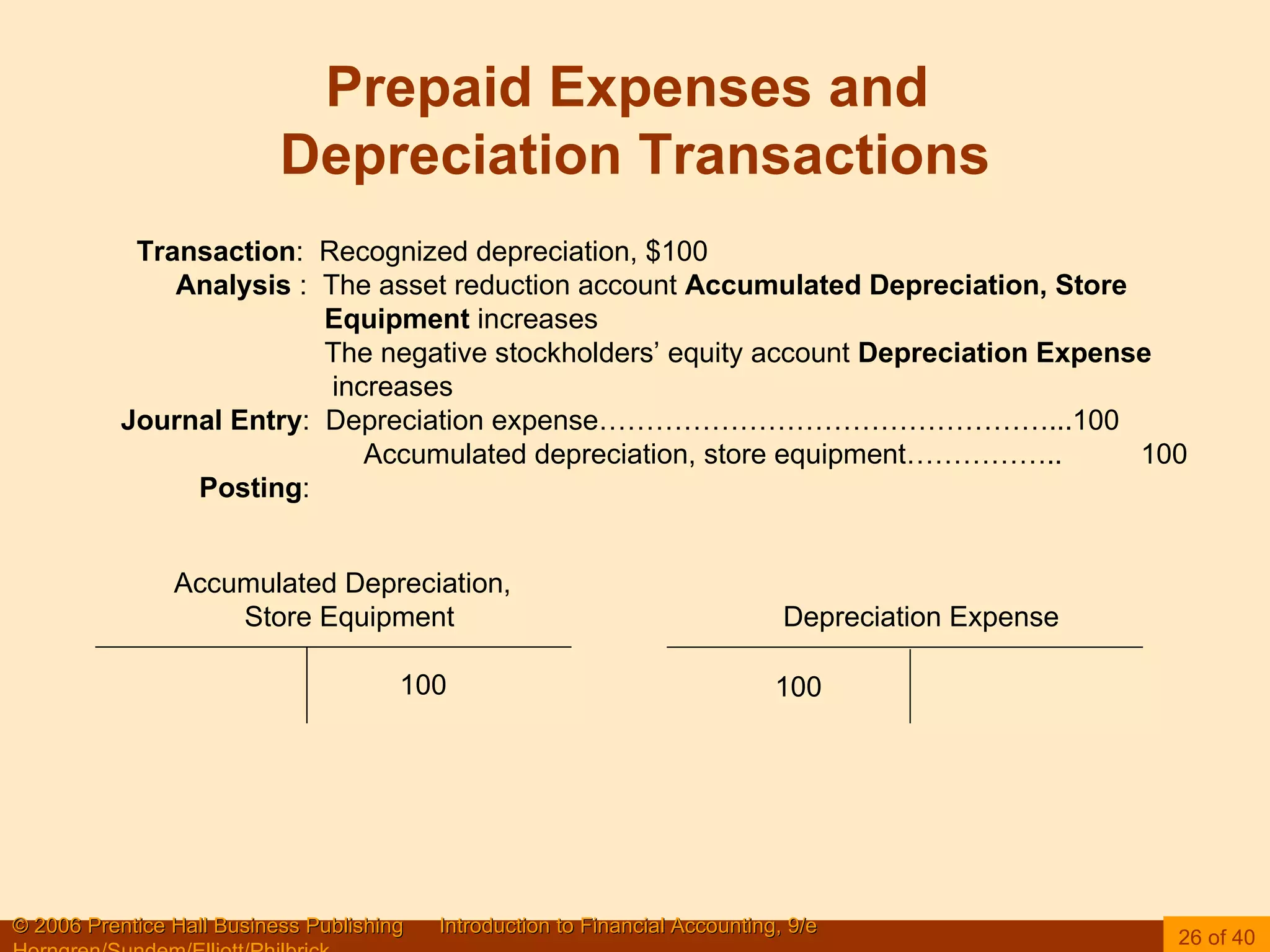

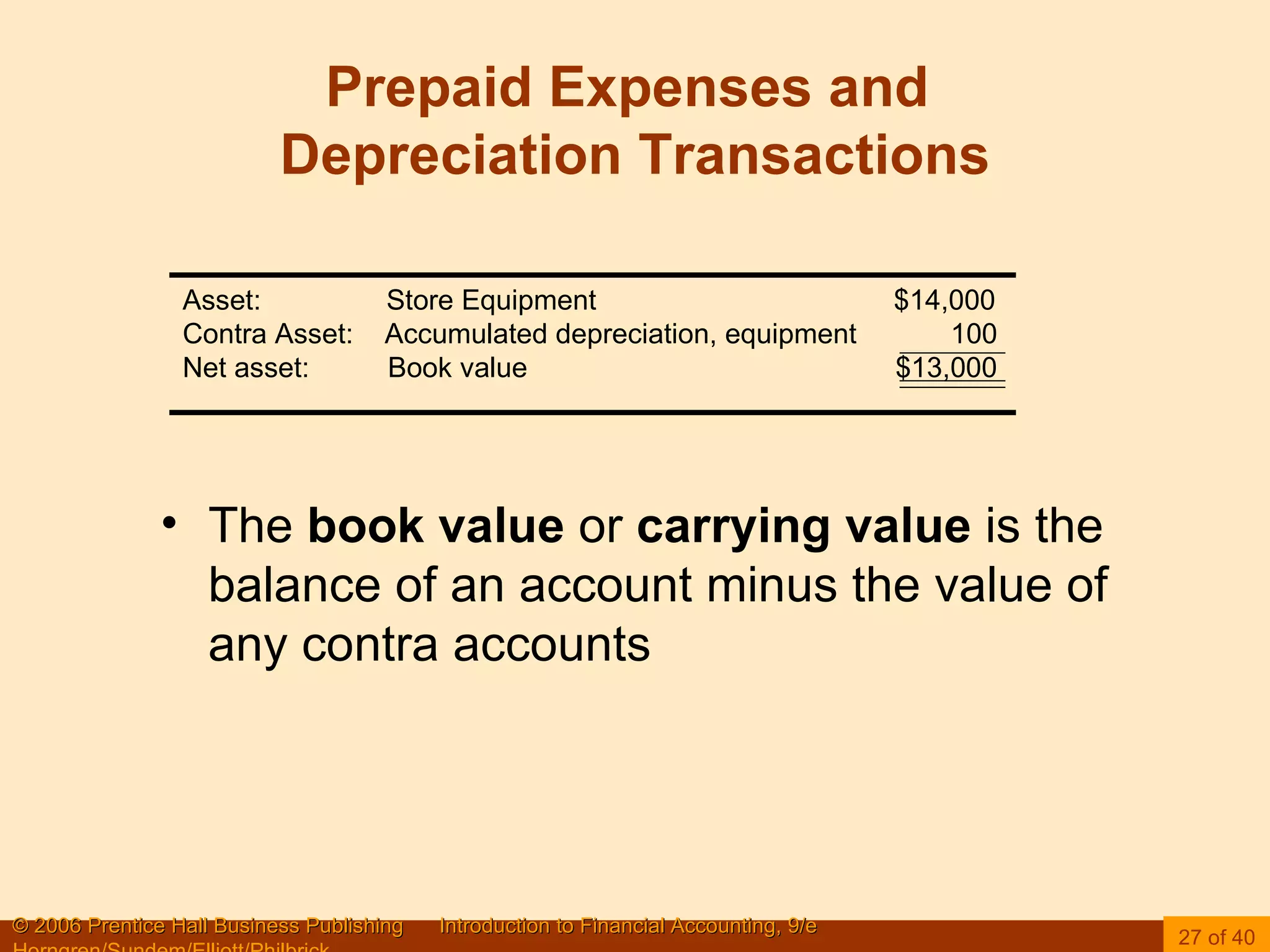

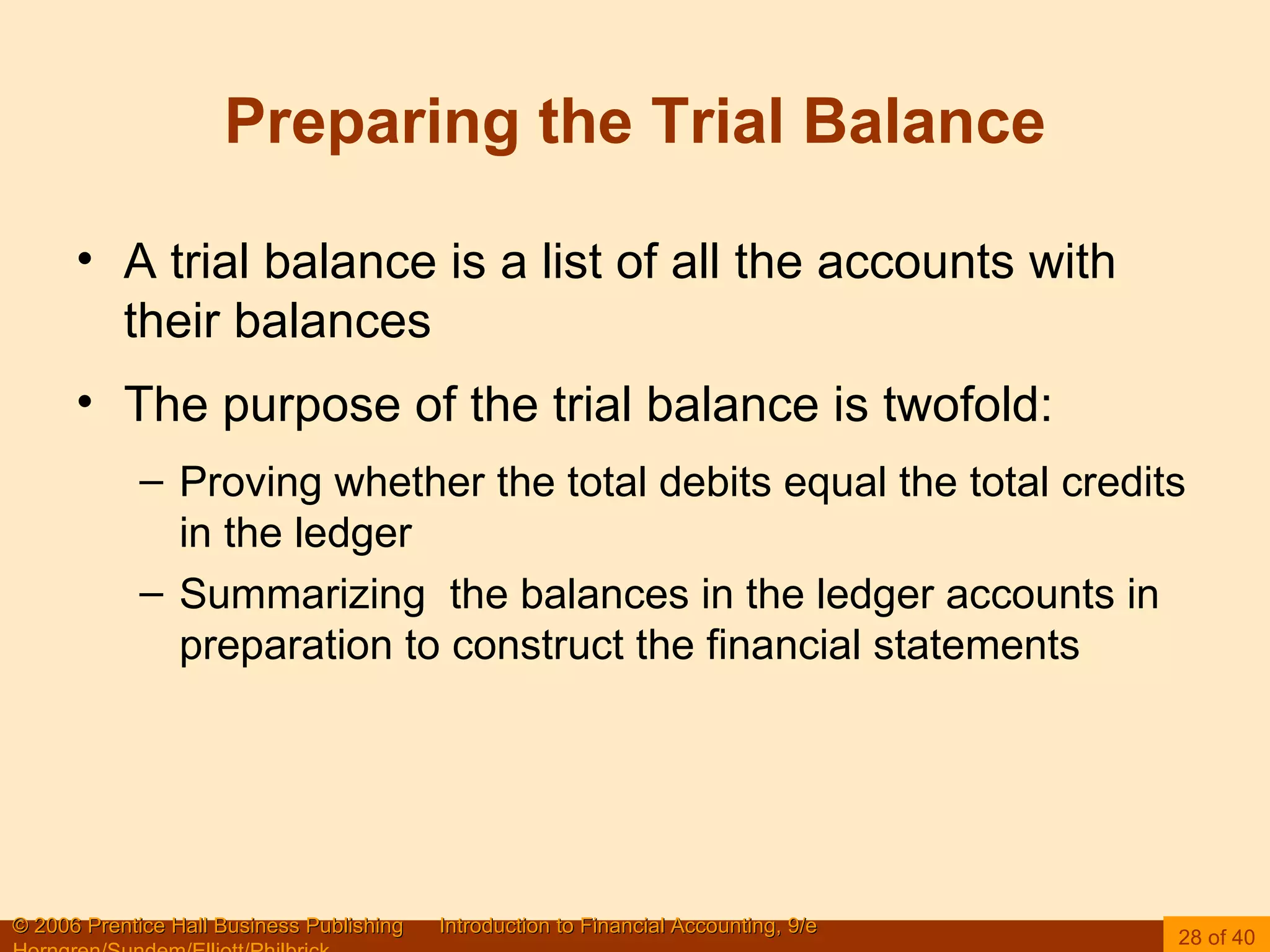

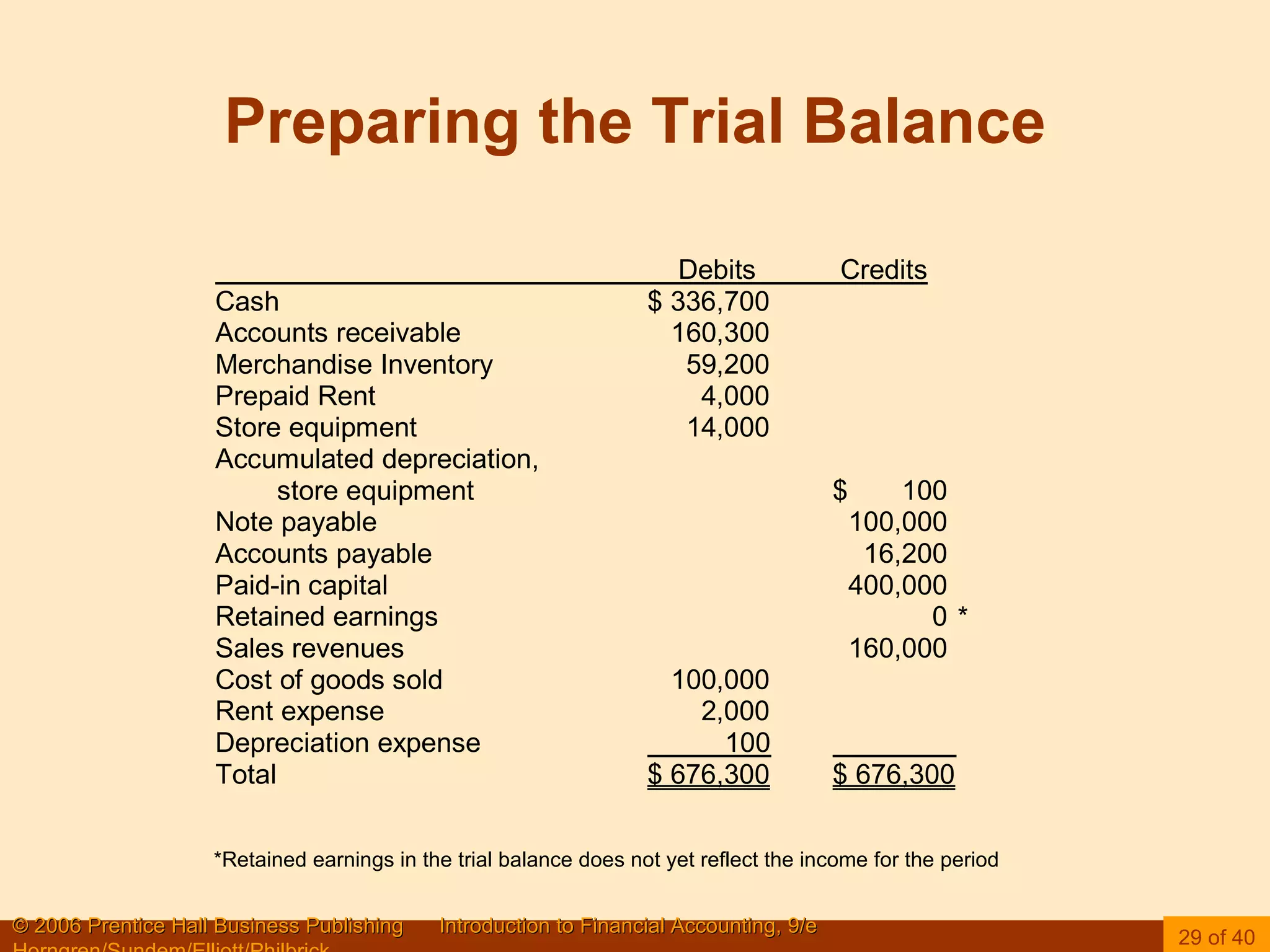

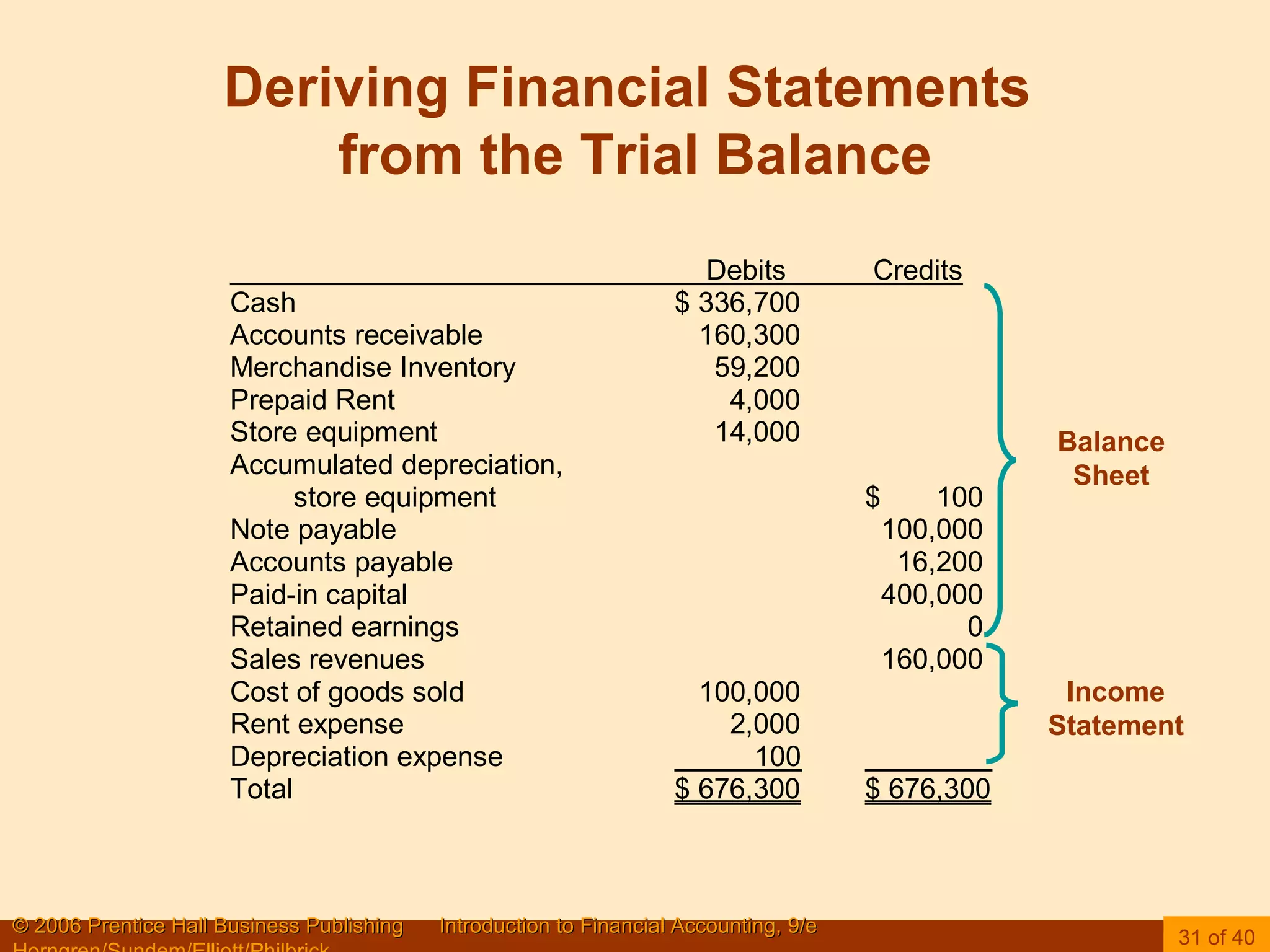

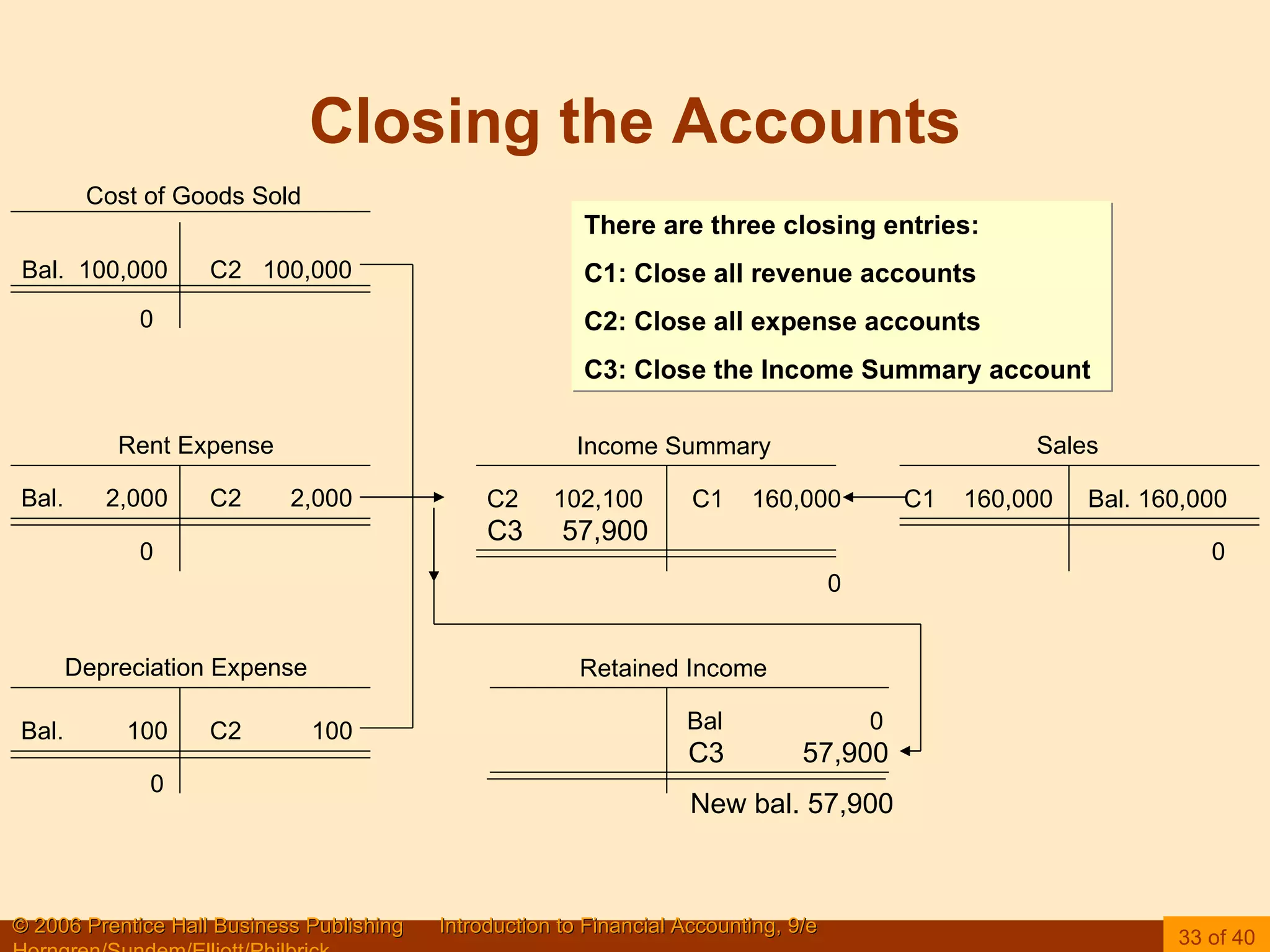

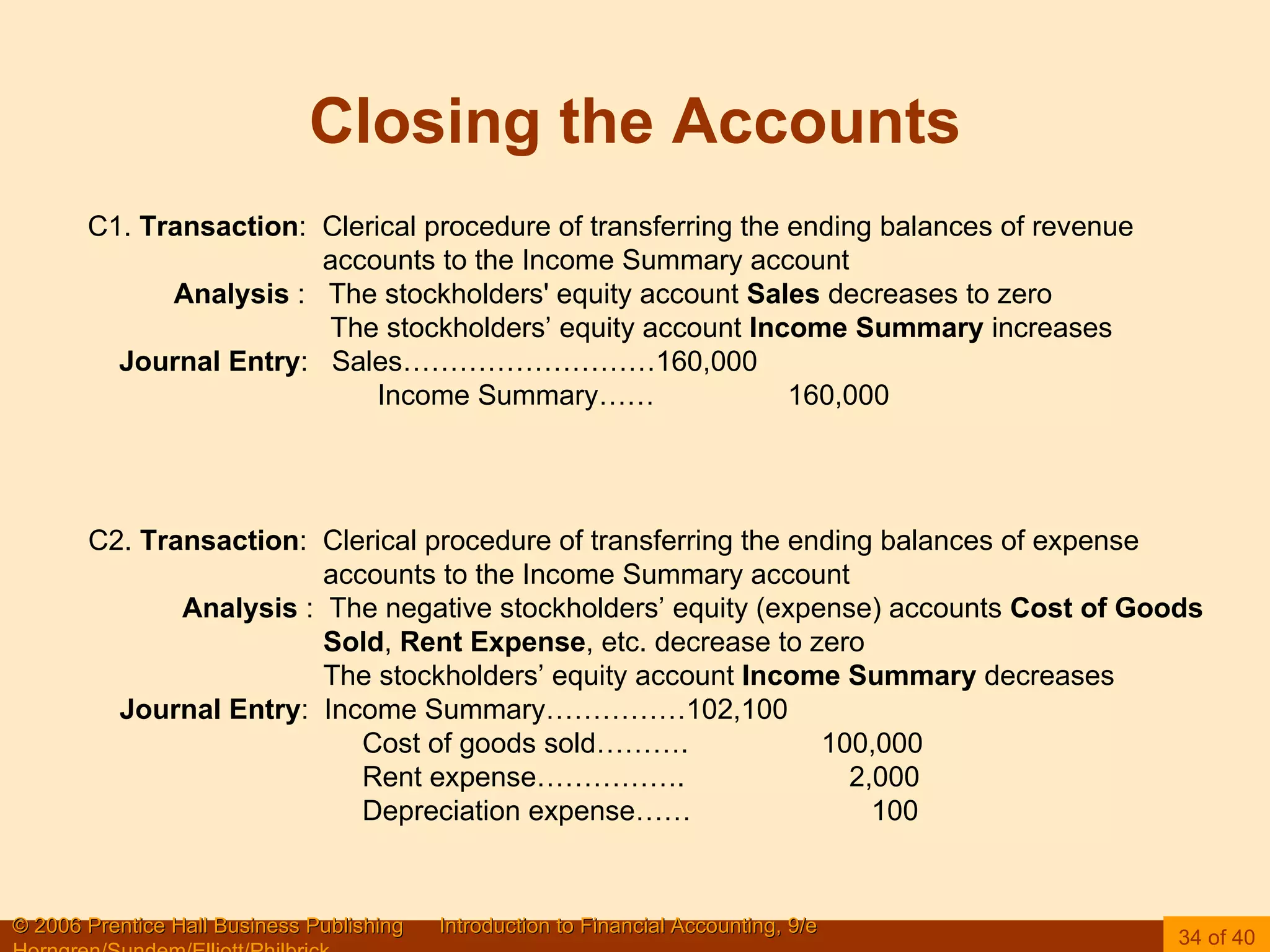

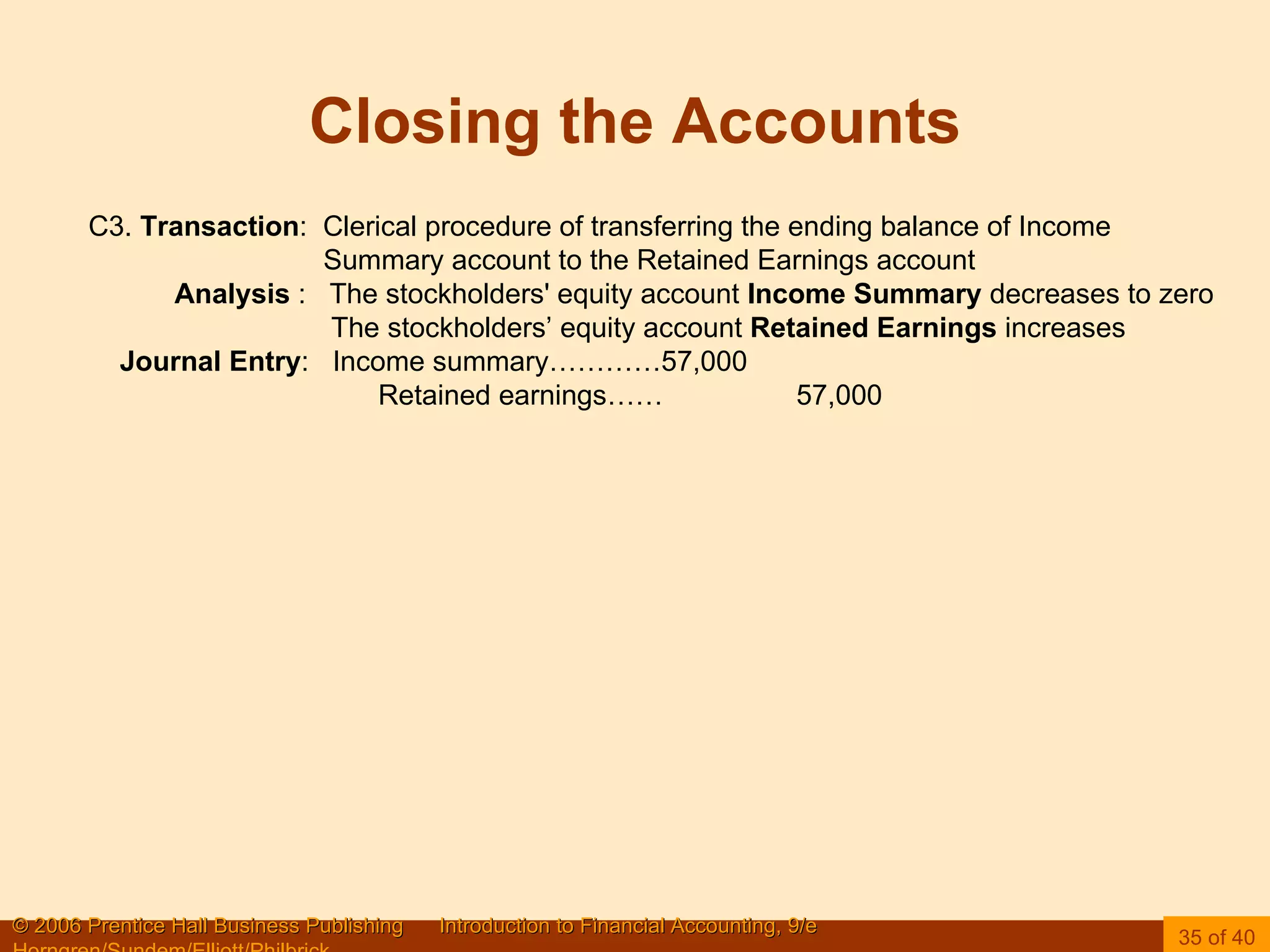

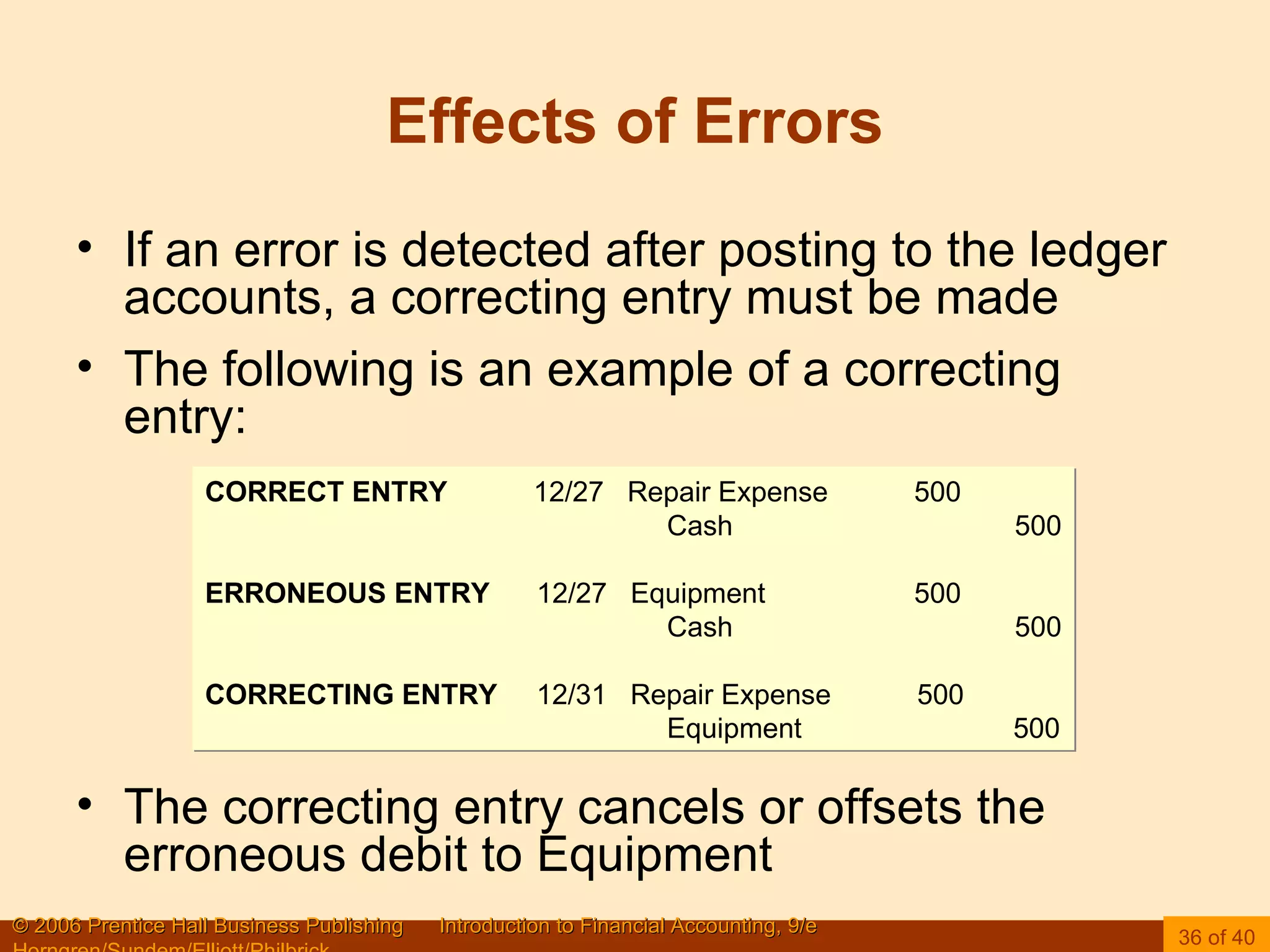

This document discusses key concepts in accounting, including the double-entry system, T-accounts, journal entries, posting transactions, closing revenue and expense accounts, preparing trial balances, and correcting errors. It also covers how computers have transformed accounting data processing.