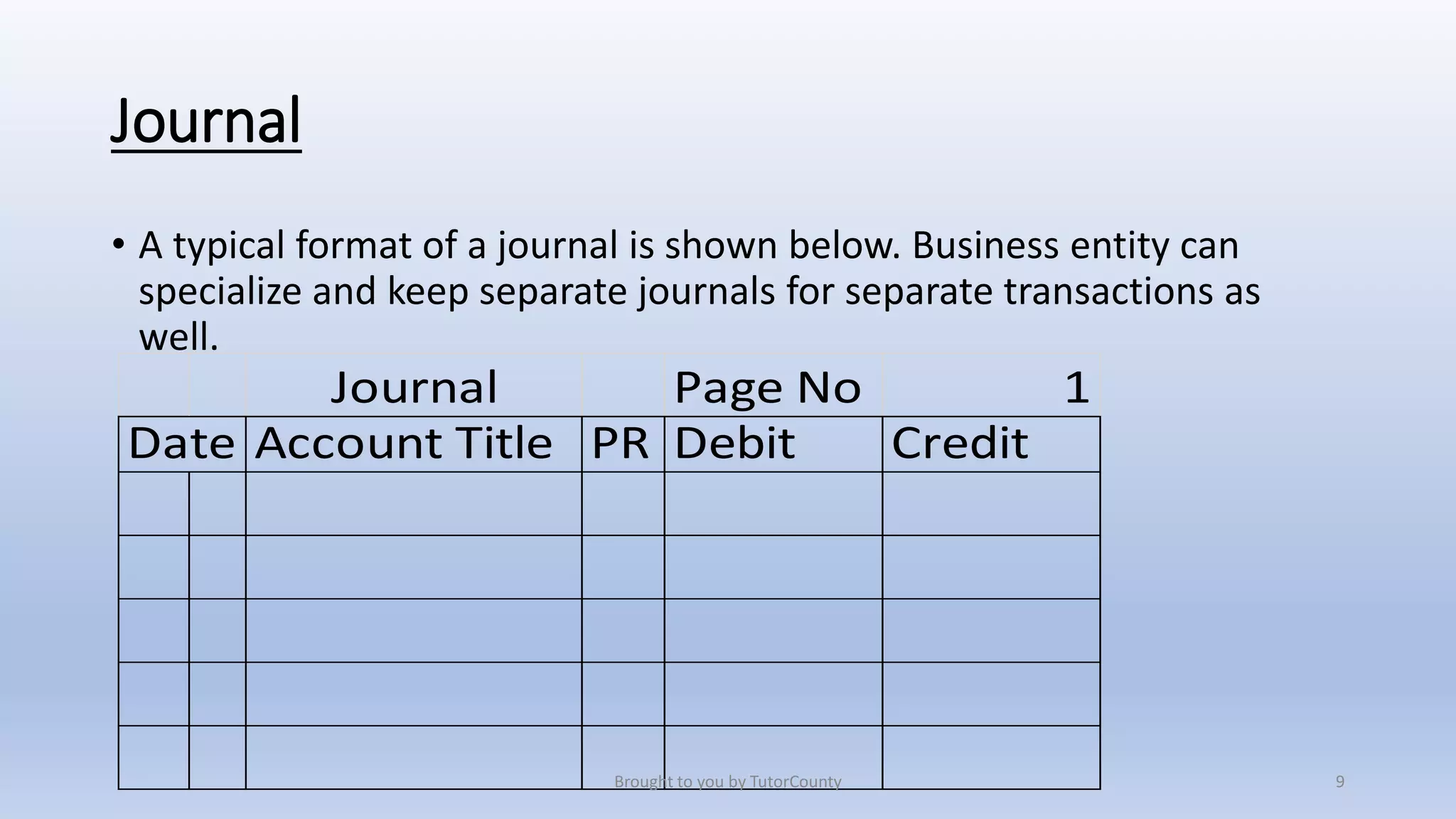

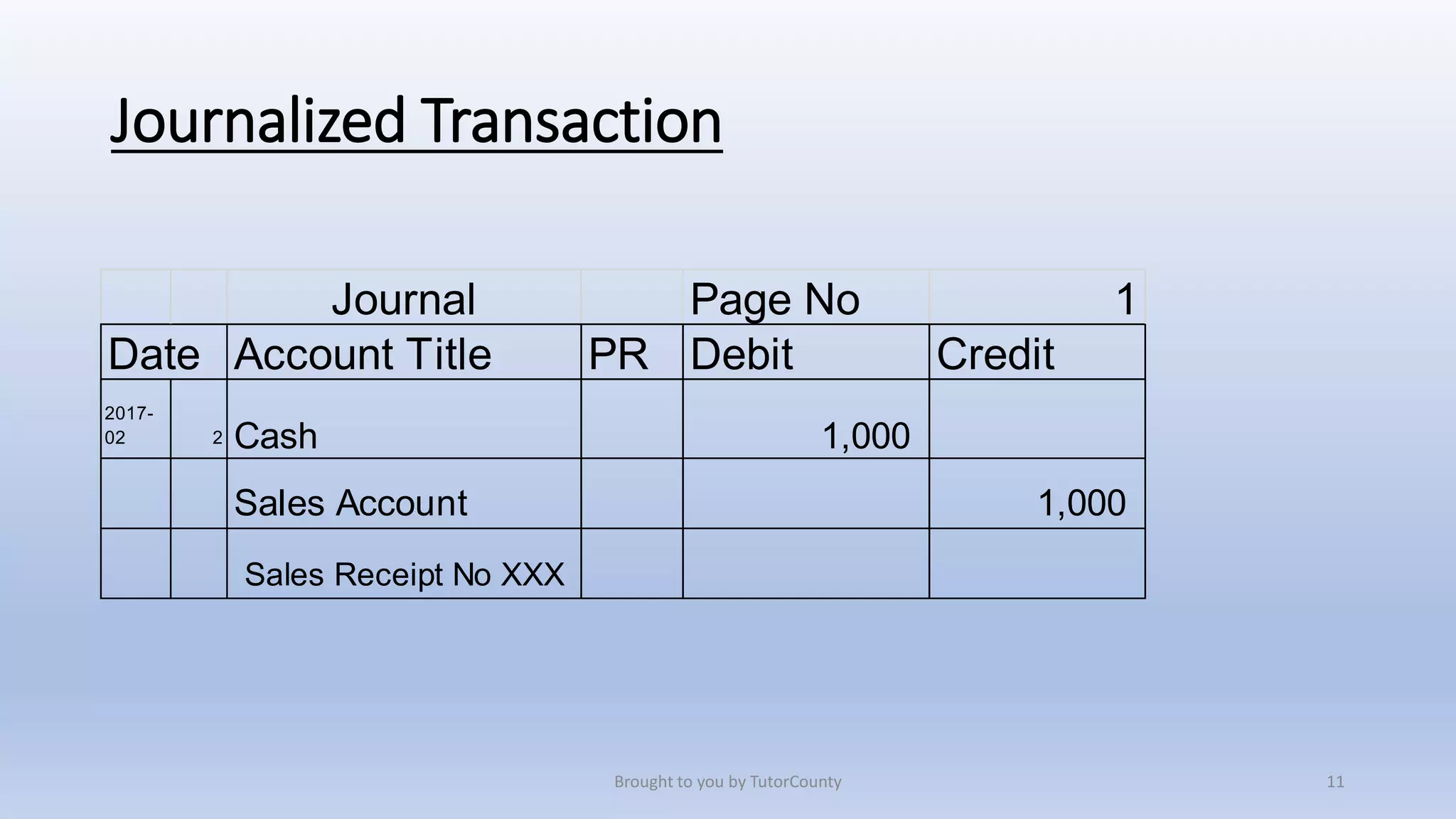

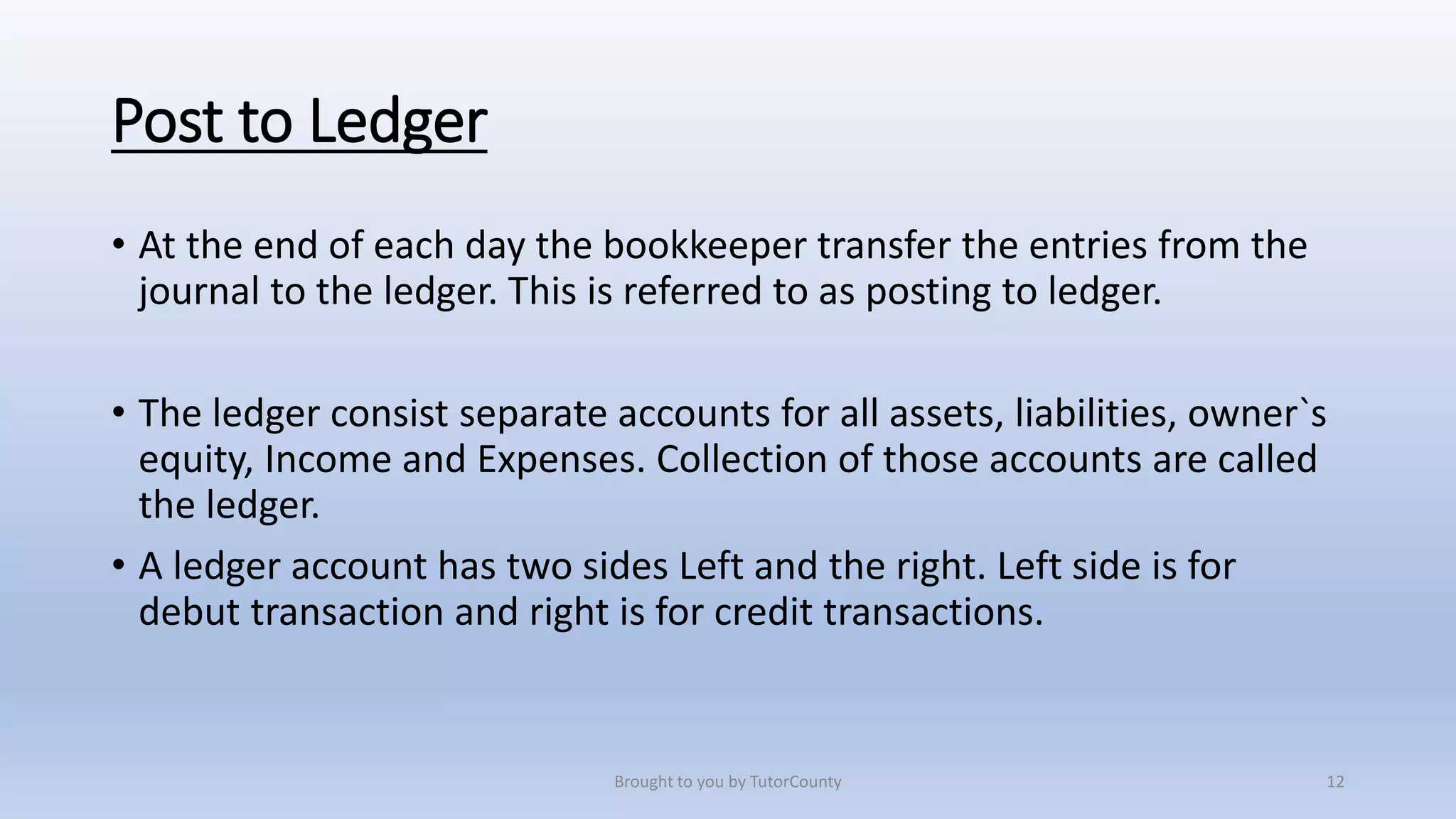

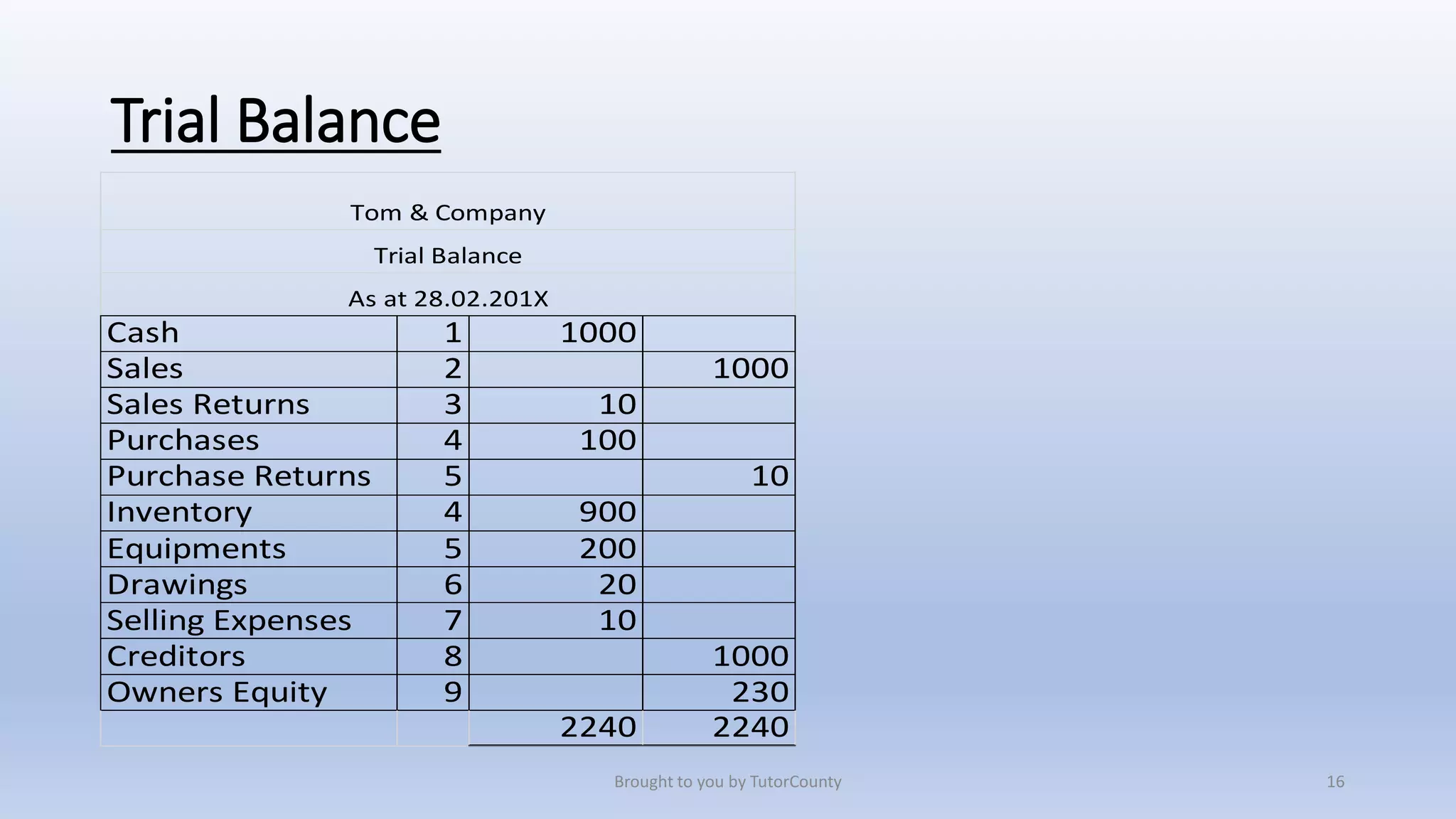

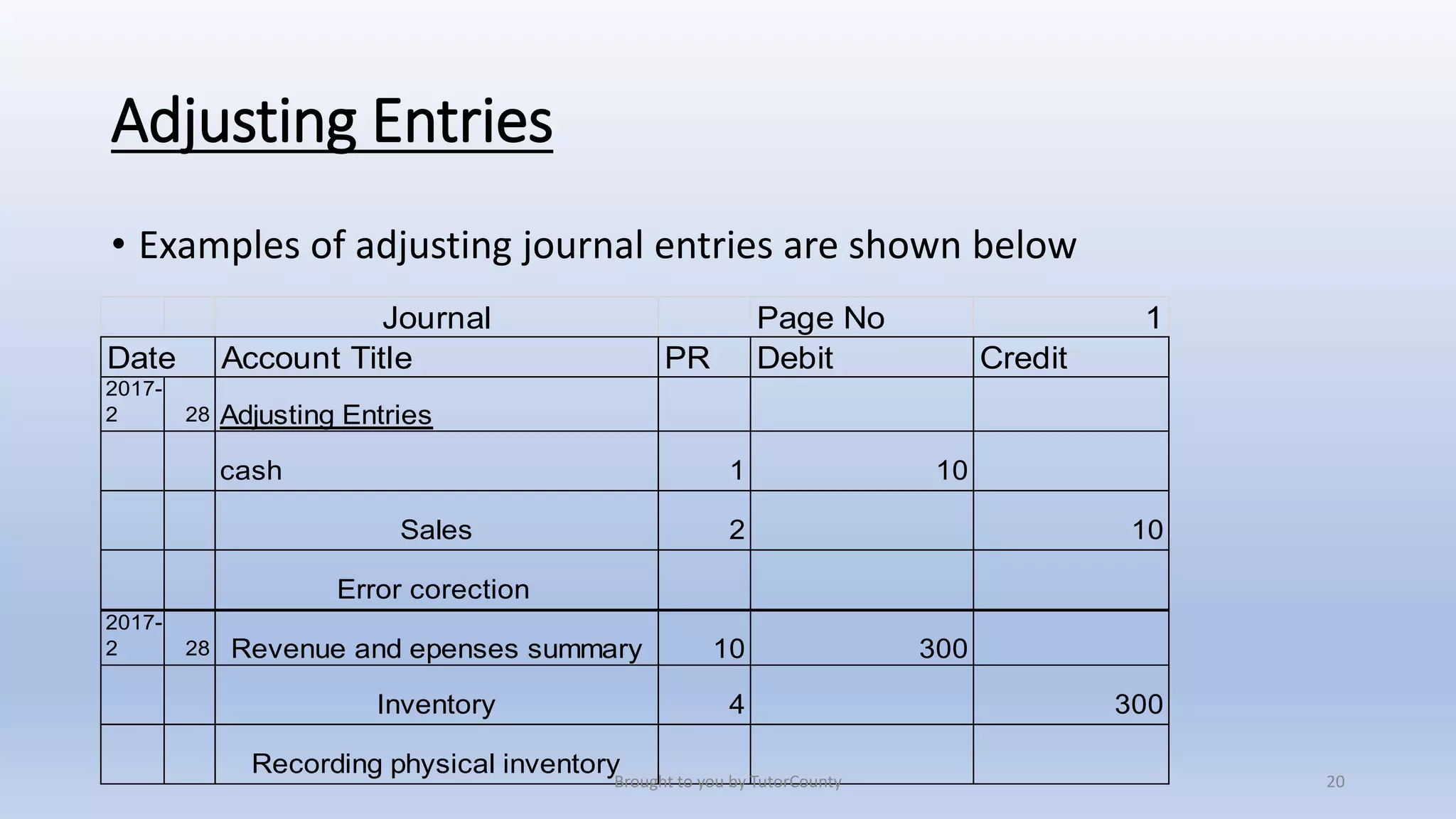

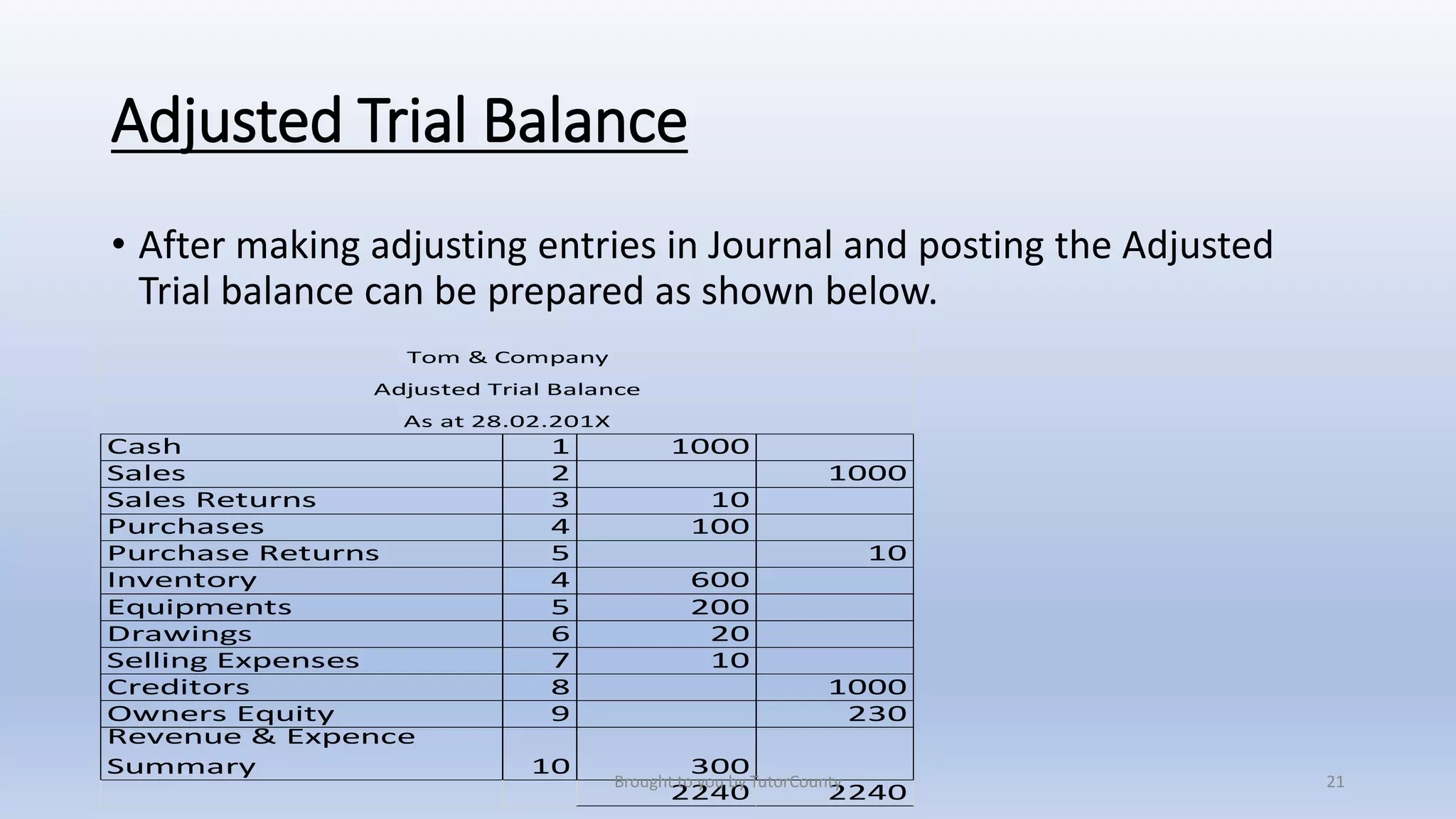

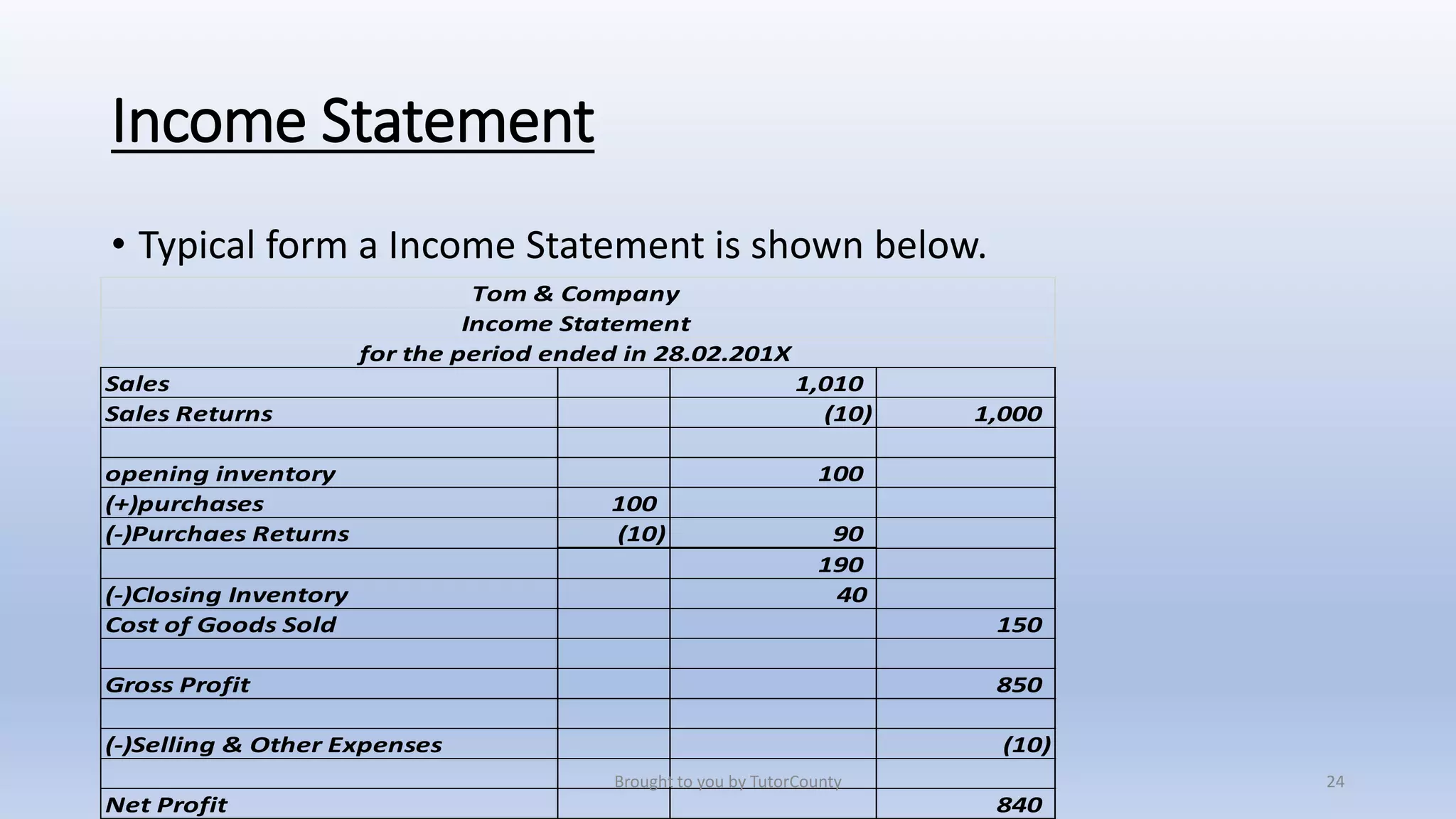

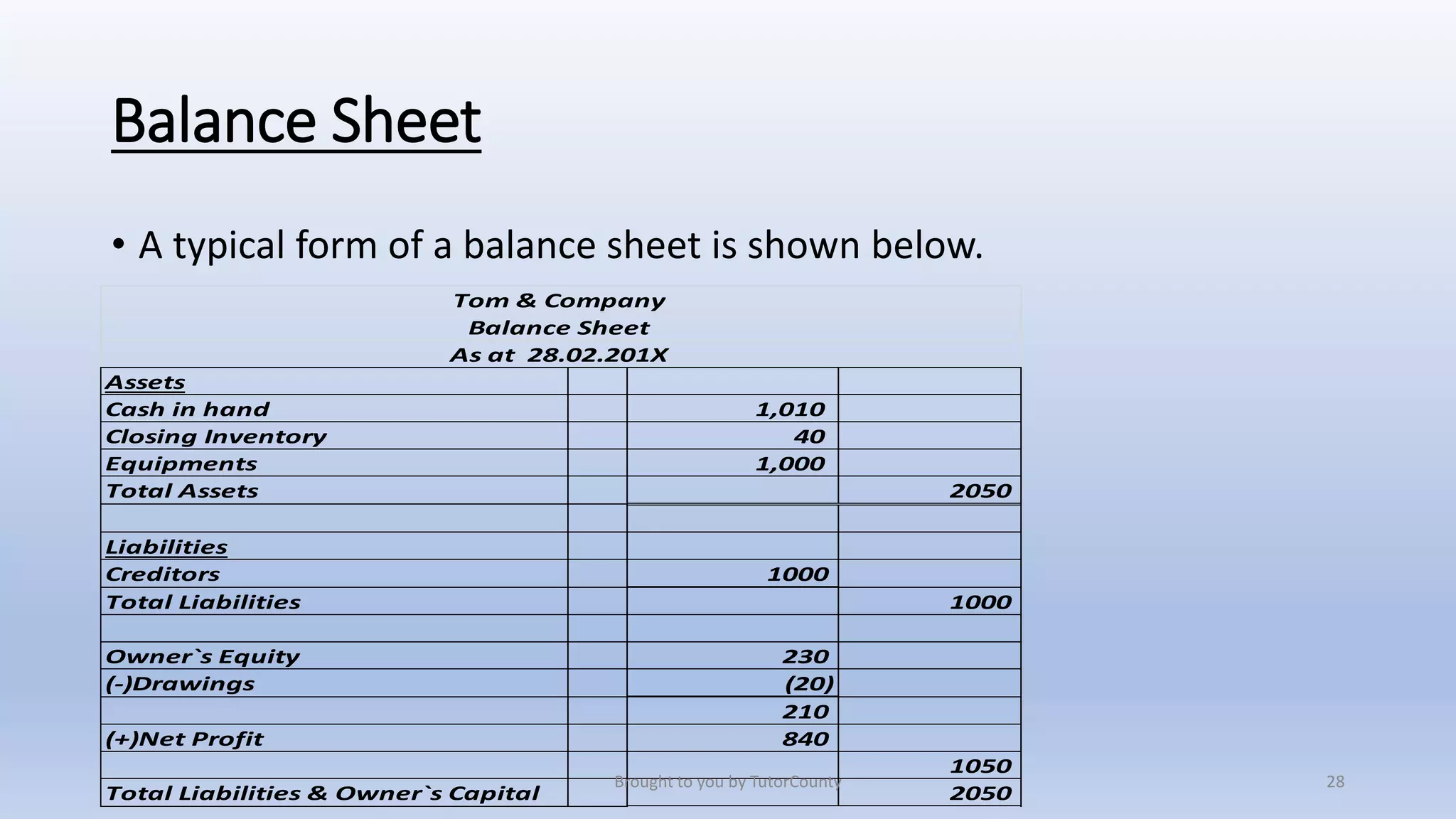

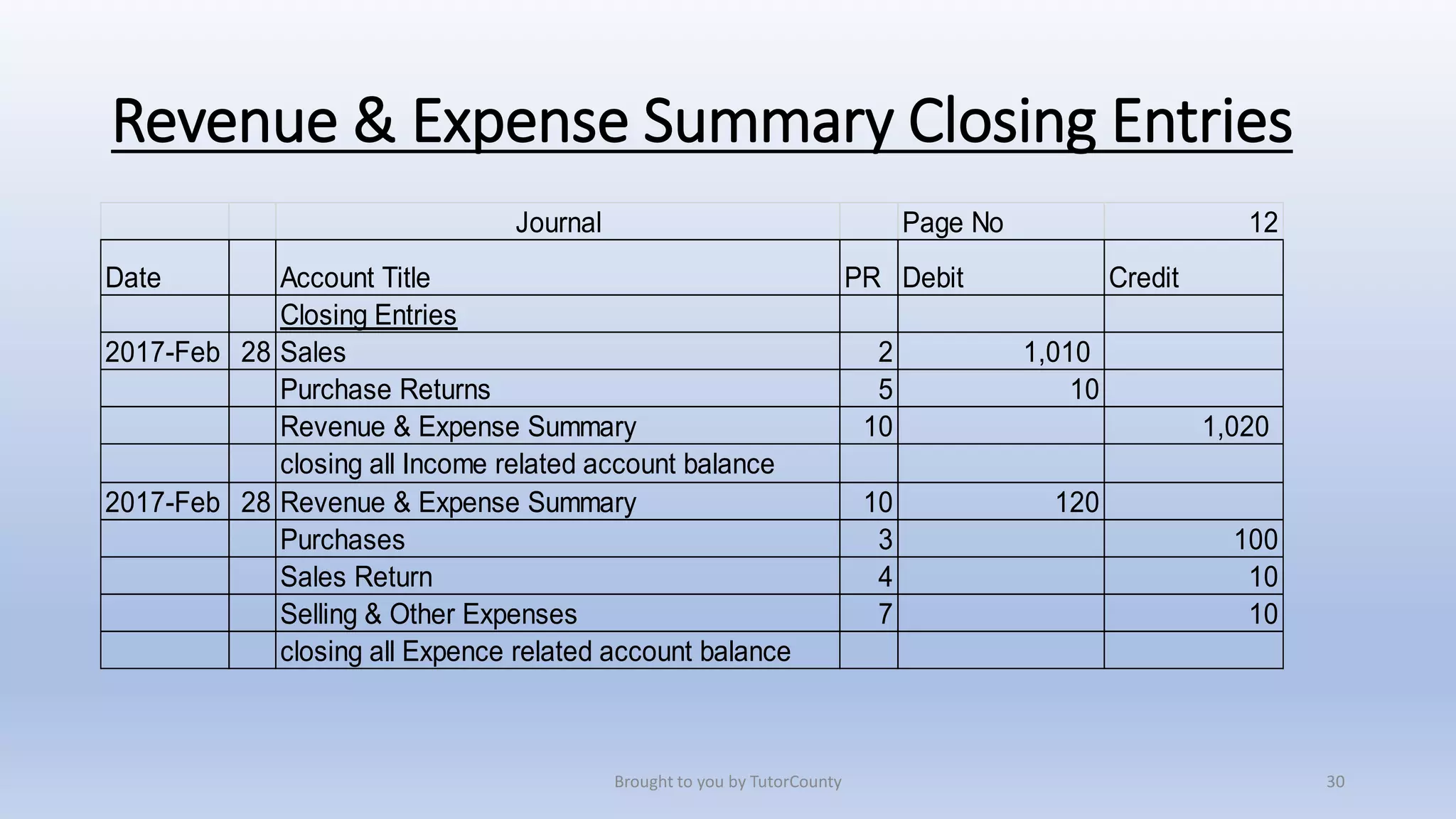

The document outlines the fundamentals of bookkeeping, including the three elements of a business entity: assets, liabilities, and owner's equity. It describes the bookkeeping cycle, the double entry system, and the process of journalizing transactions, posting to ledgers, and preparing financial statements such as income statements and balance sheets. Additionally, it covers the importance of trial balances, adjusting entries, and closing entries to ensure accurate financial reporting.