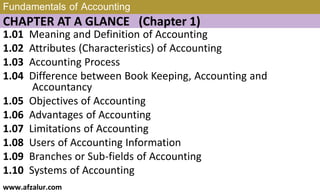

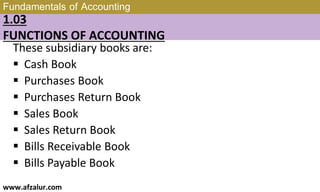

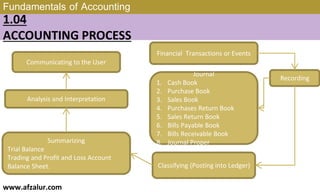

The document outlines the fundamentals of accounting, detailing its definition, characteristics, functions, objectives, advantages, and limitations. It explains the accounting process, including recording, classifying, summarizing, analyzing, and communicating financial data, as well as the distinction between bookkeeping and accounting. Furthermore, it discusses various accounting systems and bases, emphasizing the double-entry and cash versus accrual methods of accounting.