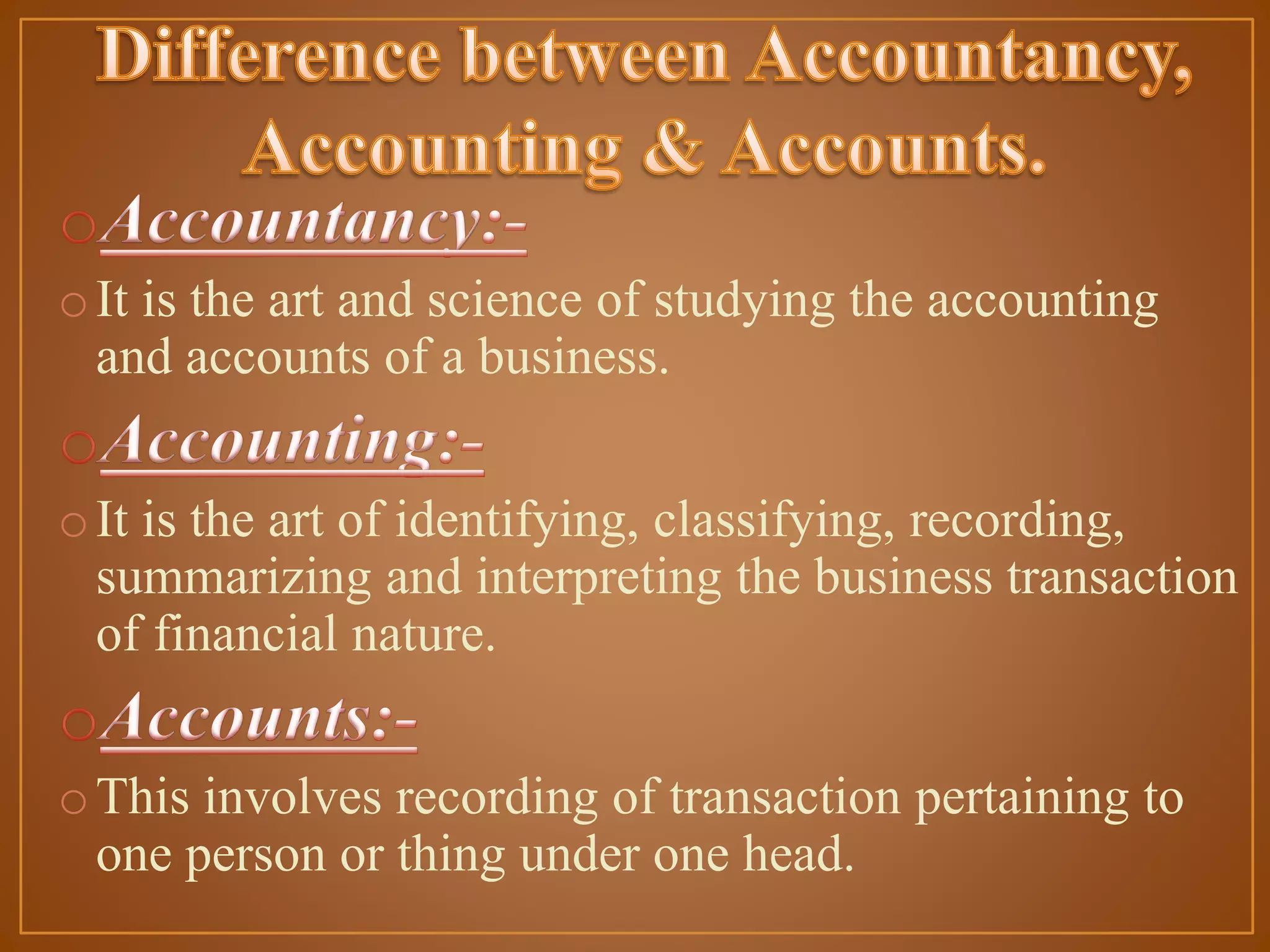

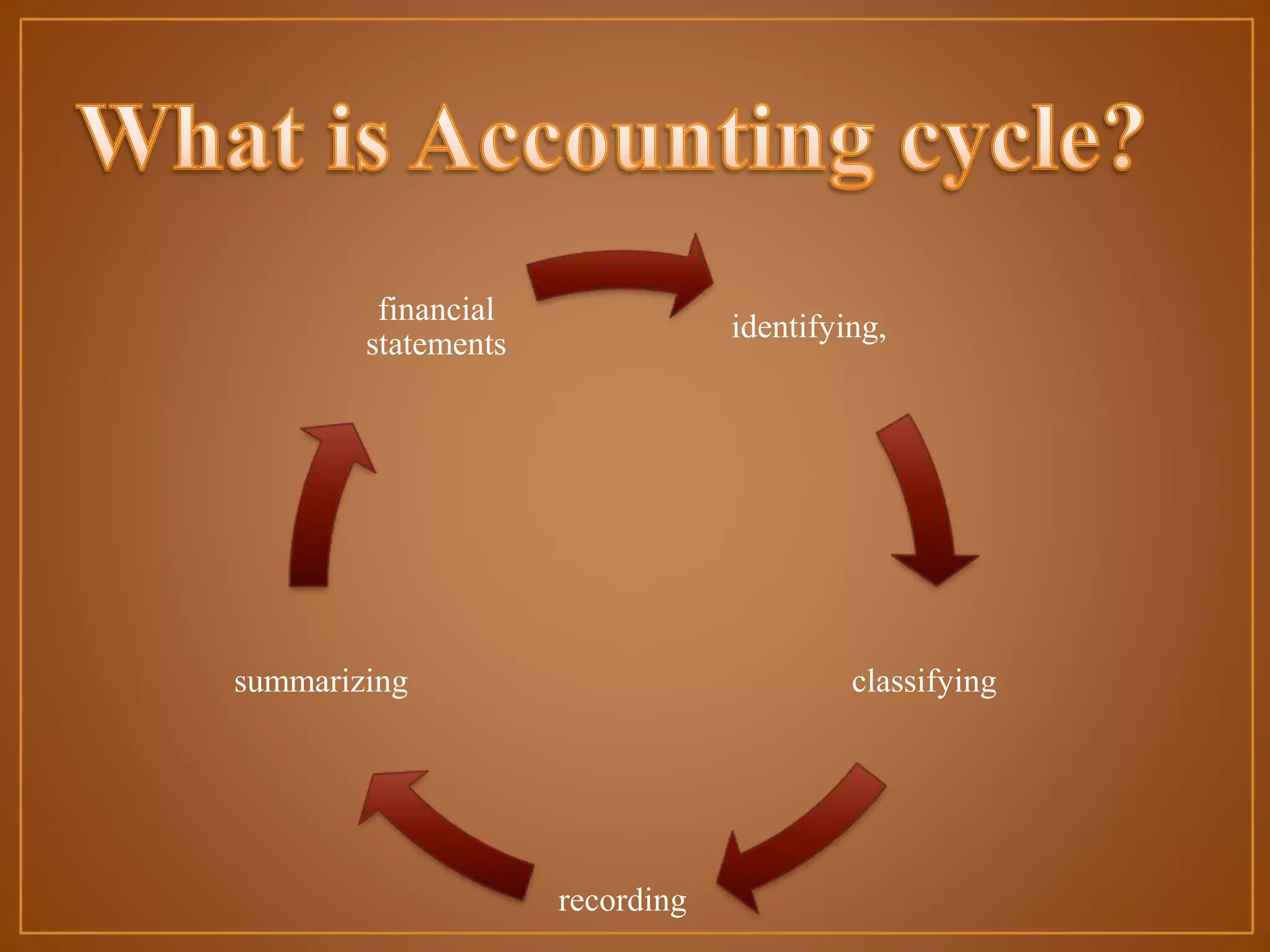

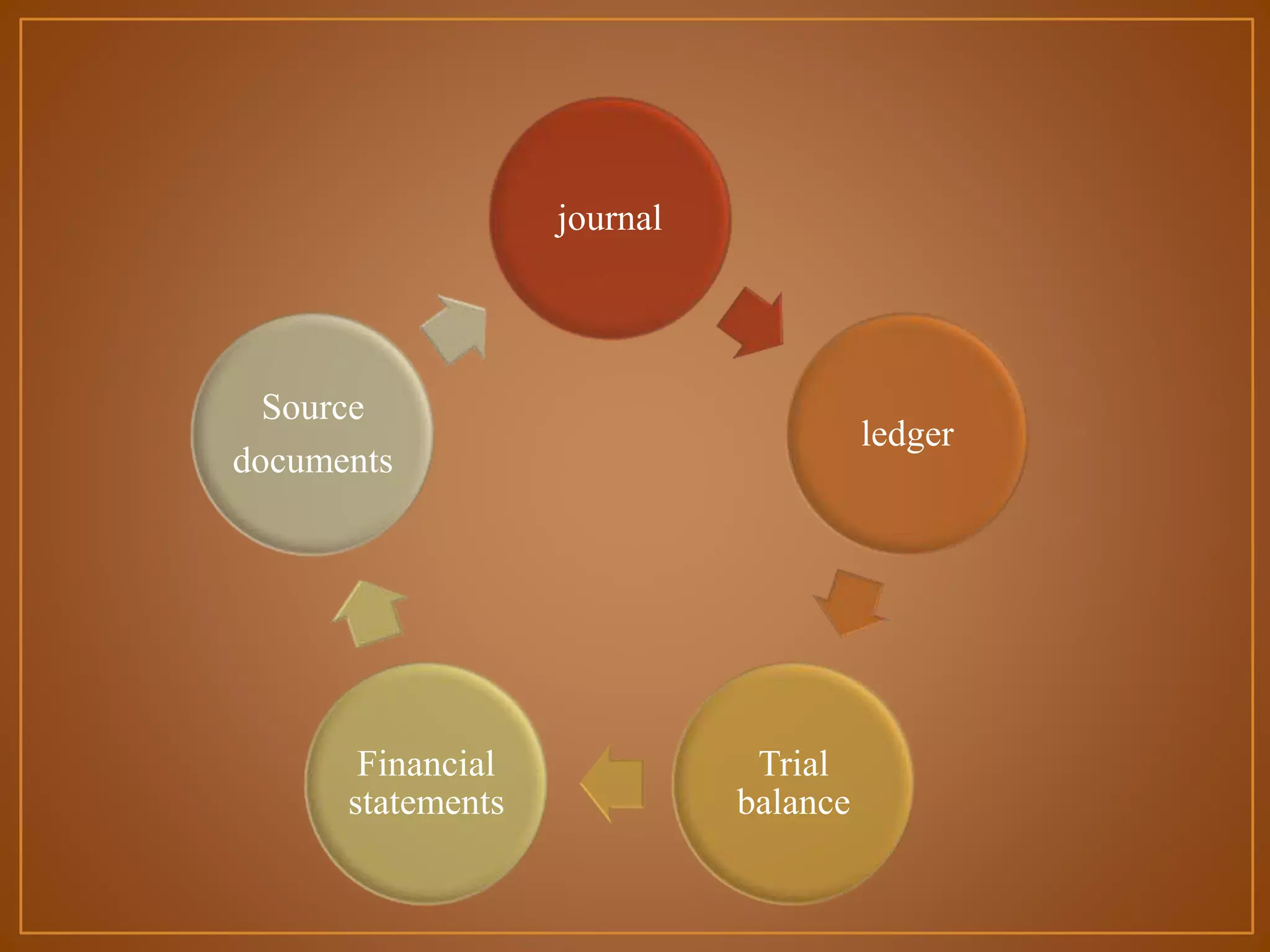

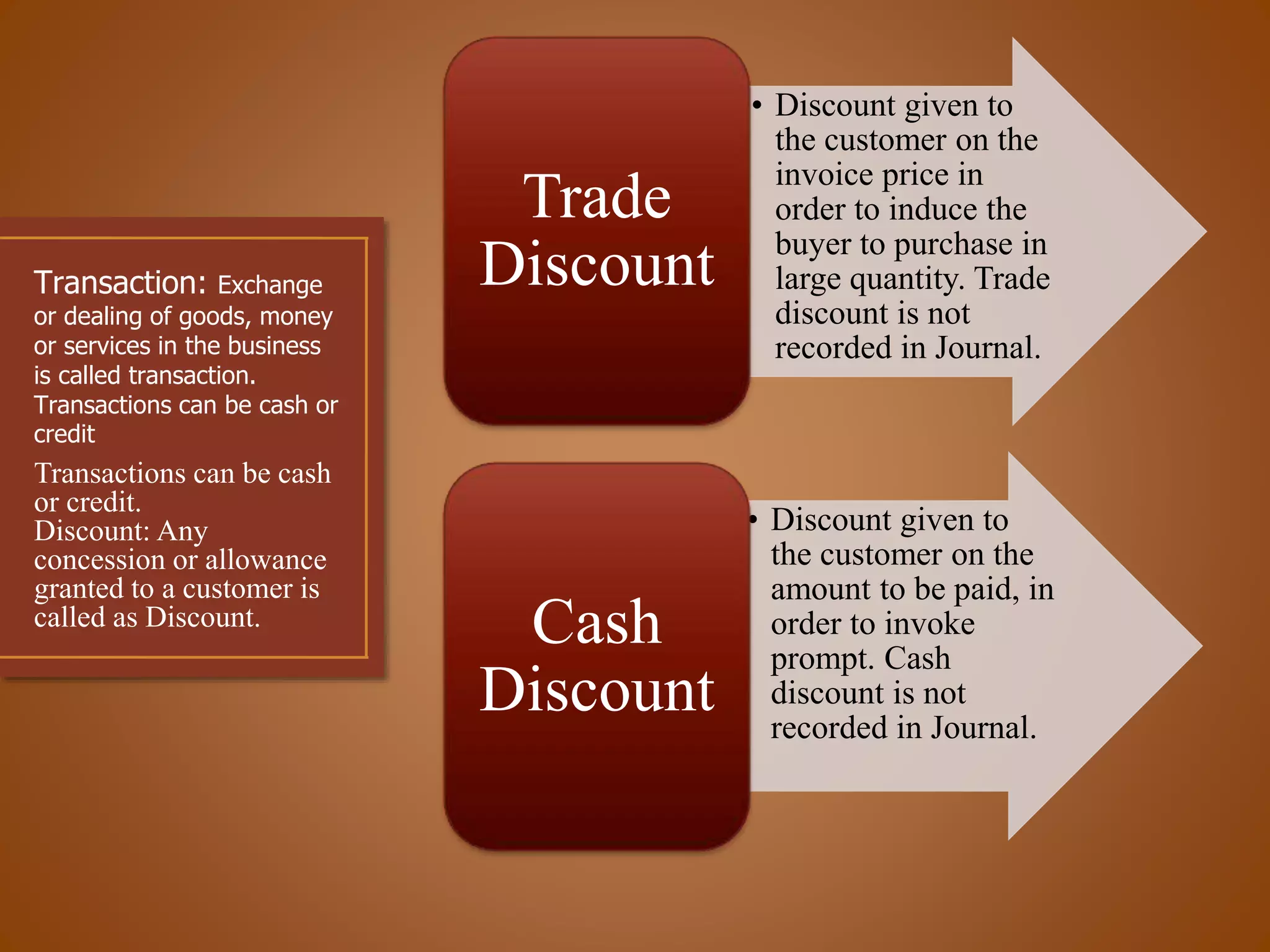

Accounting is the art of identifying, classifying, recording, and interpreting financial transactions. It involves recording transactions related to a business or person under relevant heads. Bookkeeping is the systematic recording of these transactions through journals, ledgers, and financial statements to keep track of revenues, expenses, assets, and liabilities. The goal is to evaluate the overall financial performance and position of a business.