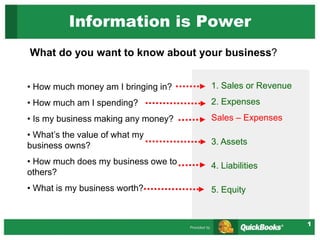

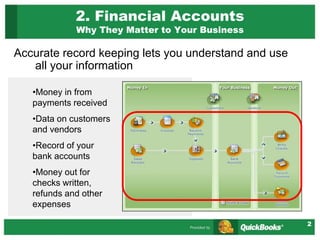

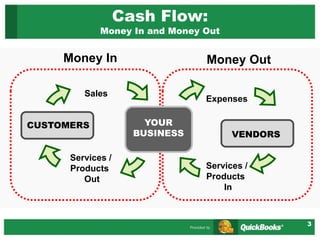

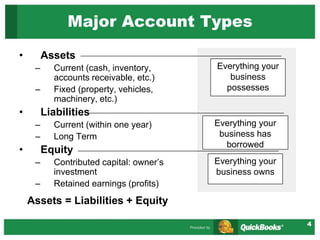

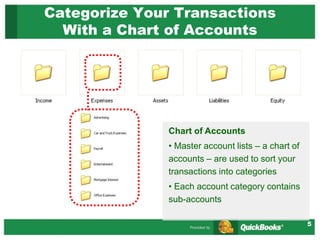

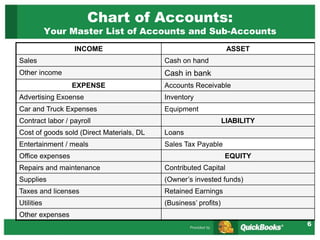

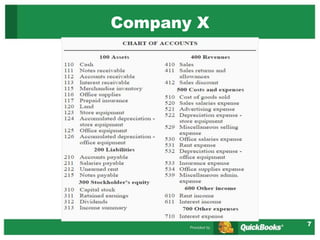

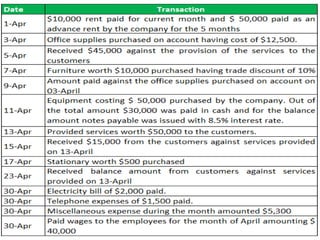

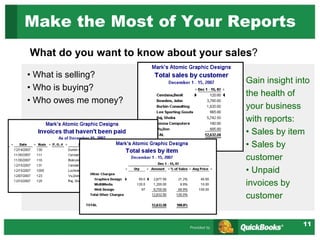

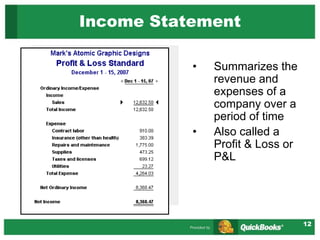

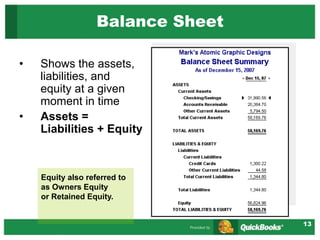

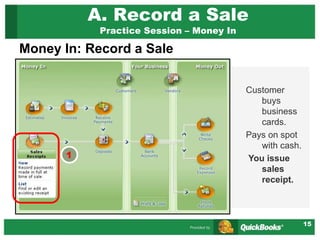

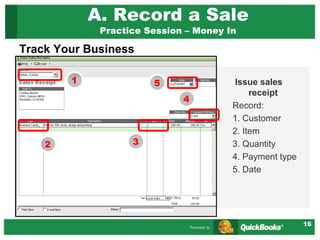

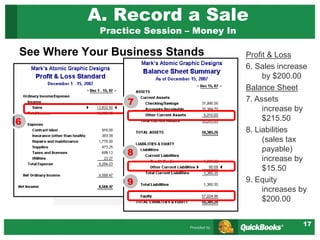

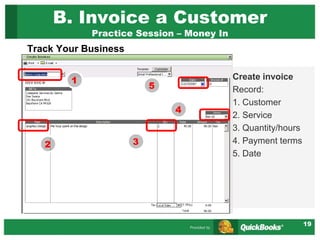

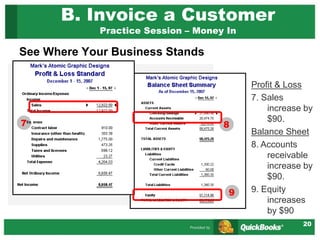

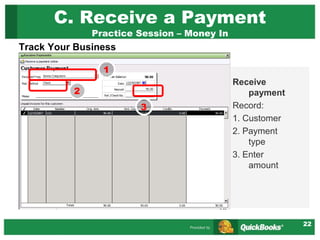

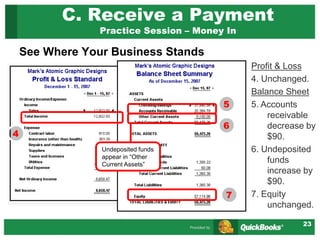

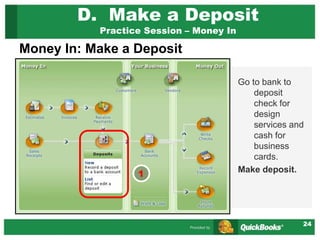

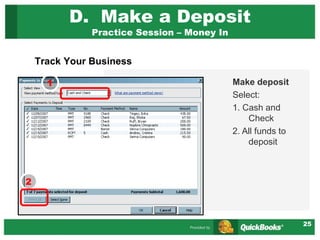

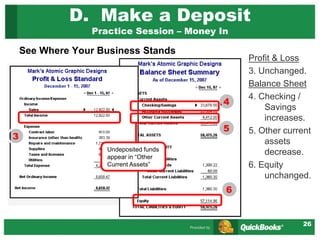

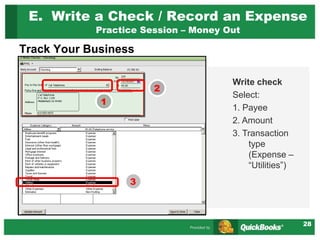

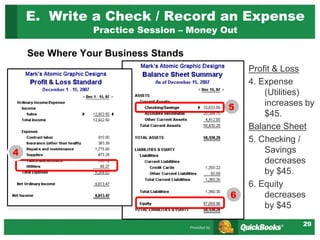

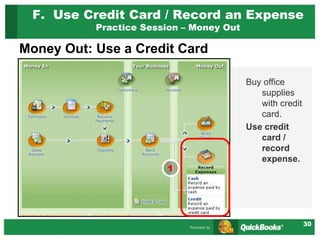

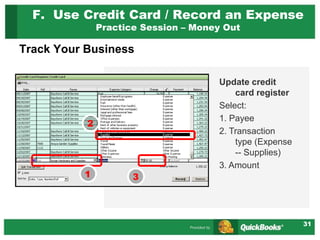

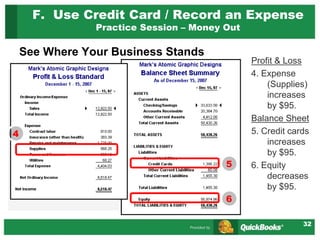

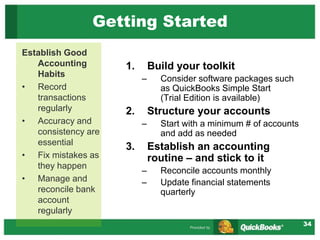

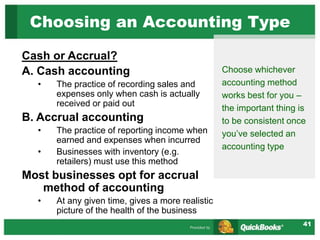

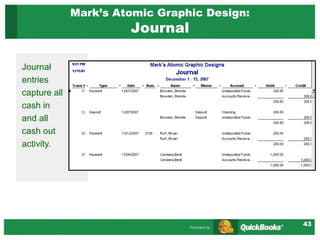

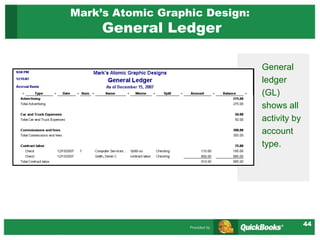

The document provides a comprehensive guide to managing business finances, highlighting the importance of accurate record-keeping, understanding cash flow, and utilizing financial statements such as income statements and balance sheets. It emphasizes categorizing transactions through a chart of accounts and offers practical exercises for recording sales, expenses, and managing essential financial tasks. Additionally, it includes tips on getting started with financial management and resources for further assistance.