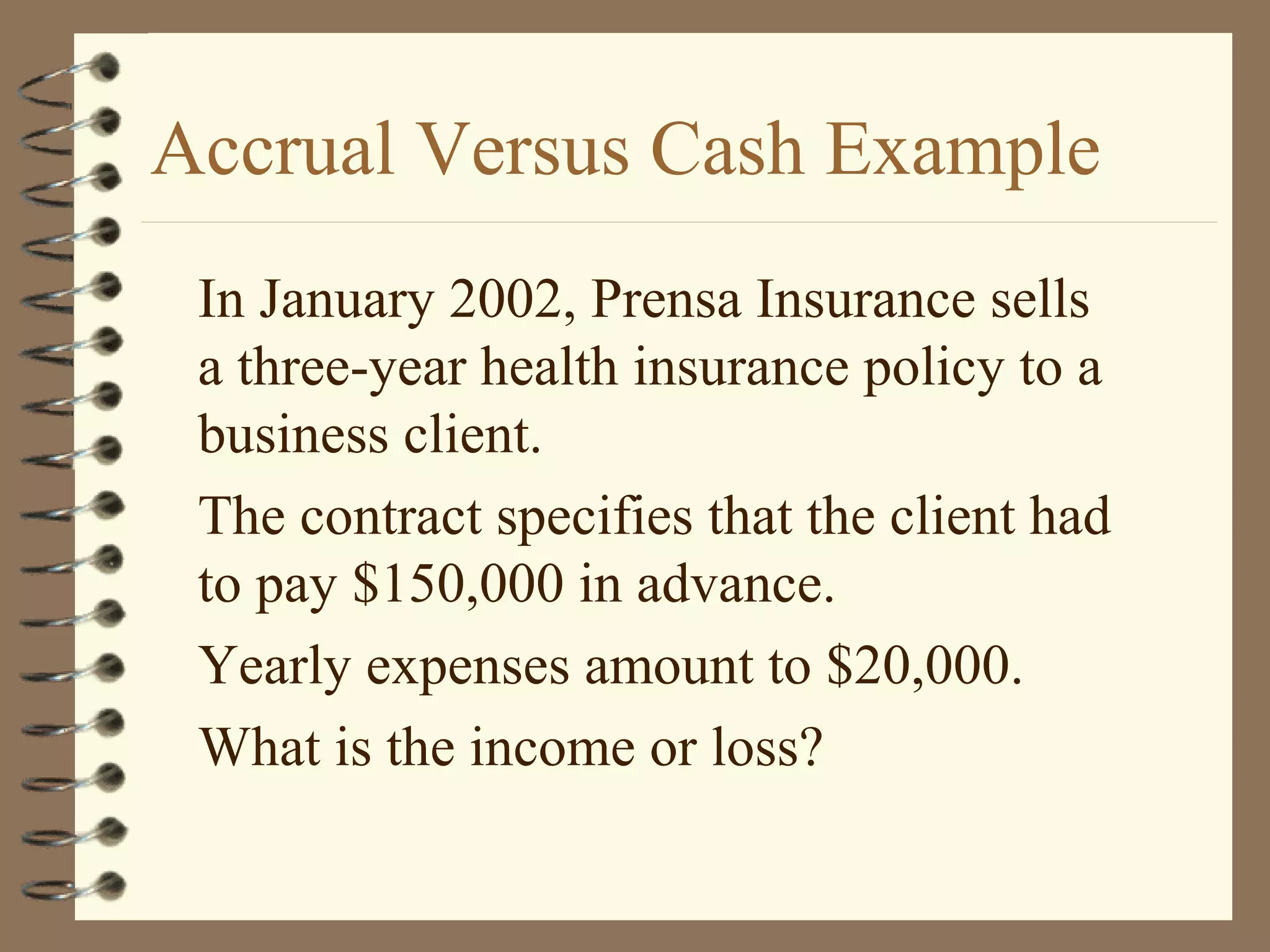

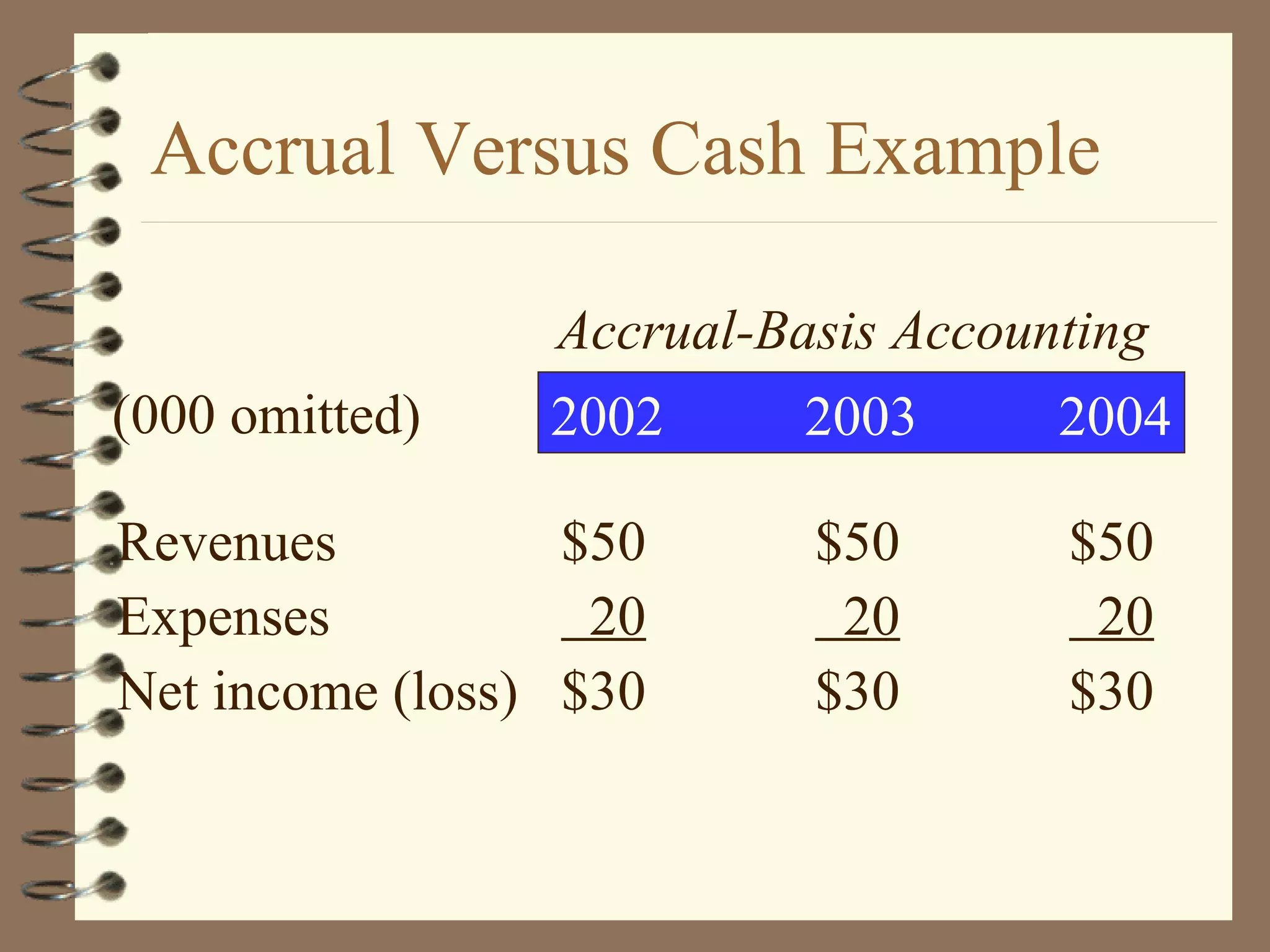

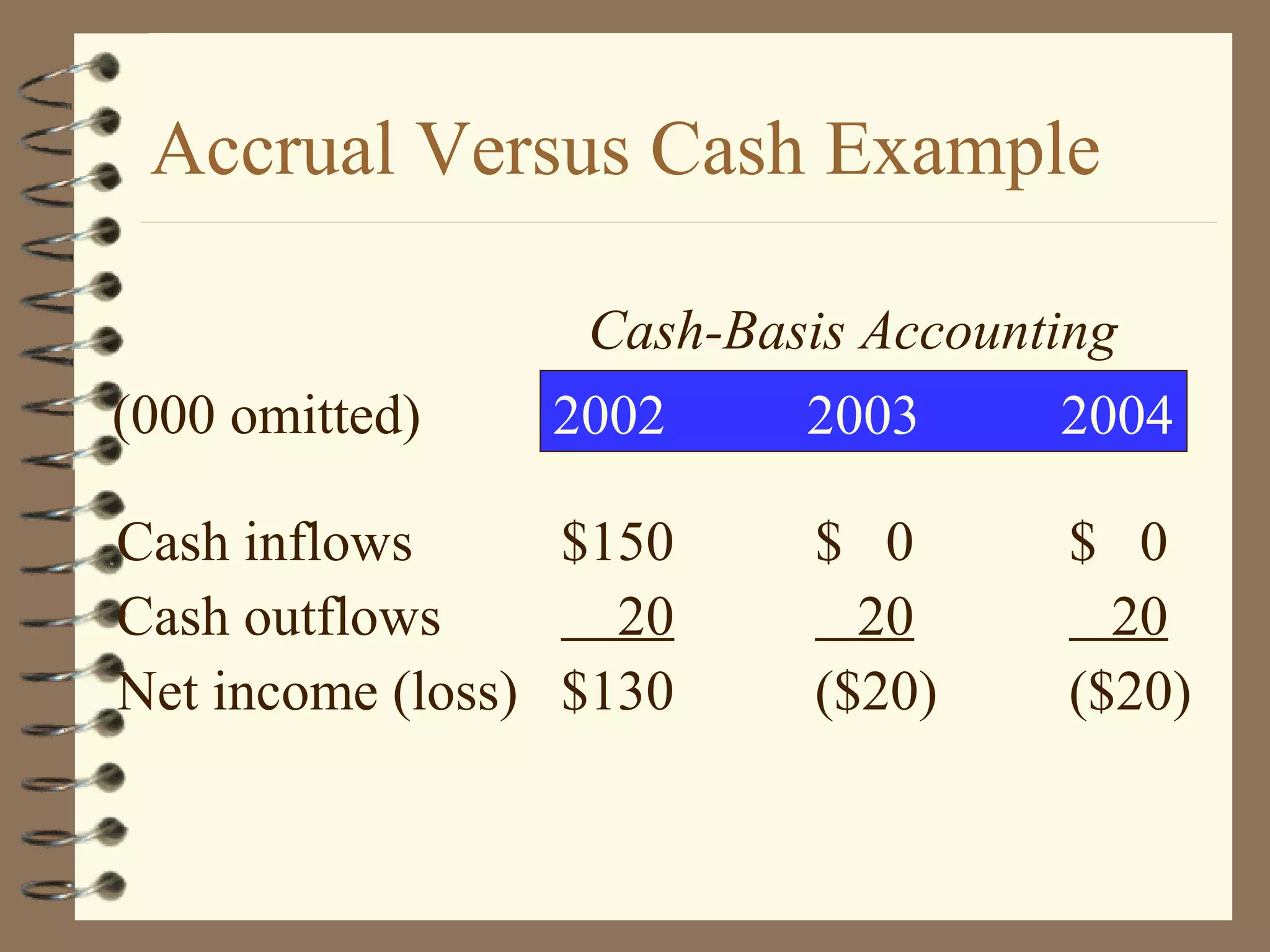

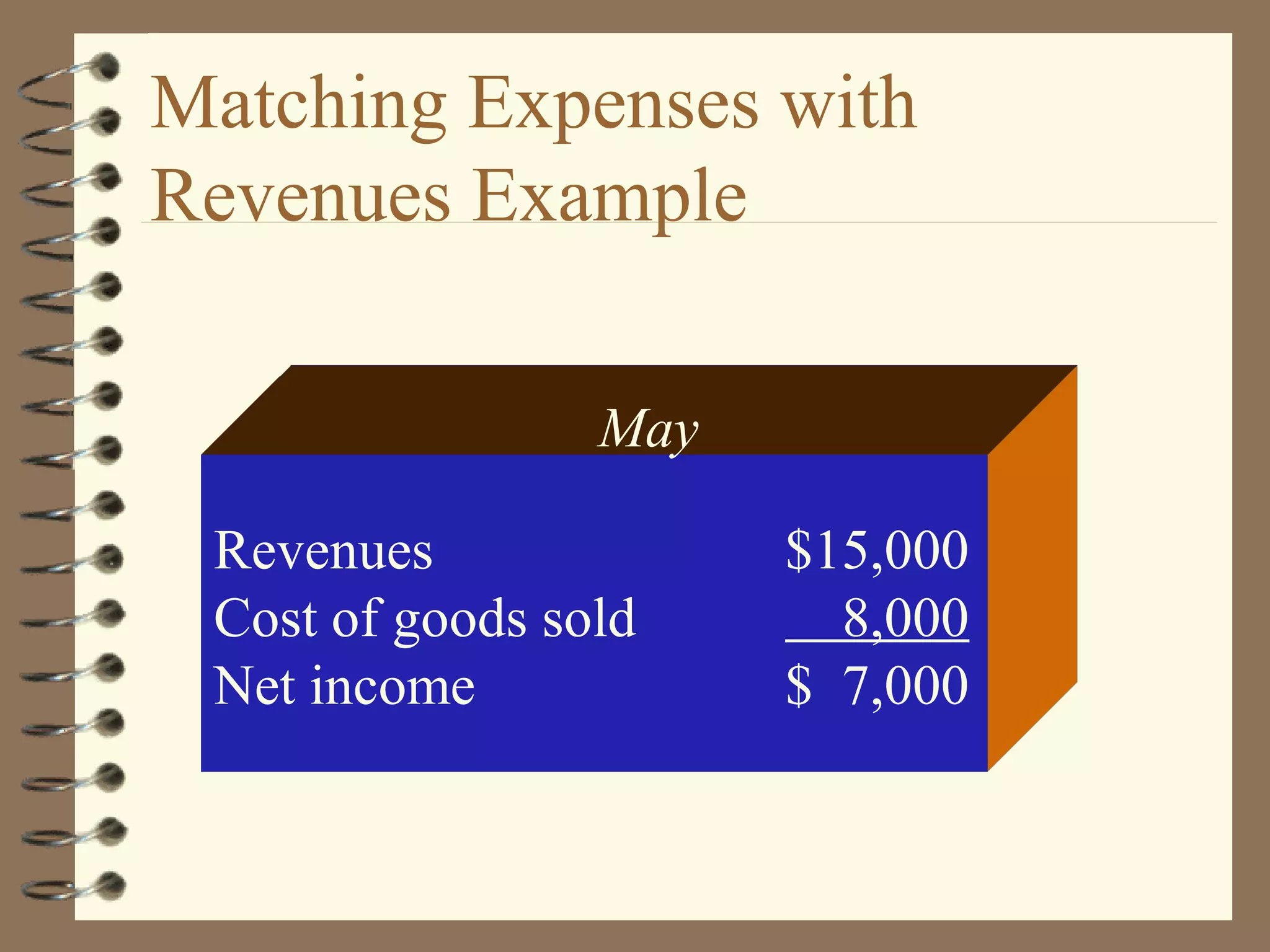

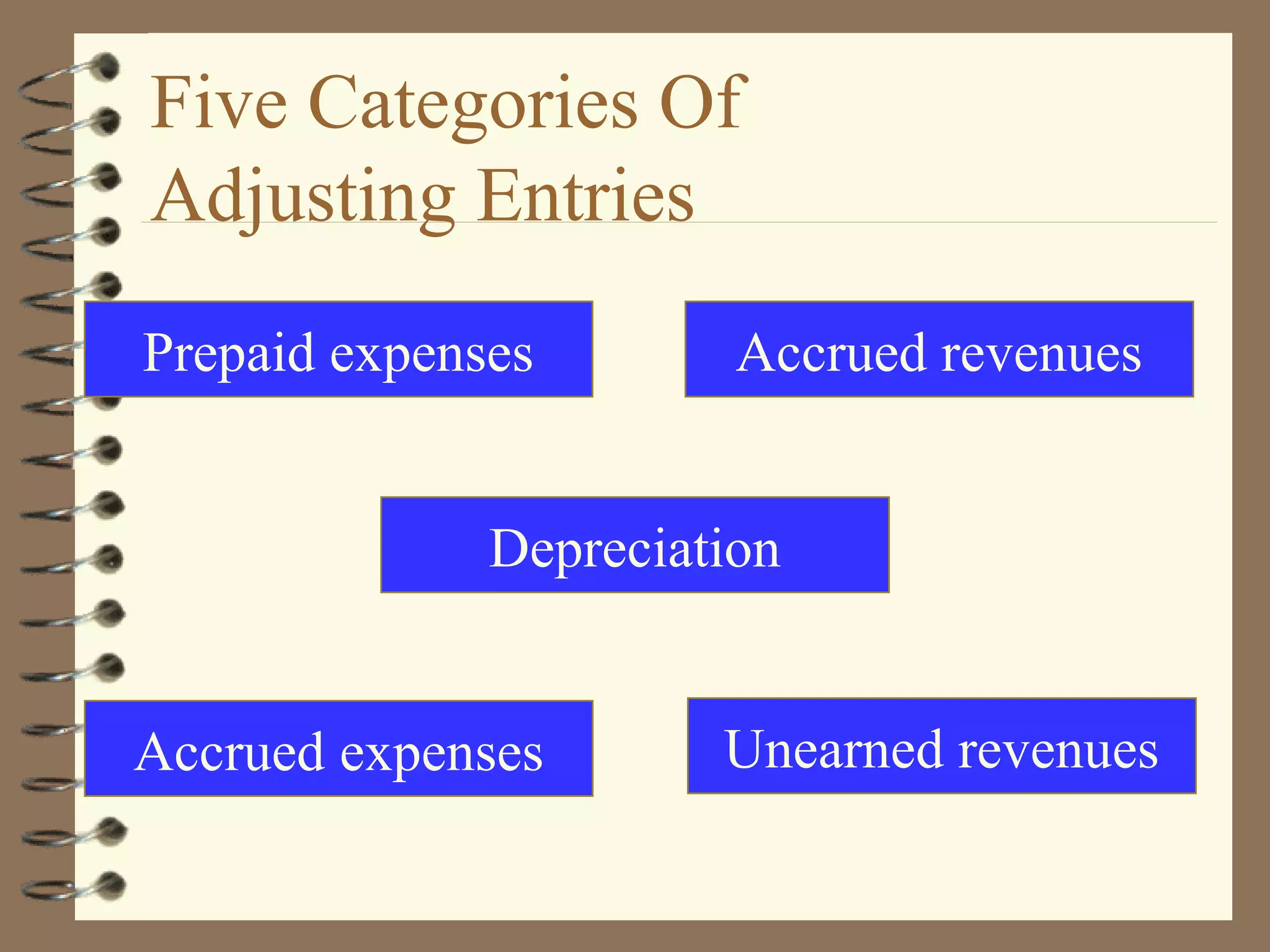

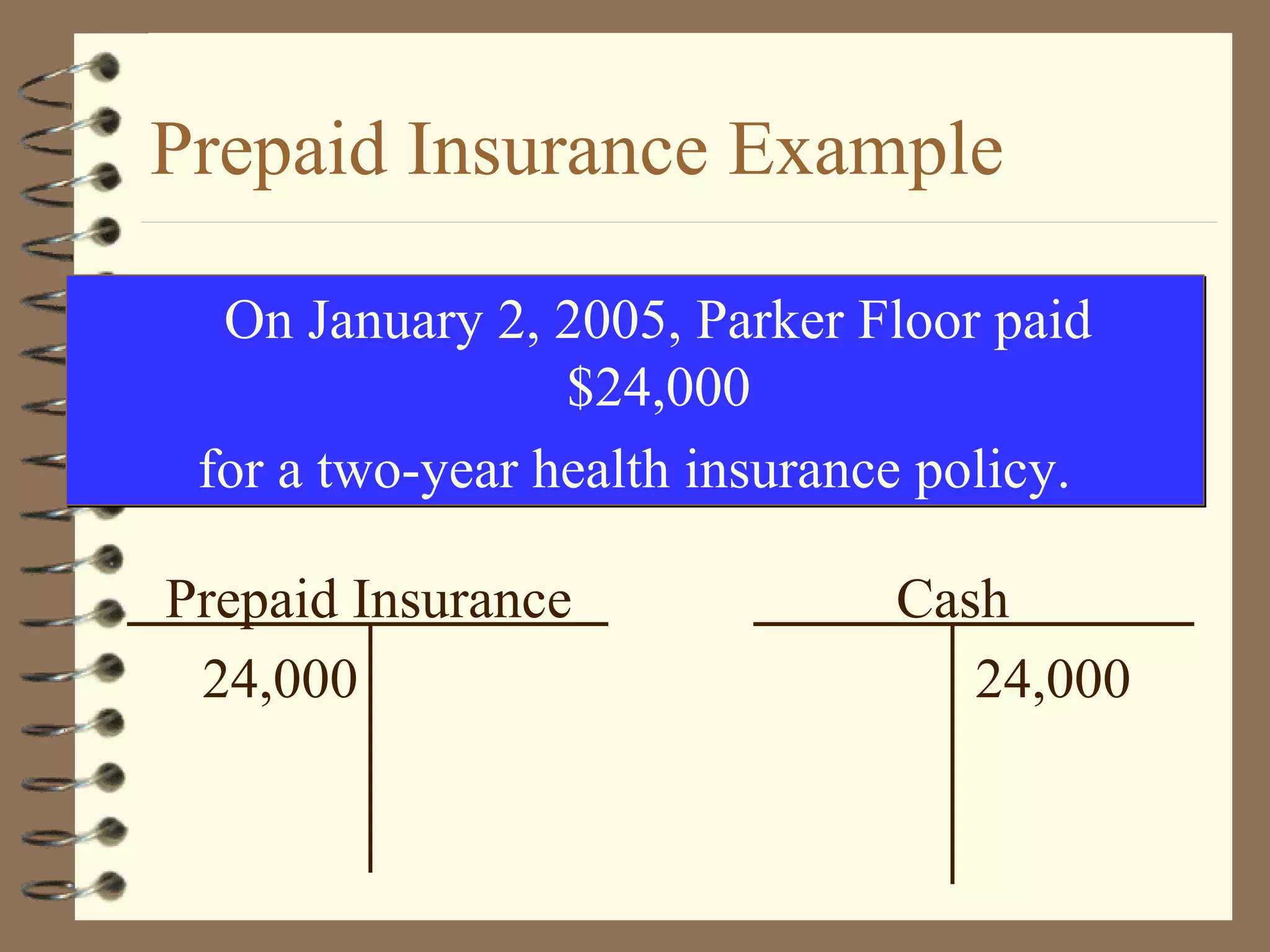

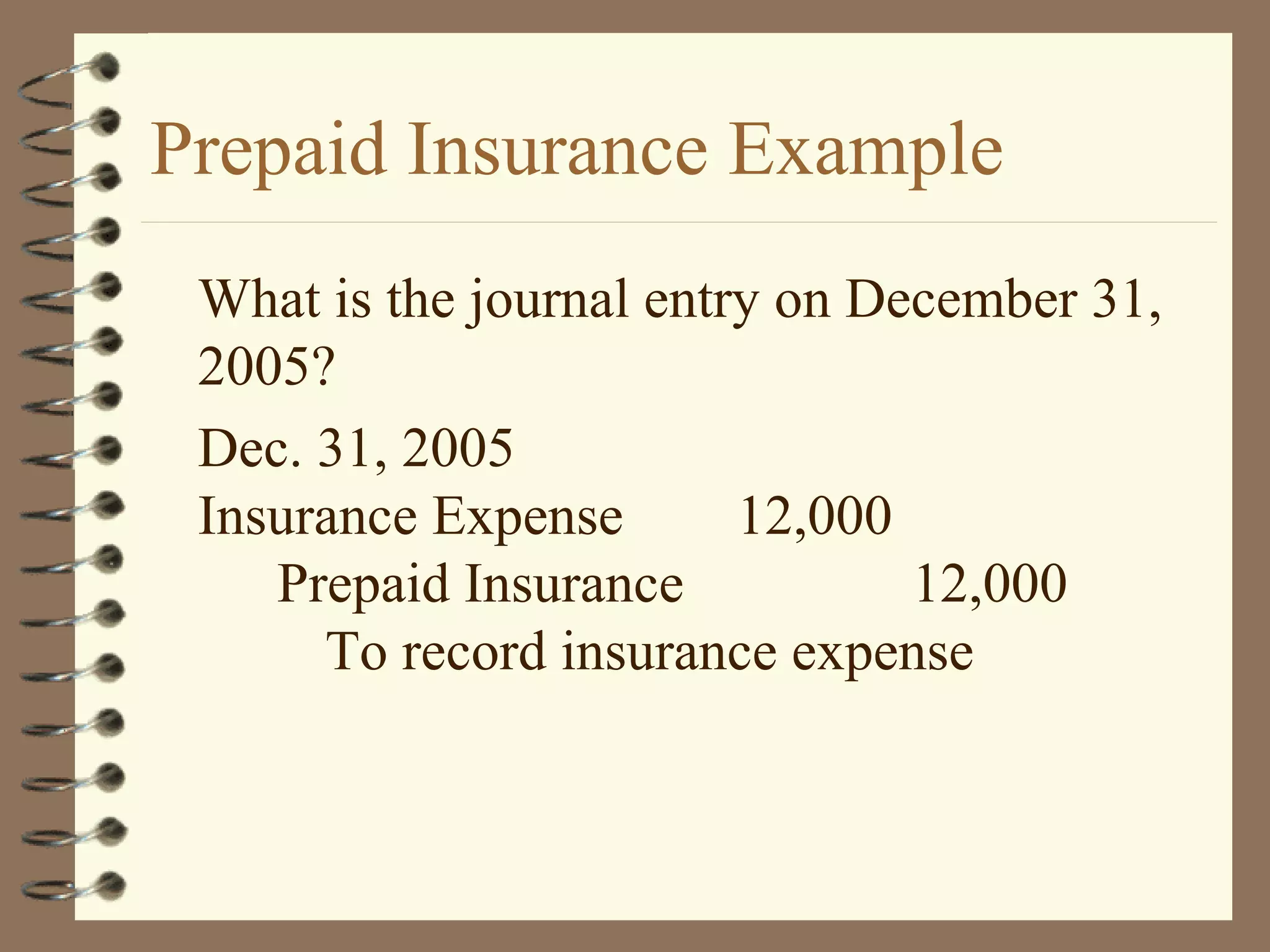

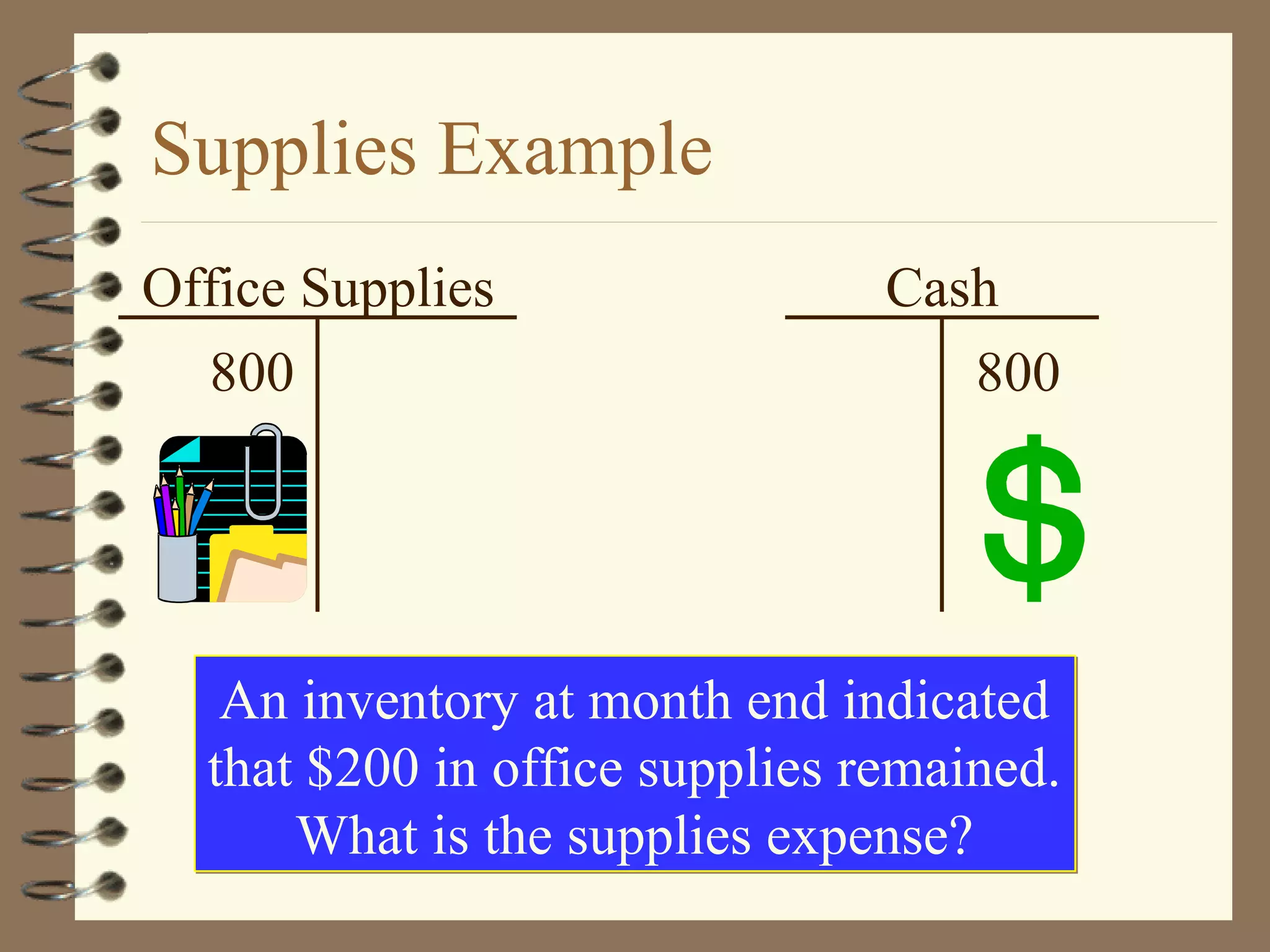

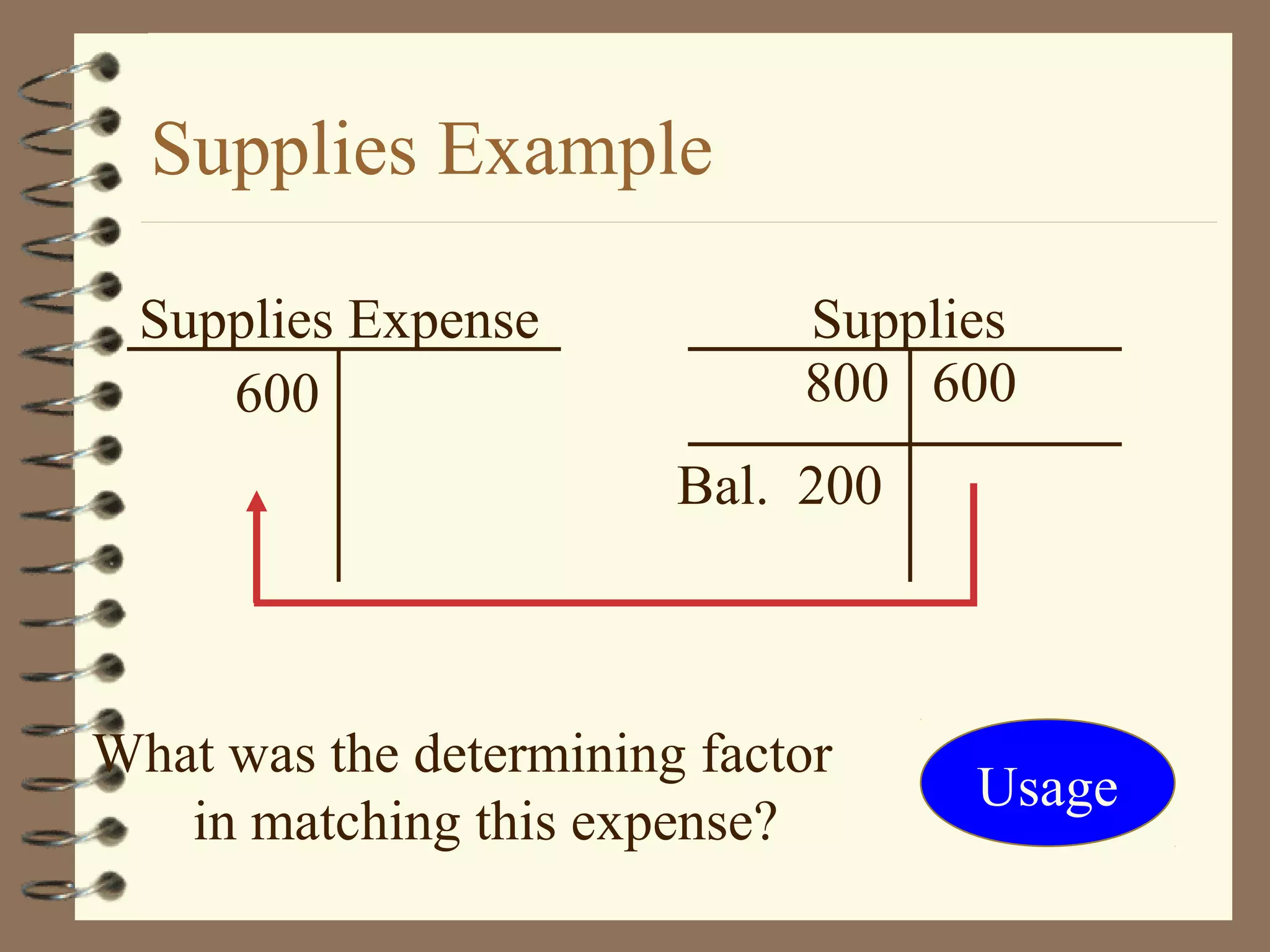

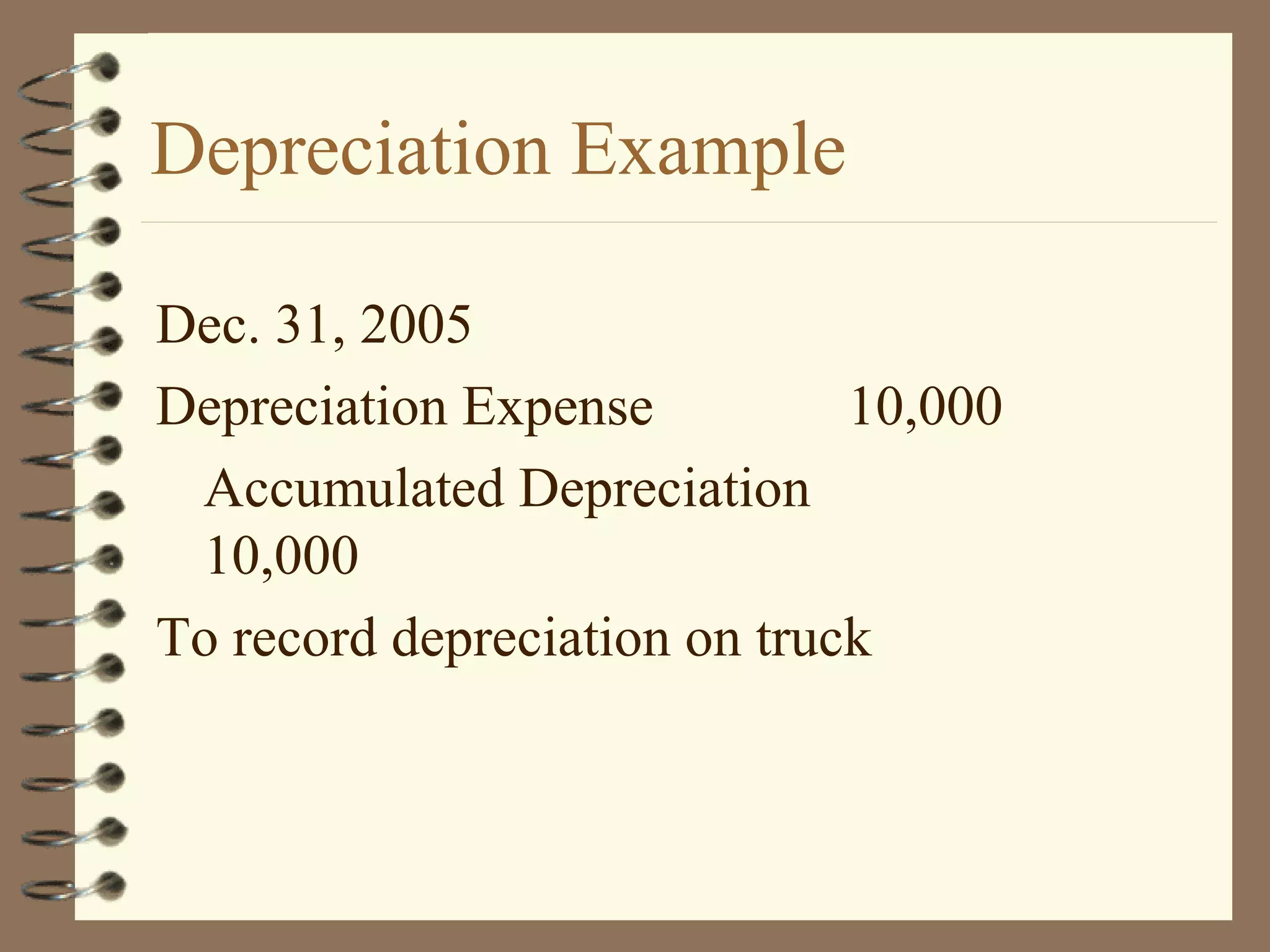

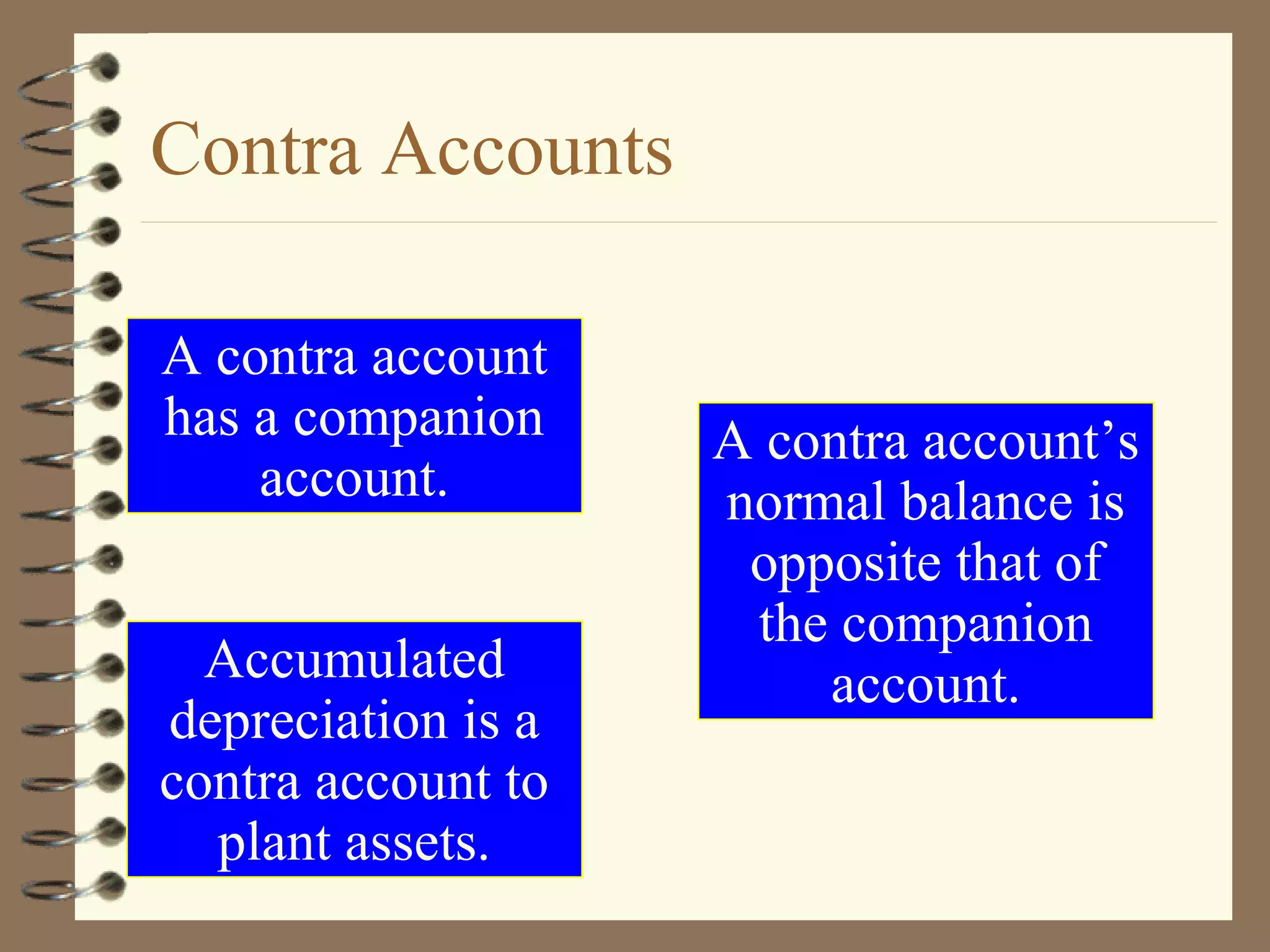

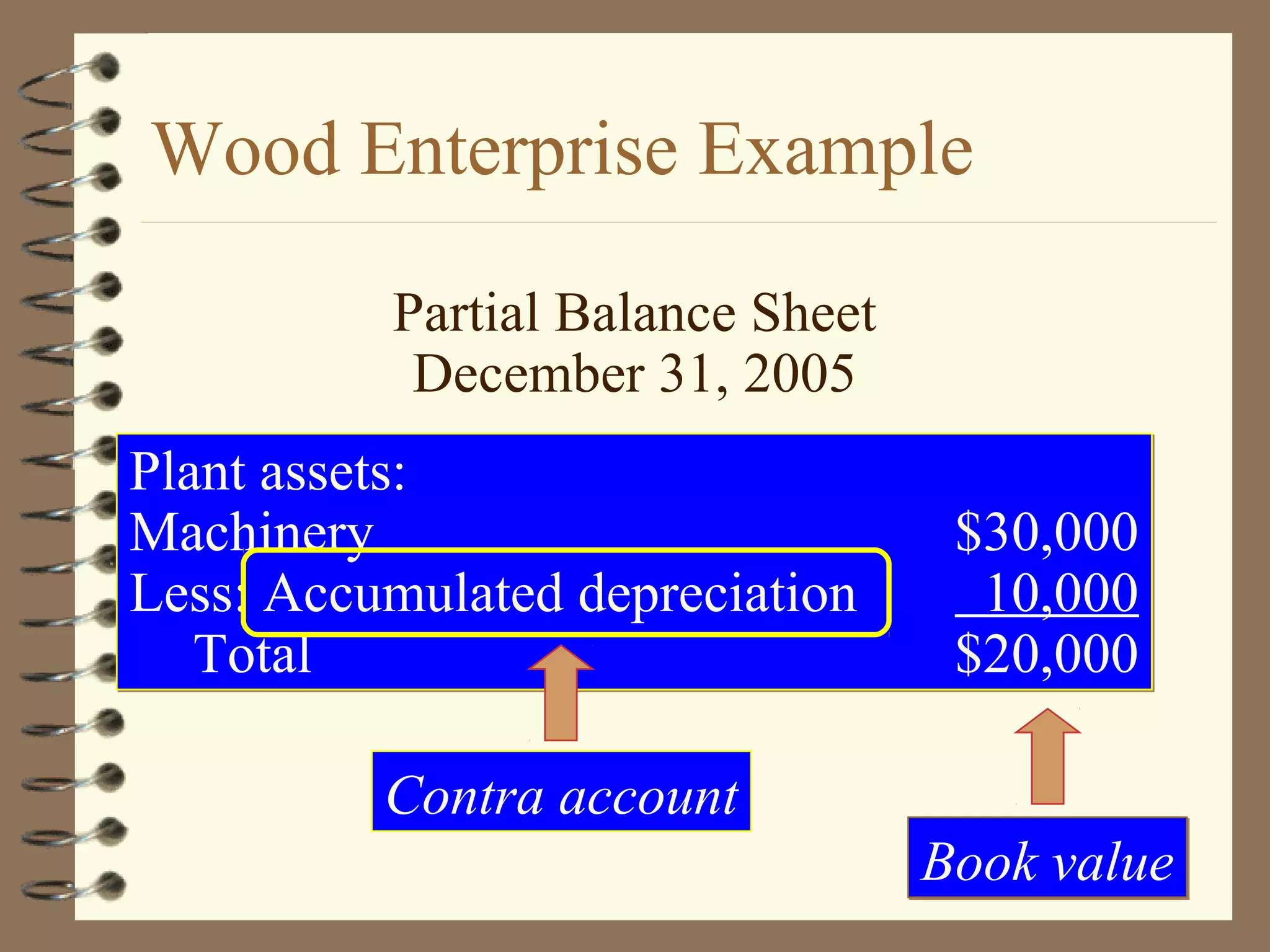

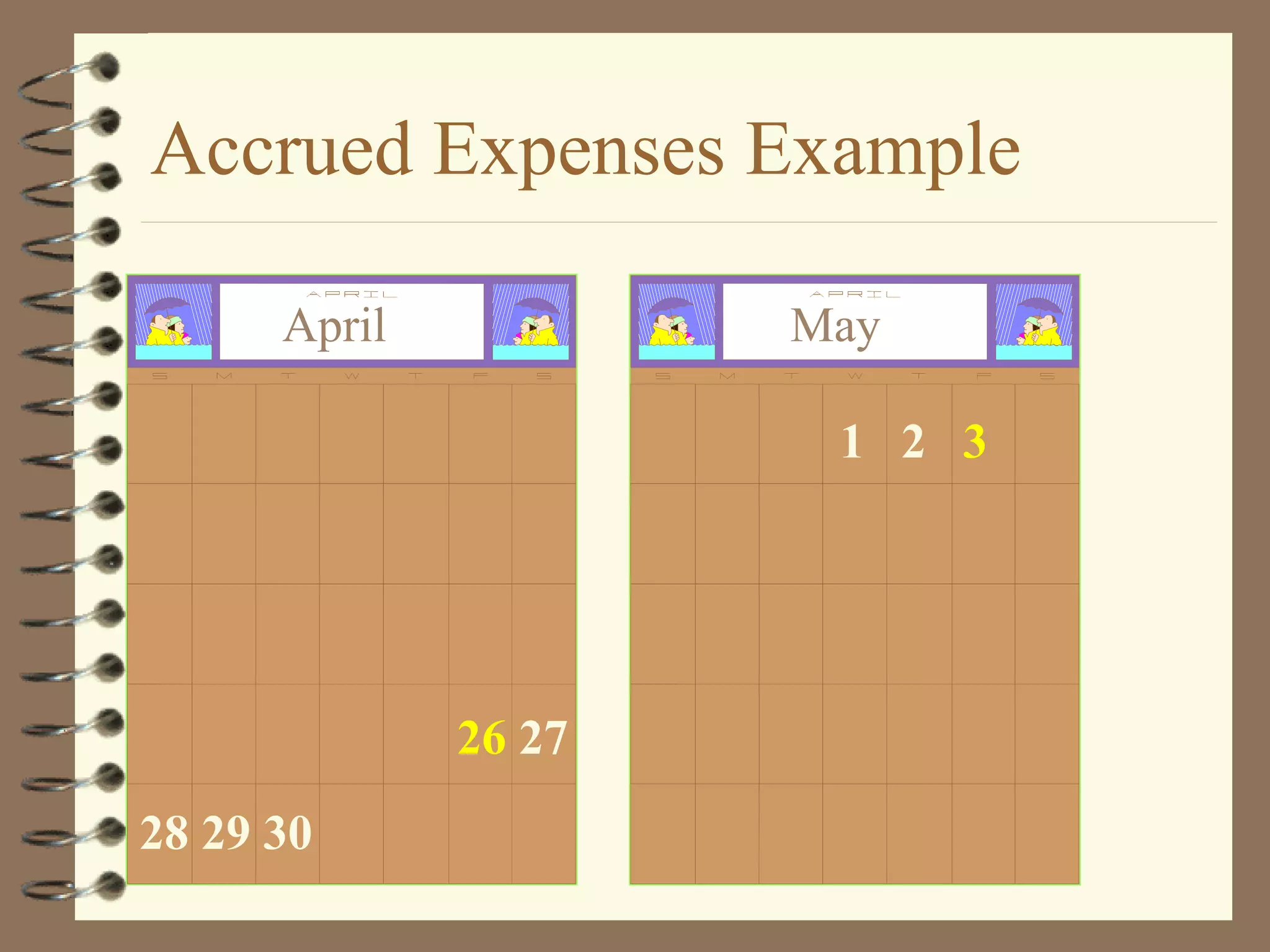

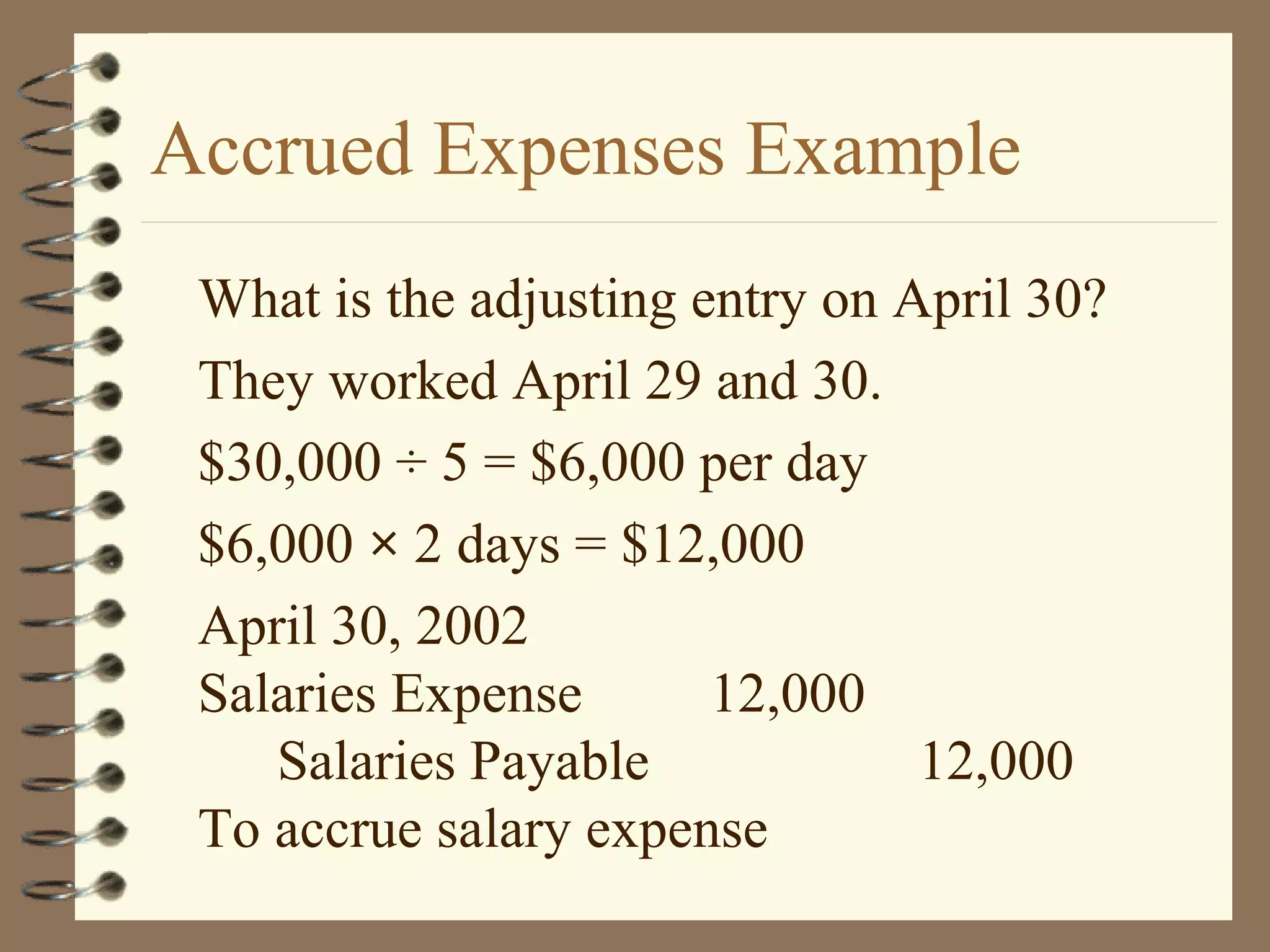

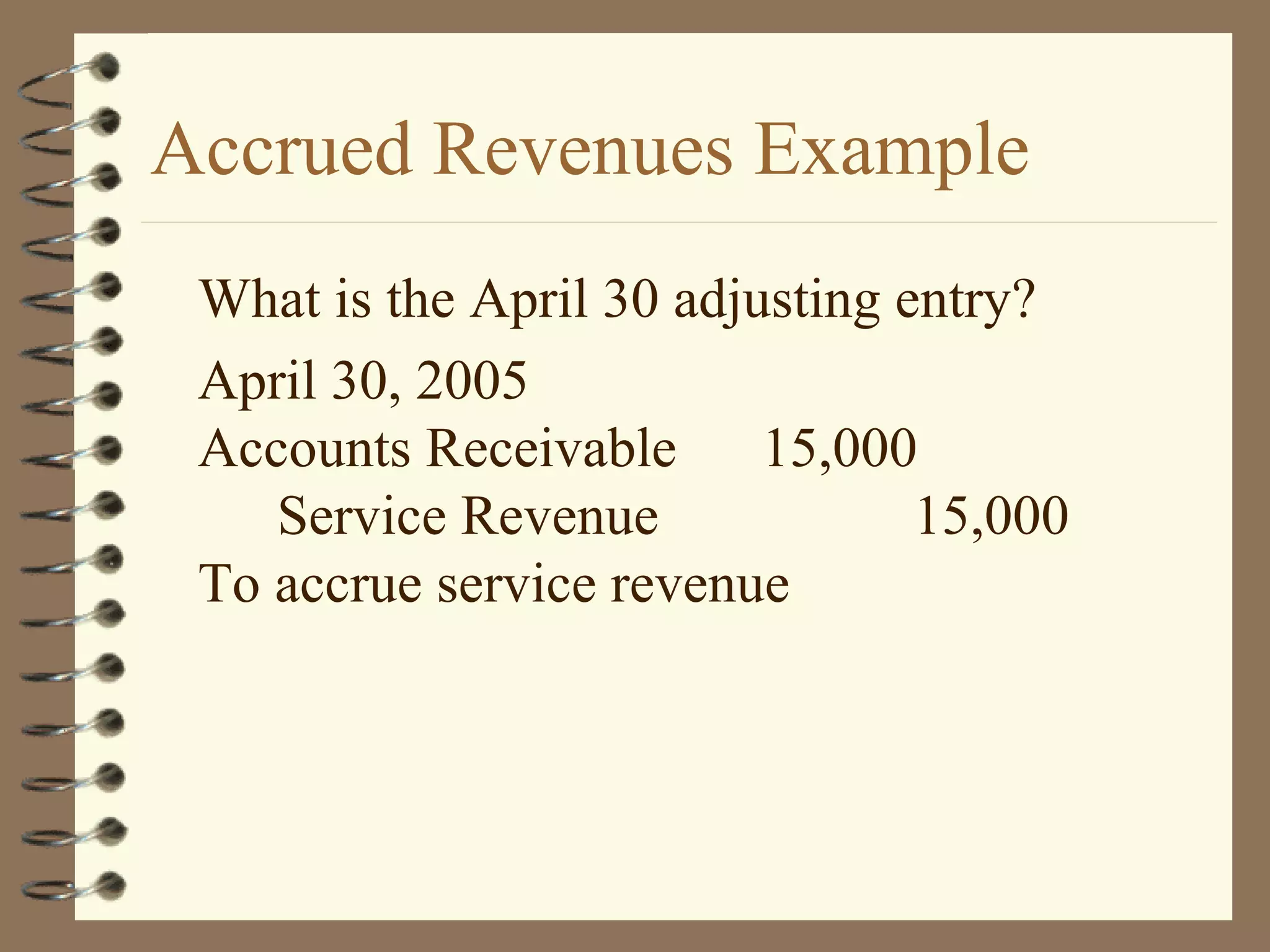

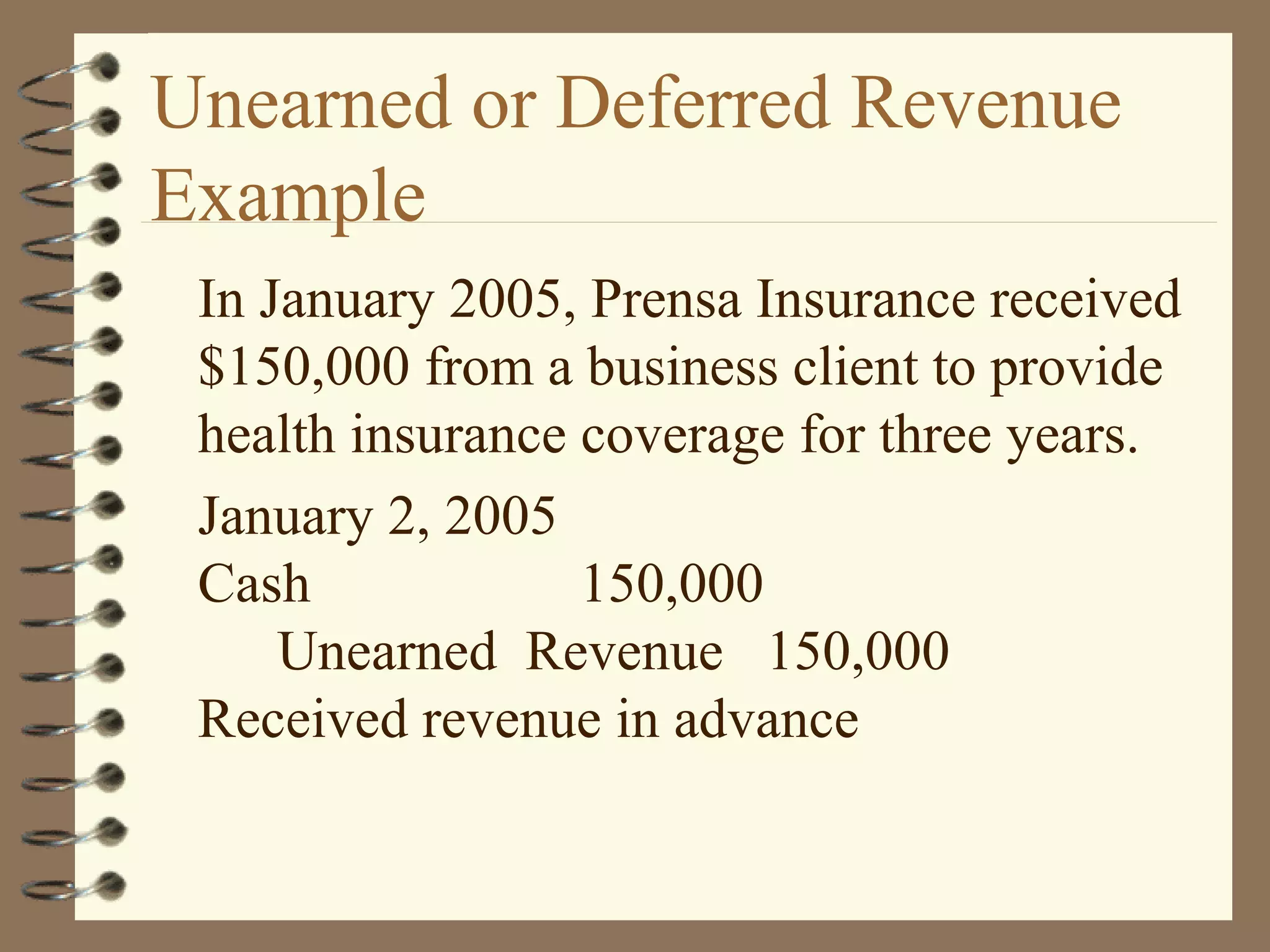

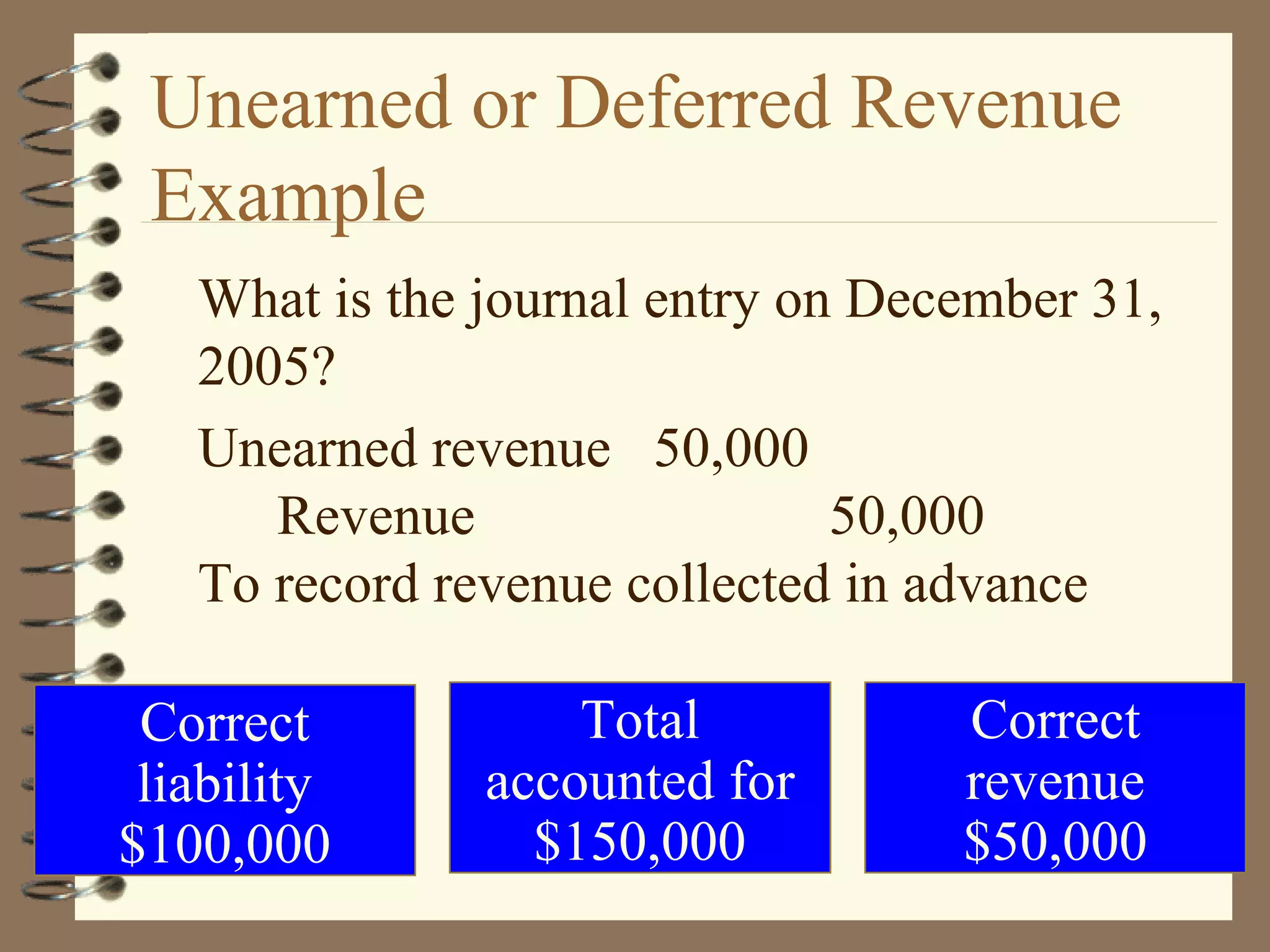

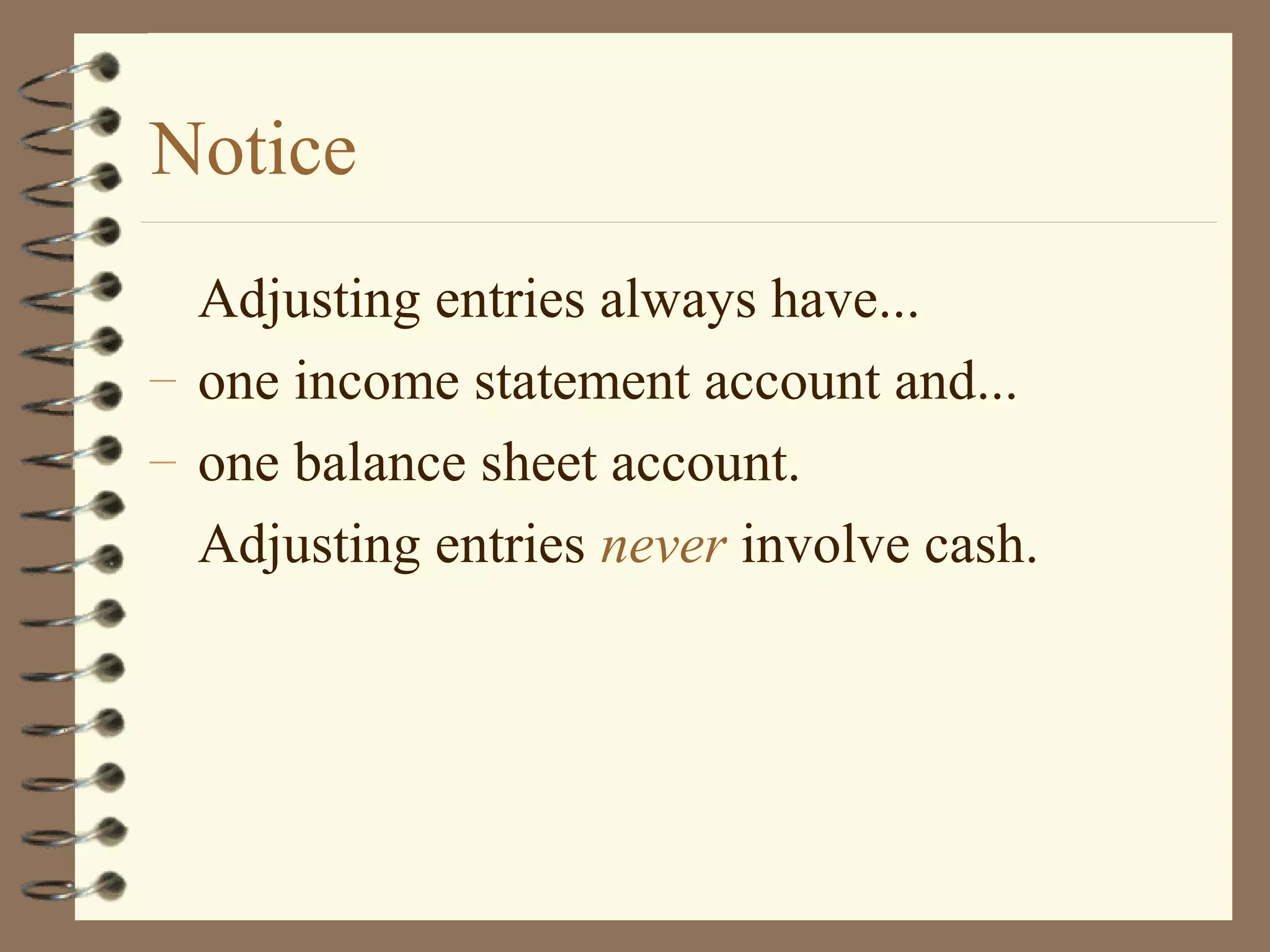

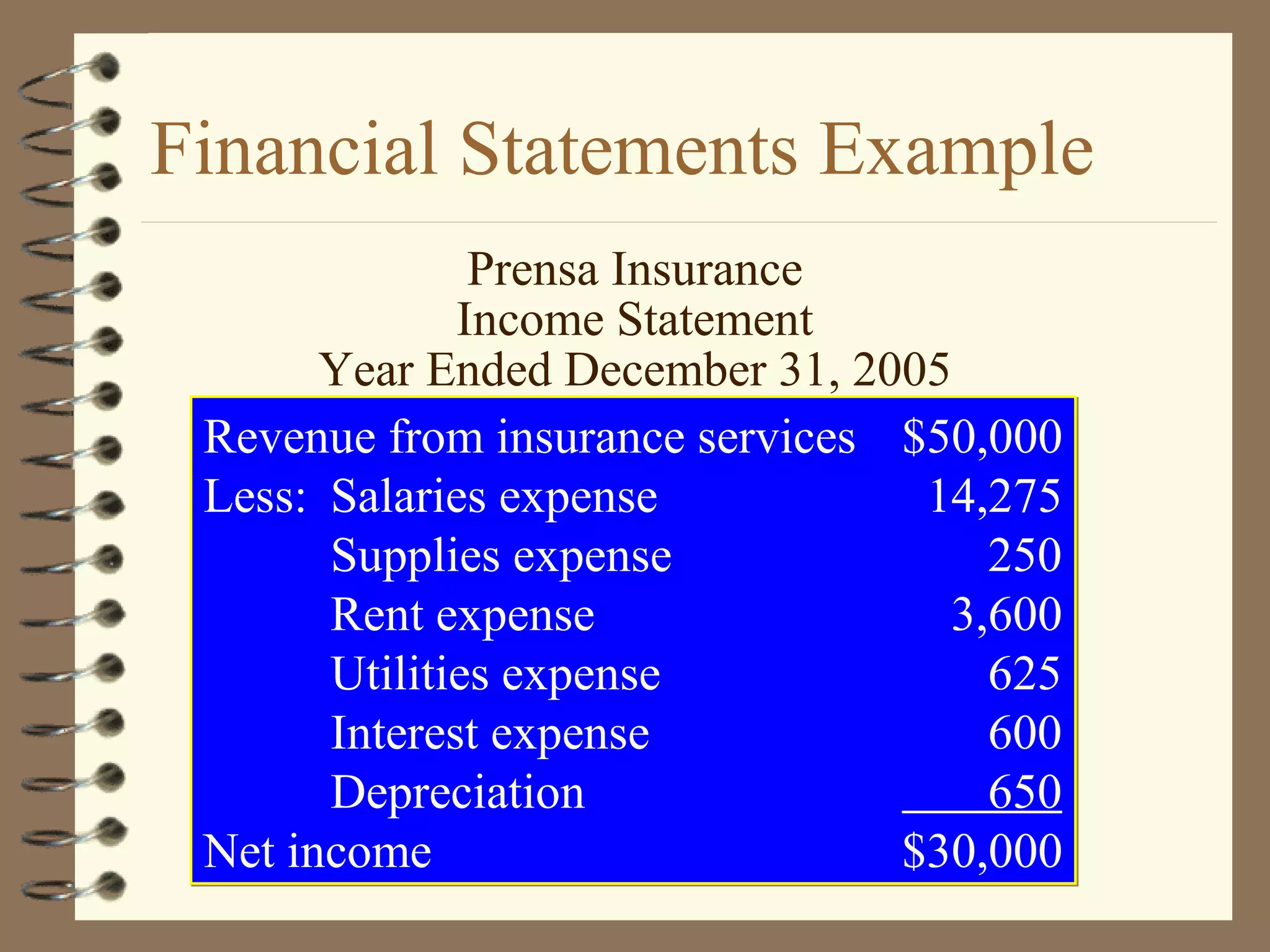

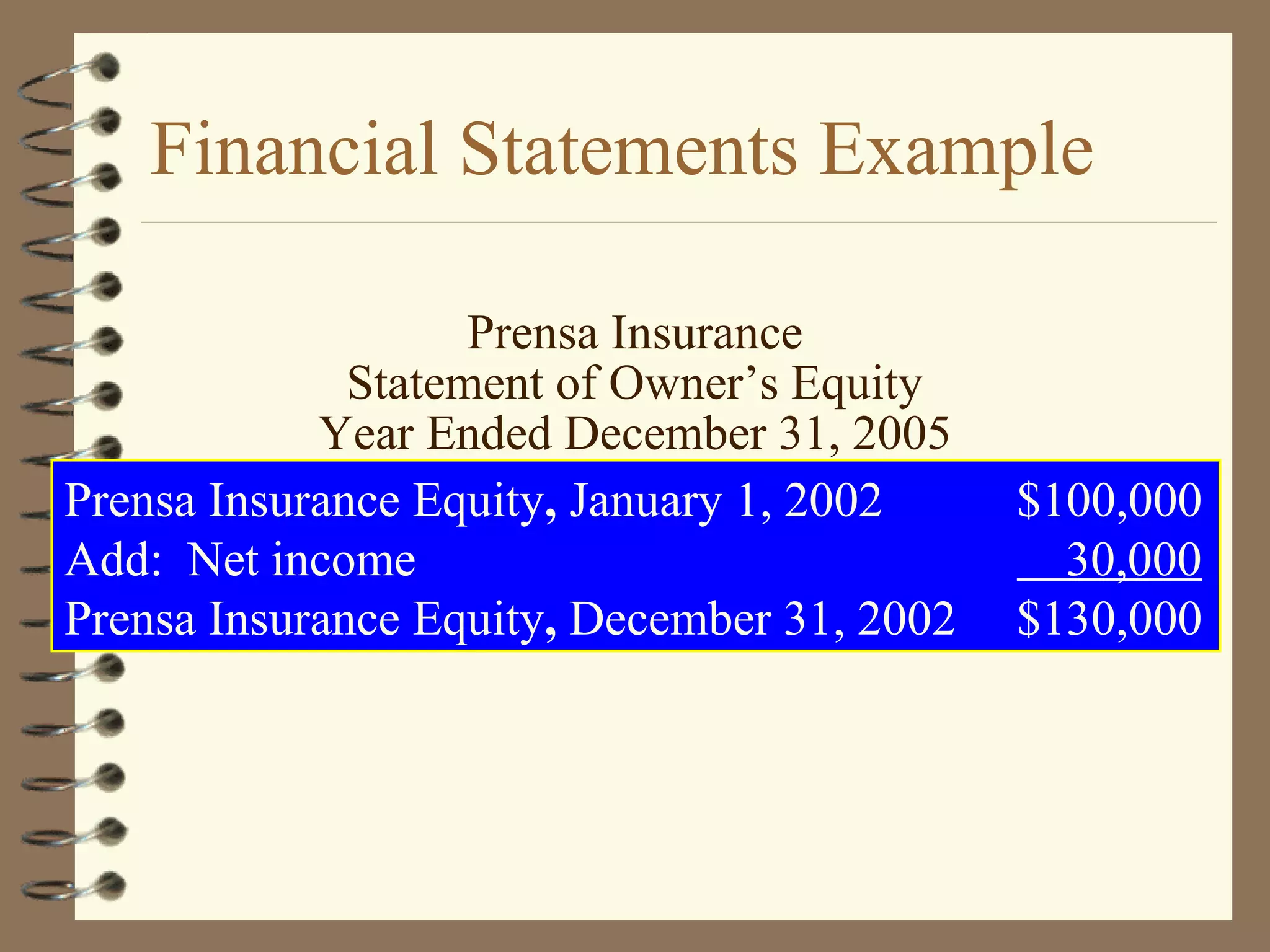

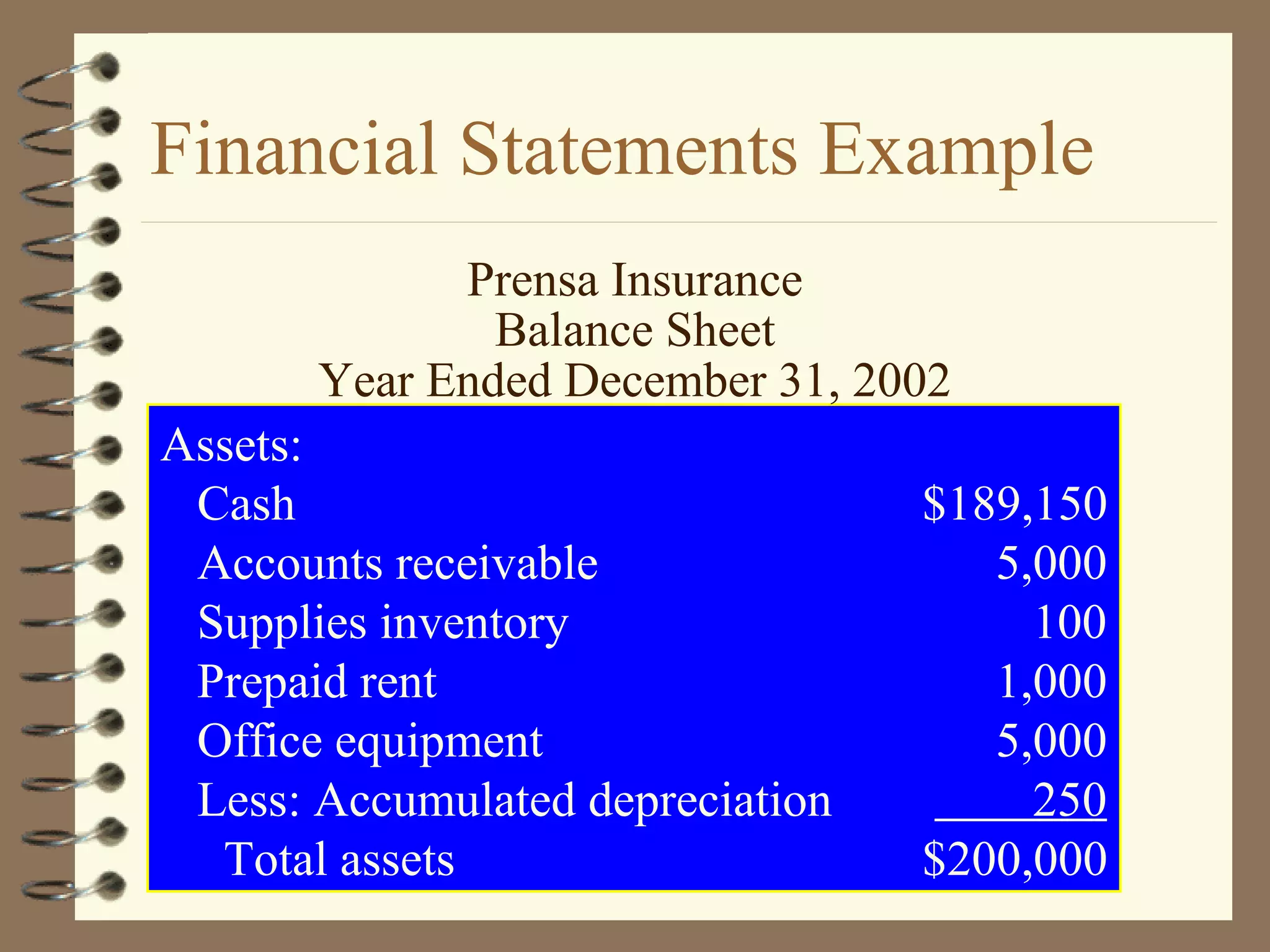

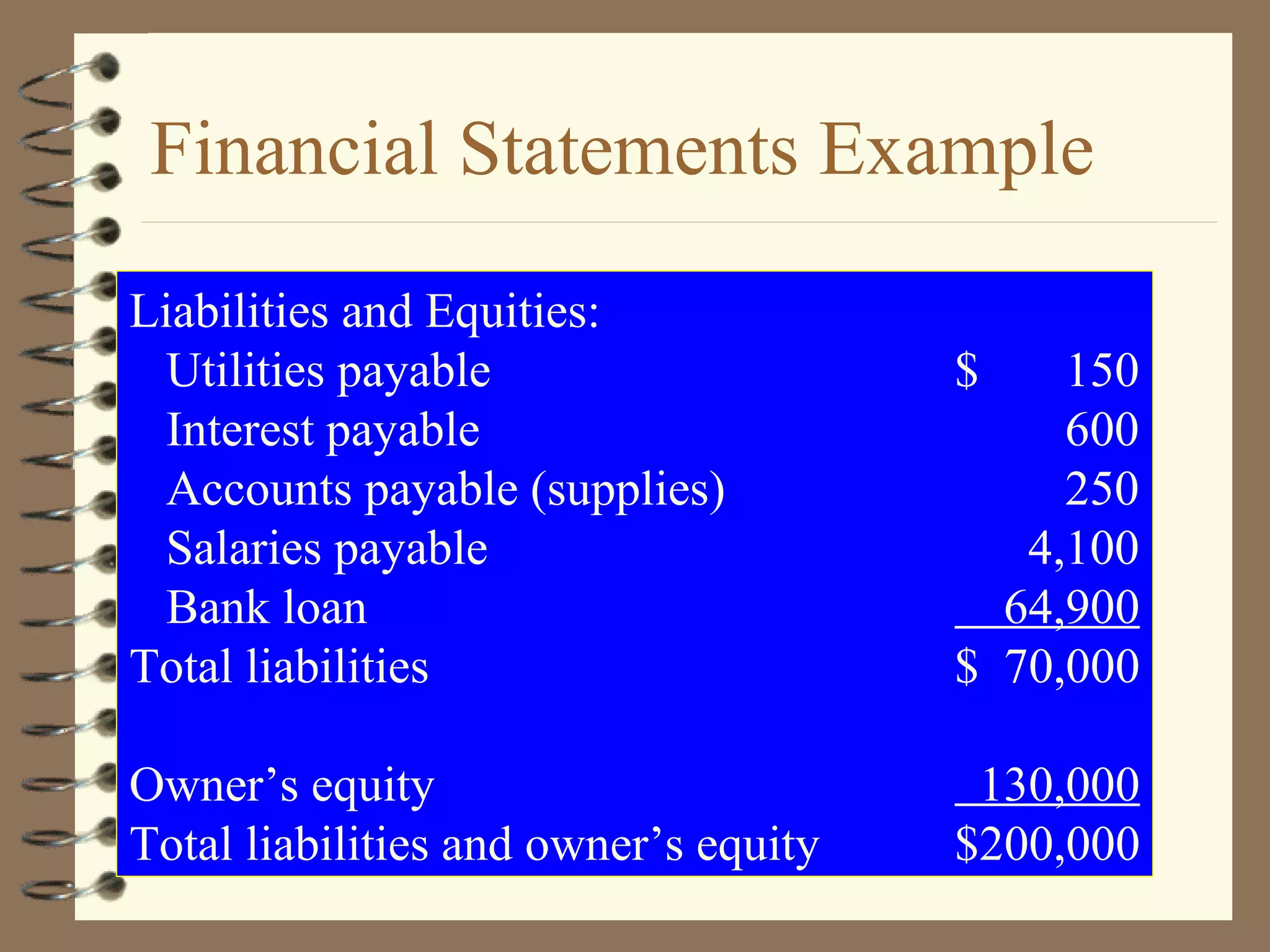

This document discusses accrual versus cash basis accounting and the adjusting process. It begins by distinguishing between accrual accounting, where transactions are recorded when revenues are earned or expenses incurred, and cash basis accounting, where transactions are recorded when cash is paid or received. The key aspects of the adjusting process covered are: applying the revenue and matching principles, making adjusting entries for prepaid, accrued, and deferred items, preparing an adjusted trial balance, and using that to make the final financial statements. The overall goal is to ensure revenues and expenses are recorded in the appropriate accounting period.