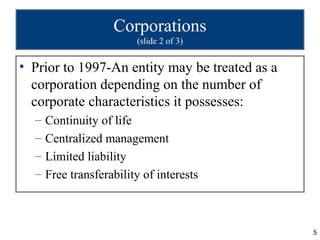

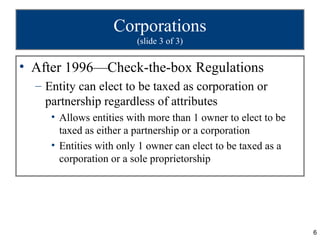

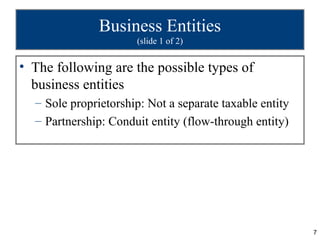

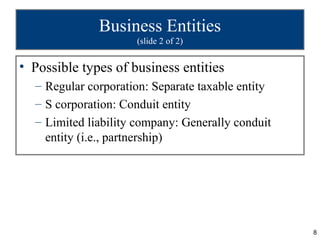

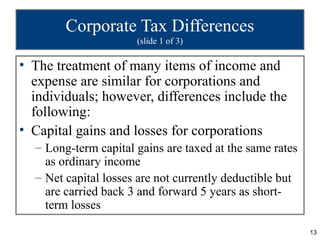

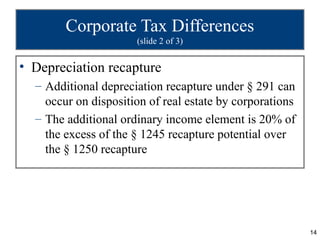

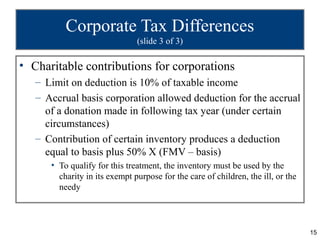

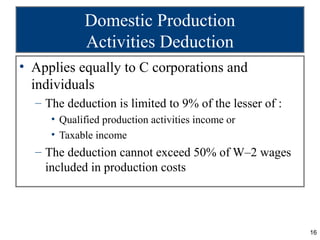

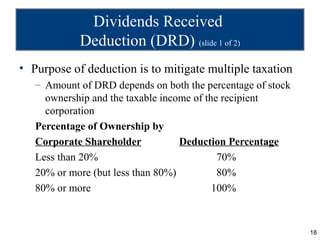

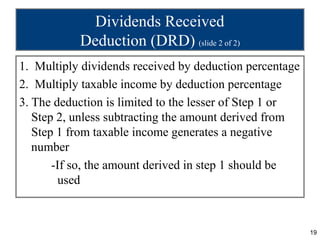

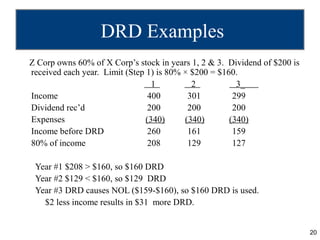

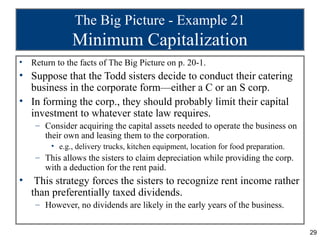

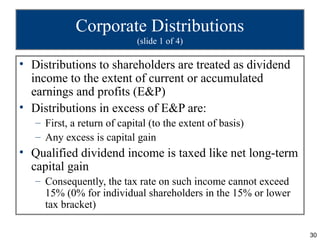

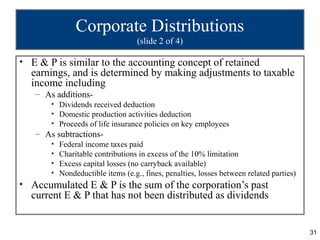

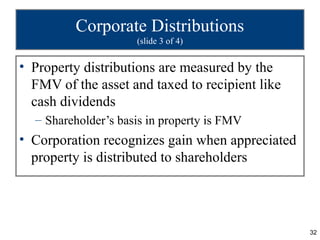

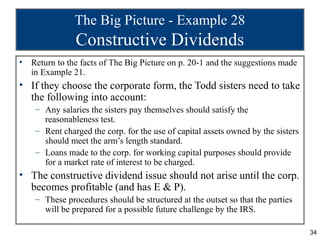

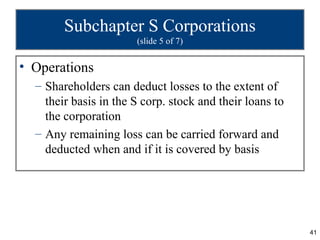

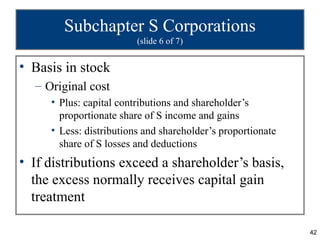

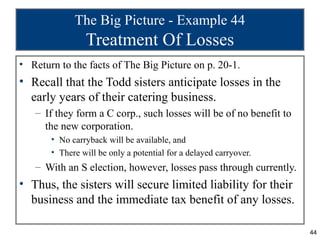

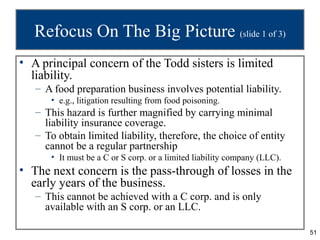

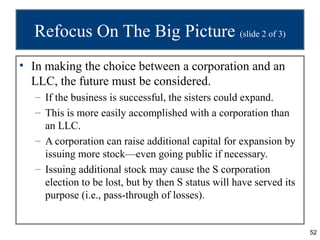

The document discusses different types of business entities that could be formed for a new catering business, including corporations, partnerships, and limited liability companies. It recommends that the sisters form an S corporation or LLC to obtain limited liability protection while also benefitting from the tax advantages of a pass-through entity that allows losses to offset their personal income. The chapter covers topics like corporate versus individual tax rules, deductions, and the dividends received deduction.