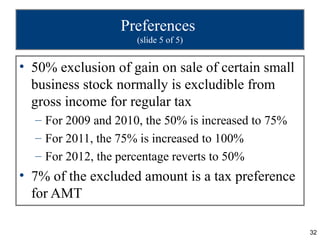

Bob and Carol paid different amounts of federal income tax even though they had identical incomes, deductions, and investments. Carol paid $15,000 more than Bob due to an oversight in the treatment of interest from private activity bonds they both owned. These bonds were issued in 2010 and interest from such bonds is not a tax preference item for the alternative minimum tax in that year. After reviewing the returns, Adam determined Carol was eligible for a $15,000 refund due to an error on her Form 6251 in treating the bond interest as a tax preference.