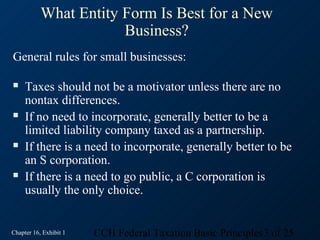

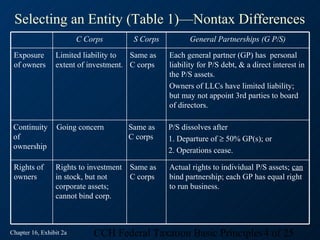

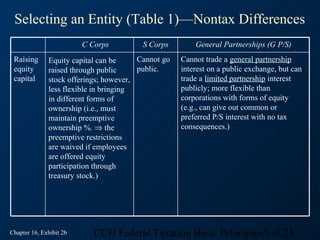

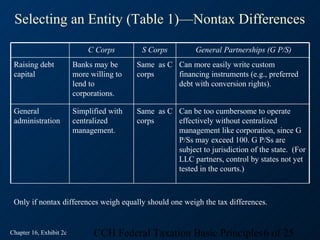

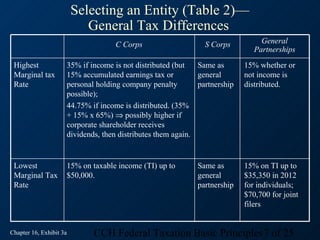

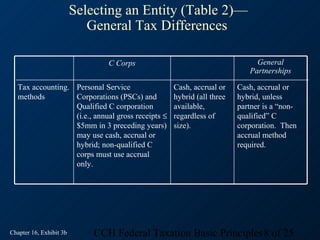

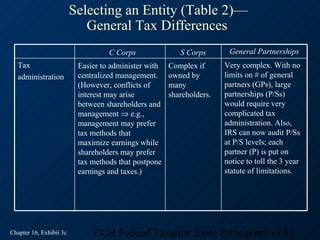

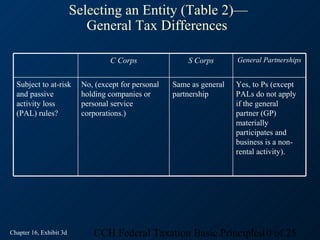

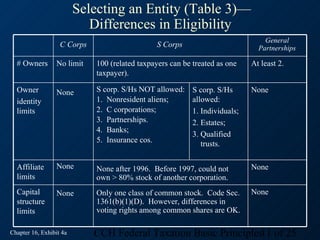

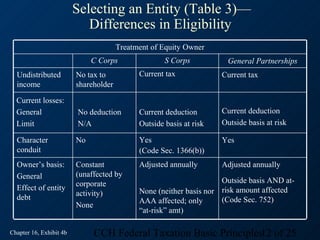

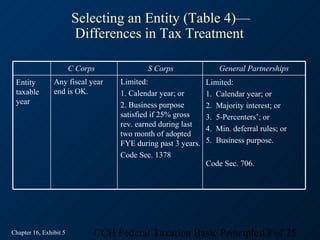

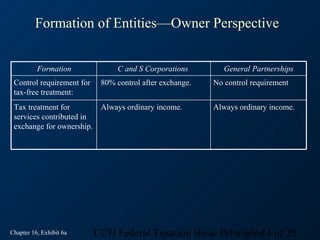

This document provides an overview and exhibits about selecting an entity form for a new business from the perspectives of tax and non-tax differences. It compares key aspects of C corporations, S corporations, and general partnerships. The exhibits include tables that outline differences in areas like exposure of owners, continuity of ownership, rights of owners, raising equity/debt capital, tax rates, accounting methods, and eligibility requirements.

![Formation of Entities—Owner Perspective

Formation C and S Corporations General Partnerships

How is an Gain = Lesser of (a) or (b): Disguised sale rules:

owner’s (a) = Realized gain; Gains: Yes; Losses: Yes except losses

recognized (b) = Boot rec’d, where boot are not recognized if the disguised

gain or loss on is any property received other sale involving a 50% + partner.

“tax-free” than common stock. Debt Recognized Gain or Loss =

formation relief is also boot to the extent [(a) - (b)] x [(c) ÷ (a)], where,

determined? it exceeds the basis of all (a) = FMV of P/S interest

property contributed. received;

Realized losses are never (b) = AB of property contributed;

recognized in a Code Sec. 351 (c) = FMV of other property

exchange; realized losses are received within two years of

always recognized in a non-

Code Sec. 351 exchange.

new ownership.

[Note: (a) - (b)] = realized gain.

Chapter 16, Exhibit 6b CCH Federal Taxation Basic Principles15 of 25](https://image.slidesharecdn.com/2013cchbasicprinciplesch16pi-120911125340-phpapp02/85/2013-cch-basic-principles-ch16-pi-15-320.jpg)

![Formation of Entities—Owner Perspective

Formation C and S Corporations General Partnerships

What is an The following formula applies Basis in partnership interest =

owner’s basis in to both tax-free and taxable (b) x {[(a) – (c)] ÷ (a)}

the ownership exchanges: AB in corp. stock =

interest? + AB in contributed prop.; (a) = FMV of P/S interest

+ Shareholder’s recog. gain; received;

– FMV of boot rec’d, including (b) = AB of property

debt relief that is boot; contributed;

– Debt relief that is not boot; (c) = FMV of other property

– Shareholder’s recog. loss. received within 2 years

of new ownership.

Chapter 16, Exhibit 6c CCH Federal Taxation Basic Principles16 of 25](https://image.slidesharecdn.com/2013cchbasicprinciplesch16pi-120911125340-phpapp02/85/2013-cch-basic-principles-ch16-pi-16-320.jpg)

![Formation of Entities—Owner Perspective

Formation C and S Corporations General Partnerships

What is an entity’s Basis in property = (a) + Basis in property = (c) + {[(a) – (c)]

adjusted basis (AB) (b), where, ÷ (a)] x (b)}, where,

in property (a) = FMV of P/S interest

contributed by a (a) = Shareholder’s AB

in contributed received;

new owner?

property; (b) = AB of property

(b) = Shareholder’s contributed;

recognized gain (if (c) = FMV other prop. received

any). w/in 2 yrs of new ownership.

Does an entity No, never. No, never.

recognize gain or

loss on the

exchange of an

ownership interest

for property in a

tax-free exchange?

Chapter 16, Exhibit 6e CCH Federal Taxation Basic Principles18 of 25](https://image.slidesharecdn.com/2013cchbasicprinciplesch16pi-120911125340-phpapp02/85/2013-cch-basic-principles-ch16-pi-18-320.jpg)

![Formation of Entities—Owner Perspective

Formation C and S Corporations General Partnerships

Does an entity Gains: Yes; Losses: No. Gains: Yes; Losses: Yes, except

compute Gain = [greater of: (a) or (b)] – losses are not recognized if the

recognized gain (c), where: disguised sale involves a 50%+

or loss on the partner.

exchange of Gain or loss = [greater of: (a) or

property other (a) = FMV of property

(b)] - (c), where:

than equity to distributed;

(a) = FMV of property

new owners? (b) = Corporation’s debt relief

distributed;

(if any);

(b) = P/S’s debt relief

(c) = Corporation’s basis in

(if any);

property distributed.

(c) = P/S’s basis in property

distributed.

Chapter 16, Exhibit 6f CCH Federal Taxation Basic Principles19 of 25](https://image.slidesharecdn.com/2013cchbasicprinciplesch16pi-120911125340-phpapp02/85/2013-cch-basic-principles-ch16-pi-19-320.jpg)

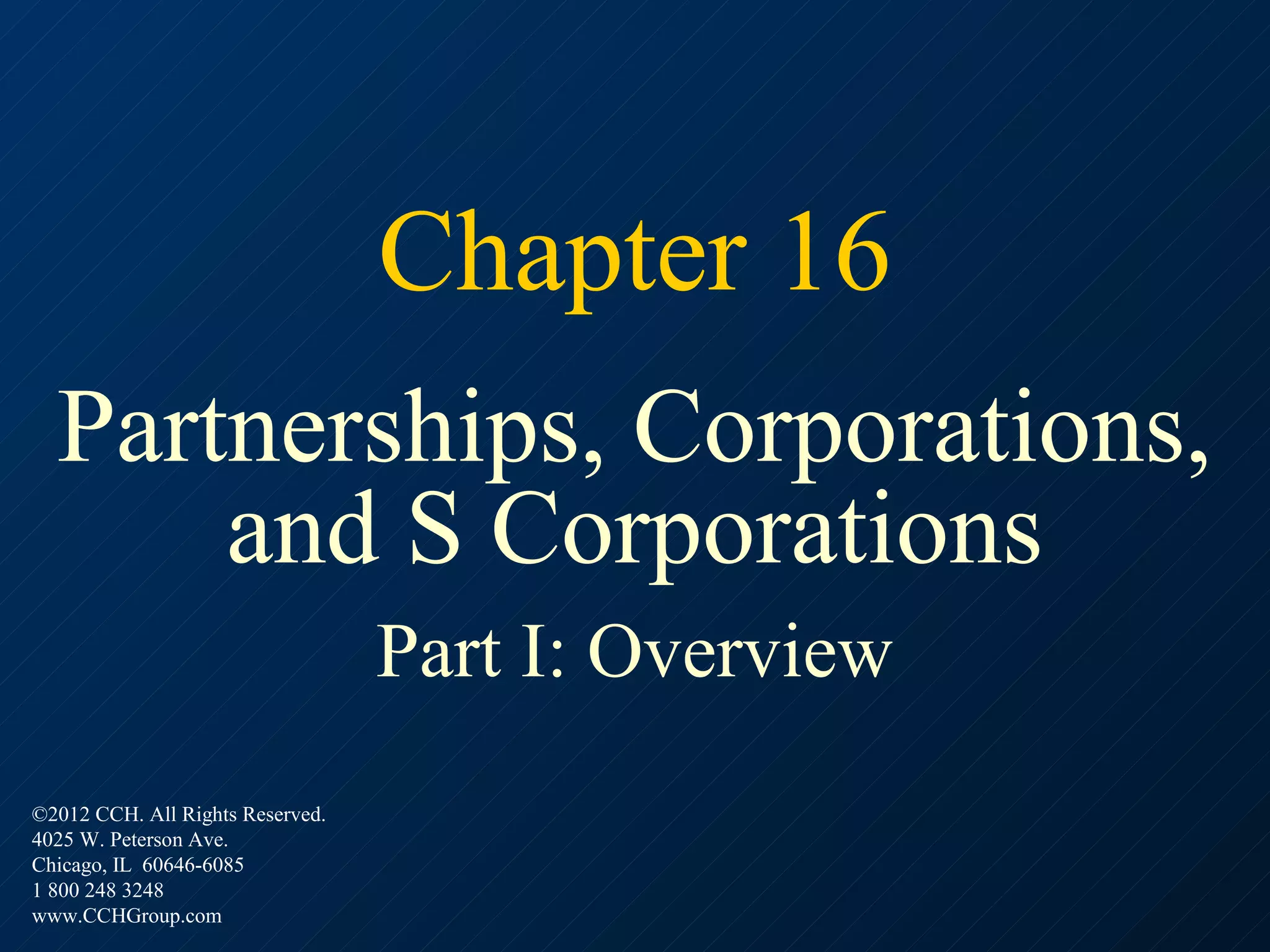

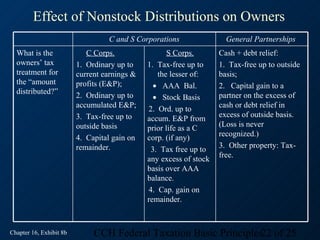

![Effect of Nonstock Distributions on Owners

C and S Corporations General Partnerships

How is “amount (a) – (b), where, Cash + debt relief

distributed” to (a) = FMV of all prop. received by [i.e., for purposes of

owners computed? shareholder; determining gain, only

(b) = Corporate debt assumed by cash + debt relief are

shareholder. subject to capital gains.

Other property received by

a partner is tax-free.]

Chapter 16, Exhibit 8a CCH Federal Taxation Basic Principles21 of 25](https://image.slidesharecdn.com/2013cchbasicprinciplesch16pi-120911125340-phpapp02/85/2013-cch-basic-principles-ch16-pi-21-320.jpg)

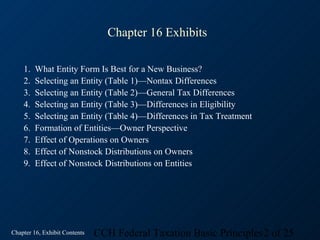

![Effect of Nonstock Distributions on Owners

C and S Corporations General Partnerships

What is the basis Always FMV, even if an owner Same as the partnership’s inside

of property assumes corporate debt. basis. [However, if a partner’s

distributed to an outside basis is less than the

owner? partnership’s inside basis in

property distributed to a partner,

then the partner’s basis of

property received is taken from

his outside basis, not from the

partnership’s inside basis. This

makes sense, given that a partner’s

outside basis must be reduced by

the “amount” of distributions and

that it cannot be negative]

Chapter 16, Exhibit 8c CCH Federal Taxation Basic Principles23 of 25](https://image.slidesharecdn.com/2013cchbasicprinciplesch16pi-120911125340-phpapp02/85/2013-cch-basic-principles-ch16-pi-23-320.jpg)