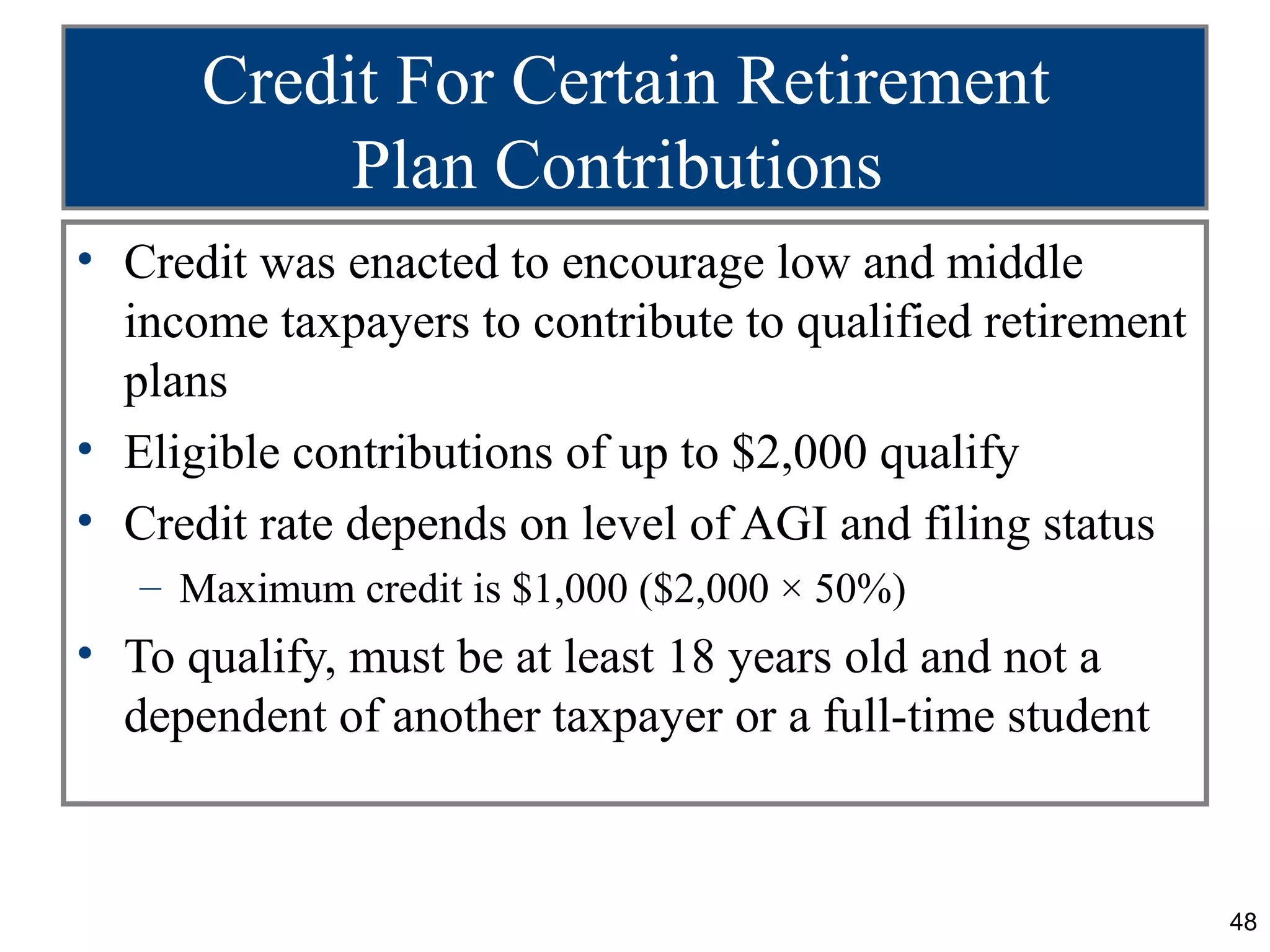

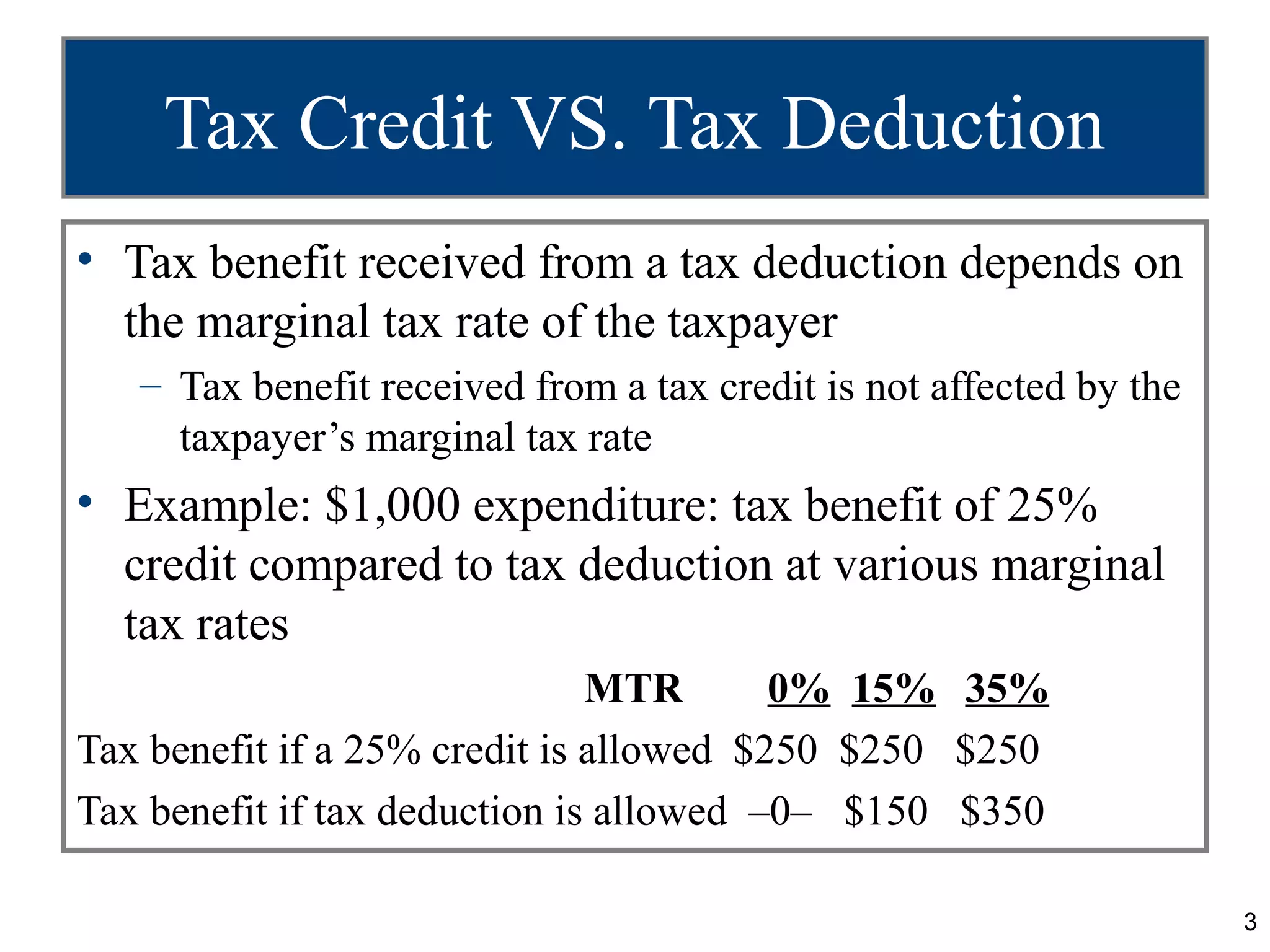

The document discusses several tax credits available to individuals and businesses, including:

1) Education tax credits that can help offset tuition and other education expenses.

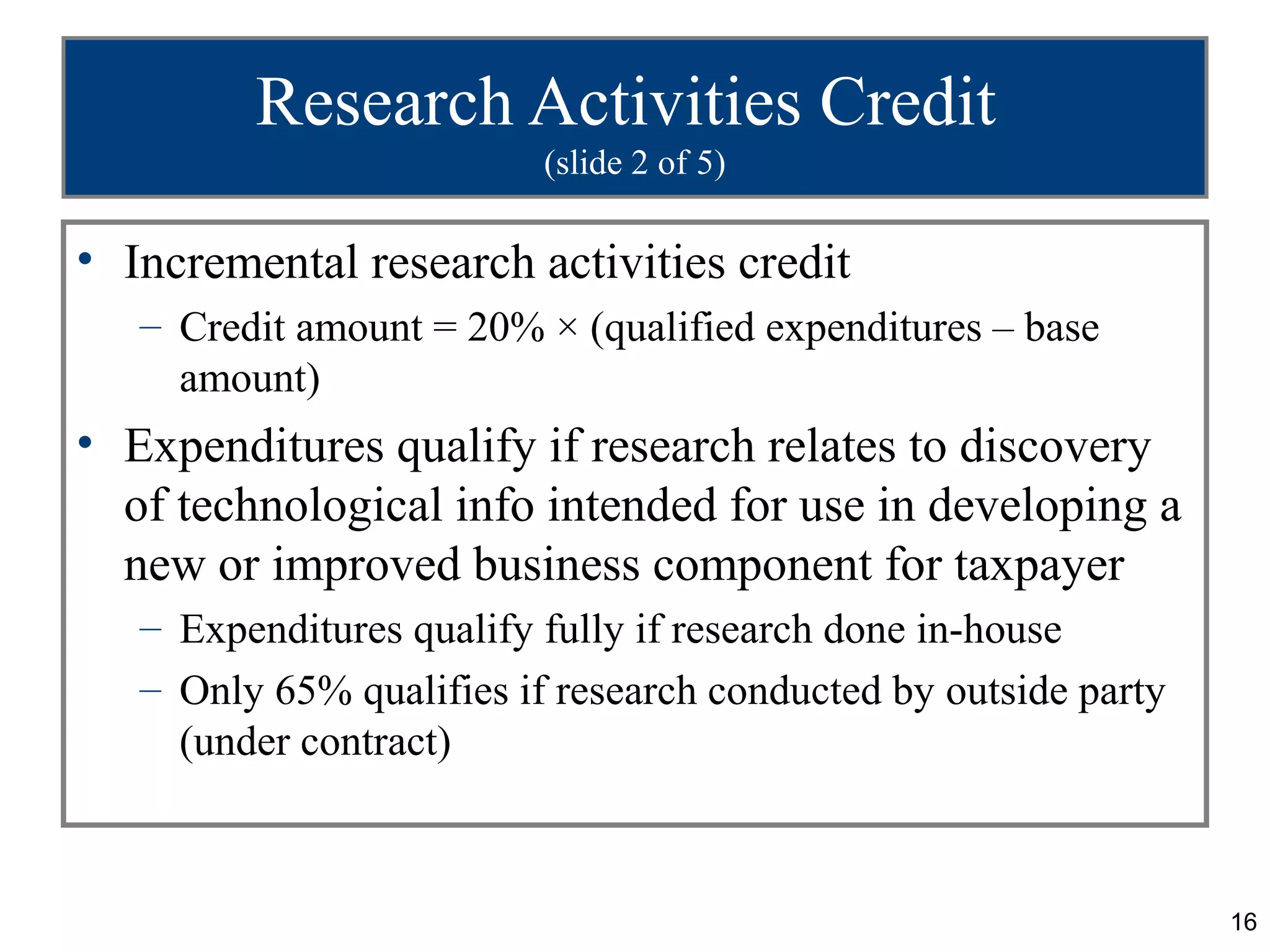

2) The research and experimentation tax credit that incentives private sector investment in research.

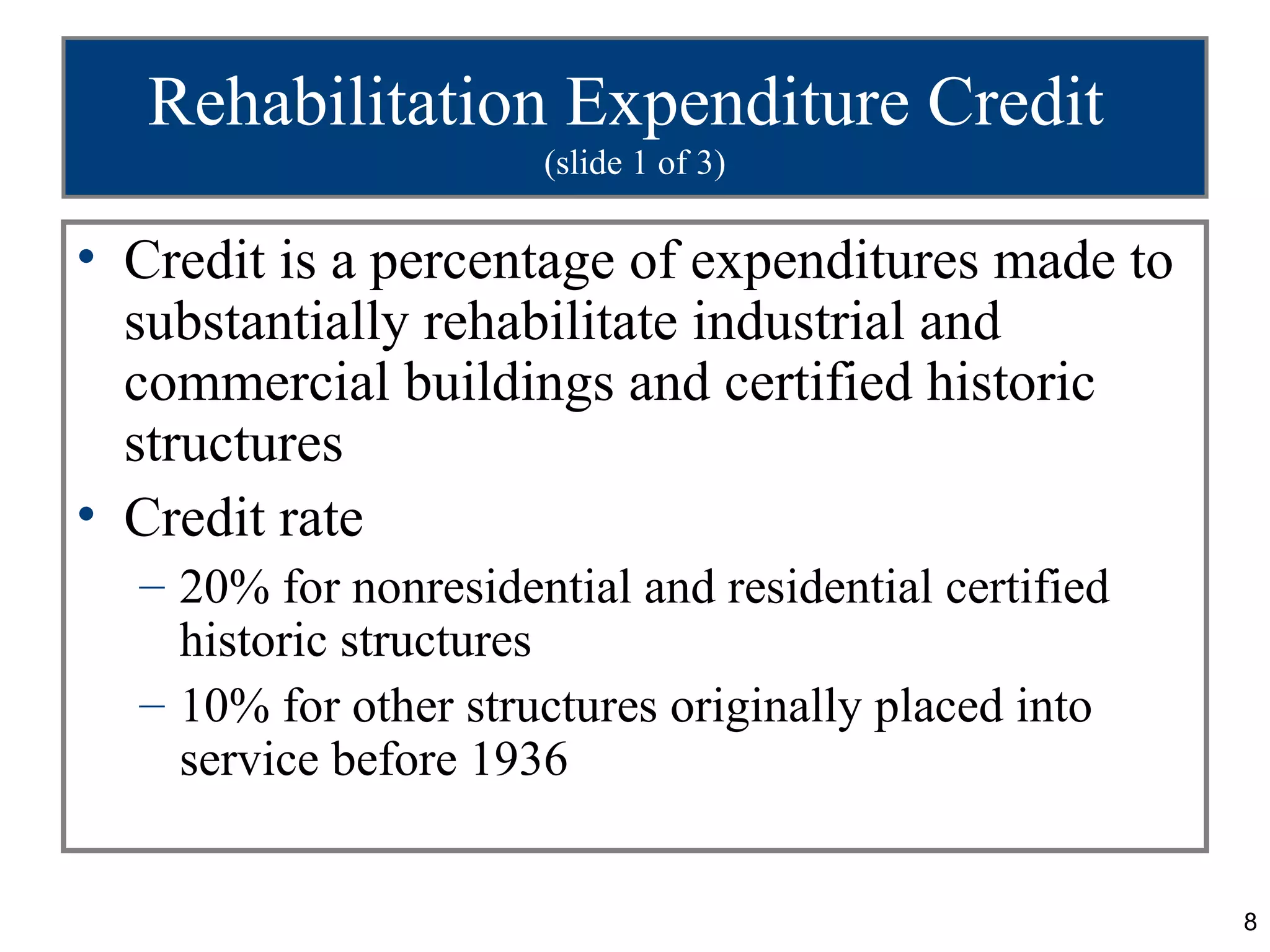

3) Tax credits for rehabilitation expenditures, hiring targeted groups of employees, and other activities.

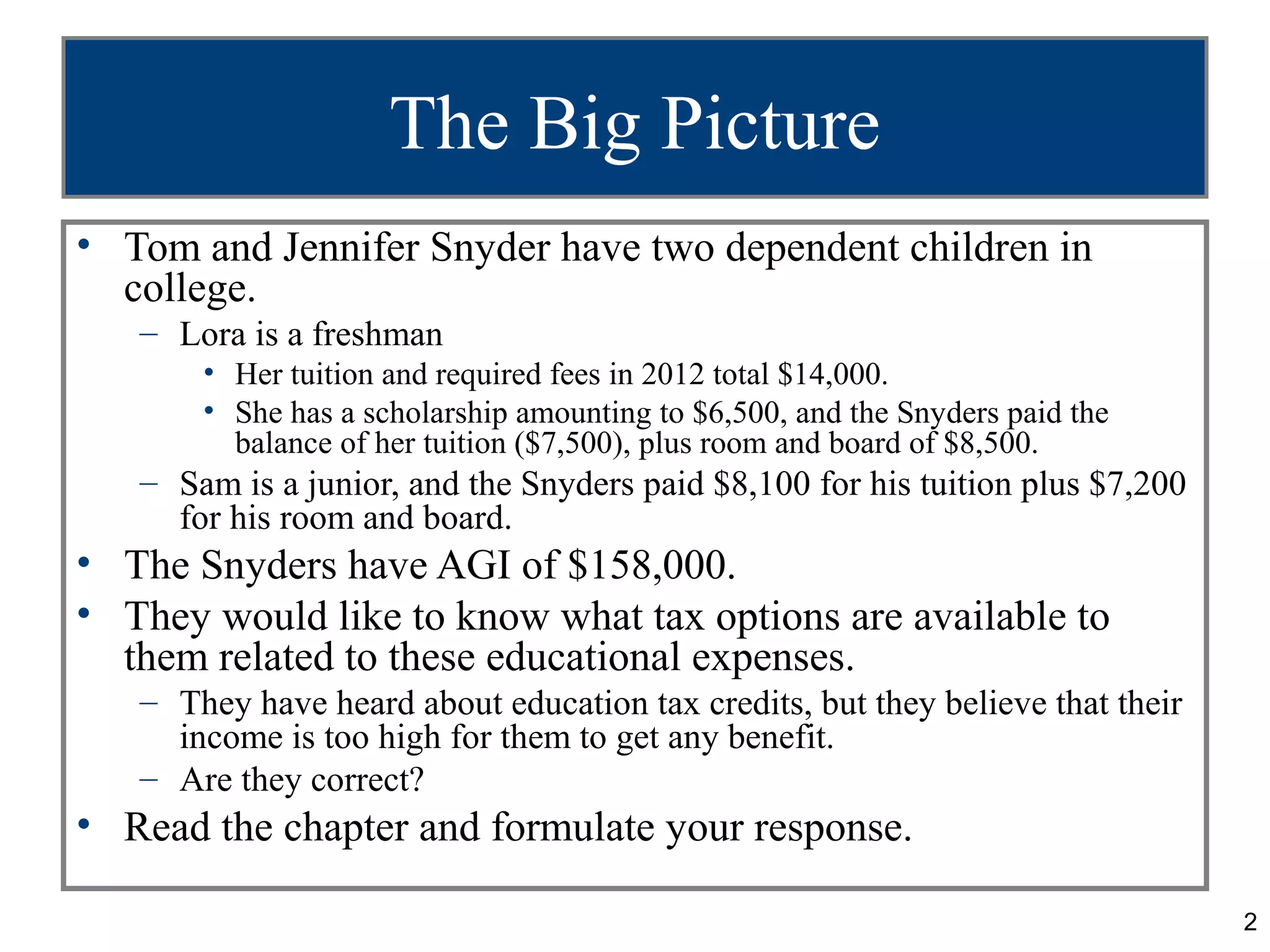

![The Big Picture - Example 32

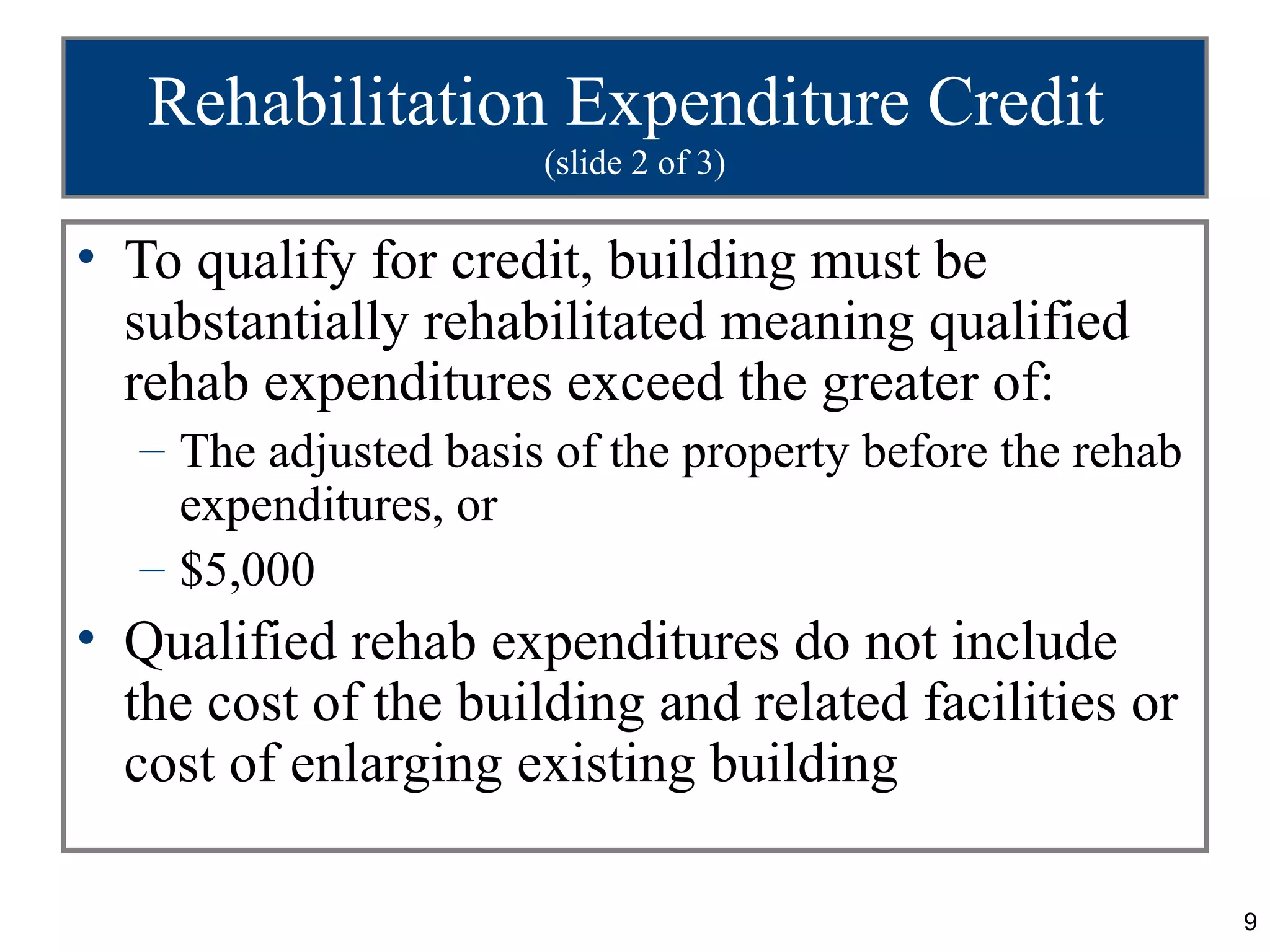

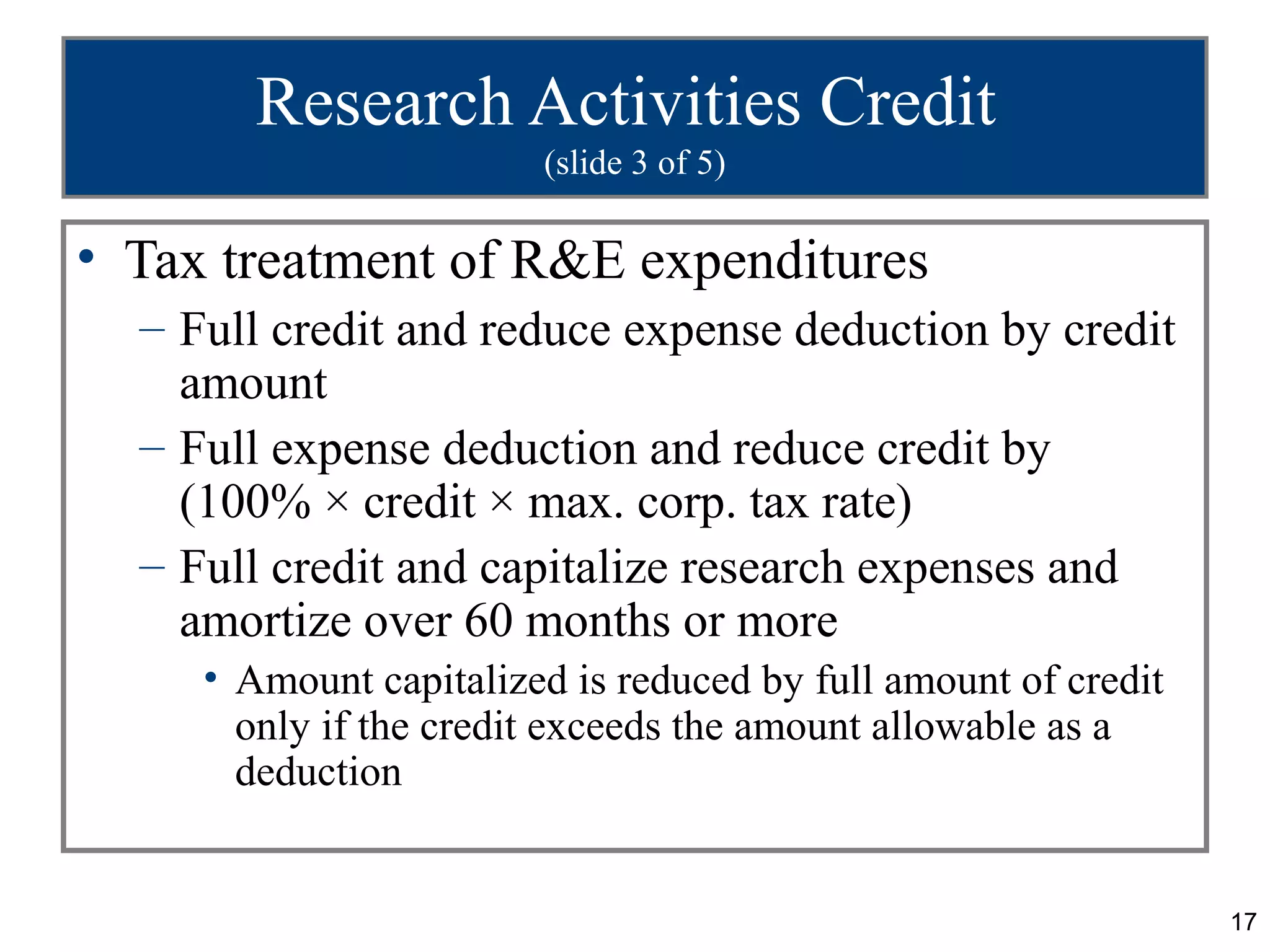

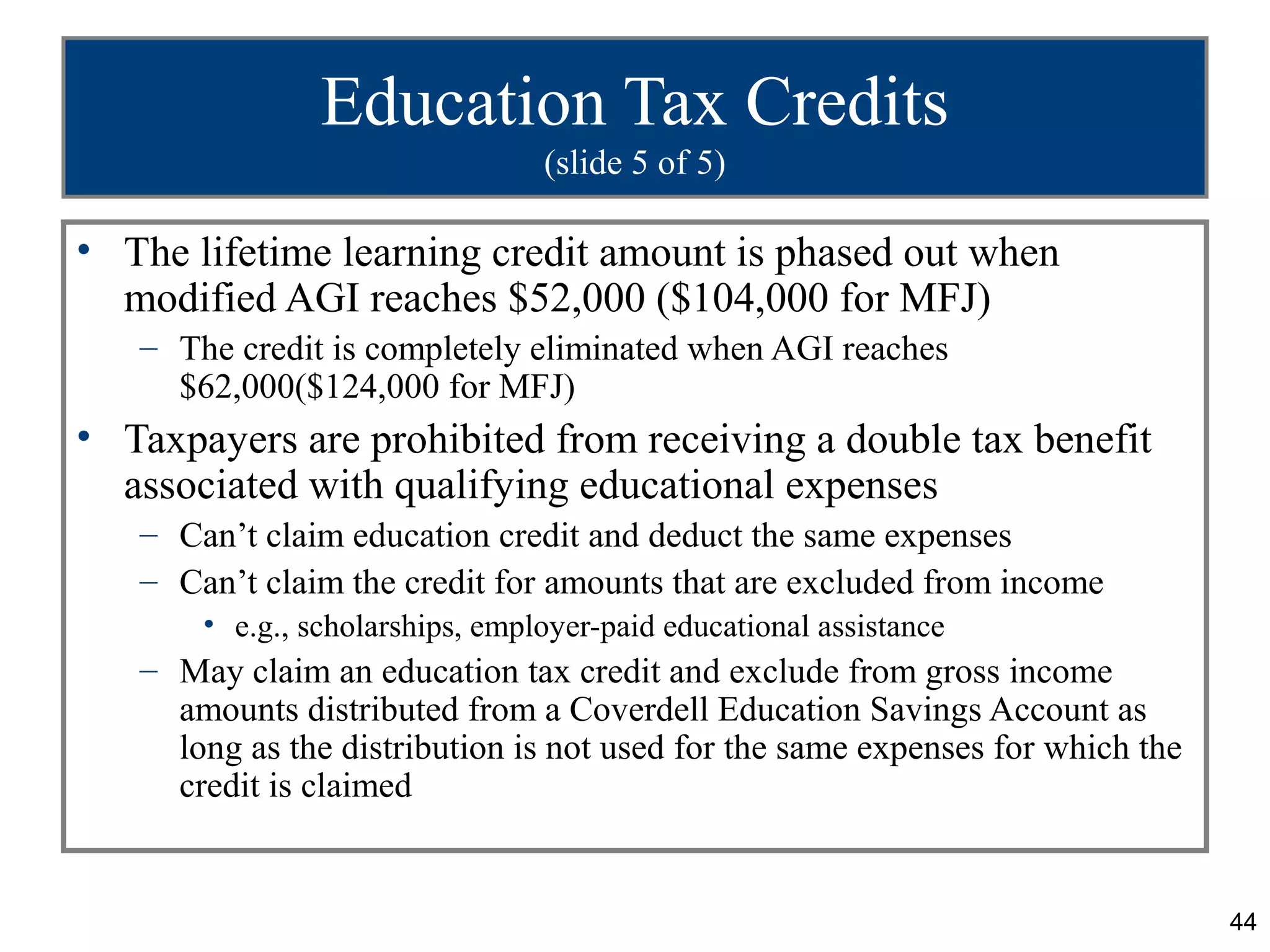

American Opportunity Credit

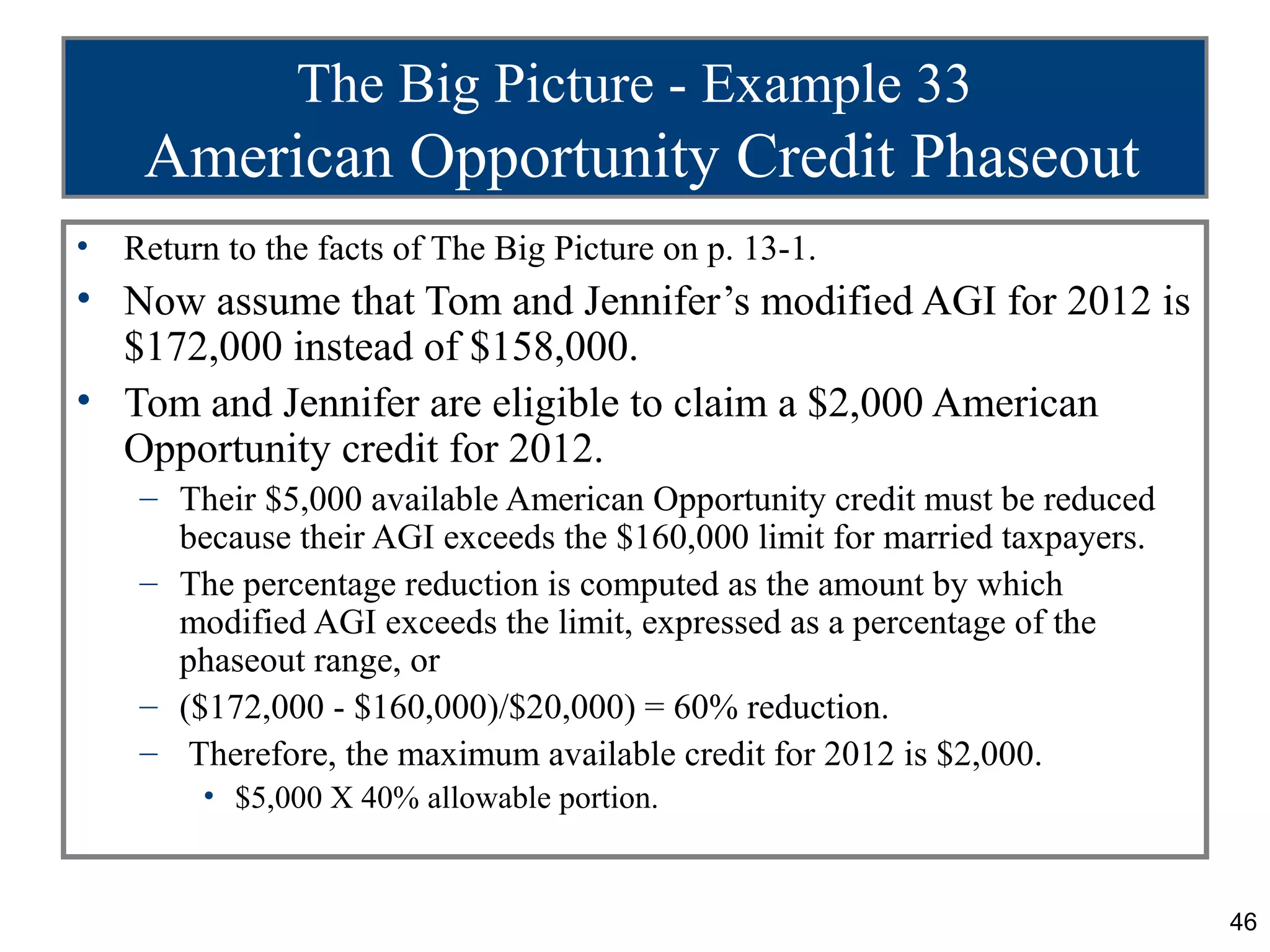

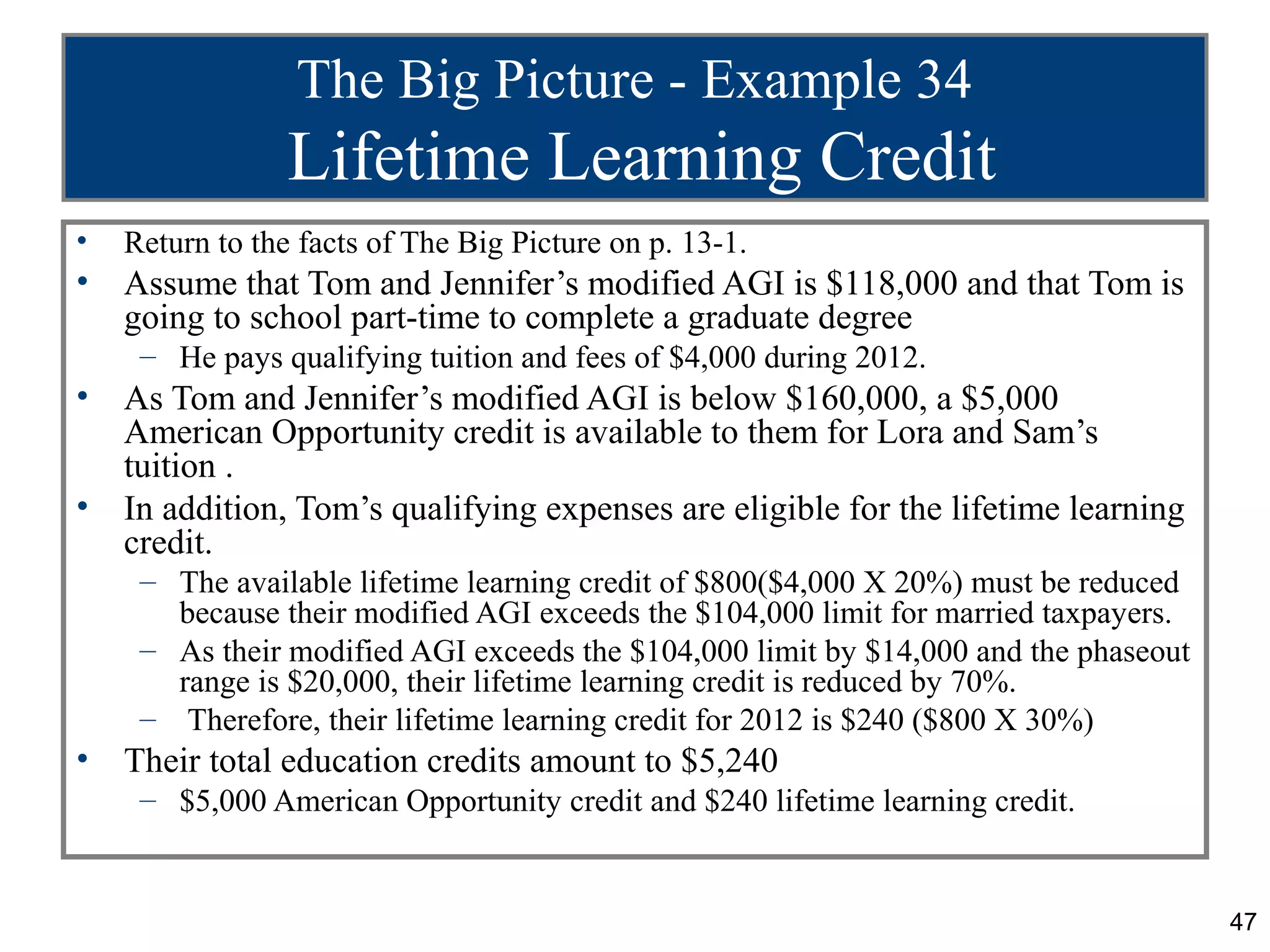

• Return to the facts of The Big Picture on p. 13-1.

• Recall that Tom and Jennifer Snyder are married, file a joint

tax return, have modified AGI of $158,000.

– Both Lora (a freshman) and Sam (a junior) are full-time students and

are Tom and Jennifer’s dependents.

• The Snyders paid the following education expenses.

– $7,500 of tuition and $8,500 for room and board for Lora, and

– $8,100 of tuition plus $7,200 for room and board for Sam.

• Lora’s and Sam’s tuition are qualified expenses for the

American Opportunity credit.

– For 2012, Tom and Jennifer may claim a $2,500 American Opportunity

credit [(100% $2,000) + (25% $2,000)] for both Lora’s and Sam’s

expenses.

– In total, a $5,000 American Opportunity credit.

45](https://image.slidesharecdn.com/pptch13-130308122028-phpapp01/75/Ppt-ch-13-45-2048.jpg)