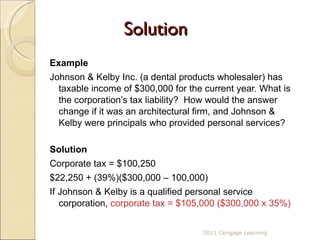

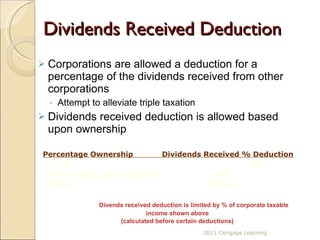

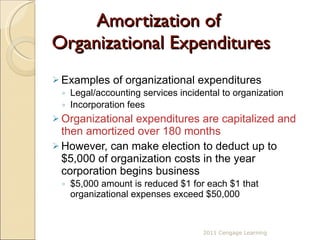

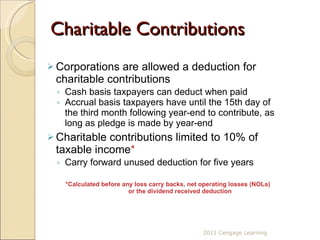

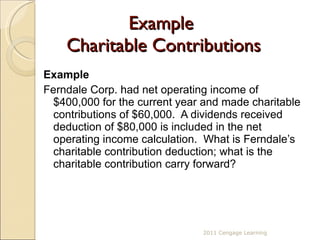

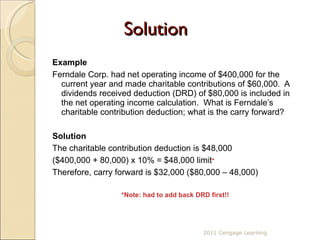

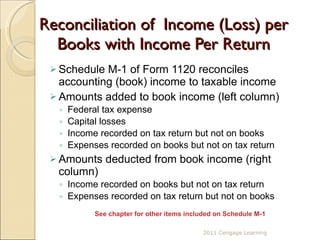

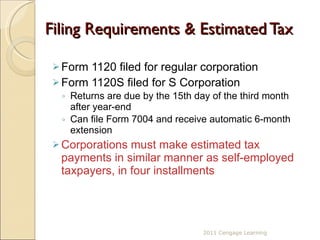

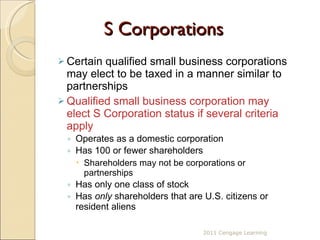

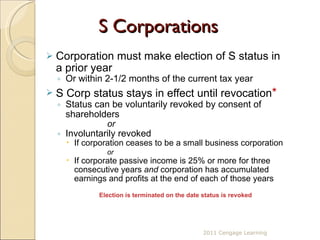

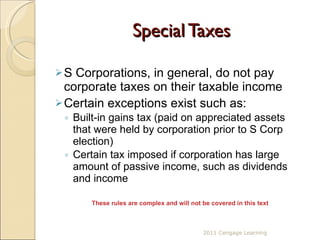

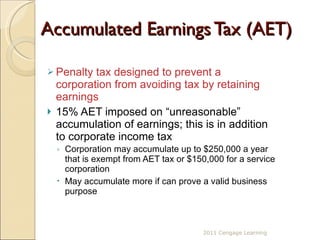

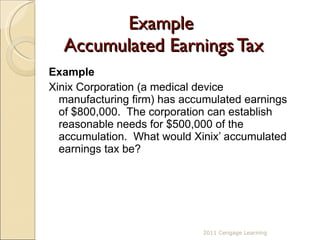

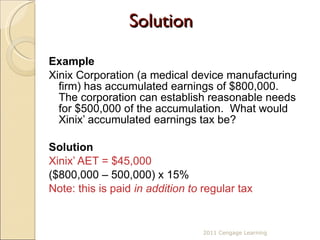

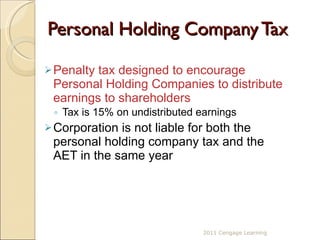

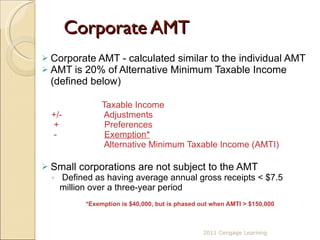

This chapter discusses corporate income taxation. It covers corporate tax rates, which are progressive up to 35% for income over $18.33 million. Capital gains are taxed at ordinary rates or alternatively at 35%. Dividends received are eligible for deductions based on ownership percentage. Charitable contributions are limited to 10% of taxable income. S corporations allow certain small businesses to pass income/losses to shareholders and avoid double taxation. Special taxes may apply to accumulated earnings and personal holding companies.