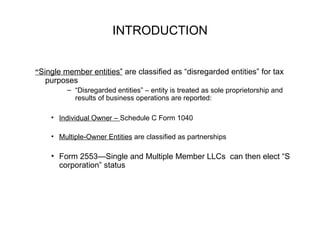

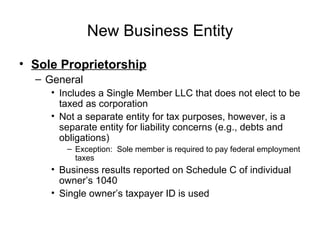

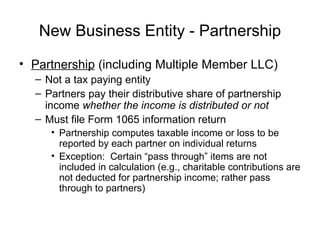

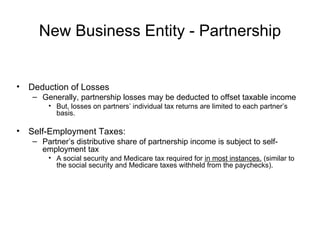

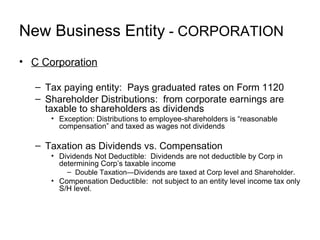

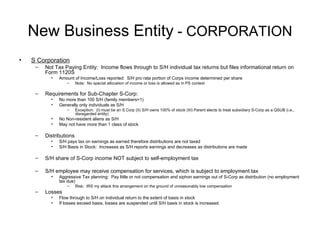

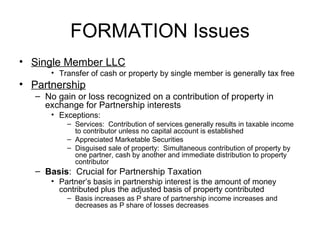

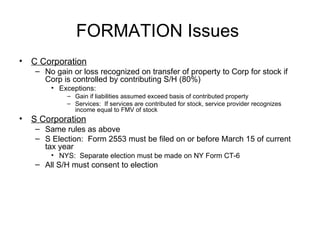

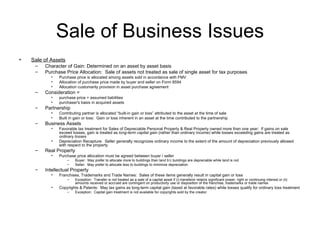

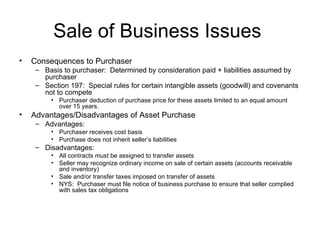

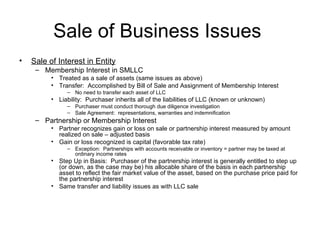

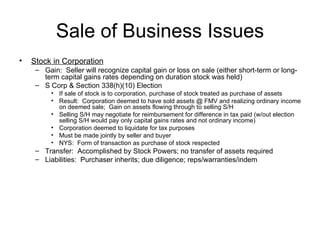

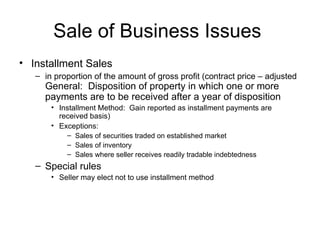

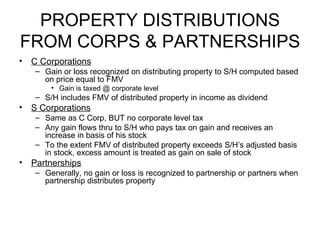

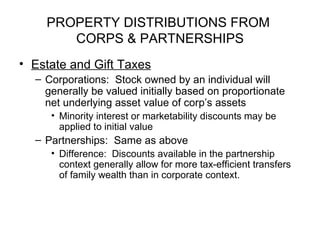

There are several tax considerations when forming a new business entity. A sole proprietorship reports profits and losses on the owner's personal tax return. Partnerships do not pay taxes but partners report their distributive share of income regardless of distributions. Corporations can elect S corporation status to avoid double taxation of dividends. The tax treatment of asset and stock sales depends on whether assets are sold individually or as part of an entity.