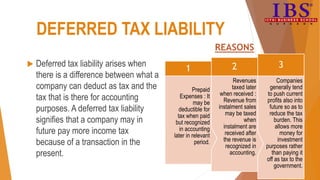

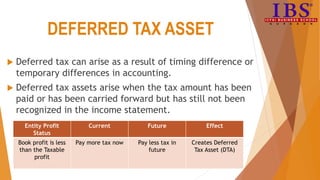

The document explains deferred tax, highlighting differences between accounting income and taxable income due to timing differences in expense recognition, leading to either deferred tax liabilities or assets. Deferred tax liabilities occur when current profits are shifted to the future, impacting tax payments, while deferred tax assets arise from taxes paid but not yet recognized in accounting. The document provides examples demonstrating how to account for deferred tax liabilities and assets in financial statements.