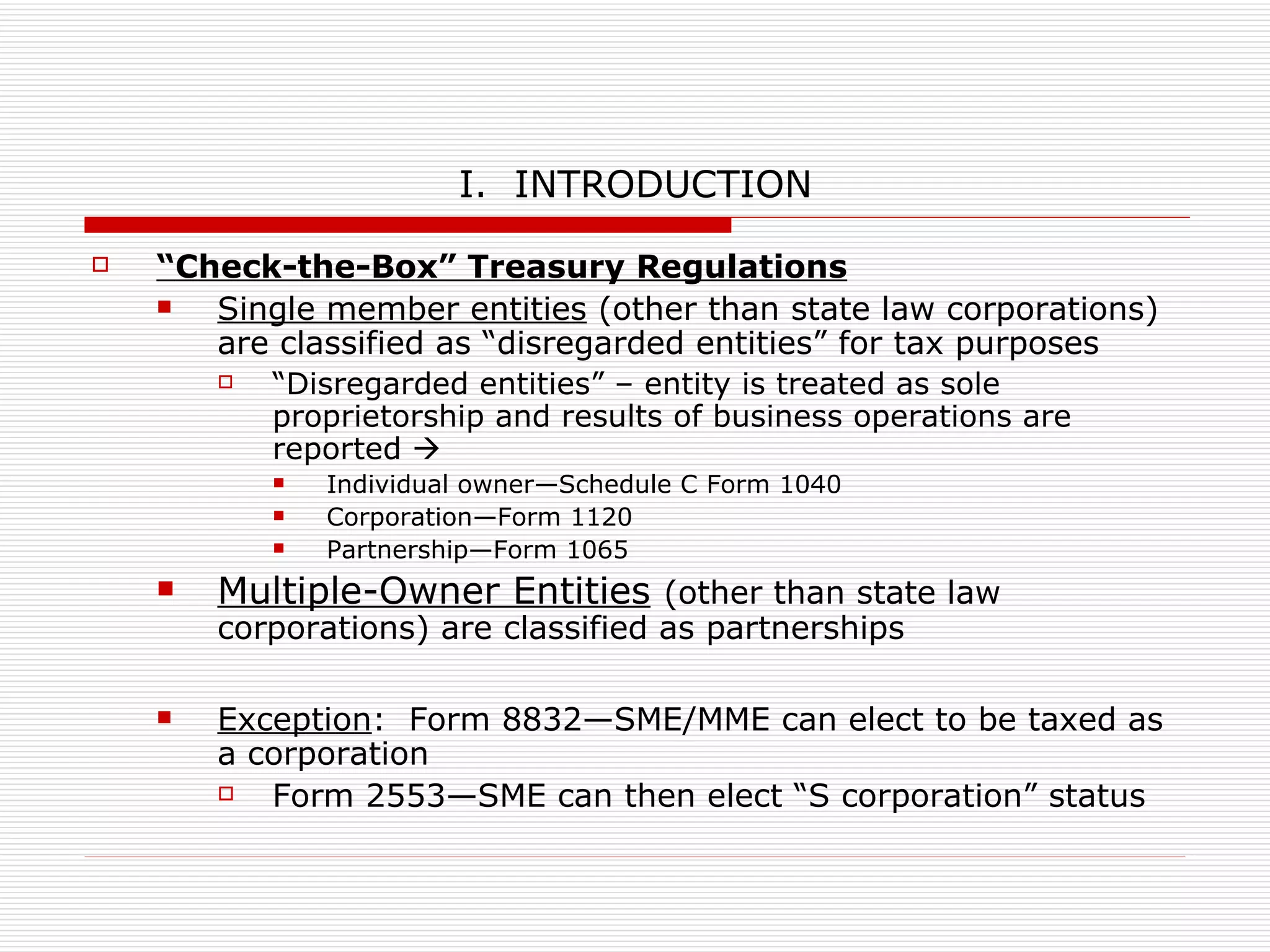

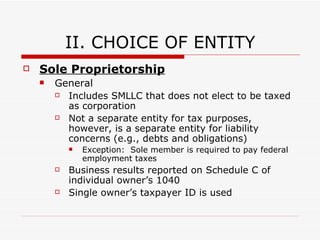

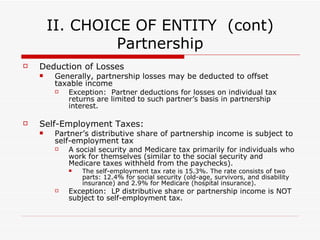

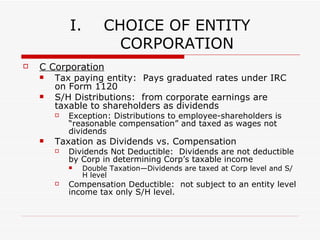

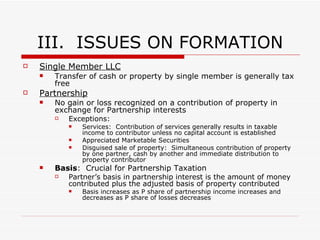

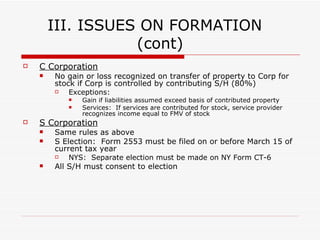

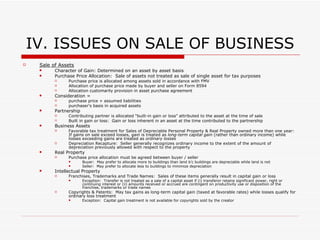

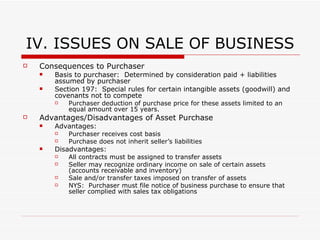

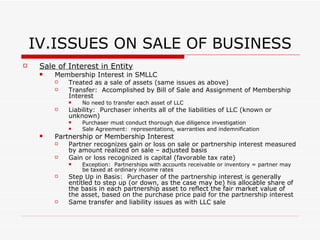

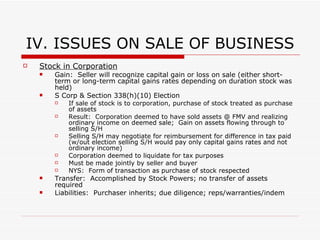

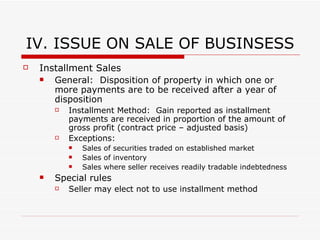

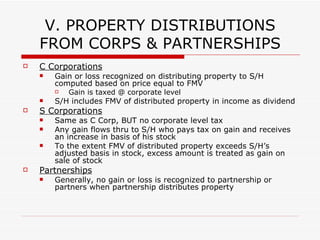

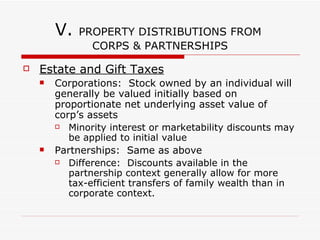

The document outlines tax considerations for various business entities, including sole proprietorships, partnerships, and corporations, focusing on their classification for tax purposes and the implications of their structure on taxation. It details the requirements for S corporations and addresses issues related to the sale of businesses, property distributions, and the recognition of gains or losses. Additionally, it explores the impact of entity choice on taxation and the specific tax treatment of different transaction types.