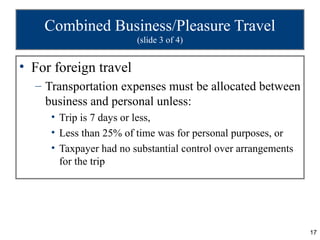

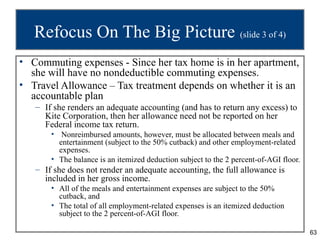

Morgan has accepted a new sales job that requires travel and some entertainment expenses. She will work out of her apartment and be reimbursed for some travel expenses. Some of Morgan's expenses may be deductible, including transportation between client sites, home office expenses if the office space is exclusively used for work, and moving expenses if she meets certain tests. However, commuting costs and some education or entertainment expenses would not be deductible.