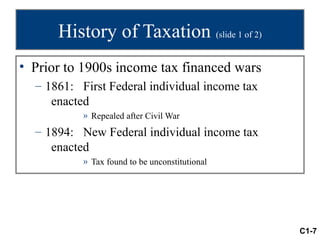

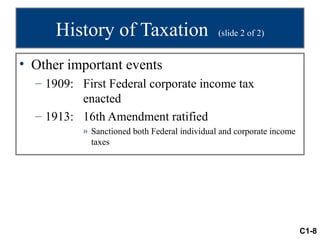

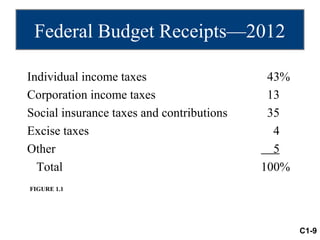

The document provides an overview of US taxation including:

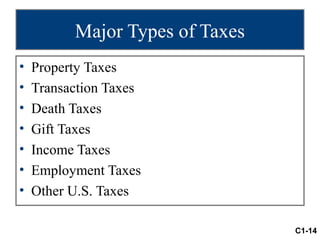

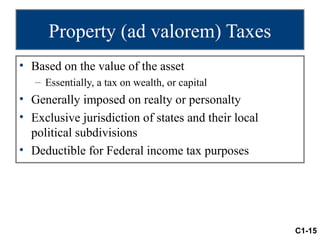

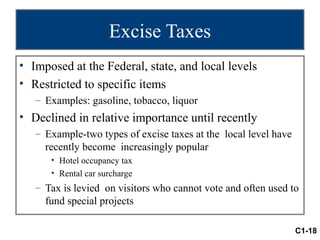

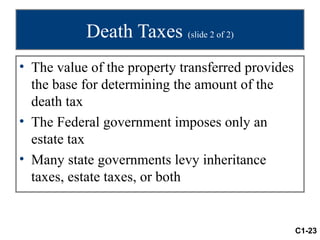

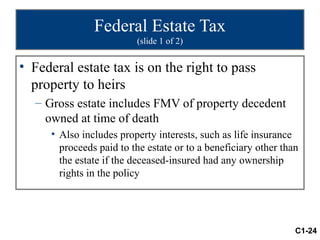

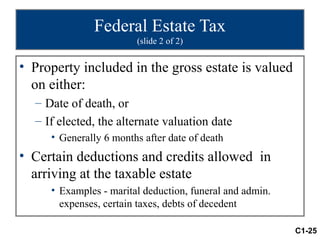

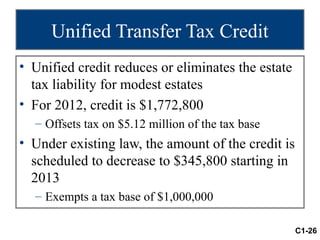

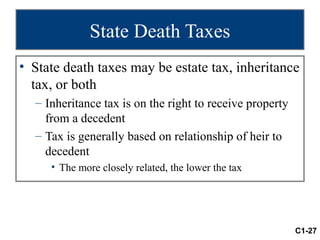

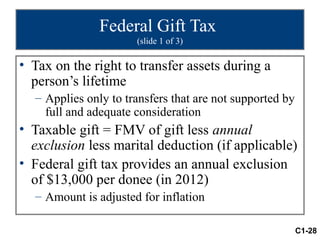

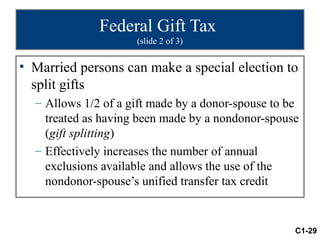

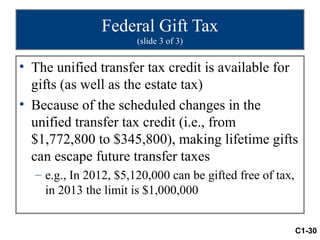

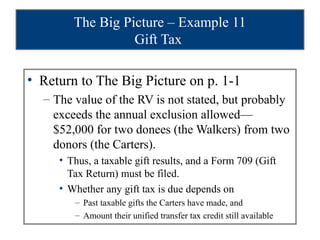

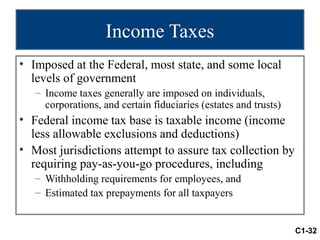

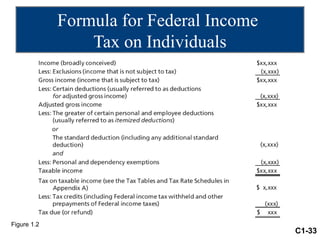

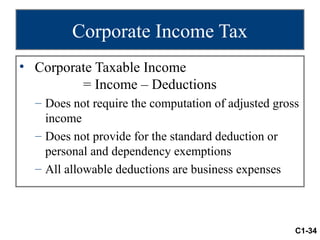

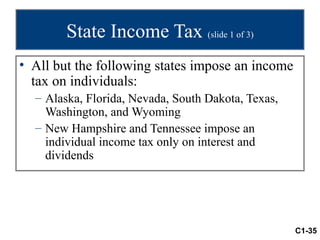

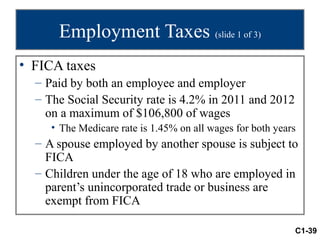

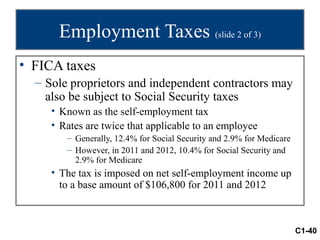

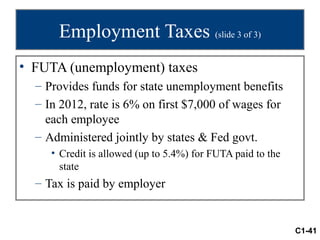

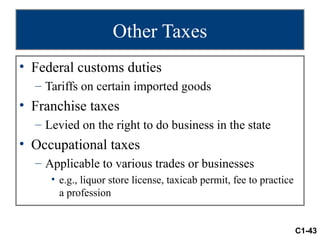

1) It describes different types of taxes such as income taxes, property taxes, employment taxes, and gift/estate taxes.

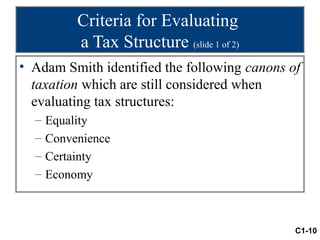

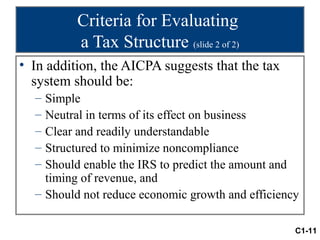

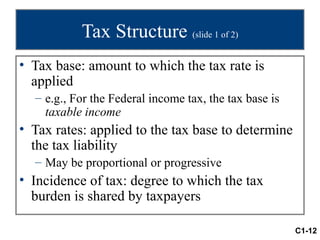

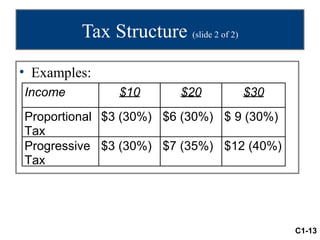

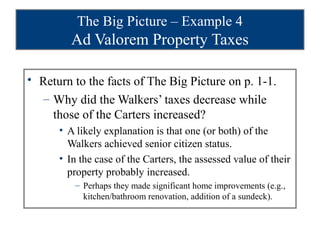

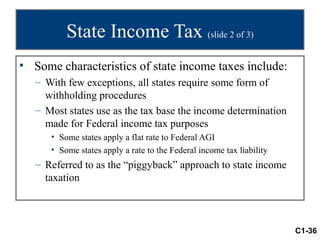

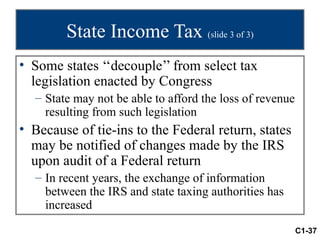

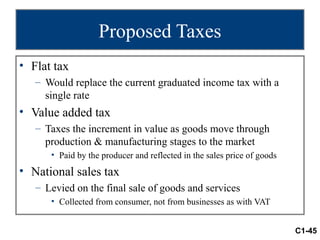

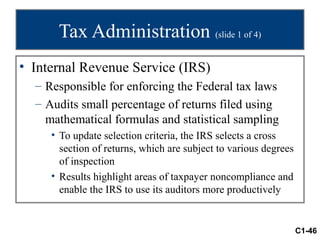

2) It discusses key concepts related to taxation including tax bases, tax rates, tax structures, and criteria for evaluating tax systems.

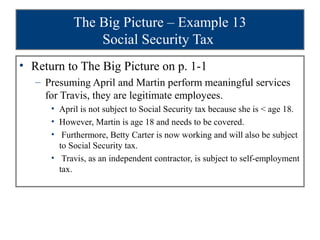

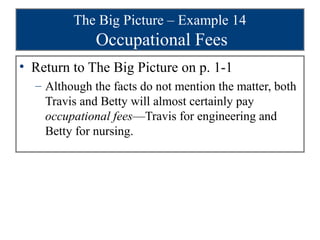

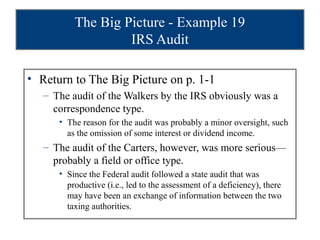

3) It provides examples and explanations of how different taxes could apply to a fictional married couple described in the introductory scenario.