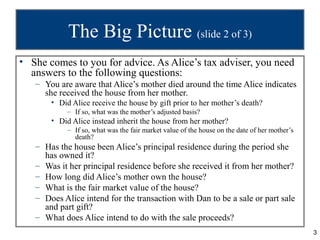

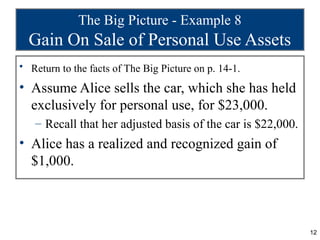

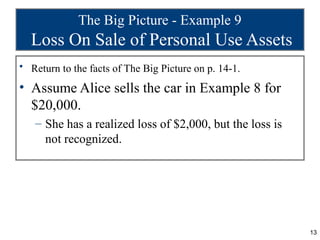

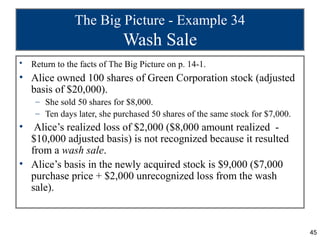

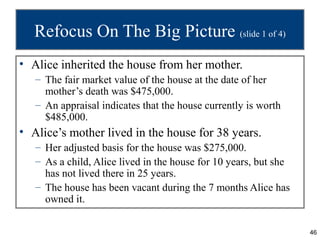

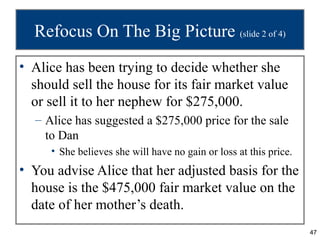

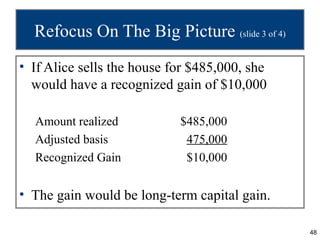

Alice owns a house that she inherited from her mother 7 months ago. She is considering selling the house to her nephew Dan for $275,000 and thinks she will have no gain or loss. As Alice's tax advisor, you need information to determine the tax consequences, such as whether Alice received the house as a gift or inheritance, the basis of the property, and whether it has been her primary residence. You will also need to advise Alice on the tax consequences of selling her car that she has owned for 4 months, as well as transactions involving the sale of stock at a loss and subsequent repurchase.

![Gift Basis

(slide 9 of 10)

• Adjustment for gift taxes

– The proportion of gift tax paid (on gifts after 1976)

by the donor on appreciation of asset can be added

to basis of donee

– The donee's basis is equal to: Donor’s basis +

[(unrealized appreciation/taxable gift) × gift tax]

29](https://image.slidesharecdn.com/pptch14-130308122029-phpapp02/85/Ppt-ch-14-29-320.jpg)

![Gift Basis

(slide 10 of 10)

• Example of gift tax:

– Cathy received a gift from Darren on June 15 of

this year

– FMV on June 15 was $33,000

– Darren had a basis in the asset of $28,000

– Darren paid gift tax of $800

– Cathy’s basis in the gifted property is $28,200

[$28,000 + ($5,000/($33,000 – $13,000) × $800)]

30](https://image.slidesharecdn.com/pptch14-130308122029-phpapp02/85/Ppt-ch-14-30-320.jpg)

![Refocus On The Big Picture (slide 4 of 4)

• If, instead, Alice sells the house to her nephew for $275,000,

she will have a part sale and part gift. The realized gain on the

sale of $5,670 is recognized as long-term capital gain.

Amount realized $ 275,000

Less: Adjusted basis * (269,330)

Realized gain $ 5,670

Recognized gain $ 5,670

*[($275,000/$485,000) X $475,000] = $269,330

• Alice is then deemed to have made a gift to Dan of $210,000

($485,000 - $275,000).

• With this information, Alice can make an informed selection

between the two options.

49](https://image.slidesharecdn.com/pptch14-130308122029-phpapp02/85/Ppt-ch-14-49-320.jpg)