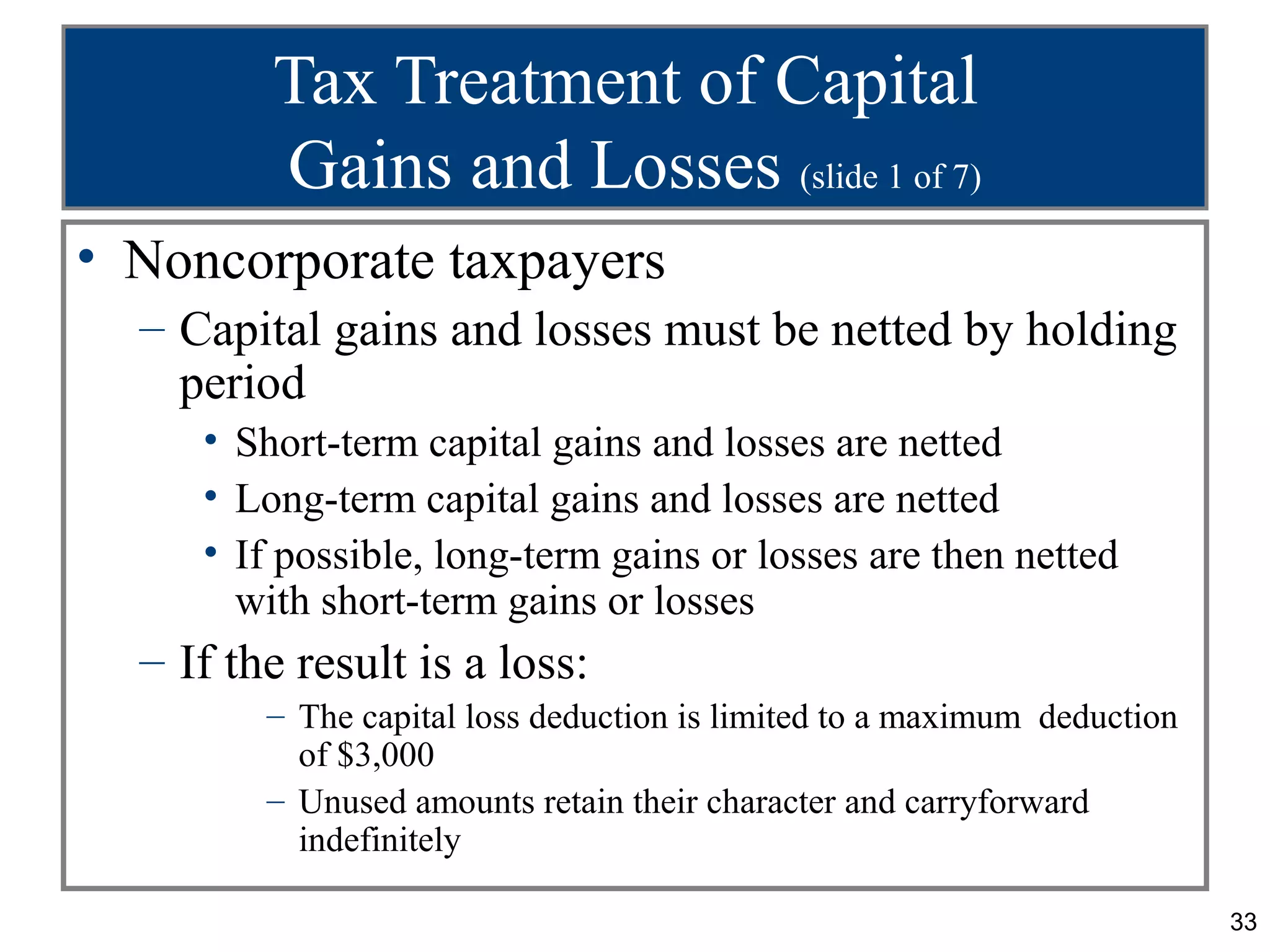

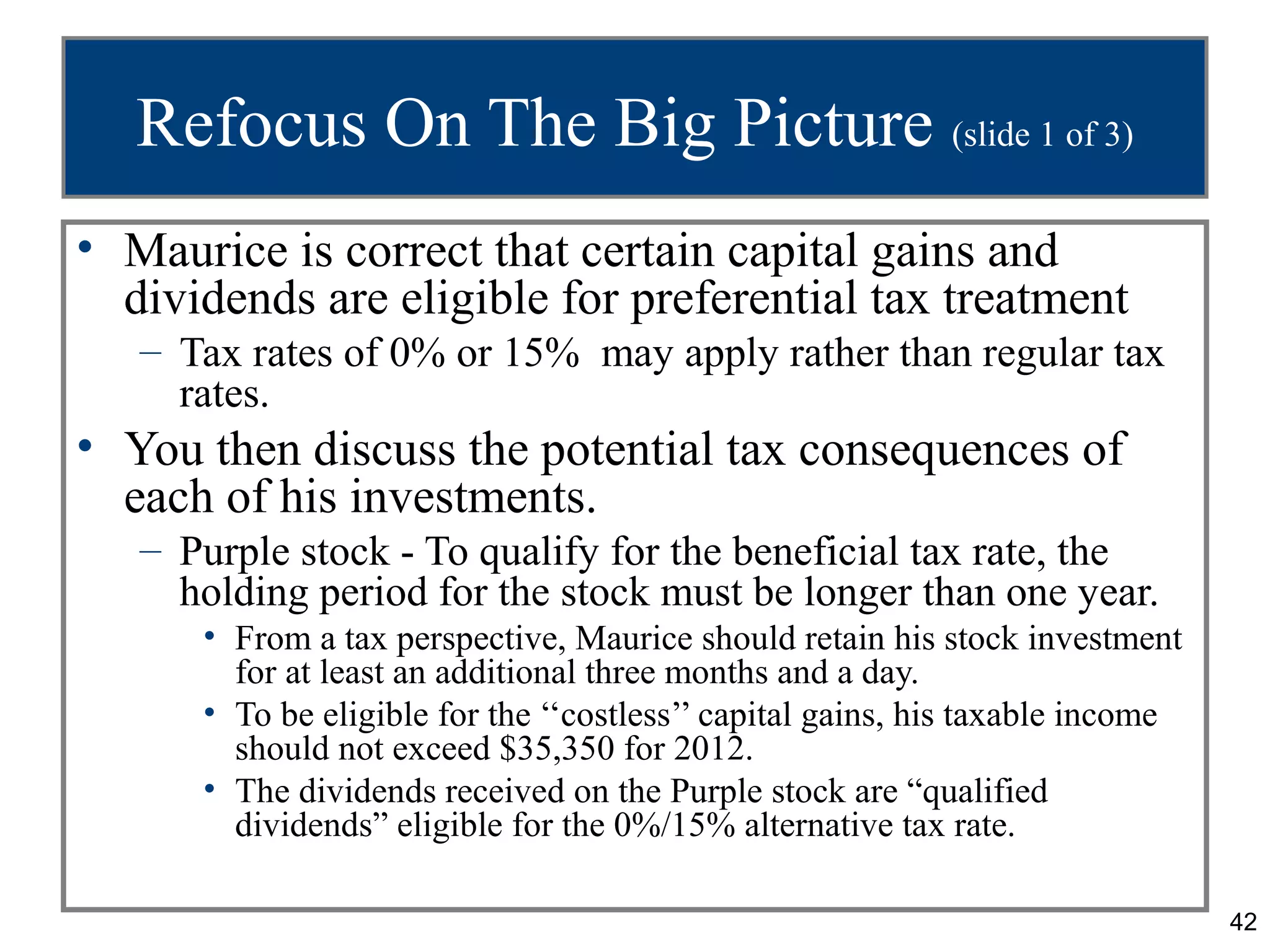

Maurice inherited $500,000 and invested it in various assets on the advice of a financial advisor. He is now considering selling some investments and moving money between bonds. The summary provides an overview of the tax treatment of capital gains and losses, including the classification of different assets as capital or ordinary assets, what qualifies as a "sale or exchange," and how gains or losses from various transactions are treated for tax purposes. It also notes that long-term capital gains may be taxed at a lower rate than ordinary gains.