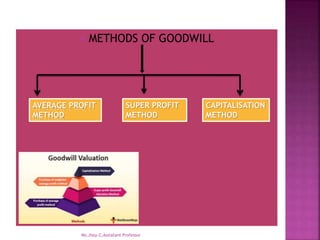

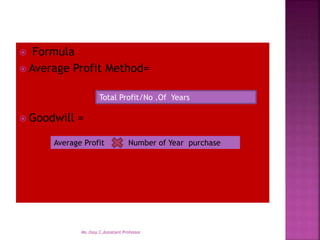

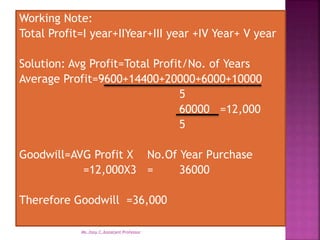

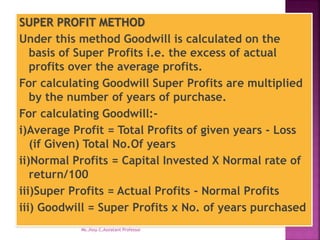

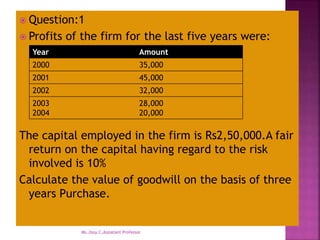

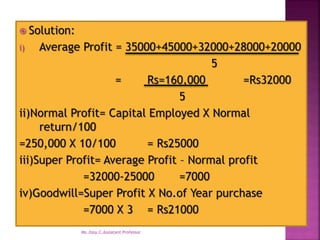

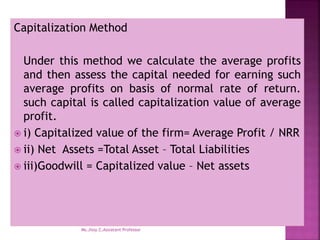

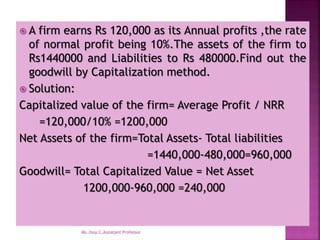

This document discusses different methods for valuing goodwill in a business. It defines goodwill as the reputation or good name of a business that can be expressed in monetary terms. It then explains three methods for calculating goodwill: the average profit method, which multiplies average profits by the number of years purchased; the super profit method, which considers excess profits over a normal rate of return; and the capitalization method, which calculates the capital needed to generate average profits based on a normal rate of return. For each method, it provides an example calculation to illustrate how to apply the method.