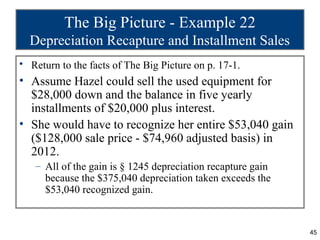

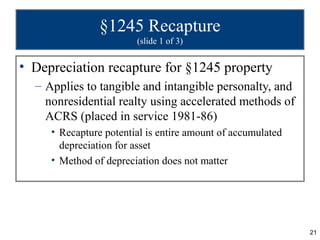

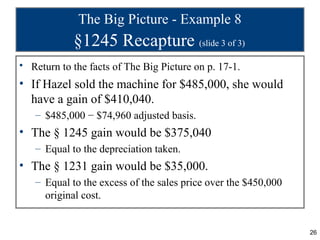

Hazel Brown owns an arts and crafts store. In 2012, she is planning to sell the store equipment she purchased in 2009 for $450,000 and has since depreciated.

- If she sells the equipment for $128,000, she will have a $53,040 gain. This full amount will be treated as ordinary income under §1245 recapture rules rather than potential §1231 capital gain, since the gain is less than her total depreciation of $375,040.

- If she sells the equipment for more than its original $450,000 cost, the portion of gain up to her $375,040 in total depreciation would be ordinary income under §12

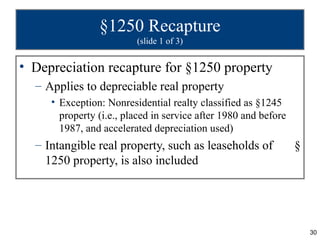

![§1250 Recapture

(slide 3 of 3)

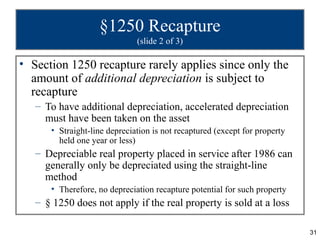

• The § 1250 recapture rules also apply to the

following property for which accelerated depreciation

was used:

– Additional first-year depreciation [§ 168(k)] exceeding

straight-line depreciation taken on leasehold

improvements, qualified restaurant property, and qualified

retail improvement property.

– Immediate expense deduction [§ 179(f)] exceeding straight-

line depreciation taken on leasehold improvements,

qualified restaurant property, and qualified retail

improvement property.

32](https://image.slidesharecdn.com/pptch17-130308122032-phpapp02/85/Ppt-ch-17-32-320.jpg)