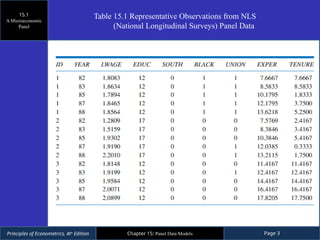

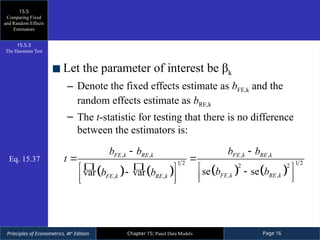

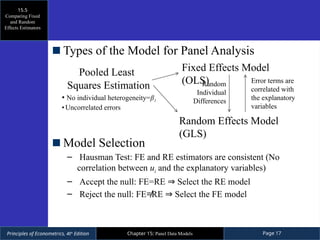

Chapter 15 of 'Principles of Econometrics' discusses panel data models, which integrate cross-sectional and time series data to analyze changes over time in multiple subjects. It differentiates between balanced and unbalanced panels and compares fixed effects and random effects models, highlighting the strengths and weaknesses of pooled least squares estimations and the implications of individual heterogeneity. The chapter also introduces the Hausman test for model selection between fixed and random effects models, providing guidance on when to use each model based on correlations between error components and explanatory variables.