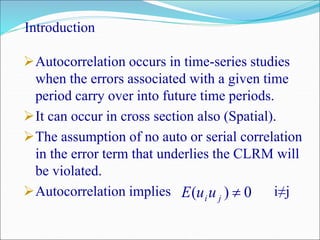

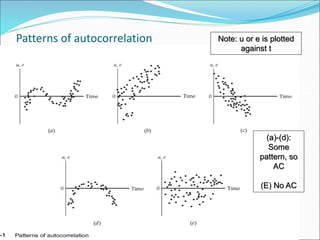

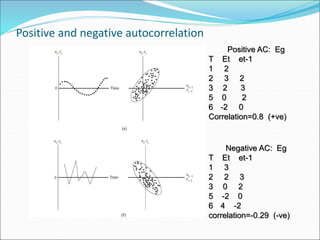

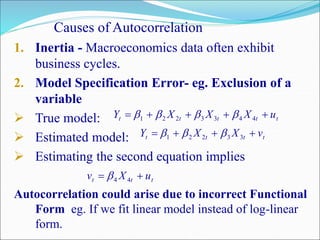

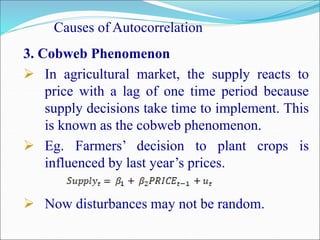

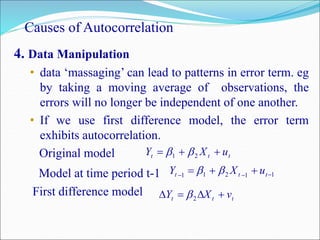

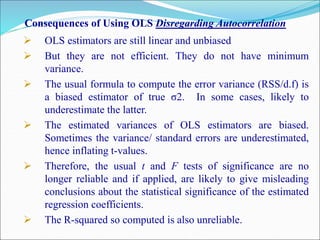

Autocorrelation occurs when errors in a time series model are correlated across time periods, violating the assumption of independent errors. This can be caused by inertia in the data, omitted variables, incorrect functional form, or data manipulation. Consequences of ignoring autocorrelation in OLS models include inefficient estimators, biased error variances, and unreliable t-tests, F-tests, and R-squared values. Autocorrelation can be identified through patterns in the error terms and estimated using measures like sample autocorrelation.