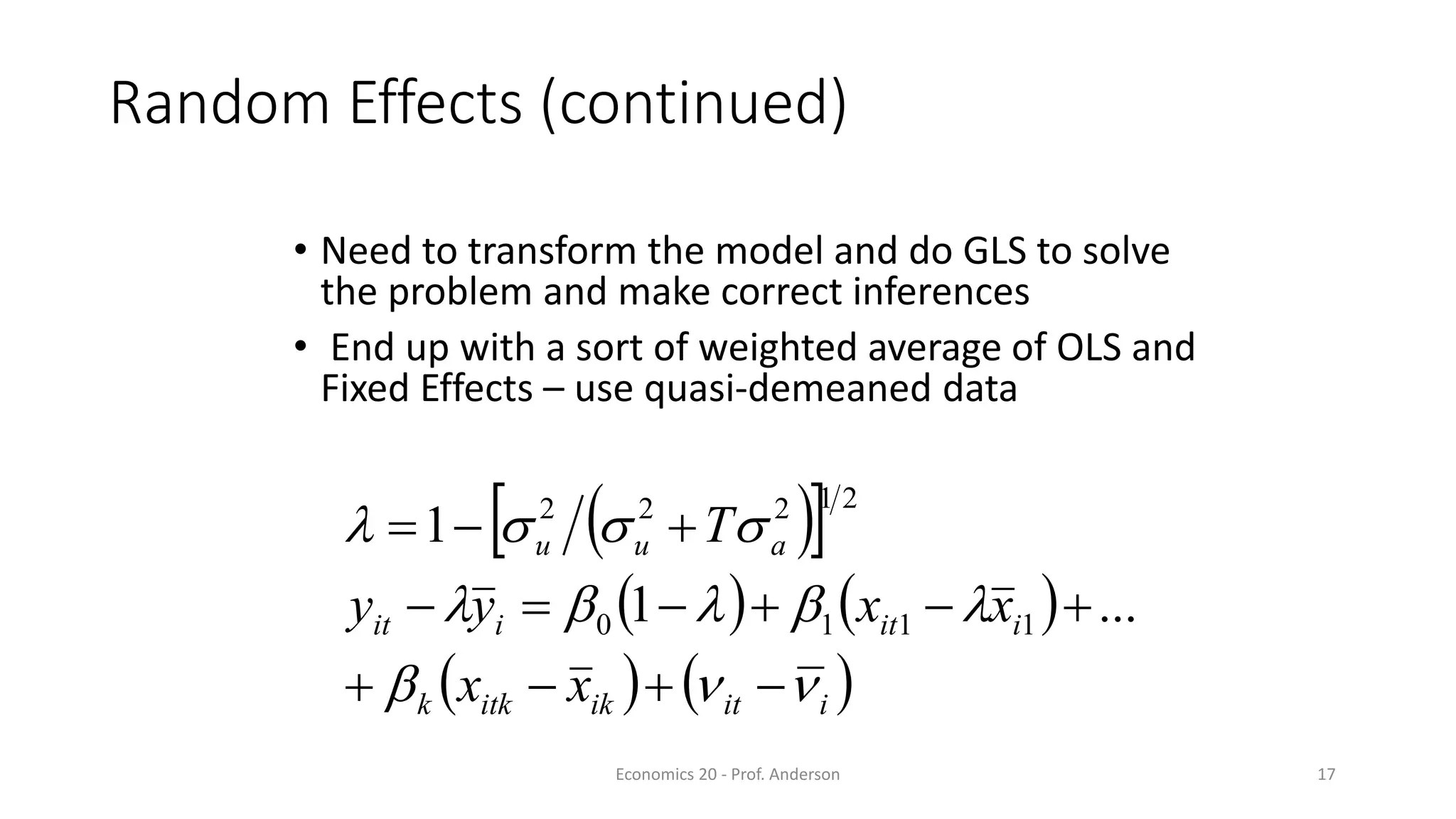

This document discusses various methods for analyzing panel data, including panel regression models, pooled cross-sections, difference-in-differences, fixed effects estimation, first-differences, random effects, and choosing between fixed and random effects models. Panel data allows observing the same cross-sectional units over time, enabling investigation of changes over time as well as addressing omitted variable bias through differencing methods that remove time-invariant characteristics.