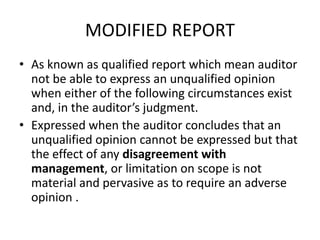

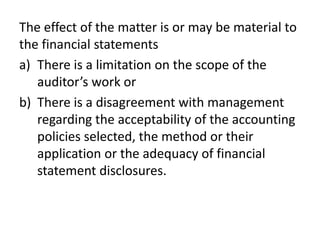

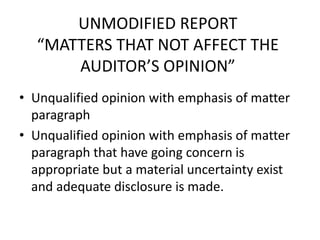

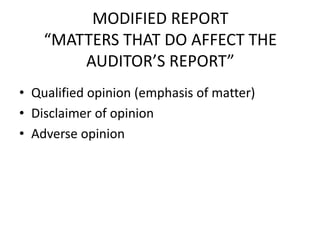

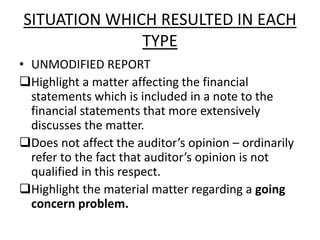

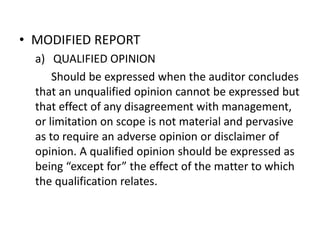

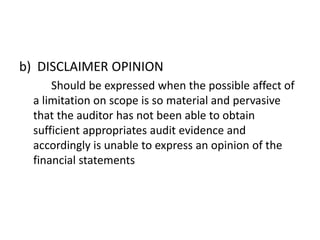

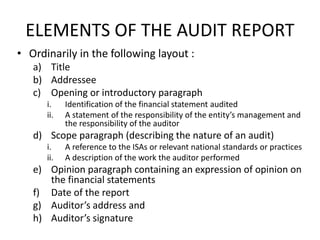

This document outlines the scope and content for Chapter 5 of an audit course. It covers understanding audit reports, the types of reports including unmodified and modified, and the elements and situations that result in each type of report. It also discusses the auditor's responsibilities, including maintaining professional skepticism and ensuring financial statements are free from material misstatement. The types of audits are defined as external, internal, and compliance audits.