The document discusses consolidated financial statements and the reporting entity. It provides answers to questions about consolidated financial statements and when they should be prepared. Key points include:

- Consolidated financial statements present the financial position and results of a parent company and its subsidiaries as if they were a single entity.

- They provide a better understanding of the total resources and revenue under a parent's control.

- Consolidation is appropriate when a parent has control over a majority of another entity's voting shares. Control is the primary criterion for consolidation.

- Noncontrolling shareholders may find separate subsidiary statements more useful than consolidated statements.

![Chapter 03 - The Reporting Entity and Consolidated Financial Statements

SOLUTIONS TO CASES

C3-1 Computation of Total Asset Values

The relationship observed should always be true. Assets reported by the parent company

include its investment in the net assets of the subsidiaries. These totals must be eliminated

in the consolidation process to avoid double counting. There also may be intercompany

receivables and payables between the companies that must be eliminated when

consolidated statements are prepared. In addition, inventory or other assets reported by the

individual companies may be overstated as a result of unrealized profits on intercorporate

purchases and sales. The amounts of the assets must be adjusted and the unrealized

profits eliminated in the consolidation process. In addition, subsidiary assets and liabilities

at the time the subsidiaries were acquired by the parent may have had fair values different

from their book values, and the amounts reported in the consolidated financial statements

would be based on those fair values.

C3-2 Accounting Entity [AICPA Adapted]

a.

(1) The conventional or traditional approach has been used to define the accounting

entity in terms of a specific firm, enterprise, or economic unit that is separate and apart

from the owner or owners and from other enterprises. The accounting entity has not

necessarily been defined in the same way as a legal entity. For example, partnerships

and sole proprietorships are accounted for separately from the owners although such a

distinction might not exist legally. Thus, it was recognized that the transactions of the

enterprise should be accounted for and reported on separately from those of the

owners.

An extension of this approach is to define the accounting entity in terms of an

economic unit that controls resources, makes and carries out commitments, and

conducts economic activity. In the broadest sense an accounting entity could be

established in any situation where there is an input-output relationship. Such an

accounting entity may be an individual, a profit-seeking or not-for-profit enterprise, or a

subdivision of a profit-seeking or not-for-profit enterprise for which a system of

accounts is maintained. This approach is oriented toward providing information to the

economic entity which it can use in evaluating its operating results and financial

position.

An alternative approach is to define the accounting entity in terms of an area of

economic interest to a particular individual, group, or institution. The boundaries of

such an economic entity would be identified by determining (a) the interested

individual, group, or institution and (b) the nature of that individual's, group's, or

institution's interest. In theory a number of separate legal entities or economic units

could be included in a single accounting entity. Thus, this approach is oriented to the

external users of financial reports.

3-5](https://image.slidesharecdn.com/chap003-131230190613-phpapp02/85/solusi-manual-advanced-acc-zy-Chap003-5-320.jpg)

![Chapter 03 - The Reporting Entity and Consolidated Financial Statements

Amortization of the fair value increment in March’s 2008 consolidated income statement

was $9,750 ($97,500/10). Under FASB Statement No. 141R, the annual write-off would

have been $15,000 ($150,000/10).

Primary citations:

FASB 141

FASB 141R

C3-4 Joint Venture Investment

a. ARB No. 51 and FASB Interpretation No. 46R (FIN 46R) are the primary authoritative

pronouncements dealing with the types of ownership issues arising in this situation. Under

normal circumstances, the company holding majority ownership in another entity is

expected to consolidate that entity in preparing its financial statements. Thus, unless other

circumstances dictate, Dell should have planned to consolidate DFS as a result of its 70

percent equity ownership. While FIN 46R is a highly complex document and greater detail

of the ownership agreement may be needed to decide this matter, the interpretation

appears to permit equity holders to avoid consolidating an entity if the equity holders (1) do

not have the ability to make decisions about the entity’s activities, (2) are not obligated to

absorb the expected losses of the entity if they occur, or (3) do not have the right to receive

the expected residual returns of the entity if they occur [FIN 46R, Par. 5b].

It does appear that Dell and CIT Group do, in fact, have the ability to make operating and

other decisions about DFS, they must absorb losses in the manner set forth in the

agreement, and they must share residual returns in the manner set forth in the agreement.

Control appears to reside with the equity holders and should not provide a barrier to

consolidation.

Dell might argue that it need not consolidate DFS because the joint venture agreement

apparently did allocate losses initially to CIT. However, these losses were to be recovered

from future income. Thus, both Dell and CIT were to be affected by the profits and losses of

DFS. Given the importance of DFS to Dell and representation on the board of directors by

CIT, DFS would not be expected to sustain continued losses.

In light of the joint venture arrangement and Dell’s ownership interest, consolidation by Dell

seems appropriate and there seems to be little support for Dell not consolidating DFS.

b. Dell fully consolidated DFS in its latest financial statements in which the joint venture is

reported. Dell indicated that it is the primary beneficiary of DFS. Under the revised joint

venture agreement, both profits and losses of DFS are shared 70 percent to Dell and 30

percent to CIT. Thus, with a 70 percent ownership interest and an allocation of losses in

addition to profits, the requirement to consolidate DFS is quite clear. Note (from Dell’s SEC

Form 10-K) that Dell has an option to purchase CIT’s interest in DFS. Thus, DFS may

become wholly owned by Dell.

c. Yes, Dell does employ off-balance sheet financing. It sells customer financing

receivables to qualifying special purpose entities. In accordance with current standards,

qualifying SPEs are not consolidated.

3-8](https://image.slidesharecdn.com/chap003-131230190613-phpapp02/85/solusi-manual-advanced-acc-zy-Chap003-8-320.jpg)

![Chapter 03 - The Reporting Entity and Consolidated Financial Statements

C3-5 Need for Consolidation [AICPA Adapted]

a. All identifiable assets acquired and liabilities assumed in a business combination,

whether or not shown in the financial statements of Moore, should be valued at their fair

values at the date of acquisition. Then, the excess of the fair value of the consideration

given by Sharp to acquire its ownership interest in Moore, plus the fair value of the

noncontrolling interest, over the sum of the amounts assigned to the identifiable assets

acquired less liabilities assumed should be recognized as goodwill.

b. Consolidated financial statements should be prepared in order to present the financial

position and operating results for an economic entity in a manner more meaningful than if

separate statements are prepared.

c. The usual first necessary condition for consolidation is a controlling financial interest.

Under current accounting standards, a controlling financial interest is assumed to exist

when one company, directly or indirectly, owns over fifty percent of the outstanding voting

shares of another company.

C3-6 What Company is That?

Information for answering this case can be obtained from the SEC's EDGAR database

(www.sec.gov) and from the home pages for Viacom (www.viacom.com), ConAgra

(www.conagra.com), and Yum! Brands (www.yum.com).

a.. Viacom is well known for ownership of companies in the entertainment industry. On

January 1, 2006, Viacom divided its operations by spinning off to Viacom shareholders

ownership of CBS Corporation. Following the division Viacom continues to own MTV,

Nickelodeon, Nick at Nite, Comedy Central, CMT, Country Music Television, Paramount

Pictures, Paramount Home Entertainment, SKG, BET, Dreamworks, and other related

companies. Summer Redstone holds controlling interest in both Viacom and CBS and

serves as Executive Chairman of both companies.

b. Some of the well-known product lines of ConAgra include Healthy Choice, Pam, Peter

Pan, Slim Jim, Swill Miss, Orville Redenbacher’s, Hunt’s, Reddi-Wip, VanCamp, Libby’s,

LaChoy, Egg Beaters, Wesson, Banquet, Blue Bonnet, Chef Boyardee, Parkay, and

Rosarita.

c. Yum! Brands, Inc., is the world’s largest quick service restaurant company. Well known

brands include Taco Bell, A&W, KFC, and Pizza Hut. Yum was originally spun off from

Pepsico in 1997. Prior to its current name, Yum’s name was TRICON Global Restaurants,

Inc.

3-9](https://image.slidesharecdn.com/chap003-131230190613-phpapp02/85/solusi-manual-advanced-acc-zy-Chap003-9-320.jpg)

![Chapter 03 - The Reporting Entity and Consolidated Financial Statements

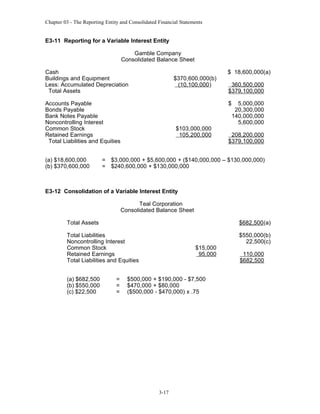

SOLUTIONS TO EXERCISES

E3-1 Multiple-Choice Questions on Consolidation Overview

[AICPA Adapted]

1. d

2. c

3. b

4. a

5. b

E3-2 Multiple-Choice Questions on Variable Interest Entities

1. c

2. d

3. a

4. b

5. b

E3-3 Multiple-Choice Questions on Consolidated Balances [AICPA Adapted]

1. a

2. b

3. b

4. c

5. a

3-14](https://image.slidesharecdn.com/chap003-131230190613-phpapp02/85/solusi-manual-advanced-acc-zy-Chap003-14-320.jpg)

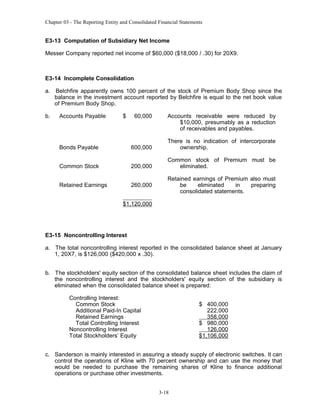

![Chapter 03 - The Reporting Entity and Consolidated Financial Statements

E3-4 Multiple-Choice Questions on Consolidation Overview

[AICPA Adapted]

1. d

2. a

3. b

4. d

E3-5 Balance Sheet Consolidation

a. $470,000 = $470,000 - $55,000 + $55,000

b. $605,000 = ($470,000 - $55,000) + $190,000

c. $405,000 = $270,000 + $135,000

d. $200,000 (as reported by Guild Corporation)

E3-6 Balance Sheet Consolidation with Intercompany Transfer

a. $645,000 = $510,000 + $135,000

b. $845,000 = $510,000 + $350,000 - $15,000

c. $655,000 = ($320,000 + $135,000) + $215,000 - $15,000

d. $190,000 (as reported by Potter Company)

E3-7 Intercompany Transfers

a. Consolidated current assets will be overstated by $37,000 if no eliminations are made.

Inventory will be overstated by $25,000 and accounts receivable will be overstated by

$12,000.

b. Net working capital will be overstated by $25,000 due to unrealized intercompany

inventory profits. The overstatement of accounts payable and accounts receivable will

offset.

c. Net income of the period following will be understated by $25,000 as a result of

overstating cost of goods sold by that amount.

3-15](https://image.slidesharecdn.com/chap003-131230190613-phpapp02/85/solusi-manual-advanced-acc-zy-Chap003-15-320.jpg)

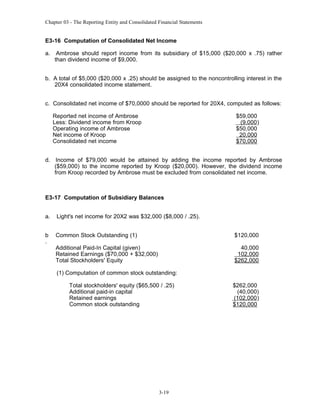

![Chapter 03 - The Reporting Entity and Consolidated Financial Statements

E3-18 Subsidiary Acquired at Net Book Value

Banner Corporation and Subsidiary

Consolidated Balance Sheet

December 31, 20X8

Cash ($40,000 + $20,000)

Accounts Receivable ($120,000 + $70,000)

Inventory ($180,000 + $90,000)

Fixed Assets (net) ($350,000 + $240,000)

Total Assets

$

60,000

190,000

270,000

590,000

$1,110,000

Accounts Payable ($65,000 + $30,000)

Notes Payable ($350,000 + $220,000)

Common Stock

Retained Earnings

Total Liabilities and Stockholders' Equity

$

95,000

570,000

150,000

295,000

$1,110,000

E3-19* Applying Alternative Accounting Theories

a.

Proprietary theory:

Total revenue [$400,000 + ($200,000 x .75)]

Total expenses [$280,000 + ($160,000 x .75)]

Consolidated net income [$120,000 + ($40,000 x .75)]

b.

Parent company theory:

Total revenue ($400,000 + $200,000)

Total expenses ($280,000 + $160,000)

Consolidated net income [$120,000 + ($40,000 x .75)]

c.

$600,000

440,000

150,000

Entity theory:

Total revenue ($400,000 + $200,000)

Total expenses ($280,000 + $160,000)

Consolidated net income ($120,000 + $40,000)

d.

$550,000

400,000

150,000

$600,000

440,000

160,000

Current accounting practice:

Total revenue ($400,000 + $200,000)

Total expenses ($280,000 + $160,000)

Consolidated net income ($120,000 + $40,000)

3-20

$600,000

440,000

160,000](https://image.slidesharecdn.com/chap003-131230190613-phpapp02/85/solusi-manual-advanced-acc-zy-Chap003-20-320.jpg)

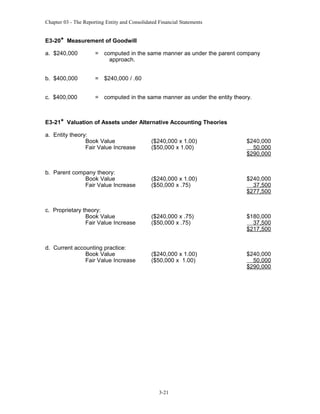

![Chapter 03 - The Reporting Entity and Consolidated Financial Statements

E3-22* Reported Income under Alternative Accounting Theories

a. Entity theory:

Total revenue ($410,000 + $200,000)

Total expenses ($320,000 + $150,000)

Consolidated net income [$90,000 + ($50,000 x 1.00)]

$610,000

470,000

140,000

b. Parent company theory:

Total revenue ($410,000 + $200,000)

Total expenses ($320,000 + $150,000)

Consolidated net income [$90,000 + ($50,000 x .80)]

$610,000

470,000

130,000

c. Proprietary theory:

Total revenue [$410,000 + ($200,000 x .80)]

Total expenses [$320,000 + ($150,000 x .80)]

Consolidated net income [$90,000 + ($50,000 x .80)]

$570,000

440,000

130,000

d. Current accounting practice:

Total revenue ($410,000 + $200,000)

Total expenses ($320,000 + $150,000)

Consolidated net income [$90,000 + (50,000 x 1.00)]

E3-23* Acquisition of Majority Ownership

a. Net identifiable assets: $690,000 = $520,000 + $170,000

b. Goodwill: $30,000 = $200,000 - $170,000

c. Noncontrolling interest: $50,000 = $200,000 x .25

3-22

$610,000

470,000

140,000](https://image.slidesharecdn.com/chap003-131230190613-phpapp02/85/solusi-manual-advanced-acc-zy-Chap003-22-320.jpg)

![Chapter 03 - The Reporting Entity and Consolidated Financial Statements

SOLUTIONS TO PROBLEMS

P3-24 Multiple-Choice Questions on Consolidated and Combined Financial

Statements [AICPA Adapted]

1. d

2. c

3. b

4. c

P3-25 Intercompany Sales

a. Net income will be overstated by $30,000 ($50,000 - $20,000) if no adjustment is made

to eliminate the effects of the intercompany transfer.

b.

Knight Corporation and Subsidiary

Consolidated Income Statement

Year Ended December 31, 20X6

Sales

Cost of goods sold

Consolidated net income

c.

$300,000

(200,000 )

$100,000

Knight Corporation and Subsidiary

Consolidated Income Statement

Year Ended December 31, 20X6

Sales

Cost of goods sold

Consolidated net income

$250,000

(180,000 )

$ 70,000

d. Each of the three income statement items is changed when the effects of the

intercompany sale are eliminated.

3-23](https://image.slidesharecdn.com/chap003-131230190613-phpapp02/85/solusi-manual-advanced-acc-zy-Chap003-23-320.jpg)

![Chapter 03 - The Reporting Entity and Consolidated Financial Statements

P3-27 Determining Net Income of Parent Company

Consolidated net income

Income of subsidiary ($15,200 / .40)

Income from Tally's operations

$164,300

(38,000)

$126,300

P3-28 Reported Balances

a.

The investment balance reported by Roof will be $192,000.

b.

Total assets will increase by $310,000.

c.

Total liabilities will increase by $95,000.

d.

The amount of goodwill for the entity as a whole will be $25,000

[($192,000 + $48,000) - ($310,000 - $95,000)].

e.

Noncontrolling interest will be reported at $48,000 ($240,000 x .20).

P3-29 Acquisition Price

a.

$57,000 = ($120,000 - $25,000) x .60

b.

$81,000 = ($120,000 - $25,000) + $40,000 - $54,000

c.

$48,800 = ($120,000 - $25,000) + $27,000 - $73,200

3-25](https://image.slidesharecdn.com/chap003-131230190613-phpapp02/85/solusi-manual-advanced-acc-zy-Chap003-25-320.jpg)

![Chapter 03 - The Reporting Entity and Consolidated Financial Statements

P3-35 Parent Company and Consolidated Amounts

a.

b.

Common stock of Tempro Company

on December 31, 20X5

Retained earnings of Tempro Company

January 1, 20X5

Sales for 20X5

Less: Expenses

Dividends paid

Retained earnings of Tempro Company

on December 31, 20X5

Net book value on December 31, 20X5

Proportion of stock acquired by Quoton

Purchase price

Net book value on December 31, 20X5

Proportion of stock held by

noncontrolling interest

Balance assigned to noncontrolling interest

$ 90,000

$130,000

195,000

(160,000)

(15,000)

150,000

$240,000

x

.80

$192,000

$240,000

x

.20

$ 48,000

c. Consolidated net income is $143,000. None of the 20X5 net income of Tempro

Company was earned after the date of purchase and, therefore, none can be included

in consolidated net income.

d. Consolidate net income would be $178,000 [$143,000 + ($195,000 - $160,000)].

3-30](https://image.slidesharecdn.com/chap003-131230190613-phpapp02/85/solusi-manual-advanced-acc-zy-Chap003-30-320.jpg)

![Chapter 03 - The Reporting Entity and Consolidated Financial Statements

P3-36 Parent Company and Consolidated Balances

a.

b.

Balance in investment account, December 31, 20X7

Exacto net assets on date of acquisition

Cumulative earnings since acquisition

Cumulative dividends since acquisition

Net assets on December 31, 20X7

Proportion of stock held by True Corporation

Book value of claim by True Corporation

Unamortized differential December 31, 20X7

Number of years remaining for amortization

Annual amortization

Total years of amortization

Amount paid in excess of book value

$260,000

110,000

(46,000)

$324,000

x

.75

$259,800

(243,000)

$ 16,800

÷

7

$ 2,400

x

10

$ 24,000

$32,000 ($24,000 / .75) will be added to buildings and equipment each year.

c.

$9,600 ($3,200 x 3 years) will be added to accumulated depreciation at

December 31, 20X7.

d.

$86,600 = [($324,000 + $32,000 - $9,600) x .25] will be assigned to

noncontrolling interest in the consolidated balance sheet prepared at December 31,

20X7.

3-31](https://image.slidesharecdn.com/chap003-131230190613-phpapp02/85/solusi-manual-advanced-acc-zy-Chap003-31-320.jpg)

![Chapter 03 - The Reporting Entity and Consolidated Financial Statements

P3-38 Comprehensive Problem: Consolidated Financial Statements

a.

Cash: $71,000 + $33,000 = $104,000

b.

Receivables (net): $431,000 + $122,000 - $45,000 = $508,000

c.

Inventory: $909,000 + $370,000 - ($45,000 - $34,000) = $1,268,000

d.

Investment in Mangle Stock: Not reported in consolidated statements

e.

Equipment (net): $1,528,000 + $475,000 + $25,000(1) - $5,000(2) = $2,023,000

(1) $25,000 = [$55,000 – ($1,250,000 - $1,220,000)]

(2) $5,000 = $25,000 / 5 years

f.

Goodwill: ($1,250,000 - $1,220,000) = $30,000

g.

Current Payables: $227,000 + $95,000 - $45,000 = $277,000

h.

Common Stock (par): $1,000,000

i.

Sales Revenue: $8,325,000 + $2,980,000 - $45,000 = $11,260,000

j.

Cost of Goods Sold: $5,150,000 + $2,010,000 - $34,000 = $7,126,000

k.

Depreciation Expense: $302,000 + $85,000 + $5,000 = $392,000

3-33](https://image.slidesharecdn.com/chap003-131230190613-phpapp02/85/solusi-manual-advanced-acc-zy-Chap003-33-320.jpg)

![Chapter 03 - The Reporting Entity and Consolidated Financial Statements

P3-39* Balance Sheet Amounts under Alternative Accounting Theories

a.

Proprietary theory:

Cash and inventory [$300,000 + ($80,000 x .75)]

Buildings and Equipment (net)

[$400,000 + ($180,000 x .75)]

Goodwill [$210,000 - ($260,000 x .75)]

b.

$380,000

565,000

15,000

Entity theory:

Cash and inventory ($300,000 + $80,000)

Buildings and Equipment (net)

($400,000 + $180,000)

Goodwill [($210,000 / .75) - $260,000]

d.

535,000

15,000

Parent company theory:

Cash and inventory ($300,000 + $80,000)

Buildings and Equipment (net)

[$400,000 + $120,000 + ($60,000 x .75)]

Goodwill [$210,000 – ($260,000 x .75)]

c.

$360,000

$380,000

580,000

20,000

Current accounting practice:

Cash and inventory ($300,000 + $80,000)

Buildings and Equipment (net)

($400,000 + $180,000)

Goodwill [($210,000 / .75) - $260,000]

3-34

$380,000

580,000

20,000](https://image.slidesharecdn.com/chap003-131230190613-phpapp02/85/solusi-manual-advanced-acc-zy-Chap003-34-320.jpg)