This document contains chapter 4 from an accounting textbook on consolidation of wholly owned subsidiaries. It includes questions and answers on consolidation topics such as:

- The purpose of eliminating entries in consolidation vs adjusting entries

- How differentials arise from acquisitions and how they are treated

- How a subsidiary's equity accounts are eliminated in consolidation

- How pushdown accounting can eliminate differentials

It also includes case studies on:

- Why consolidation is necessary to prepare consolidated financial statements

- Issues around presenting consolidated financial statements for a company with diverse subsidiaries

- Treatment of an unprofitable subsidiary in consolidation

- Assigning an acquisition differential to a subsidiary's assets and liabilities

- Implications of a subsidiary having negative

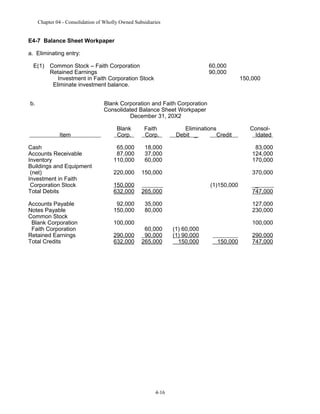

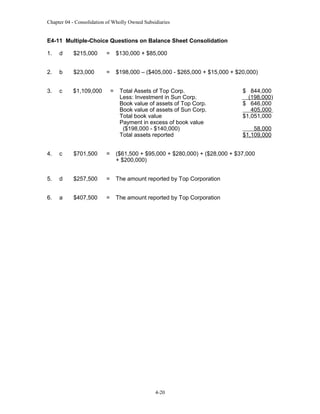

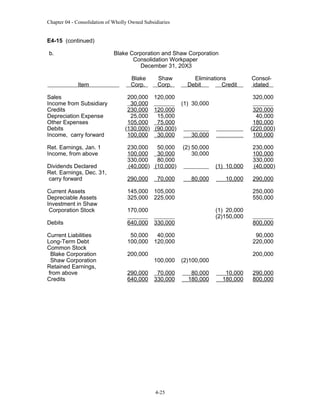

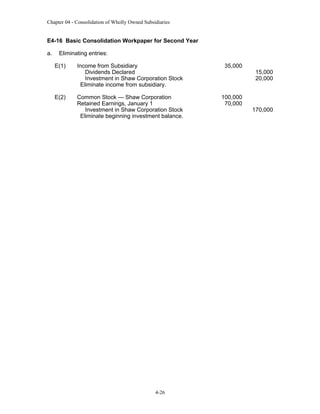

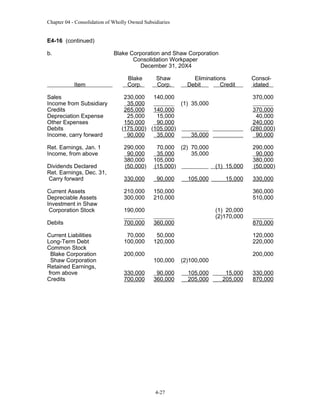

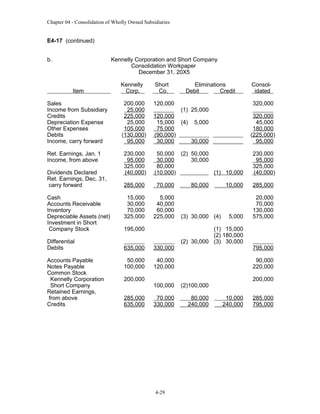

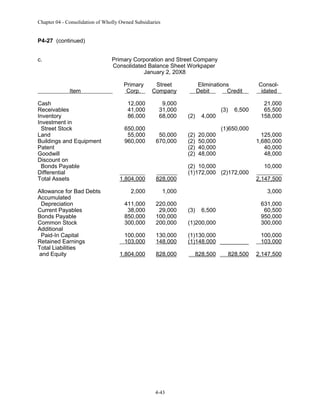

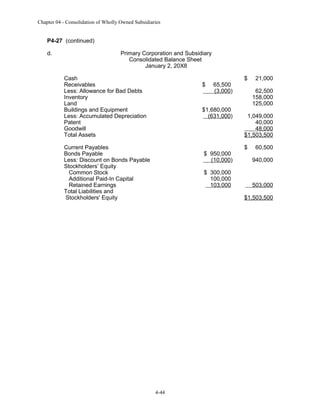

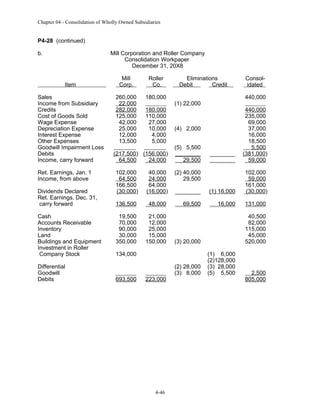

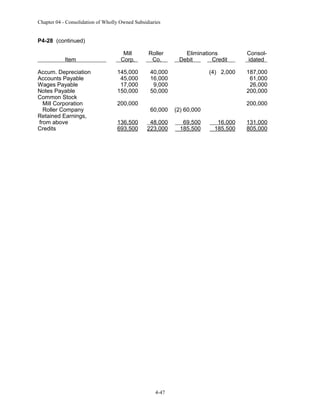

![Chapter 04 - Consolidation of Wholly Owned Subsidiaries

C4-2 Account Presentation

MEMO

To:

From:

Re:

Chief Accountant

Prime Company

, Accounting Staff

Combining Broadly Diversified Balance Sheet Accounts

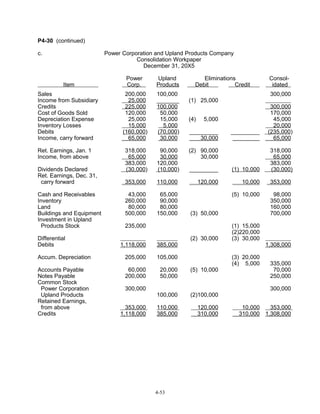

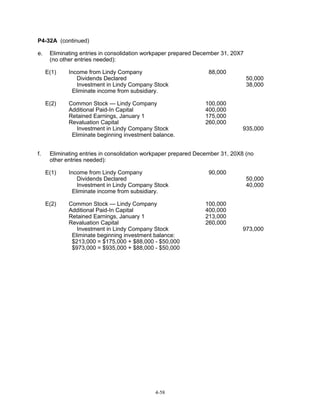

Many manufacturing and merchandising enterprises excluded finance, insurance, real

estate, leasing, and perhaps other types of subsidiaries from consolidation prior to 1987

on the basis of “nonhomogeneous” operations. Companies generally argued that the

accounts of these companies were dissimilar in nature and combining them in the

consolidated financial statements would mislead investors. FASB 94 specifically

eliminated the exception for nonhomogeneous operations. [FASB 94, Par. 9] FASB 160

affirms the requirement for consolidating entities in which a controlling financial interest

is held.

Prime Company controls companies in very different industries and combining the

accounts of its subsidiaries may lead to confusion by some investors; however, it may be

equally confusing to provide detailed listings of assets and liabilities by industry or other

breakdowns in the consolidated balance sheet. The actual number of assets and

liabilities presented in the consolidated balance sheet must be carefully considered, but

is the decision of Prime’s management.

It is important to recognize that the notes to the consolidated financial statements are

regarded as an integral part of the financial statements and Prime Company is required

to include in its notes to the financial statements certain information on its reportable

segments [FASB 131]. Because of the diversity of its ownership, Prime may wish to

provide more than the minimum disclosures specified in FASB 131. Segment

information appears to be used quite broadly by investors and permits the company to

provide sufficient detail to assist the financial statement user in gaining a better

understanding of the various operating divisions of the company.

You have requested information on those situations in which it may not be appropriate to

combine similar appearing accounts of two or more subsidiaries. The following is a

partial listing of such situations: (a) the accounts of a subsidiary should not be included

along with other subsidiaries if control of the assets and liabilities does not rest with

Prime Company, as when a subsidiary is in receivership; (b) while the assets and liability

accounts of the subsidiary should be combined with the parent, the equity account

balances should not; (c) negative account balances in cash or accounts receivable

should be reclassified as liabilities rather than being added to the positive

4-5](https://image.slidesharecdn.com/chap004-131230190651-phpapp01/85/solusi-manual-advanced-acc-zy-Chap004-5-320.jpg)

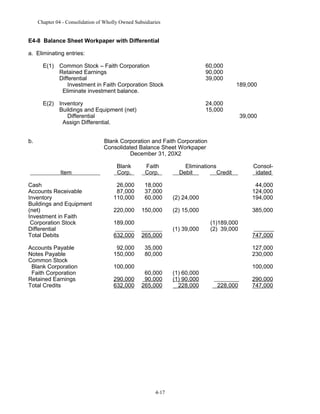

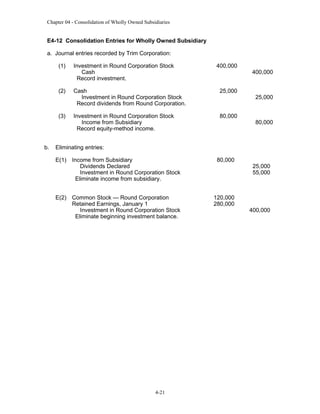

![Chapter 04 - Consolidation of Wholly Owned Subsidiaries

C4-3 Consolidating an Unprofitable Subsidiary

MEMO

TO:

Chief Accountant

Amazing Chemical Corporation

FROM:

Re:

, Accounting Staff

Consolidation of Unprofitable Boatyard

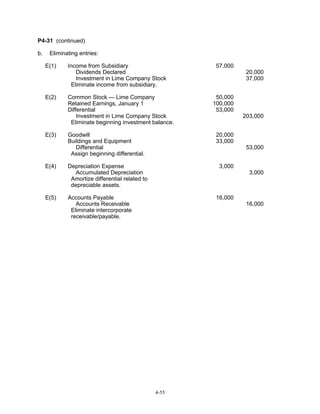

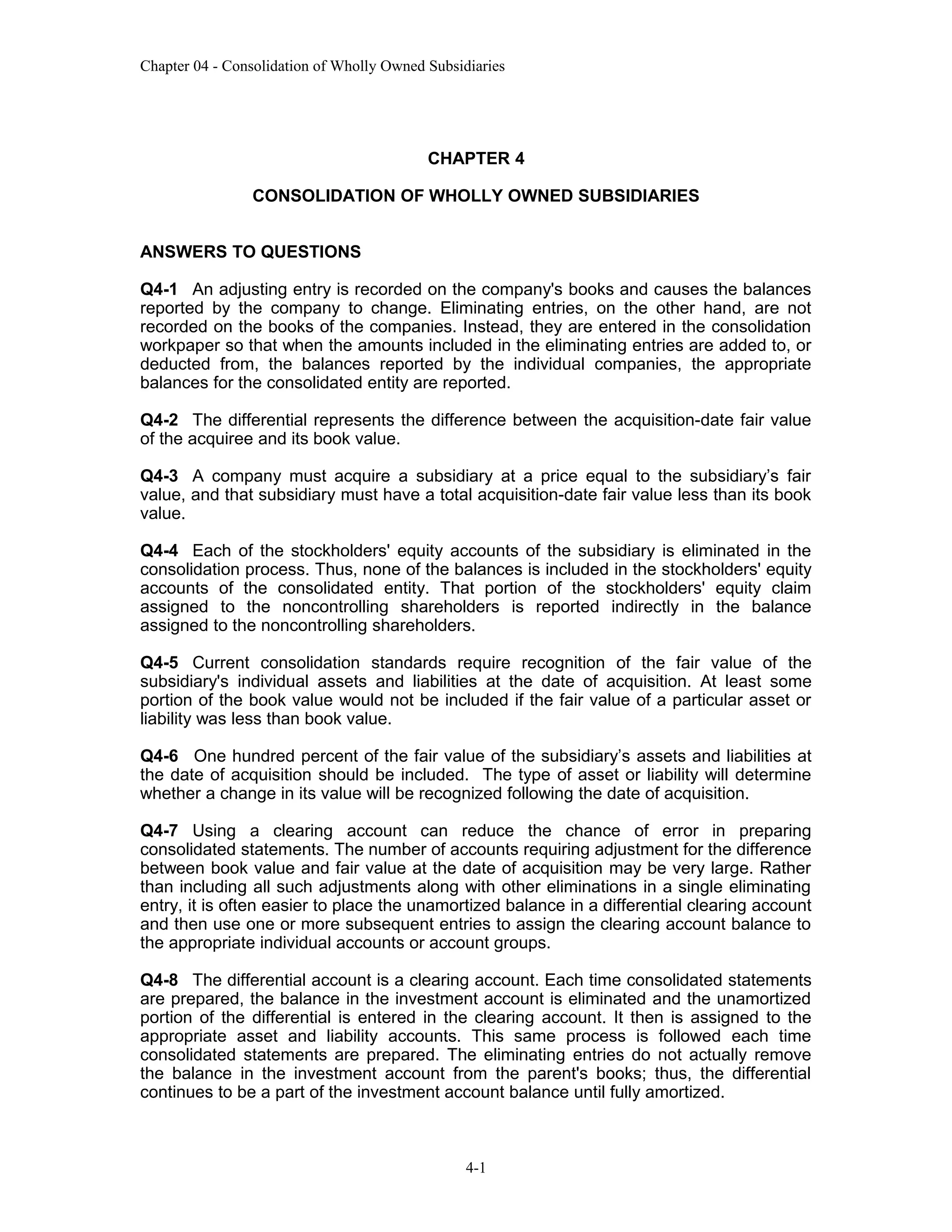

This memo is intended to provide recommendations on the presentation of the boatyard

in Amazing Chemical’s consolidated financial statements. Amazing Chemical

Corporation currently has full ownership of the boatyard and should fully consolidate the

boatyard in its financial statements. Consolidated statements should be prepared when

a company directly or indirectly has a controlling financial interest in one or more other

companies. [ARB 51, Par. 1] This requirement has been reaffirmed by FASB 160.

Prior to the issuance of FASB 94, Amazing Chemical may have justified excluding the

boatyard from consolidation based on the differences in operating characteristics

between the subsidiary and the parent company; however, FASB 94 specifically deleted

the nonhomogeneity exclusion [FASB 94, Par. 9]. Thus, Amazing Chemical appears to

be following generally accepted accounting procedures in fully consolidating the

boatyard in its financial statements and should continue to do so.

The operations of the boatyard appear to be distinct from the other operations of the

parent company and its losses appear to be sufficient to establish it as a reportable

segment [FASB 131, Par. 10 and 18]. While the operating losses of the boatyard may

not be evident in analyzing the consolidated income statement, a review of the notes to

the consolidated statements should provide adequate disclosure of its operations as a

reportable segment. The financial statements for the current period should contain these

disclosures and if prior period statements have not included the boatyard as a reportable

segment it may be necessary to restate those statements.

Failure of the president of Amazing Chemical to receive approval by the board of

directors for the purchase of the boatyard and his subsequent actions to keep

information about its operations from the board members appears to be a serious breach

of ethics. These actions by the president should immediately be brought to the attention

of the board of directors for appropriate action by the board.

Primary citations:

ARB 51, Par. 1

FASB 94, Par. 9

FASB 131, Par. 10 and 18

FASB 160

4-7](https://image.slidesharecdn.com/chap004-131230190651-phpapp01/85/solusi-manual-advanced-acc-zy-Chap004-7-320.jpg)

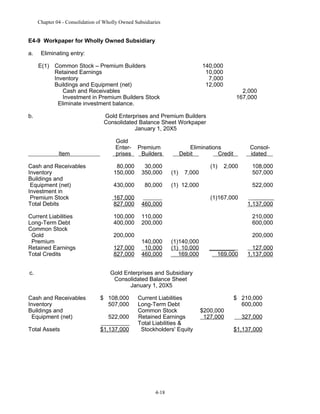

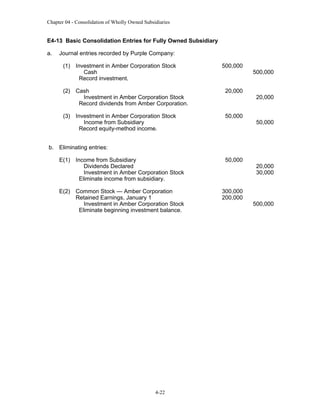

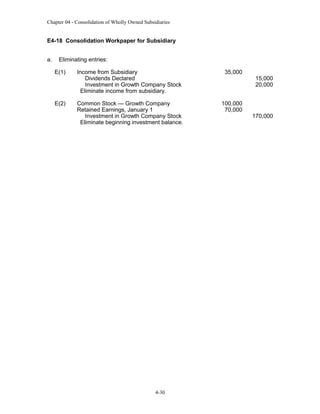

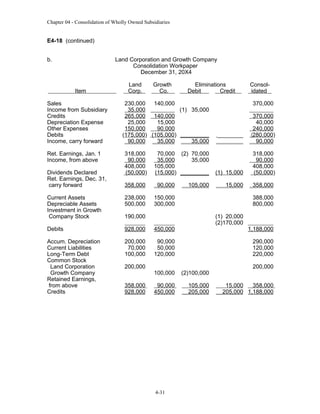

![Chapter 04 - Consolidation of Wholly Owned Subsidiaries

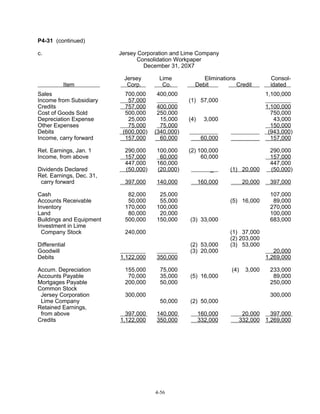

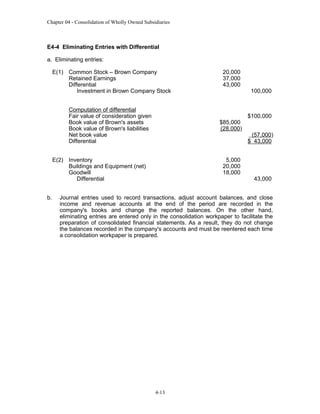

SOLUTIONS TO EXERCISES

E4-1 Multiple-Choice Questions on Consolidation Process

1. c

2. d [AICPA Adapted]

3. d

4. b

5. a

E4-2 Multiple-Choice Questions on Consolidation [AICPA Adapted]

1. c

2. a

3. d

4. c $400,000 = $1,700,000 - $1,300,000

E4-3 Basic Elimination Entry

Common Stock – Broadway Corporation

Additional Paid-In Capital

Retained Earnings

Investment in Broadway Common Stock

4-12

200,000

300,000

100,000

600,000](https://image.slidesharecdn.com/chap004-131230190651-phpapp01/85/solusi-manual-advanced-acc-zy-Chap004-12-320.jpg)

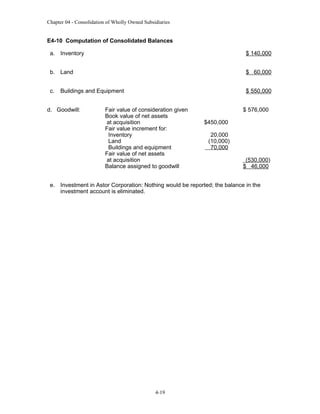

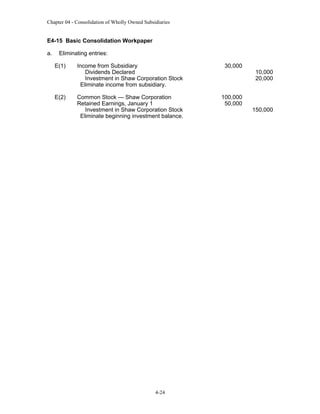

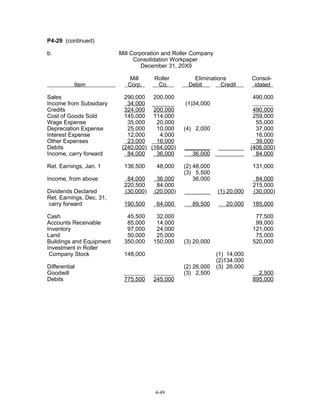

![Chapter 04 - Consolidation of Wholly Owned Subsidiaries

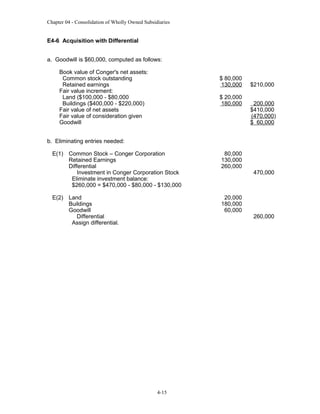

P4-22 Balance Sheet Consolidation [AICPA Adapted]

Case Inc. and Frey Inc.

Consolidated Balance Sheet Workpaper

December 31, 20X4

Item

Cash

Accounts and

Other Receivables

Inventory

Land

Deprec. Assets (net)

Investment in

Frey Inc. Stock

Long-Term Investments

and Other Assets

Differential

Total Debits

Accounts Payable

and Other Current

Liabilities

Long-Term Debt

Common Stock, $25 Par

Additional Paid-In

Capital

Retained Earnings

Total Credits

Case

Inc.

Frey

Inc.

825,000

330,000

2,140,000

2,310,000

650,000

4,575,000

Eliminations

Debit

Credit

Consolidated

1,155,000

835,000

1,045,000

300,000 (2)

1,980,000

2,975,000

3,355,000

1,200,000

6,555,000

250,000

2,680,000

(1)2,680,000

865,000

385,000

14,045,000

4,875,000

(1)

250,000

(2) 250,000

1,250,000

16,490,000

2,465,000

1,900,000

3,200,000

1,145,000

1,300,000

1,000,000 (1) 1,000,000

3,610,000

3,200,000

3,200,000

2,100,000

4,380,000

14,045,000

190,000 (1) 190,000

1,240,000 (1) 1,240,000

4,875,000

2,930,000

2,100,000

_________ 4,380,000

2,930,000 16,490,000

4-35](https://image.slidesharecdn.com/chap004-131230190651-phpapp01/85/solusi-manual-advanced-acc-zy-Chap004-35-320.jpg)

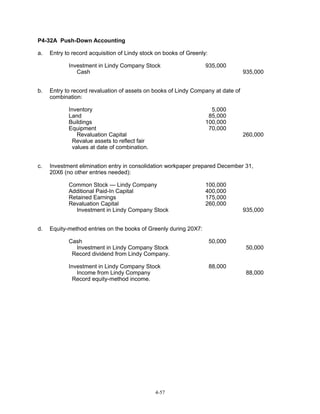

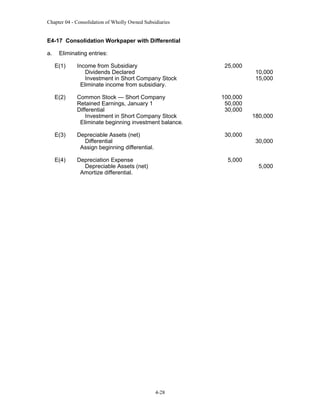

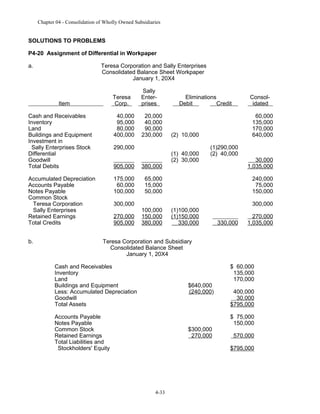

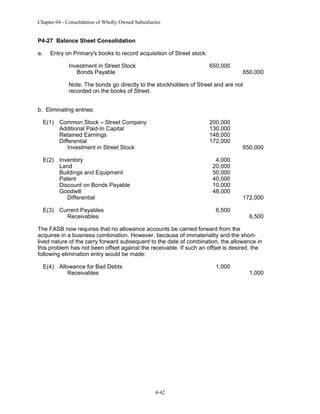

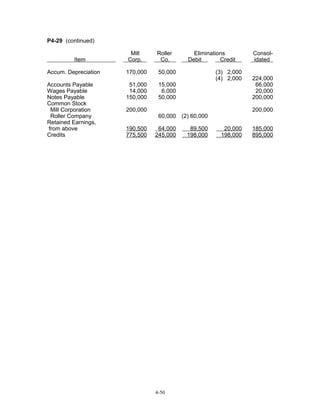

![P4-30 Comprehensive Problem: Wholly Owned Subsidiary

a.

Journal entries recorded by Power Corporation:

(1)

10,000

(2)

Investment in Upland Products Stock

Income from Subsidiary

Record equity-method income.

30,000

(3)

b.

Cash

Investment in Upland Products Stock

Record dividends from Upland Products.

Income from Subsidiary

Investment in Upland Products Stock

Amortize differential: $50,000 / 10 years

5,000

10,000

30,000

5,000

Eliminating entries:

E(1)

Income from Subsidiary

Dividends Declared

Investment in Upland Products Stock

Eliminate income from subsidiary.

E(2)

Common Stock — Upland Products

Retained Earnings, January 1

Differential

Investment in Upland Products Stock

Eliminate beginning investment balance:

$30,000 = $50,000 – [($50,000 / 10) x 4 years]

25,000

100,000

90,000

30,000

E(3)

Buildings and Equipment

Accumulated Depreciation

Differential

Assign beginning differential.

50,000

E(4)

Depreciation Expense

Accumulated Depreciation

Amortize differential.

5,000

E(5)

Accounts Payable

Cash and Receivables

Eliminate intercorporate receivable/payable.

4-52

10,000

10,000

15,000

220,000

20,000

30,000

5,000

10,000](https://image.slidesharecdn.com/chap004-131230190651-phpapp01/85/solusi-manual-advanced-acc-zy-Chap004-52-320.jpg)