Embed presentation

Download to read offline

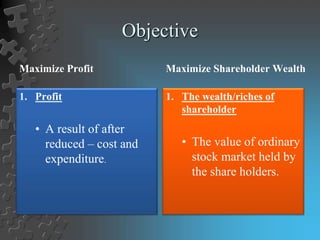

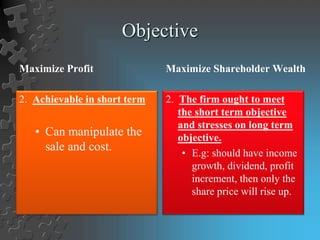

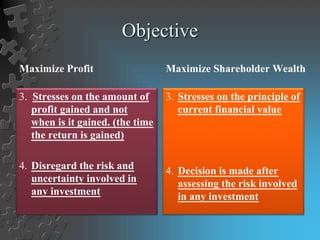

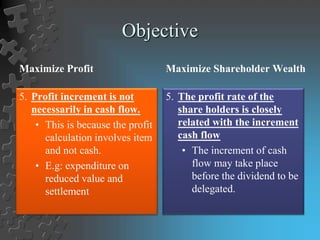

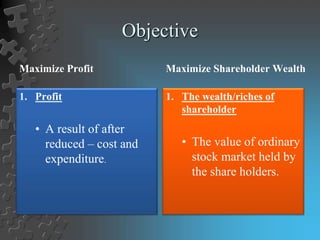

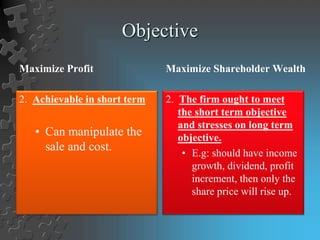

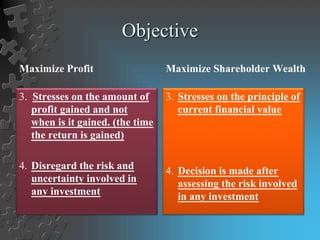

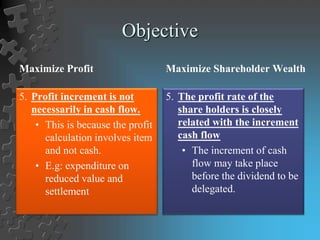

The document compares two company objectives: maximizing profit and maximizing shareholder wealth. Maximizing profit focuses on increasing the bottom line profit number through cost reductions and sales increases in the short term, without consideration for risk or when the profits are realized. Maximizing shareholder wealth emphasizes long term growth through increasing income, dividends, and share price to boost the value of shares owned by investors. It stresses assessing risk in investments and ties profitability to increased cash flow over time.