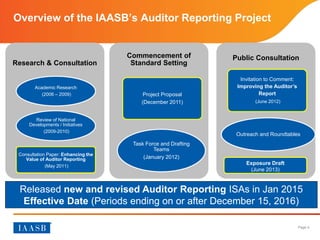

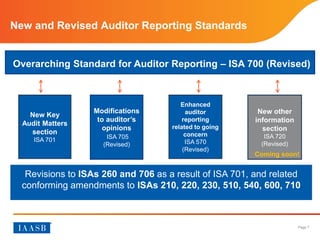

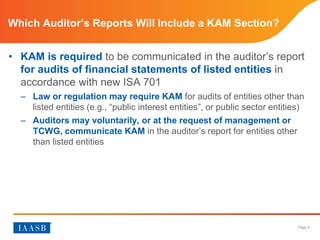

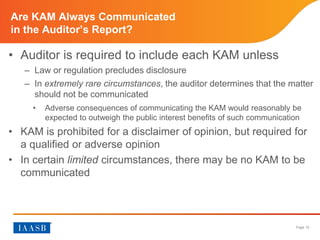

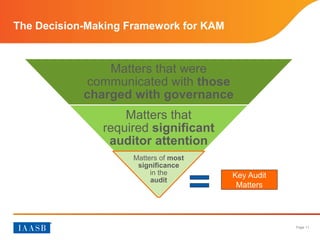

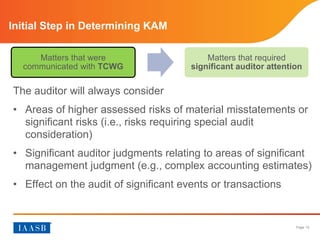

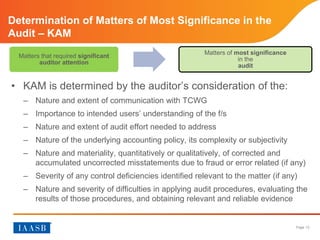

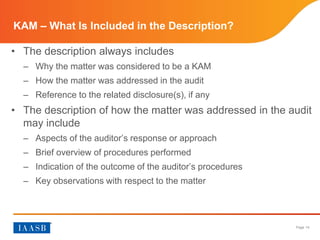

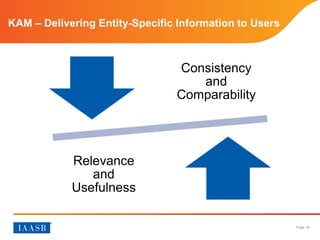

The document provides an overview of the new and revised International Standards on Auditing regarding auditor reporting that were released in January 2015 and become effective for audit periods ending on or after December 15, 2016. Key changes include requiring auditors to communicate Key Audit Matters in their reports for listed entities, enhancing reporting on going concern matters, and other changes to the format and content of audit reports. The slides describe these new standards and their objectives to improve auditor communications and the informativeness of audit reports for users.